Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Current Attempt in Progress The following transactions were recorded by an inexperienced bookkeeper during the months of June and July for Carla Vista Company.

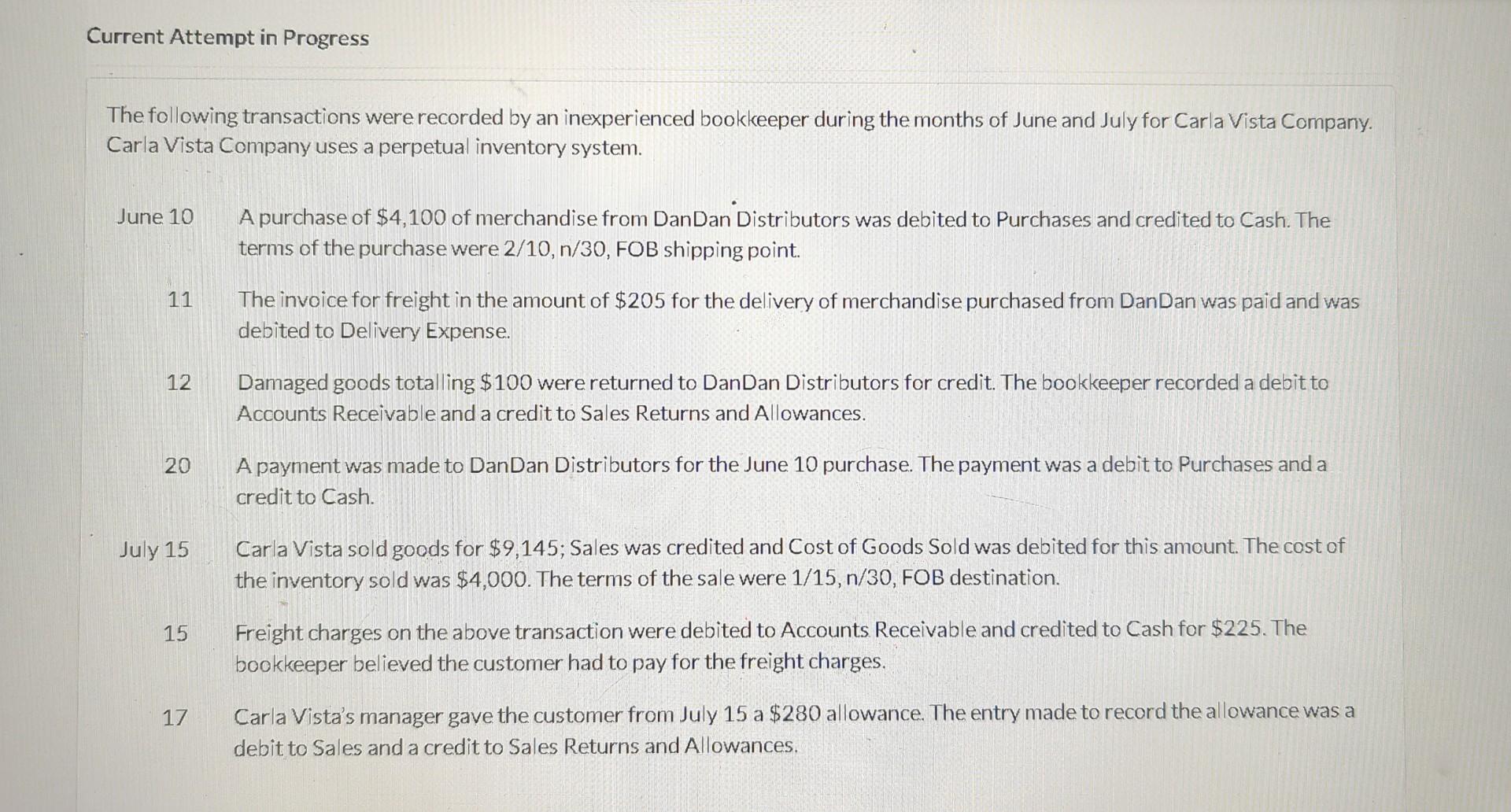

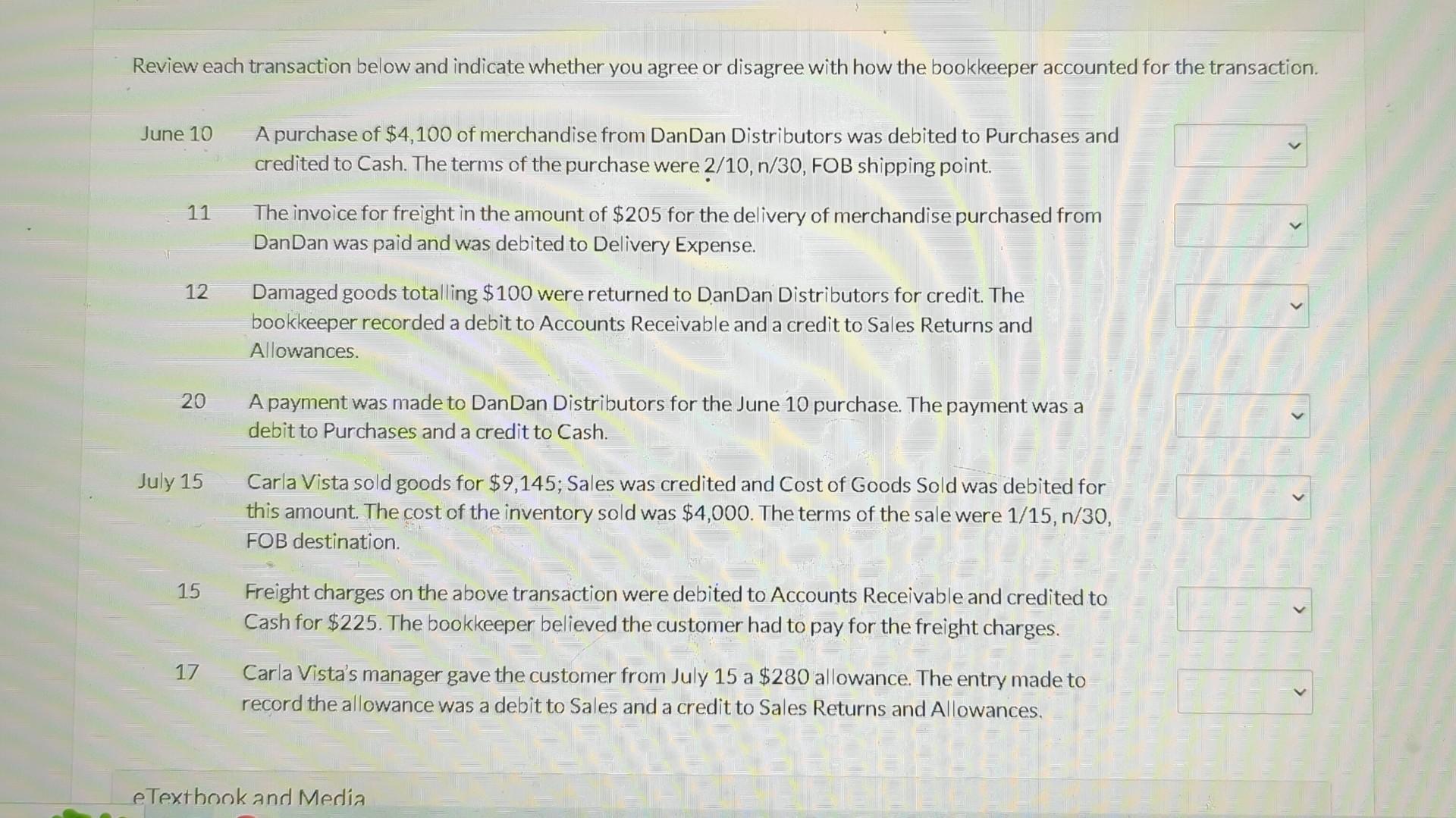

Current Attempt in Progress The following transactions were recorded by an inexperienced bookkeeper during the months of June and July for Carla Vista Company. Carla Vista Company uses a perpetual inventory system. June 10 11 12 20 July 15 15 17 A purchase of $4,100 of merchandise from DanDan Distributors was debited to Purchases and credited to Cash. The terms of the purchase were 2/10, n/30, FOB shipping point. The invoice for freight in the amount of $205 for the delivery of merchandise purchased from DanDan was paid and was debited to Delivery Expense. Damaged goods totalling $100 were returned to DanDan Distributors for credit. The bookkeeper recorded a debit to Accounts Receivable and a credit to Sales Returns and Allowances. A payment was made to DanDan Distributors for the June 10 purchase. The payment was a debit to Purchases and a credit to Cash. Carla Vista sold goods for $9,145; Sales was credited and Cost of Goods Sold was debited for this amount. The cost of the inventory sold was $4,000. The terms of the sale were 1/15, n/30, FOB destination. Freight charges on the above transaction were debited to Accounts Receivable and credited to Cash for $225. The bookkeeper believed the customer had to pay for the freight charges. Carla Vista's manager gave the customer from July 15 a $280 allowance. The entry made to record the allowance was a debit to Sales and a credit to Sales Returns and Allowances.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started