Answered step by step

Verified Expert Solution

Question

1 Approved Answer

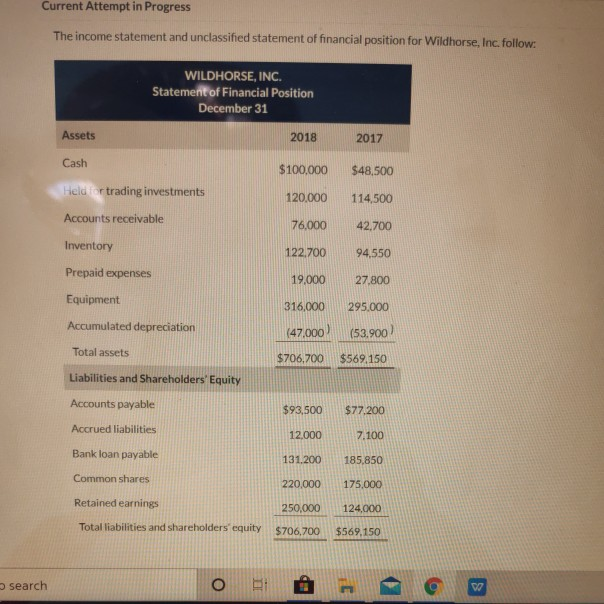

Current Attempt in Progress The income statement and unclassified statement of financial position for Wildhorse, Inc. follow: WILDHORSE, INC. Statement of Financial Position December 31

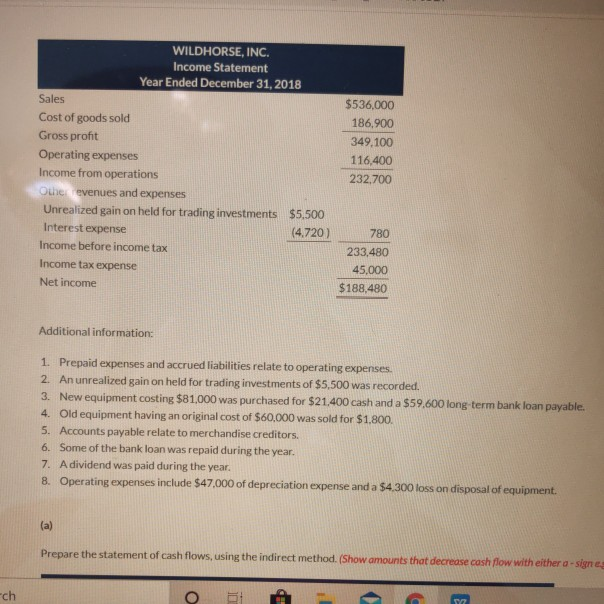

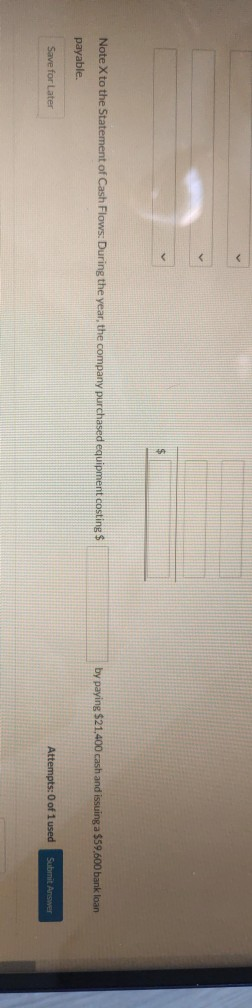

Current Attempt in Progress The income statement and unclassified statement of financial position for Wildhorse, Inc. follow: WILDHORSE, INC. Statement of Financial Position December 31 Assets 2018 2017 Cash $100,000 $48,500 120.000 114,500 Heldier trading investments Accounts receivable 76,000 42.700 Inventory 122.700 94.550 Prepaid expenses 19.000 27.800 Equipment 316,000 295.000 Accumulated depreciation (47.000 (53.900 Total assets $706,700 $569,150 Liabilities and Shareholders' Equity Accounts payable $93,500 $77.200 Accrued liabilities 12.000 7.100 Bank loan payable 131.200 185,850 Common shares 220,000 175,000 Retained earnings 250,000 124,000 Total liabilities and shareholders equity $706,700 $569.150 search o WILDHORSE, INC. Income Statement Year Ended December 31, 2018 Sales Cost of goods sold Gross profit Operating expenses Income from operations Other evenues and expenses Unrealized gain on held for trading investments $5,500 Interest expense (4.720) Income before income tax Income tax expense Net income $536,000 186,900 349.100 116,400 232,700 780 233,480 45,000 $188,480 Additional information: 1. Prepaid expenses and accrued liabilities relate to operating expenses. 2. An unrealized gain on held for trading investments of $5,500 was recorded. 3. New equipment costing $81,000 was purchased for $21.400 cash and a $59.600 long-term bank loan payable. 4. Old equipment having an original cost of $60,000 was sold for $1.800. 5. Accounts payable relate to merchandise creditors. 6. Some of the bank loan was repaid during the year. 7. A dividend was paid during the year. 8. Operating expenses include $47,000 of depreciation expense and a $4.300 loss on disposal of equipment. (a) Prepare the statement of cash flows, using the indirect method. (Show amounts that decrease cash flow with either - signes ch WILDHORSE, INC. Statement of Cash Flows-Indirect Method $ Adjustments to reconcile net income to > $ v o search ] III V hp plus.com/courses/38929/assignments/5520537?module_item_id=16896327 $ C > > $ Note X to the Statement of Cash Flows: During the year, the company purchased equipment costing by paying $21.400 cash and issuing payable Attempts:0 of us Save for Later w arch o 9 C hp $ Note X to the Statement of Cash Flows: During the year, the company purchased equipment costing $ by paying $21,400 cash and issuing a $59.600 bank loan payable. Save for Later Attempts: 0 of 1 used Submit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started