Answered step by step

Verified Expert Solution

Question

1 Approved Answer

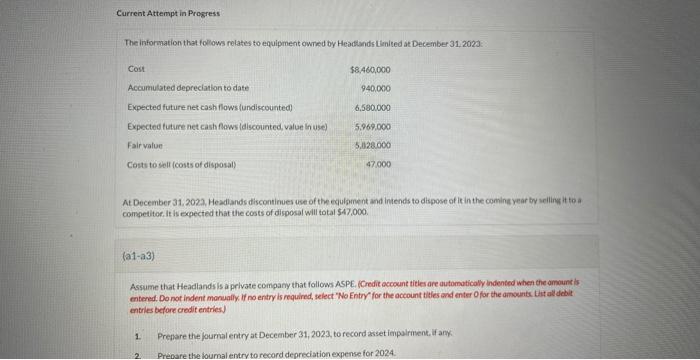

Current Attempt in Progress The information that follows relates to equipment owmed by Headtands tienited at December 31,2023. At December 31, 2022. Headlands discontinues use

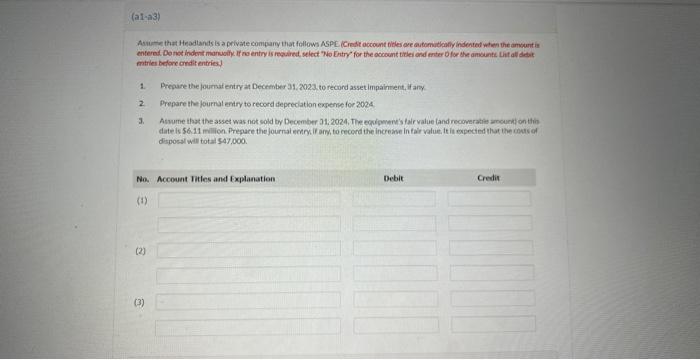

Current Attempt in Progress The information that follows relates to equipment owmed by Headtands tienited at December 31,2023. At December 31, 2022. Headlands discontinues use of the equlament and intends to dispese of it in the coming year by seilinei it to a competitor. It is expected that the costs of disposal will total $47,000. (a1a3) Assume that Headlands is a prlvate company that foliows ASPE. ICredit account tities are automoticaly indented when the ameunt is entered, Do not indent monually if no entry is required, select "No Entry" for the account bitles and enter Ofor the amounts. Lit al debit entries before credit entries) 1. Prenare the foumal entry at December 31,2023 , to record asset impalrment. if ance. 2. Prebare the foumal entry to record depreciation expense for 2024 . Asui-es that Headtands is a private company that follows ASPE (Credit occount pites are automithany indented when the amveunt is matries bedonc critit entries) 1. Prepare the joumat entry at December 31. e023 to recond assetimpainent, if any. 2. Pregare the fourial entry to record depreclation exseme for 2024 3. Aswume that the asset was not sold by December 31.2024, The expigments falr value tand recomerakies anount on thin date is 5611 milion. Prepare the journat ectry if ars, to cecond the increase in falr value it it expected that the onds of disposal will total 547,000

Current Attempt in Progress The information that follows relates to equipment owmed by Headtands tienited at December 31,2023. At December 31, 2022. Headlands discontinues use of the equlament and intends to dispese of it in the coming year by seilinei it to a competitor. It is expected that the costs of disposal will total $47,000. (a1a3) Assume that Headlands is a prlvate company that foliows ASPE. ICredit account tities are automoticaly indented when the ameunt is entered, Do not indent monually if no entry is required, select "No Entry" for the account bitles and enter Ofor the amounts. Lit al debit entries before credit entries) 1. Prenare the foumal entry at December 31,2023 , to record asset impalrment. if ance. 2. Prebare the foumal entry to record depreciation expense for 2024 . Asui-es that Headtands is a private company that follows ASPE (Credit occount pites are automithany indented when the amveunt is matries bedonc critit entries) 1. Prepare the joumat entry at December 31. e023 to recond assetimpainent, if any. 2. Pregare the fourial entry to record depreclation exseme for 2024 3. Aswume that the asset was not sold by December 31.2024, The expigments falr value tand recomerakies anount on thin date is 5611 milion. Prepare the journat ectry if ars, to cecond the increase in falr value it it expected that the onds of disposal will total 547,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started