Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Current Attempt in Progress The post-closing trial balance at 30 June 2020 of Payneham Professional Services is shown below. Transactions completed during the year

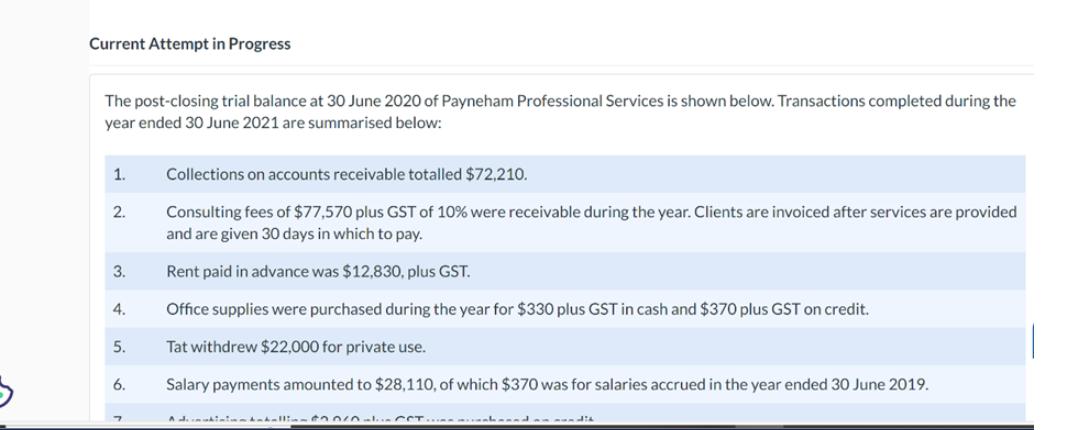

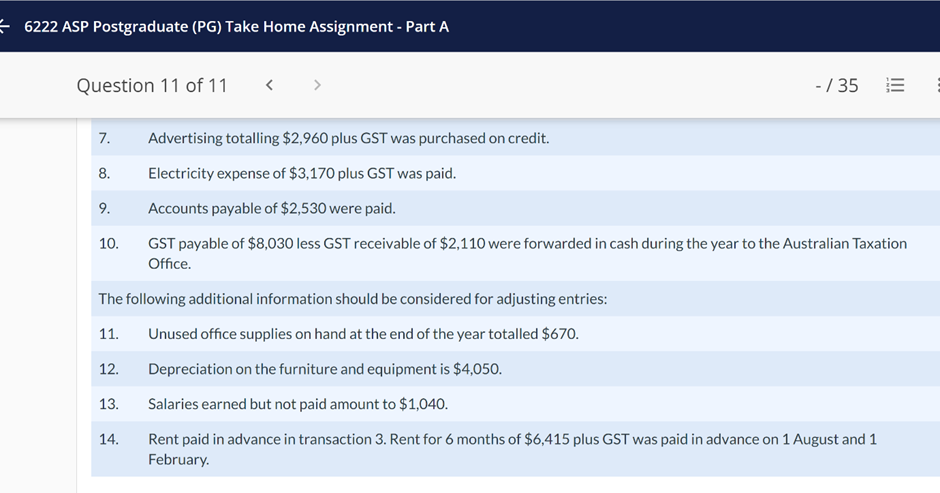

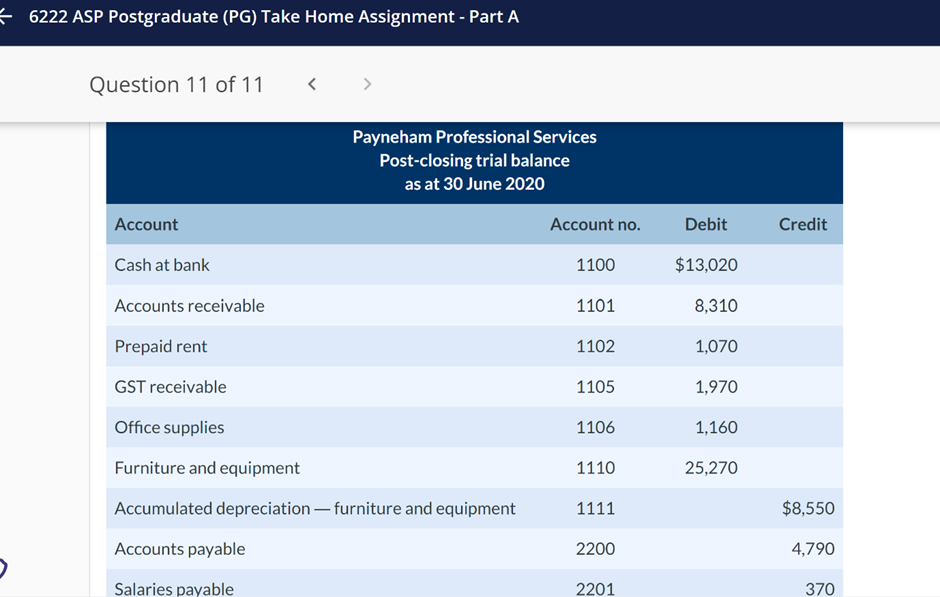

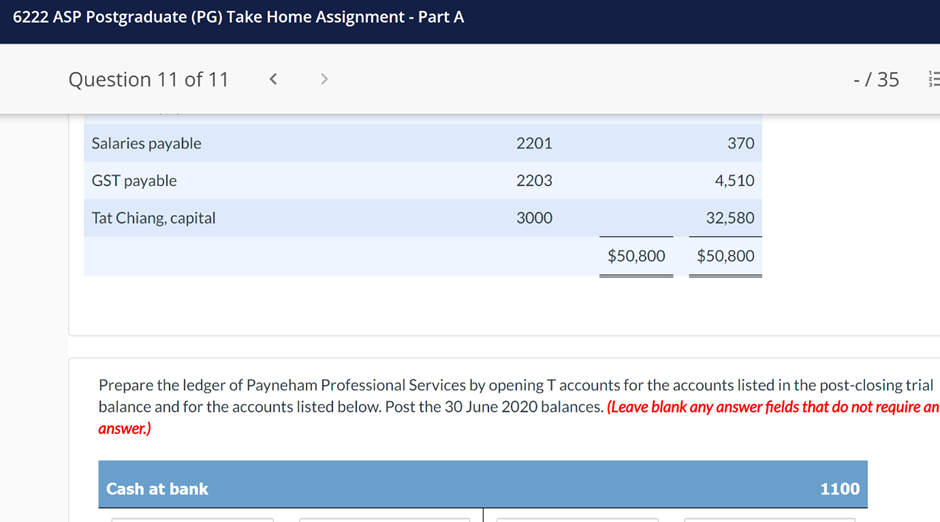

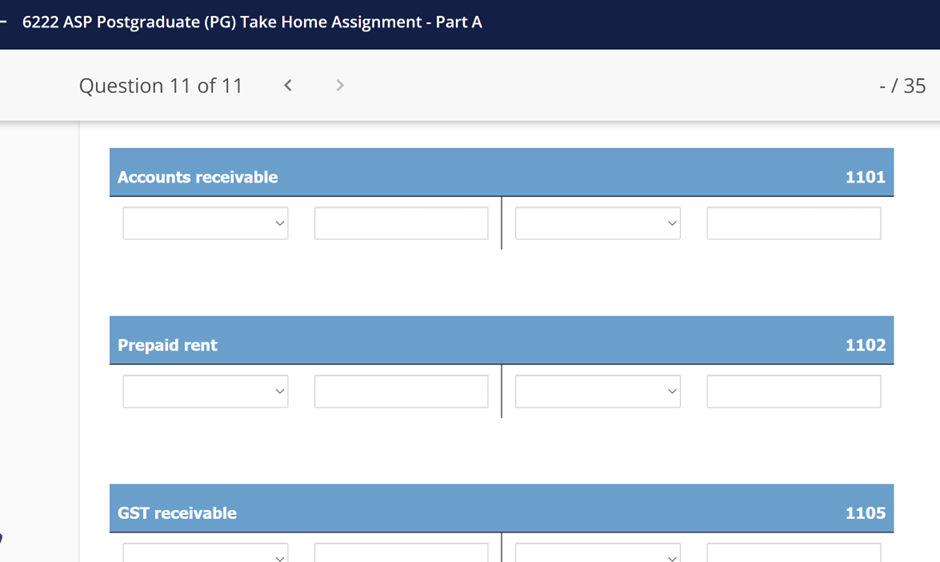

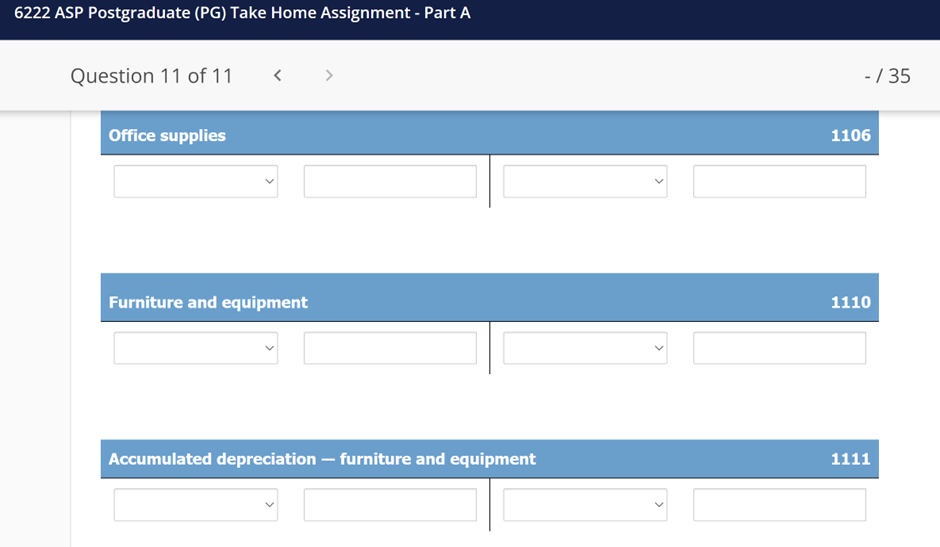

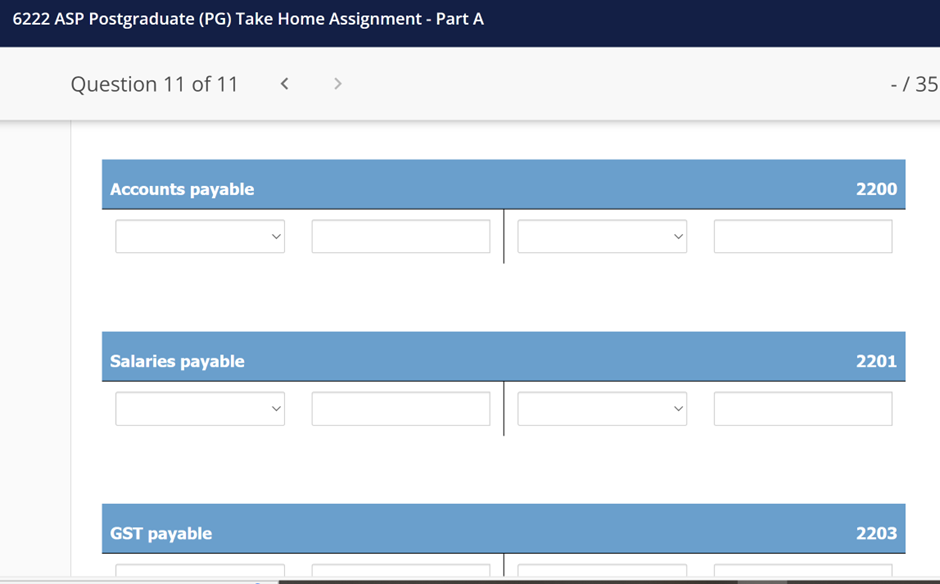

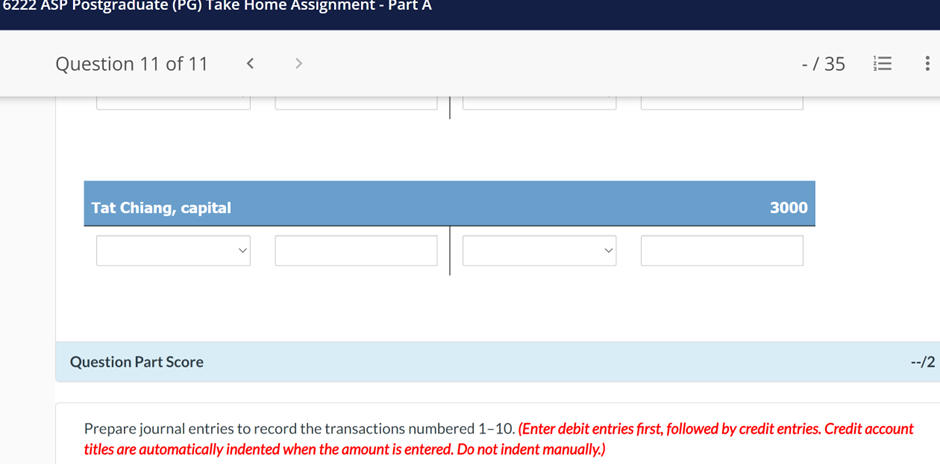

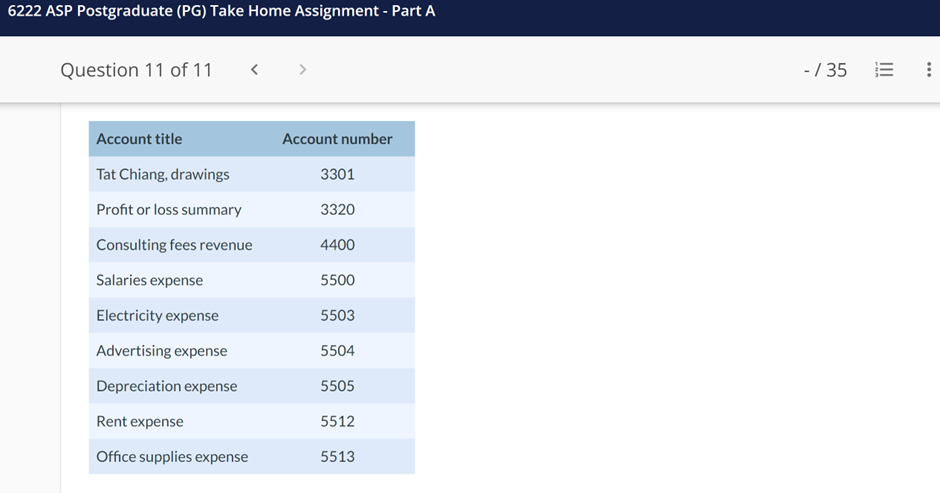

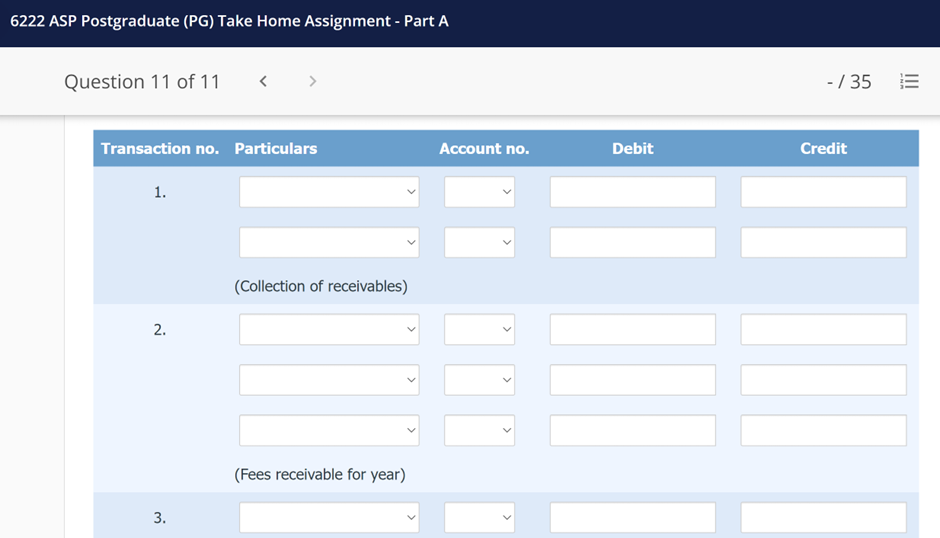

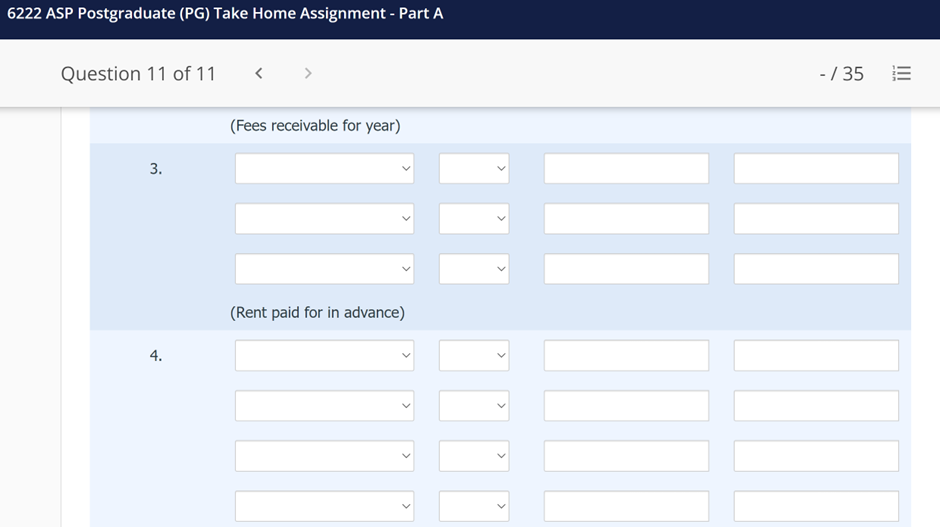

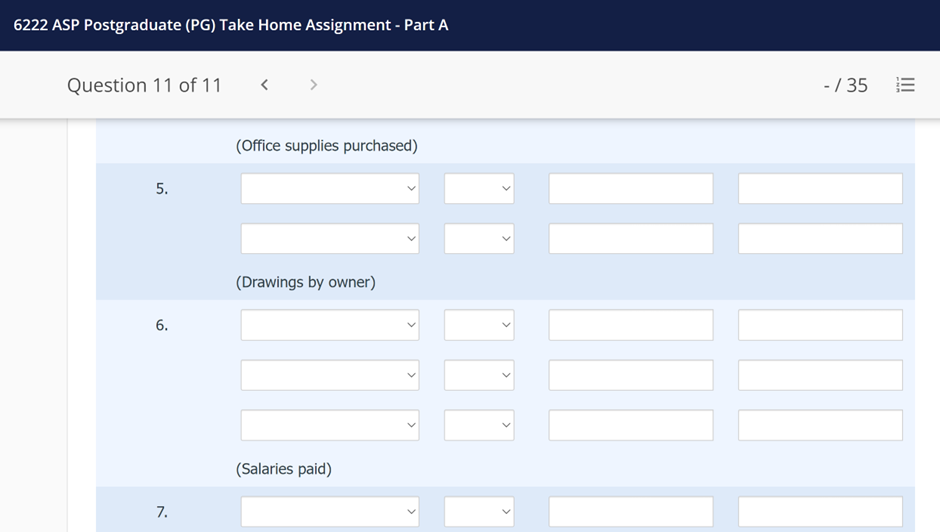

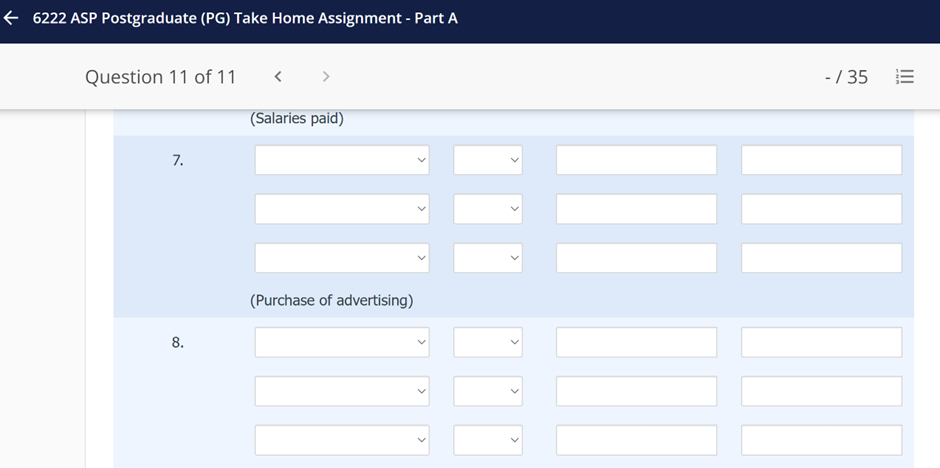

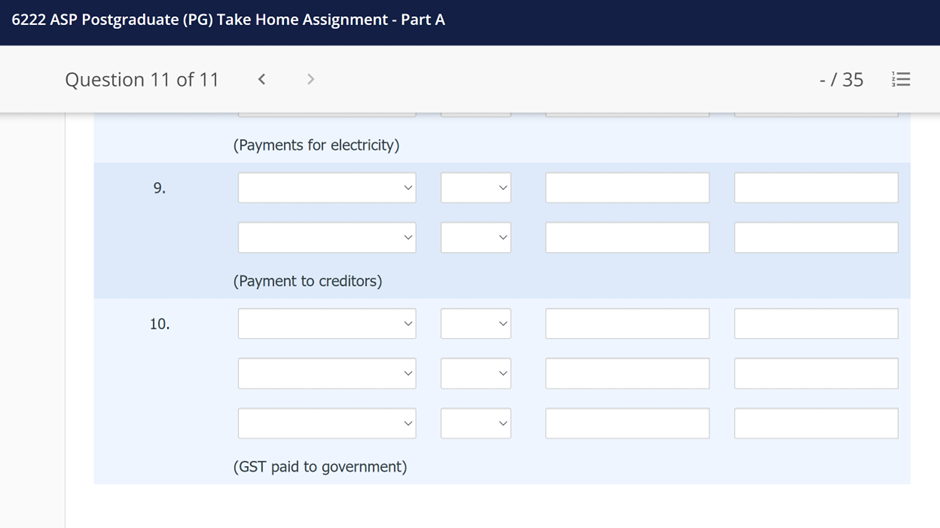

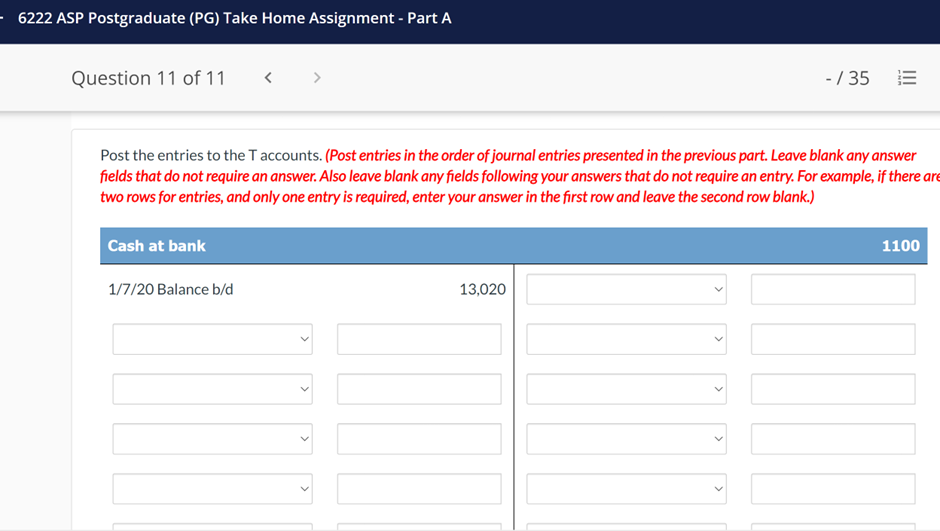

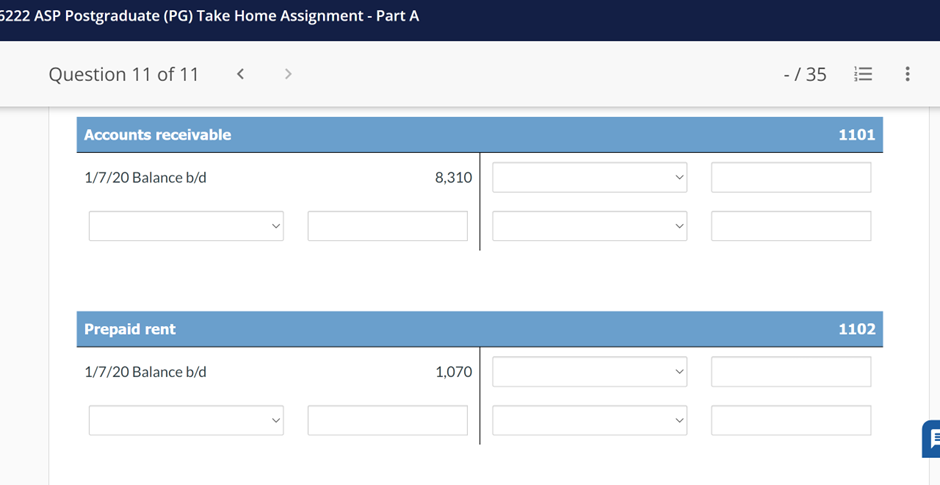

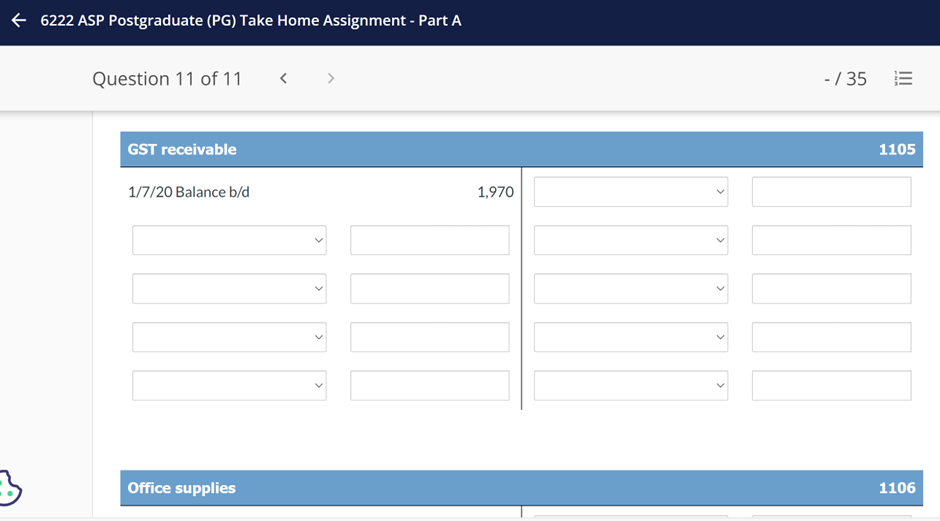

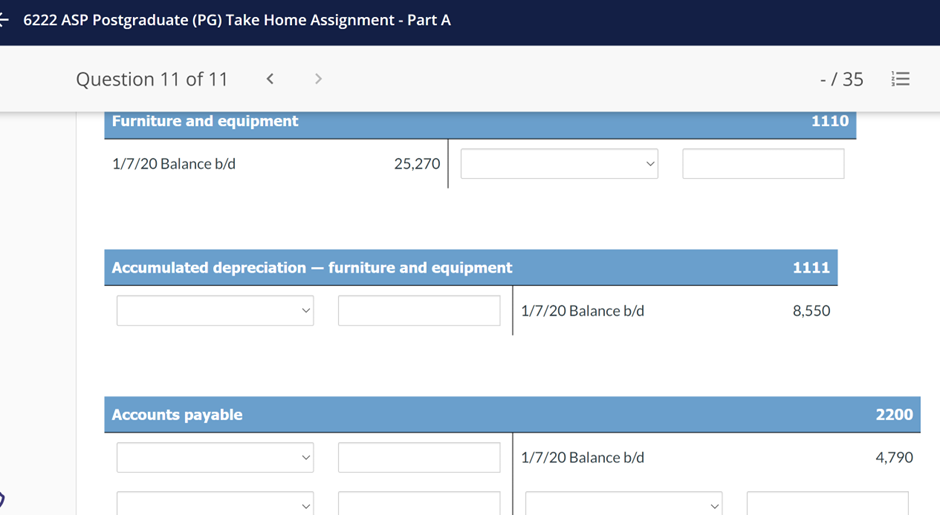

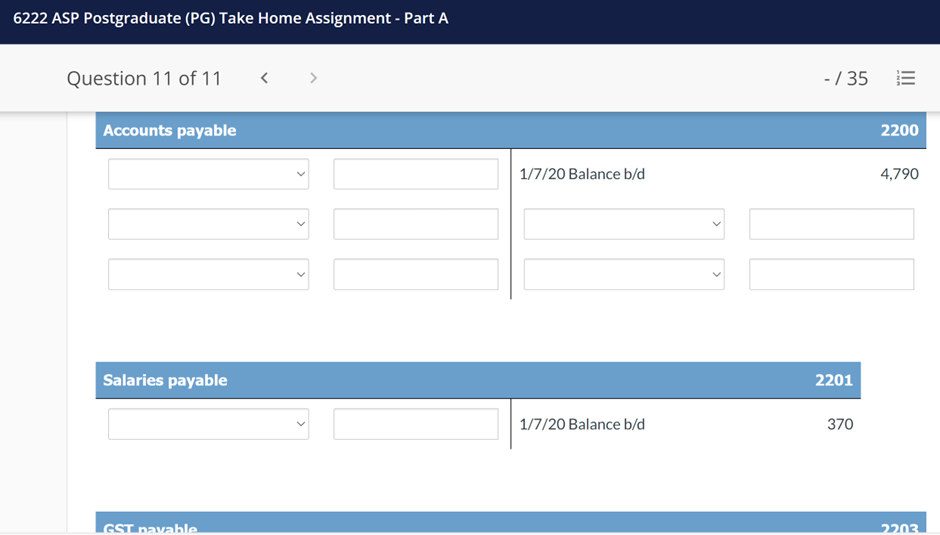

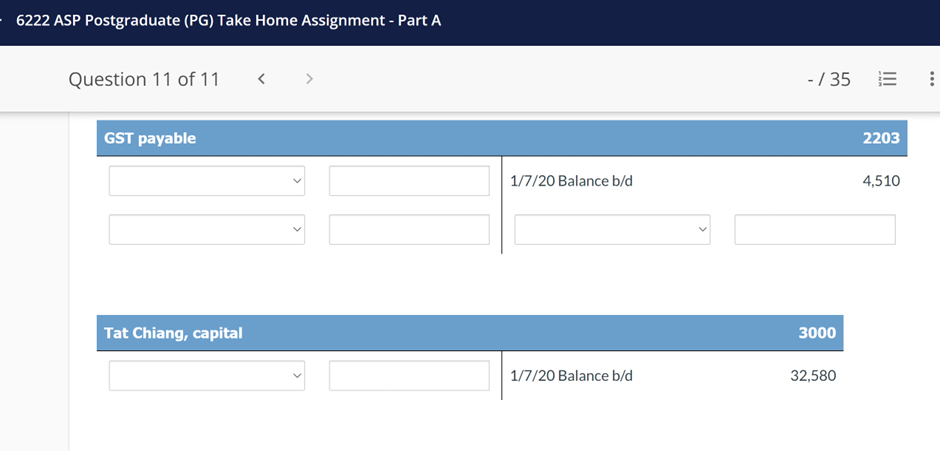

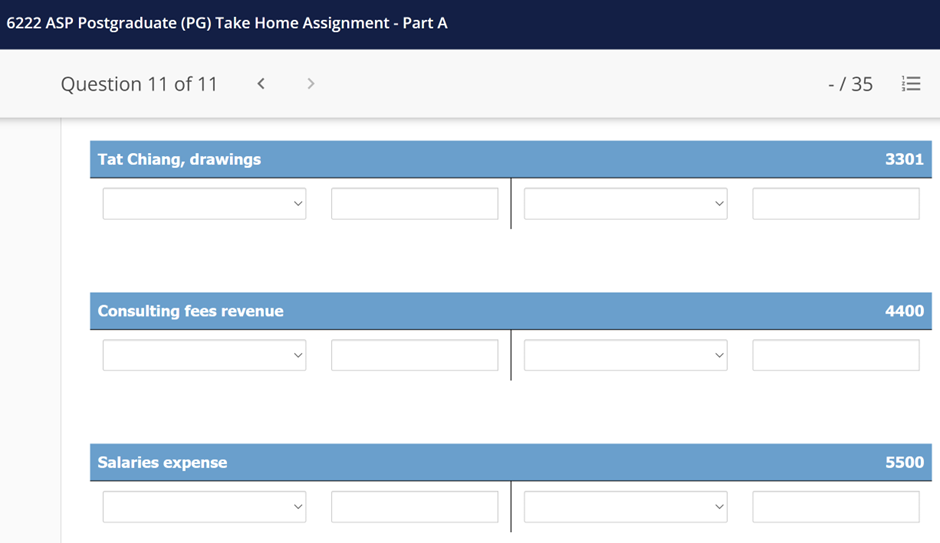

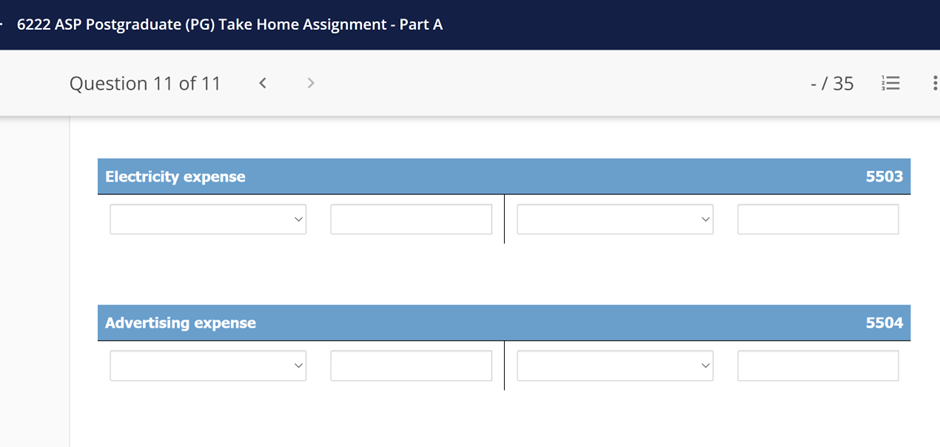

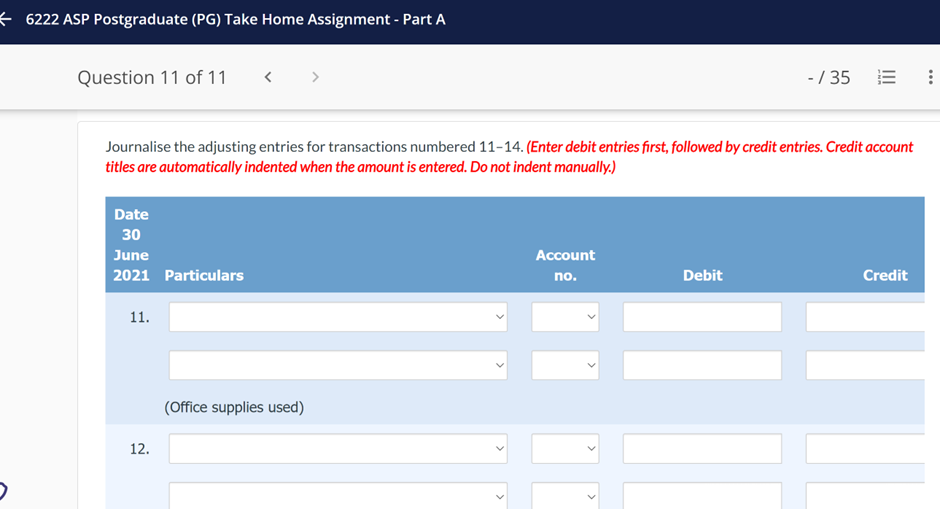

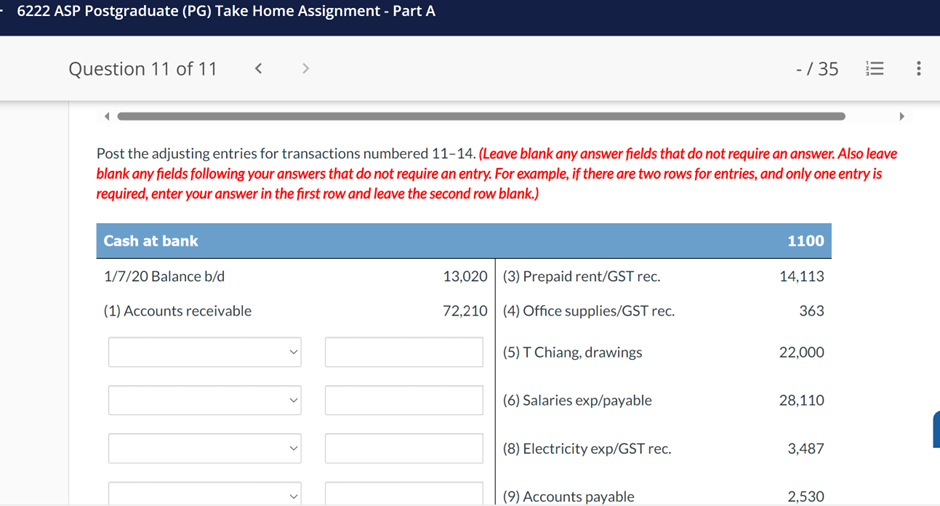

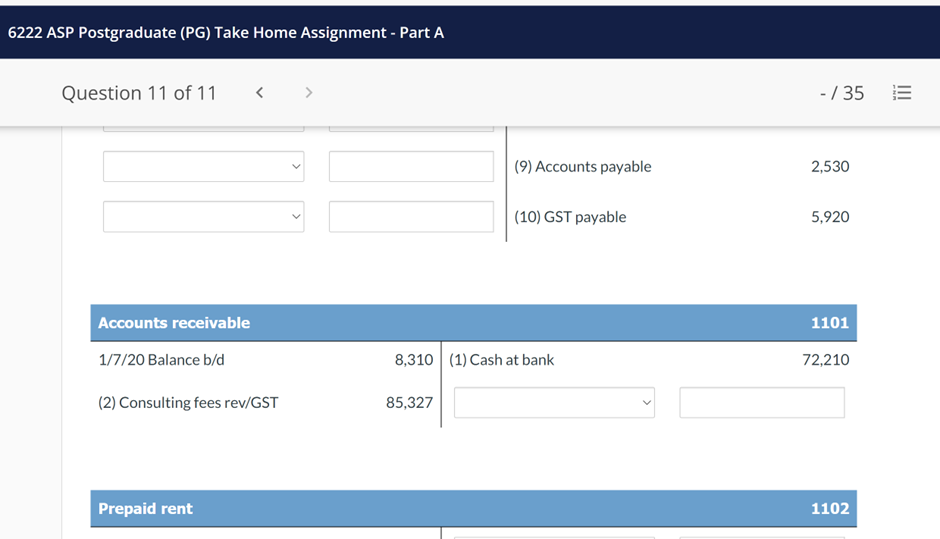

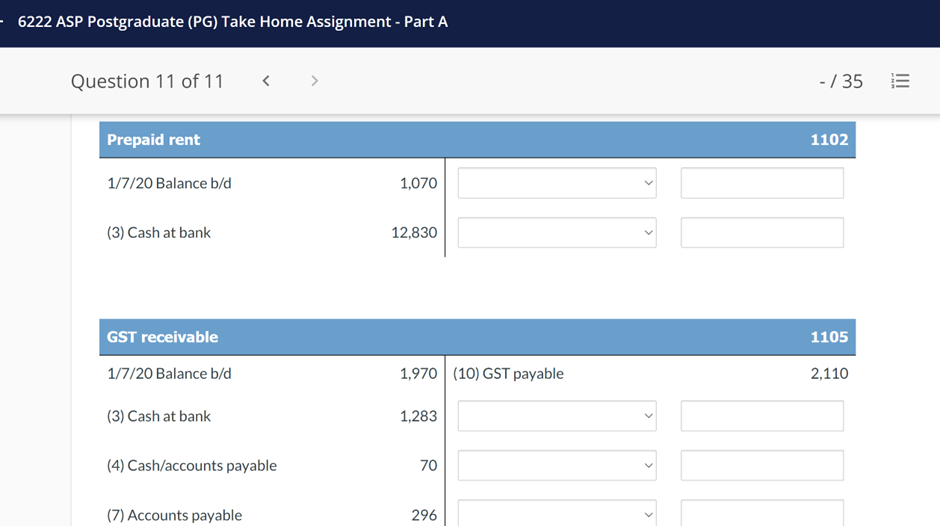

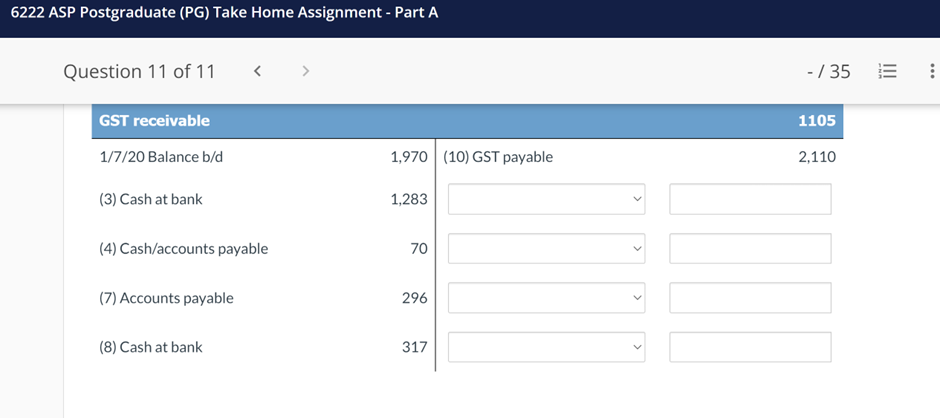

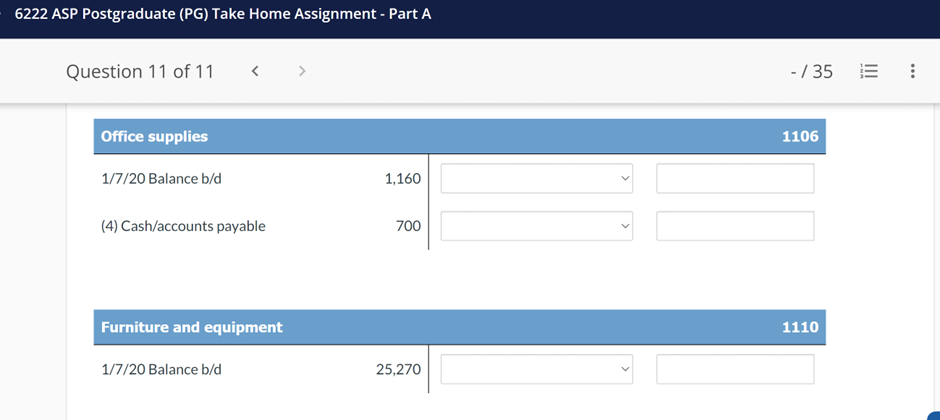

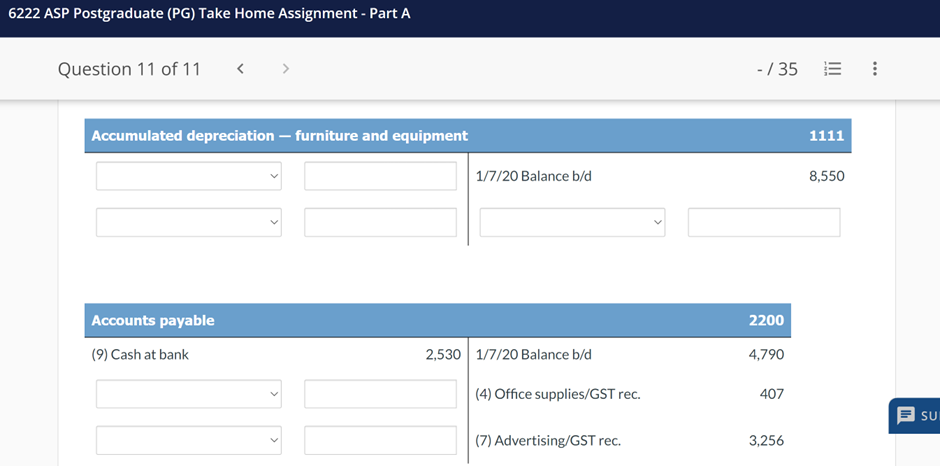

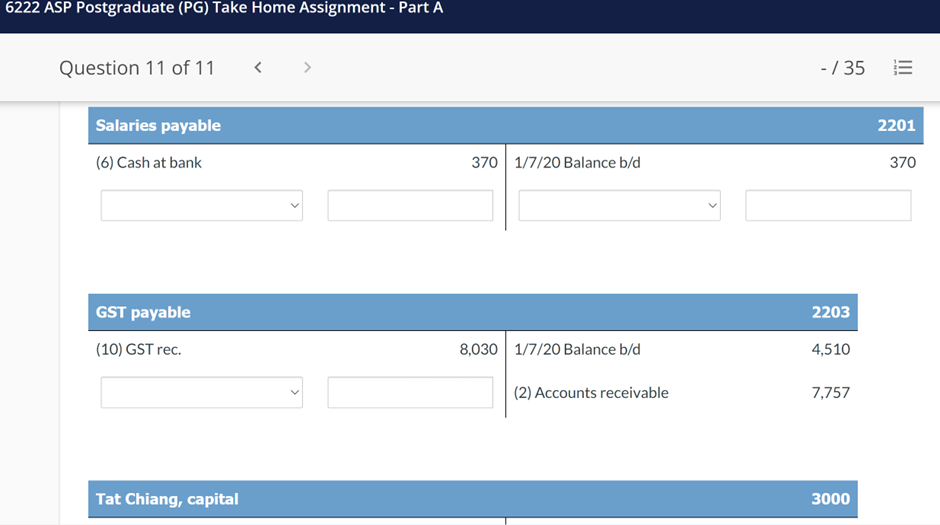

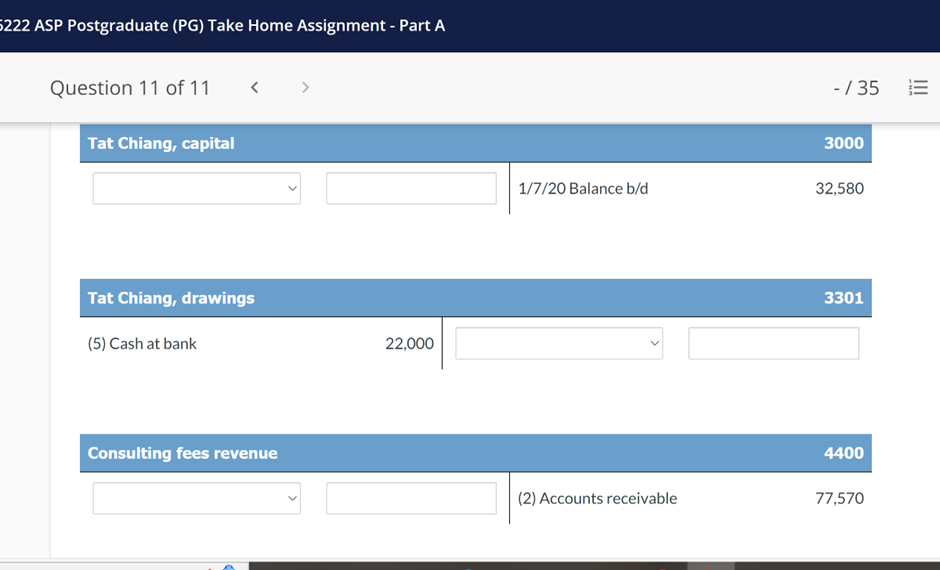

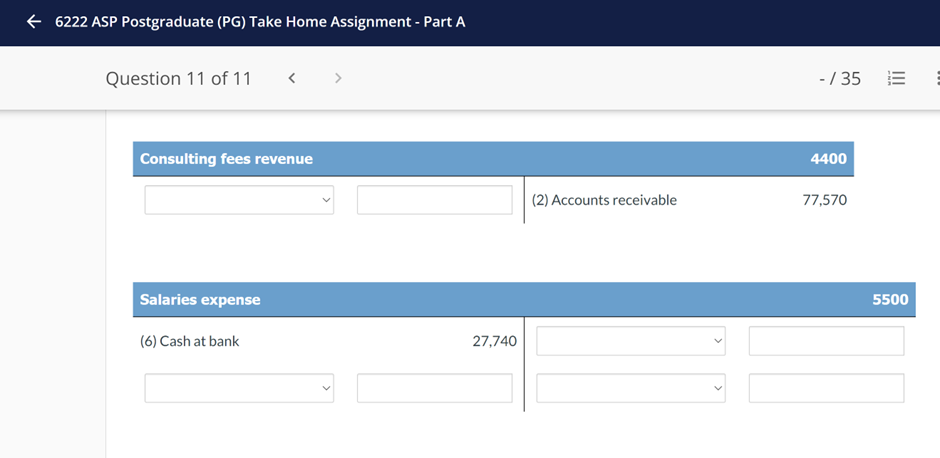

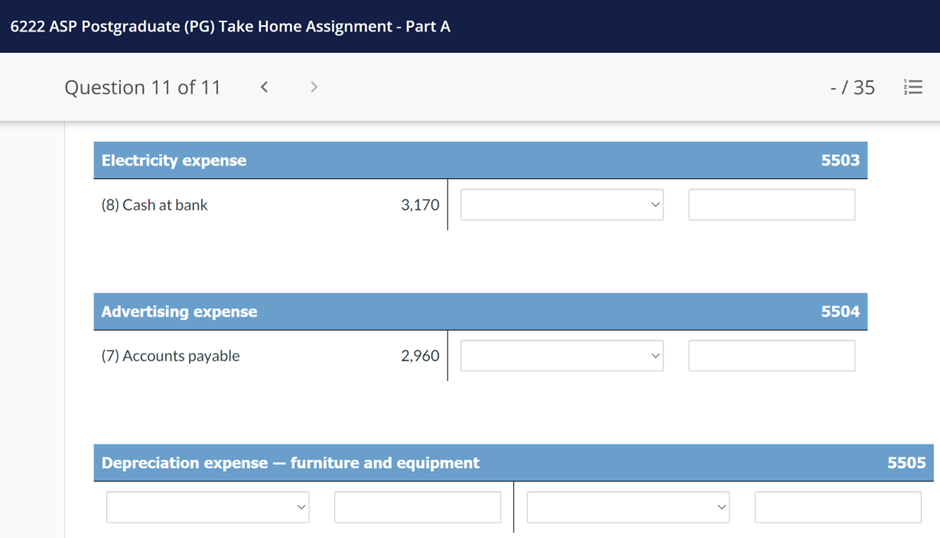

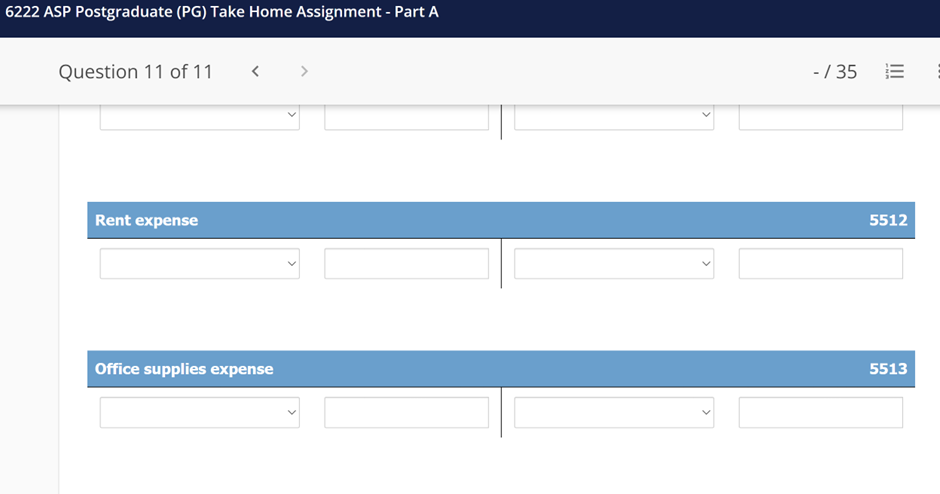

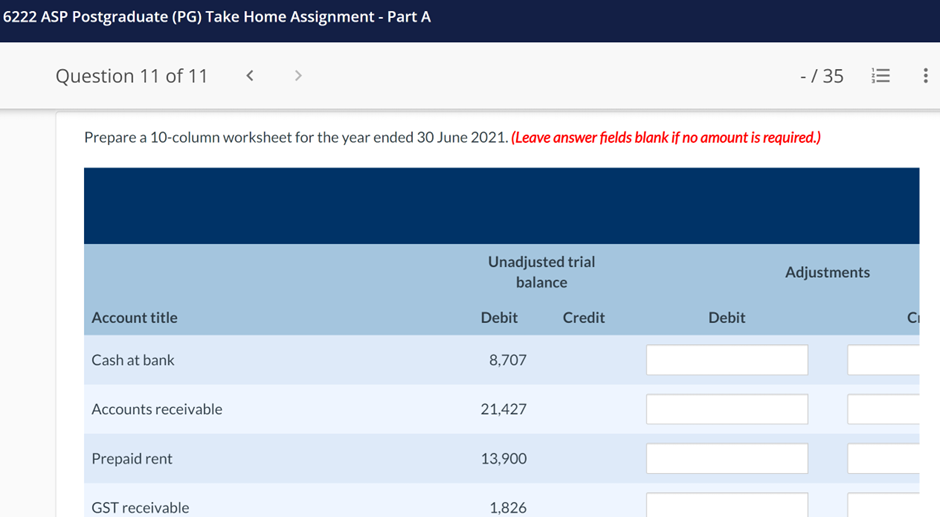

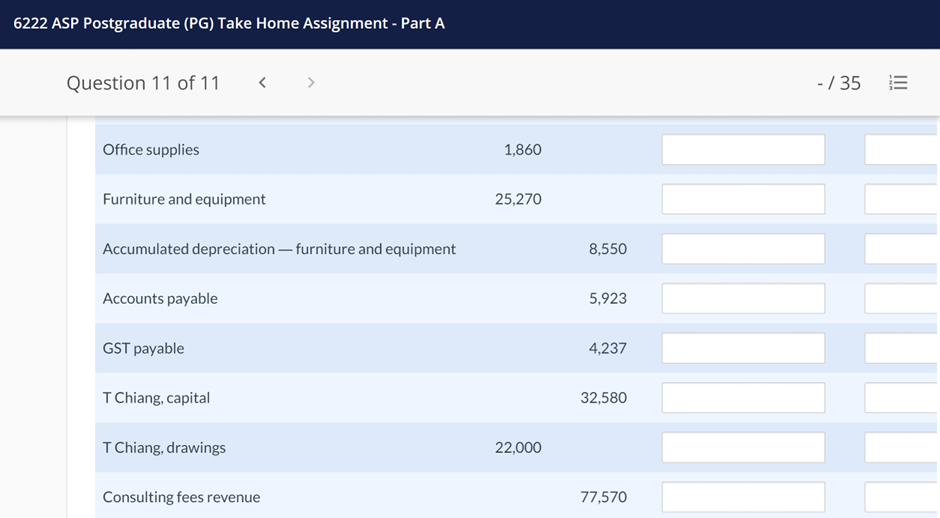

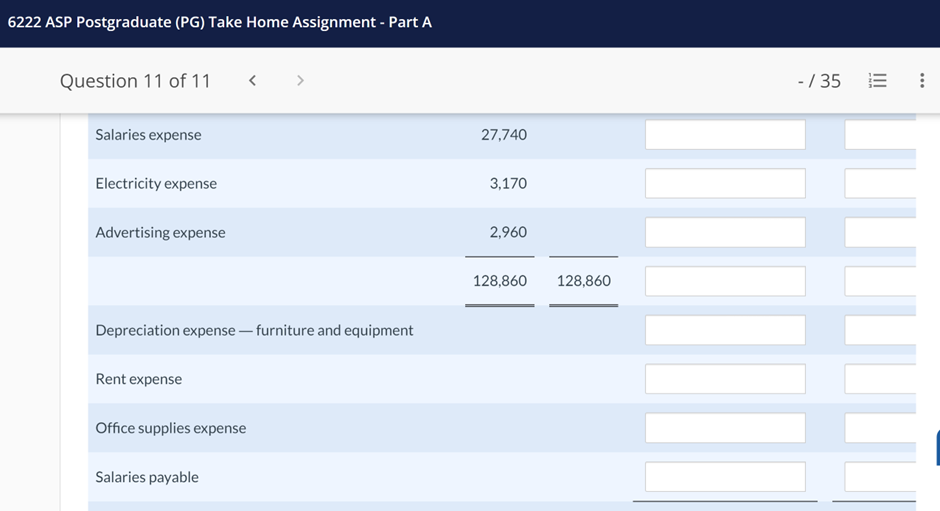

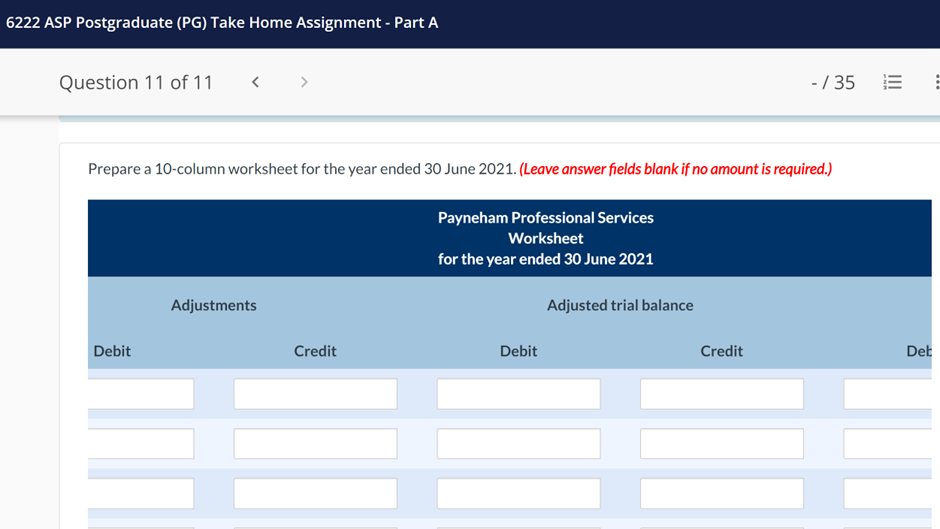

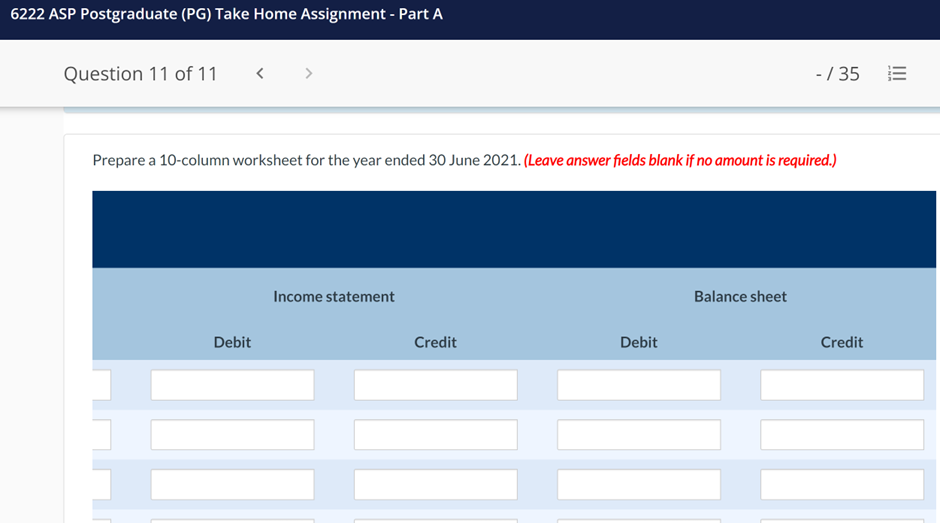

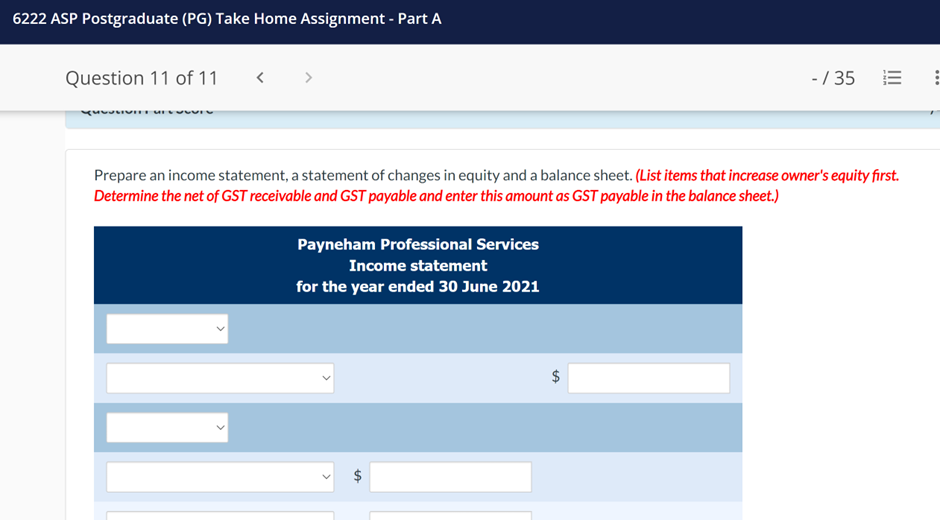

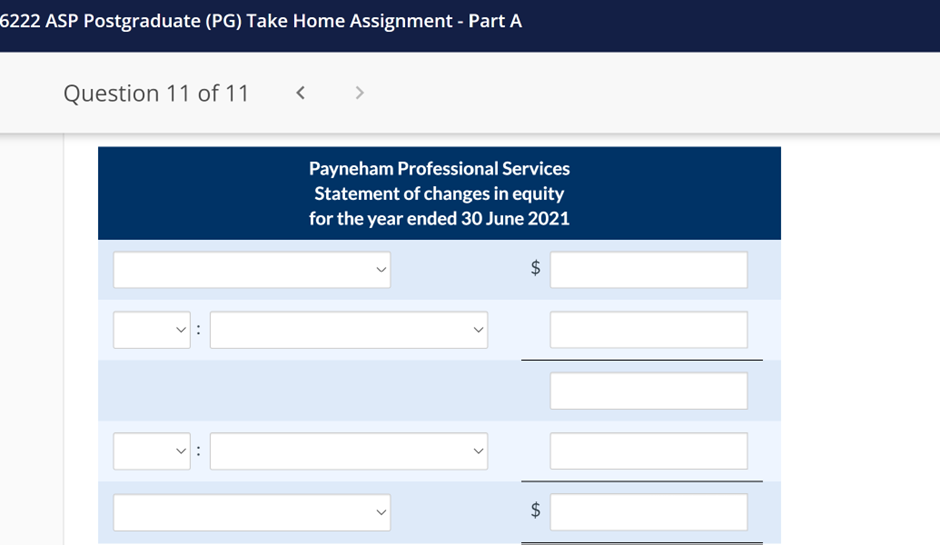

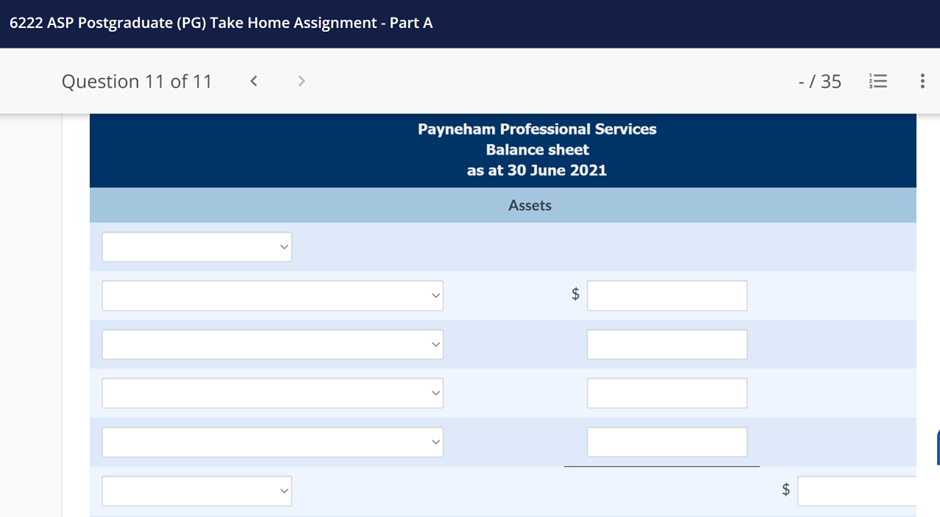

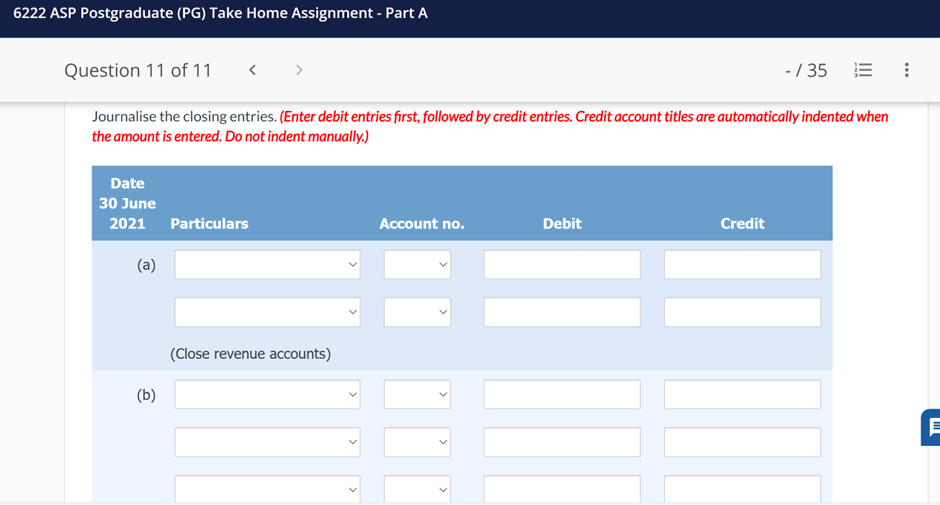

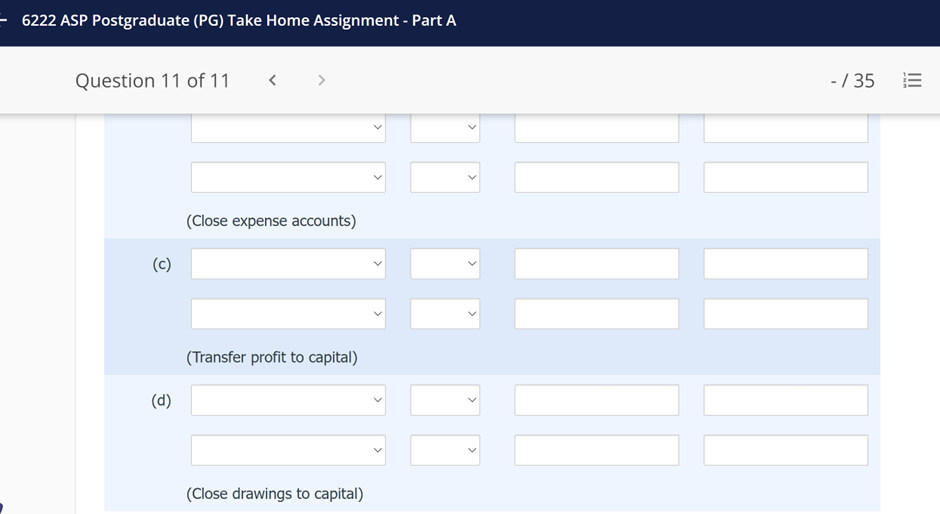

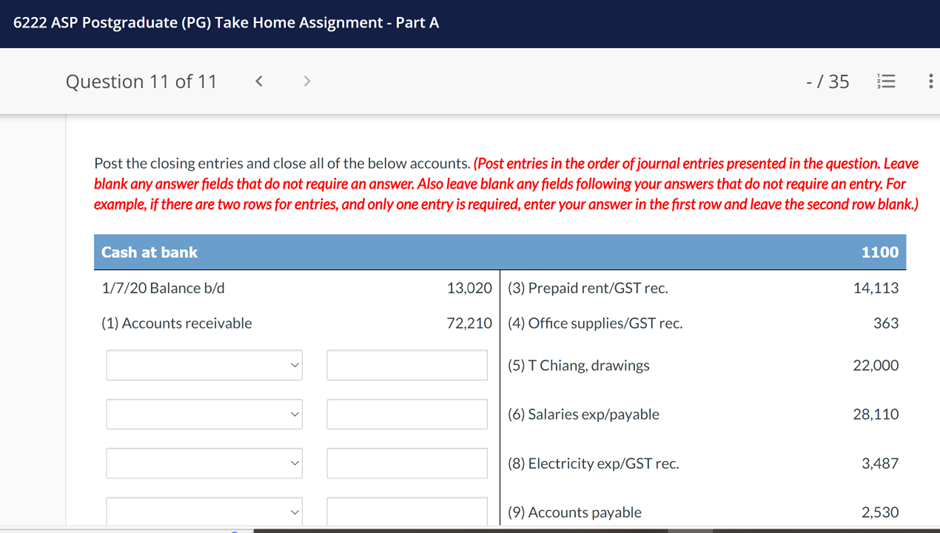

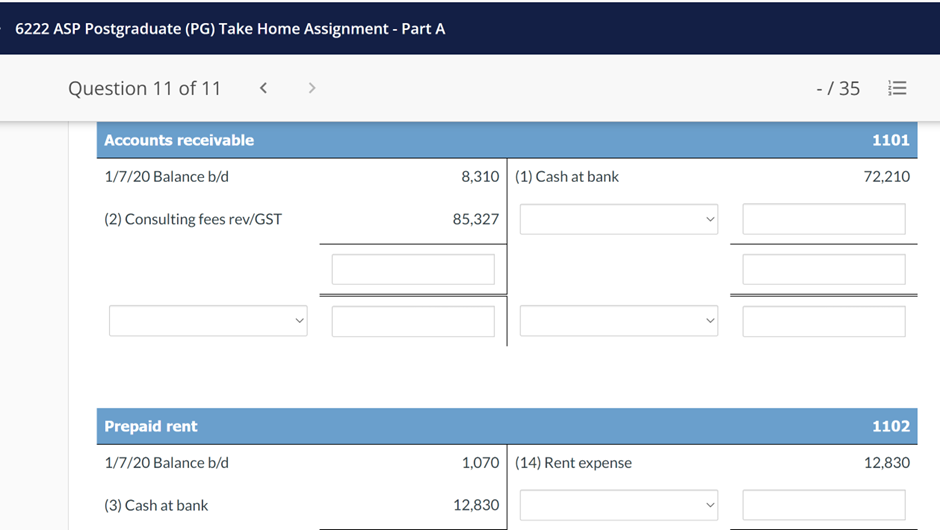

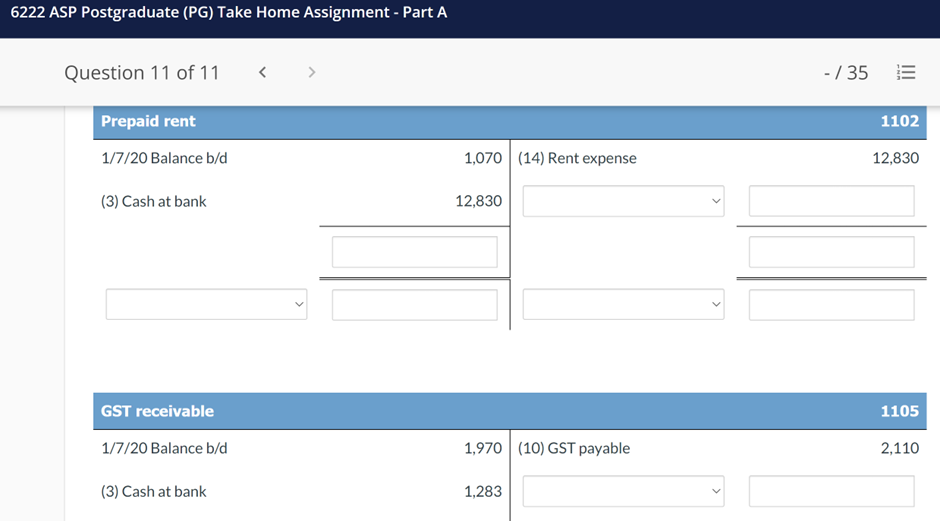

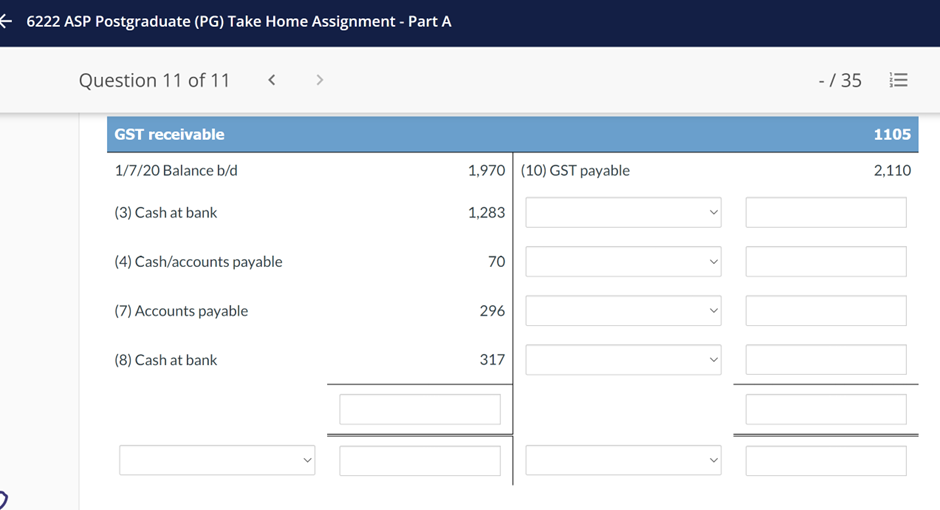

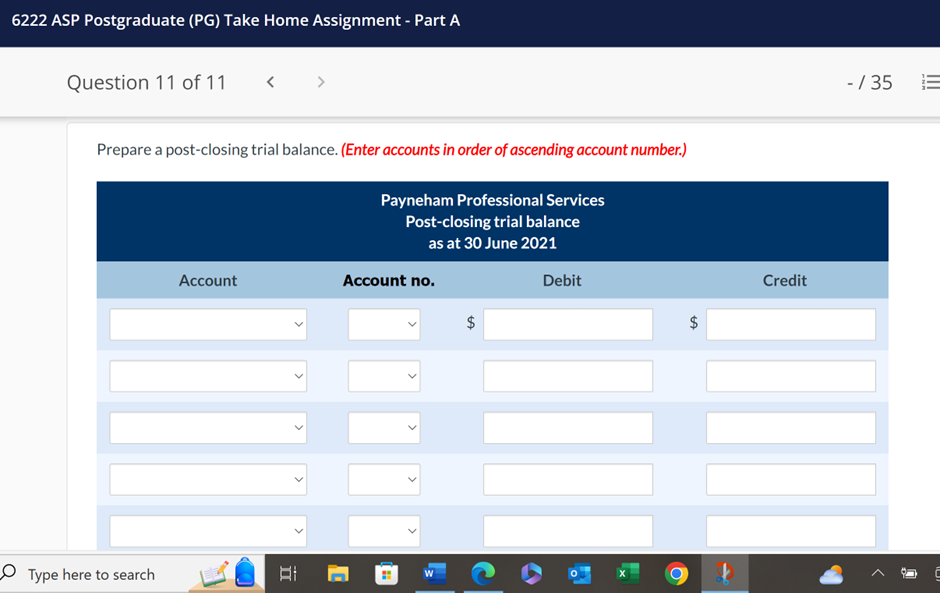

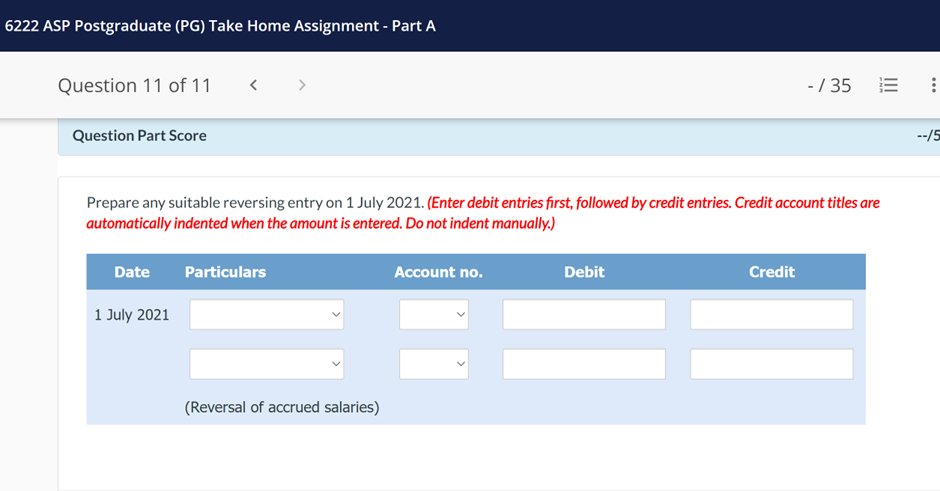

Current Attempt in Progress The post-closing trial balance at 30 June 2020 of Payneham Professional Services is shown below. Transactions completed during the year ended 30 June 2021 are summarised below: 1. Collections on accounts receivable totalled $72,210. 2. Consulting fees of $77,570 plus GST of 10% were receivable during the year. Clients are invoiced after services are provided and are given 30 days in which to pay. 3. Rent paid in advance was $12,830, plus GST. 4. Office supplies were purchased during the year for $330 plus GST in cash and $370 plus GST on credit. 5. Tat withdrew $22,000 for private use. 6. Salary payments amounted to $28,110, of which $370 was for salaries accrued in the year ended 30 June 2019. 6222 ASP Postgraduate (PG) Take Home Assignment - Part A Question 11 of 11 < > 7. Advertising totalling $2,960 plus GST was purchased on credit. 8. Electricity expense of $3,170 plus GST was paid. 9. Accounts payable of $2,530 were paid. 10. - / 35 E GST payable of $8,030 less GST receivable of $2,110 were forwarded in cash during the year to the Australian Taxation Office. The following additional information should be considered for adjusting entries: 11. Unused office supplies on hand at the end of the year totalled $670. 12. Depreciation on the furniture and equipment is $4,050. 13. 14. Salaries earned but not paid amount to $1,040. Rent paid in advance in transaction 3. Rent for 6 months of $6,415 plus GST was paid in advance on 1 August and 1 February. 6222 ASP Postgraduate (PG) Take Home Assignment - Part A Question 11 of 11 > Payneham Professional Services Post-closing trial balance as at 30 June 2020 Account Cash at bank Accounts receivable Prepaid rent Account no. Debit Credit 1100 $13,020 1101 8,310 1102 1,070 GST receivable 1105 1,970 Office supplies 1106 1,160 Furniture and equipment 1110 25,270 Accumulated depreciation - furniture and equipment 1111 $8,550 Accounts payable 2200 4,790 Salaries payable 2201 370 6222 ASP Postgraduate (PG) Take Home Assignment - Part A Question 11 of 11 < > Salaries payable GST payable Tat Chiang, capital 2201 370 2203 4,510 3000 32,580 $50,800 $50,800 - / 35 E Prepare the ledger of Payneham Professional Services by opening T accounts for the accounts listed in the post-closing trial balance and for the accounts listed below. Post the 30 June 2020 balances. (Leave blank any answer fields that do not require an answer.) Cash at bank 1100 6222 ASP Postgraduate (PG) Take Home Assignment - Part A Question 11 of 11 < > Accounts receivable Prepaid rent GST receivable - / 35 1101 1102 1105 6222 ASP Postgraduate (PG) Take Home Assignment - Part A Question 11 of 11 < > Office supplies Furniture and equipment 1106 1110 Accumulated depreciation - furniture and equipment 1111 - / 35 6222 ASP Postgraduate (PG) Take Home Assignment - Part A Question 11 of 11 < > Accounts payable 2200 - / 35 Salaries payable 2201 GST payable 2203 6222 ASP Postgraduate (PG) Take Home Assignment - Part A Question 11 of 11 Tat Chiang, capital Question Part Score 3000 -/35 E Prepare journal entries to record the transactions numbered 1-10. (Enter debit entries first, followed by credit entries. Credit account titles are automatically indented when the amount is entered. Do not indent manually.) --/2 6222 ASP Postgraduate (PG) Take Home Assignment - Part A Question 11 of 11 < > Account title Account number Tat Chiang, drawings 3301 Profit or loss summary 3320 Consulting fees revenue 4400 Salaries expense 5500 Electricity expense 5503 Advertising expense 5504 Depreciation expense 5505 Rent expense 5512 Office supplies expense 5513 -/35 ... 6222 ASP Postgraduate (PG) Take Home Assignment - Part A Question 11 of 11 < > Transaction no. Particulars 1. 2. 3. (Collection of receivables) (Fees receivable for year) - / 35 Account no. Debit Credit 6222 ASP Postgraduate (PG) Take Home Assignment - Part A Question 11 of 11 (Fees receivable for year) 3. 4. (Rent paid for in advance) - / 35 6222 ASP Postgraduate (PG) Take Home Assignment - Part A Question 11 of 11 < > 5. 6. (Office supplies purchased) 7. (Drawings by owner) (Salaries paid) > -/35 III 6222 ASP Postgraduate (PG) Take Home Assignment - Part A Question 11 of 11 III -/35 E (Salaries paid) 7. 8. (Purchase of advertising) 6222 ASP Postgraduate (PG) Take Home Assignment - Part A Question 11 of 11 < > 9. 10. 10 (Payments for electricity) (Payment to creditors) (GST paid to government) - / 35 III 6222 ASP Postgraduate (PG) Take Home Assignment - Part A Question 11 of 11 < > - / 35 E Post the entries to the T accounts. (Post entries in the order of journal entries presented in the previous part. Leave blank any answer fields that do not require an answer. Also leave blank any fields following your answers that do not require an entry. For example, if there are two rows for entries, and only one entry is required, enter your answer in the first row and leave the second row blank.) Cash at bank 1/7/20 Balance b/d 13,020 < > > 1100 5222 ASP Postgraduate (PG) Take Home Assignment - Part A Question 11 of 11 < > Accounts receivable 1/7/20 Balance b/d v 8,310 - / 35 1101 Prepaid rent 1102 1/7/20 Balance b/d 1,070 6222 ASP Postgraduate (PG) Take Home Assignment - Part A Question 11 of 11 < > GST receivable 1/7/20 Balance b/d 3 Office supplies 1,970 - / 35 III E 1105 1106 6222 ASP Postgraduate (PG) Take Home Assignment - Part A Question 11 of 11 < > Furniture and equipment 1/7/20 Balance b/d 25,270 Accumulated depreciation - furniture and equipment - / 35 1110 1111 1/7/20 Balance b/d 8,550 Accounts payable 2200 1/7/20 Balance b/d 4,790 6222 ASP Postgraduate (PG) Take Home Assignment - Part A Question 11 of 11 < > Accounts payable Salaries payable GST pavable 1/7/20 Balance b/d -/35 2201 1/7/20 Balance b/d 370 2200 4,790 2203 6222 ASP Postgraduate (PG) Take Home Assignment - Part A Question 11 of 11 < > GST payable 1/7/20 Balance b/d -/35 E Tat Chiang, capital 3000 1/7/20 Balance b/d 32,580 2203 4,510 6222 ASP Postgraduate (PG) Take Home Assignment - Part A Question 11 of 11 < > Tat Chiang, drawings Consulting fees revenue Salaries expense - / 35 3301 4400 5500 6222 ASP Postgraduate (PG) Take Home Assignment - Part A Question 11 of 11 < > Electricity expense Advertising expense - / 35 E 5503 5504 6222 ASP Postgraduate (PG) Take Home Assignment - Part A Question 11 of 11 < > - / 35 E Journalise the adjusting entries for transactions numbered 11-14. (Enter debit entries first, followed by credit entries. Credit account titles are automatically indented when the amount is entered. Do not indent manually.) Date 30 June 2021 Particulars 11. 12. (Office supplies used) Account . Debit Credit 6222 ASP Postgraduate (PG) Take Home Assignment - Part A Question 11 of 11 < > - / 35 Post the adjusting entries for transactions numbered 11-14. (Leave blank any answer fields that do not require an answer. Also leave blank any fields following your answers that do not require an entry. For example, if there are two rows for entries, and only one entry is required, enter your answer in the first row and leave the second row blank.) Cash at bank 1/7/20 Balance b/d (1) Accounts receivable 1100 13,020 (3) Prepaid rent/GST rec. 14,113 72,210 (4) Office supplies/GST rec. 363 (5) T Chiang, drawings 22,000 (6) Salaries exp/payable 28,110 (8) Electricity exp/GST rec. 3,487 (9) Accounts payable 2,530 6222 ASP Postgraduate (PG) Take Home Assignment - Part A Question 11 of 11 < > - / 35 (9) Accounts payable 2,530 (10) GST payable 5,920 Accounts receivable 1/7/20 Balance b/d 1101 8,310 (1) Cash at bank 72,210 (2) Consulting fees rev/GST 85,327 Prepaid rent 1102 6222 ASP Postgraduate (PG) Take Home Assignment - Part A Question 11 of 11 < > Prepaid rent 1/7/20 Balance b/d (3) Cash at bank GST receivable 1/7/20 Balance b/d (3) Cash at bank (4) Cash/accounts payable (7) Accounts payable 1,070 12,830 1,970 (10) GST payable 1,283 70 296 > -/35 1102 1105 2,110 6222 ASP Postgraduate (PG) Take Home Assignment - Part A Question 11 of 11 < > GST receivable 1/7/20 Balance b/d (3) Cash at bank (4) Cash/accounts payable (7) Accounts payable (8) Cash at bank 1,970 (10) GST payable 1,283 70 296 > > 317 -/35 1105 2,110 III ... 6222 ASP Postgraduate (PG) Take Home Assignment - Part A Question 11 of 11 < > Office supplies 1/7/20 Balance b/d (4) Cash/accounts payable 1,160 700 Furniture and equipment 1/7/20 Balance b/d 25,270 -/35 1106 1110 6222 ASP Postgraduate (PG) Take Home Assignment - Part A Question 11 of 11 < > Accumulated depreciation - furniture and equipment 1/7/20 Balance b/d - / 35 1111 8,550 Accounts payable 2200 (9) Cash at bank 2,530 1/7/20 Balance b/d 4,790 (4) Office supplies/GST rec. 407 SU (7) Advertising/GST rec. 3,256 6222 ASP Postgraduate (PG) Take Home Assignment - Part A Question 11 of 11 < > Salaries payable (6) Cash at bank 370 1/7/20 Balance b/d - / 35 E GST payable 2203 (10) GST rec. 8,030 1/7/20 Balance b/d 4,510 (2) Accounts receivable 7,757 Tat Chiang, capital 3000 2201 370 5222 ASP Postgraduate (PG) Take Home Assignment - Part A Question 11 of 11 < > Tat Chiang, capital Tat Chiang, drawings (5) Cash at bank Consulting fees revenue 22,000 - / 35 3000 1/7/20 Balance b/d 32,580 3301 4400 (2) Accounts receivable 77,570 6222 ASP Postgraduate (PG) Take Home Assignment - Part A Question 11 of 11 < > Consulting fees revenue Salaries expense (6) Cash at bank 27,740 -/35 E 4400 (2) Accounts receivable 77,570 5500 6222 ASP Postgraduate (PG) Take Home Assignment - Part A Question 11 of 11 < > Electricity expense (8) Cash at bank Advertising expense (7) Accounts payable Depreciation expense - 3,170 2,960 furniture and equipment -/35 E 5503 5504 5505 6222 ASP Postgraduate (PG) Take Home Assignment - Part A Question 11 of 11 > Rent expense Office supplies expense - / 35 E 5512 5513 6222 ASP Postgraduate (PG) Take Home Assignment - Part A Question 11 of 11 < > - / 35 Prepare a 10-column worksheet for the year ended 30 June 2021. (Leave answer fields blank if no amount is required.) Unadjusted trial balance Account title Debit Cash at bank 8,707 Accounts receivable 21,427 Prepaid rent GST receivable 13,900 1,826 Adjustments Credit Debit ... Ci 6222 ASP Postgraduate (PG) Take Home Assignment - Part A Question 11 of 11 < > Office supplies Furniture and equipment Accumulated depreciation-furniture and equipment Accounts payable GST payable T Chiang, capital T Chiang, drawings Consulting fees revenue 1,860 25,270 8,550 5,923 4,237 32,580 22,000 77,570 - / 35 E 6222 ASP Postgraduate (PG) Take Home Assignment - Part A Question 11 of 11 Salaries expense Electricity expense Advertising expense Depreciation expense-furniture and equipment Rent expense Office supplies expense Salaries payable 27,740 3,170 2,960 128,860 128,860 - / 35 6222 ASP Postgraduate (PG) Take Home Assignment - Part A Question 11 of 11 < > - / 35 Prepare a 10-column worksheet for the year ended 30 June 2021. (Leave answer fields blank if no amount is required.) Payneham Professional Services Worksheet for the year ended 30 June 2021 Adjusted trial balance Adjustments Debit E Credit Debit Credit Det 6222 ASP Postgraduate (PG) Take Home Assignment - Part A Question 11 of 11 < - / 35 Prepare a 10-column worksheet for the year ended 30 June 2021. (Leave answer fields blank if no amount is required.) Debit Income statement Credit Debit Balance sheet Credit 6222 ASP Postgraduate (PG) Take Home Assignment - Part A Question 11 of 11 < > FI - / 35 Prepare an income statement, a statement of changes in equity and a balance sheet. (List items that increase owner's equity first. Determine the net of GST receivable and GST payable and enter this amount as GST payable in the balance sheet.) Payneham Professional Services Income statement for the year ended 30 June 2021 +A $ 6222 ASP Postgraduate (PG) Take Home Assignment - Part A Question 11 of 11 Payneham Professional Services Statement of changes in equity for the year ended 30 June 2021 $ +A $ +A 6222 ASP Postgraduate (PG) Take Home Assignment - Part A Question 11 of 11 < Payneham Professional Services Balance sheet as at 30 June 2021 Assets - / 35 E +A $ $ SA 6222 ASP Postgraduate (PG) Take Home Assignment - Part A Question 11 of 11 < > -/35 Journalise the closing entries. (Enter debit entries first, followed by credit entries. Credit account titles are automatically indented when the amount is entered. Do not indent manually.) Date 30 June 2021 Particulars (a) (b) (Close revenue accounts) Account no. Debit Credit P 6222 ASP Postgraduate (PG) Take Home Assignment - Part A Question 11 of 11 (c) (d) (Close expense accounts) (Transfer profit to capital) (Close drawings to capital) - / 35 6222 ASP Postgraduate (PG) Take Home Assignment - Part A Question 11 of 11 < -/35 Post the closing entries and close all of the below accounts. (Post entries in the order of journal entries presented in the question. Leave blank any answer fields that do not require an answer. Also leave blank any fields following your answers that do not require an entry. For example, if there are two rows for entries, and only one entry is required, enter your answer in the first row and leave the second row blank.) Cash at bank 1/7/20 Balance b/d (1) Accounts receivable 13,020 (3) Prepaid rent/GST rec. 72,210 (4) Office supplies/GST rec. 1100 14,113 363 (5) T Chiang, drawings 22,000 (6) Salaries exp/payable 28,110 (8) Electricity exp/GST rec. 3,487 (9) Accounts payable 2,530 6222 ASP Postgraduate (PG) Take Home Assignment - Part A Question 11 of 11 < Accounts receivable 1/7/20 Balance b/d 8,310 (1) Cash at bank (2) Consulting fees rev/GST 85,327 -/35 E 1101 72,210 Prepaid rent 1102 1/7/20 Balance b/d 1,070 (14) Rent expense 12,830 (3) Cash at bank 12,830 6222 ASP Postgraduate (PG) Take Home Assignment - Part A Question 11 of 11 Prepaid rent 1/7/20 Balance b/d (3) Cash at bank GST receivable 1/7/20 Balance b/d (3) Cash at bank 1,070 (14) Rent expense 12,830 - / 35 1102 12,830 1105 1,970 (10) GST payable 2,110 1,283 6222 ASP Postgraduate (PG) Take Home Assignment - Part A Question 11 of 11 > GST receivable 1/7/20 Balance b/d (3) Cash at bank (4) Cash/accounts payable (7) Accounts payable (8) Cash at bank 1,970 (10) GST payable 1,283 70 296 317 > < - / 35 1105 2,110 6222 ASP Postgraduate (PG) Take Home Assignment - Part A Question 11 of 11 < > Prepare a post-closing trial balance. (Enter accounts in order of ascending account number.) Payneham Professional Services Post-closing trial balance as at 30 June 2021 Account Account no. Debit $ Credit +A $ Type here to search W t - / 35 6222 ASP Postgraduate (PG) Take Home Assignment - Part A Question 11 of 11 < > Question Part Score - / 35 Prepare any suitable reversing entry on 1 July 2021. (Enter debit entries first, followed by credit entries. Credit account titles are automatically indented when the amount is entered. Do not indent manually.) Date Particulars 1 July 2021 (Reversal of accrued salaries) Account no. Debit Credit --/5

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started