Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Current Attempt in Progress Your answer is partially correct. The standard cost of Product B manufactured by Oriole Company includes 3.7 units of direct materials

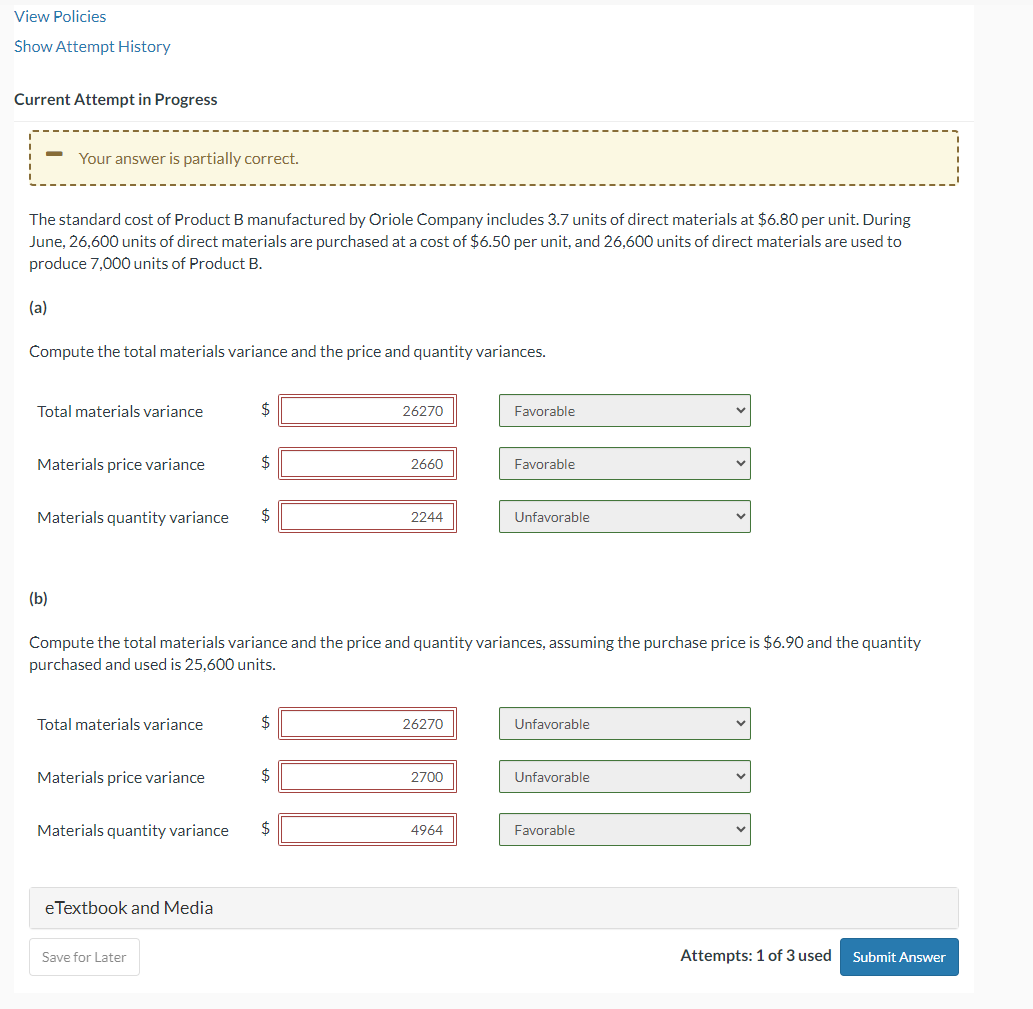

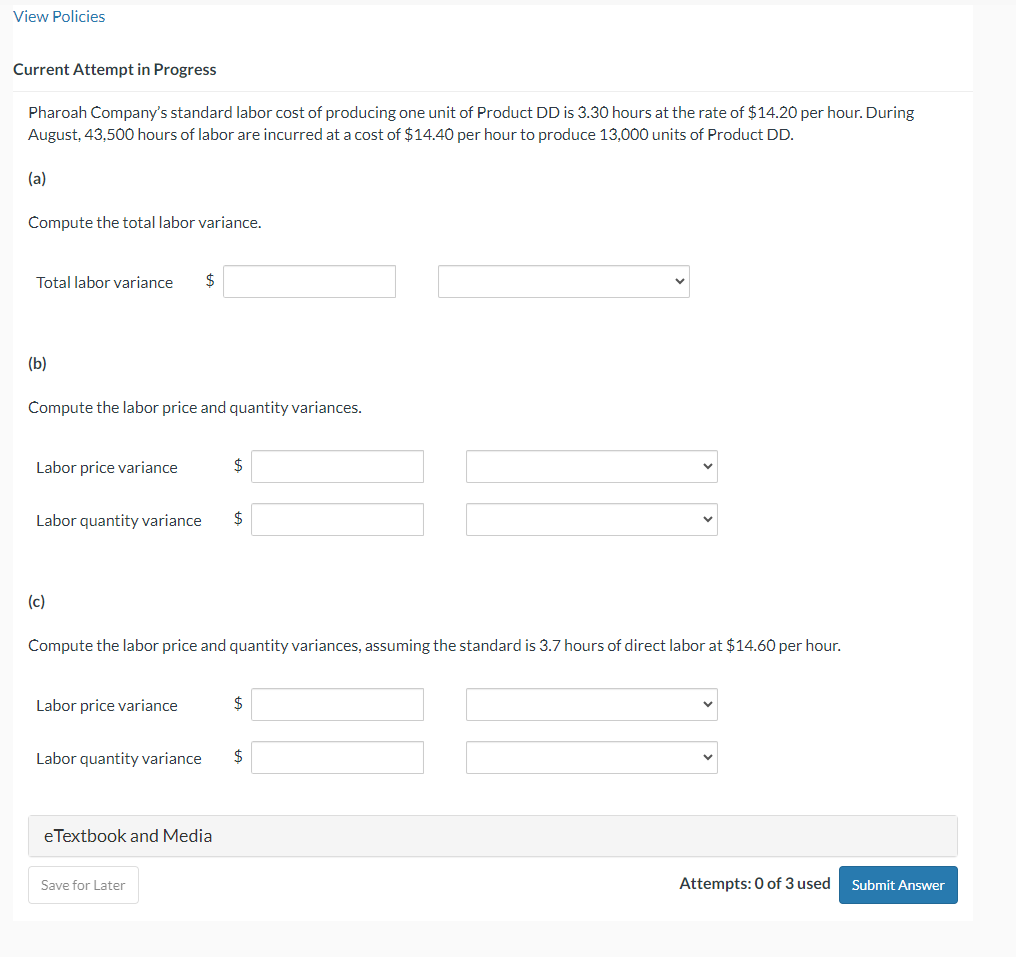

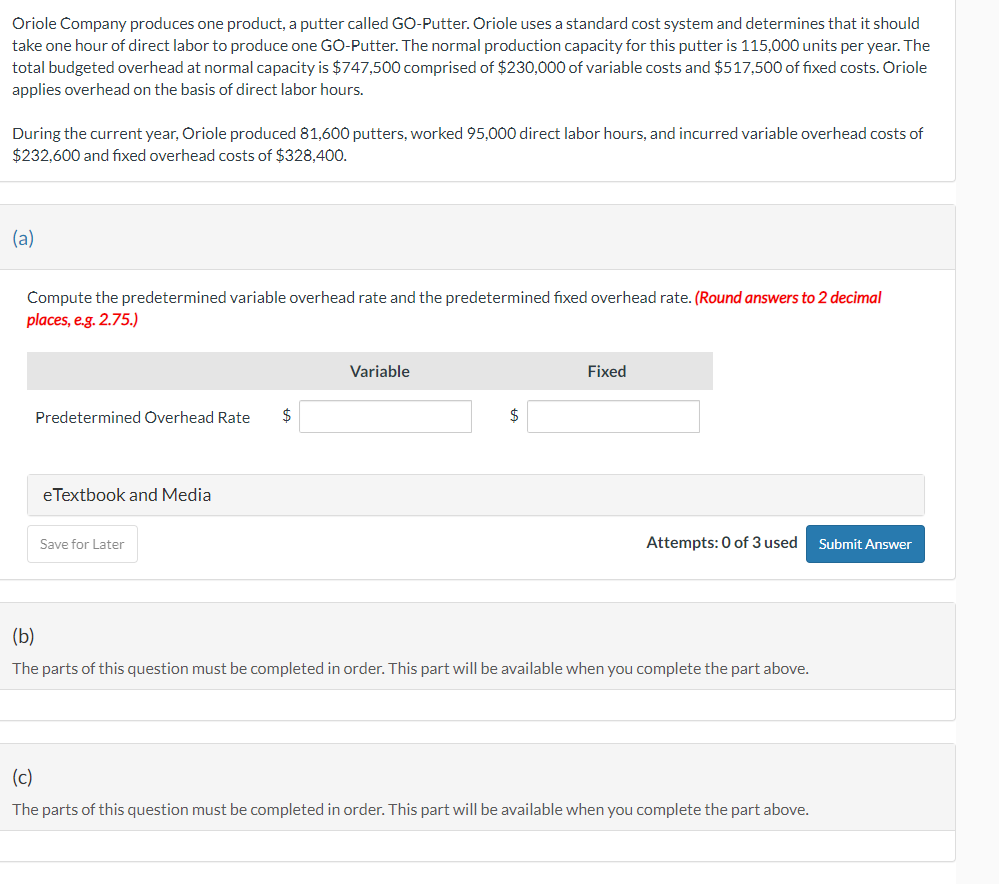

Current Attempt in Progress Your answer is partially correct. The standard cost of Product B manufactured by Oriole Company includes 3.7 units of direct materials at $6.80 per unit. During June, 26,600 units of direct materials are purchased at a cost of $6.50 per unit, and 26,600 units of direct materials are used to produce 7,000 units of Product B. (a) Compute the total materials variance and the price and quantity variances. Total materials variance $ Materials price variance $ Materials quantity variance $ (b) Compute the total materials variance and the price and quantity variances, assuming the purchase price is $6.90 and the quantity purchased and used is 25,600 units. Total materials variance $ Materials price variance $ Materials quantity variance $ Pharoah Company's standard labor cost of producing one unit of Product DD is 3.30 hours at the rate of $14.20 per hour. During August, 43,500 hours of labor are incurred at a cost of $14.40 per hour to produce 13,000 units of Product DD. (a) Compute the total labor variance. Total labor variance $ (b) Compute the labor price and quantity variances. Labor price variance $ Labor quantity variance $ (c) Compute the labor price and quantity variances, assuming the standard is 3.7 hours of direct labor at $14.60 per hour. Labor price variance $ Labor quantity variance $ eTextbook and Media Oriole Company produces one product, a putter called GO-Putter. Oriole uses a standard cost system and determines that it should take one hour of direct labor to produce one GO-Putter. The normal production capacity for this putter is 115,000 units per year. The total budgeted overhead at normal capacity is $747,500 comprised of $230,000 of variable costs and $517,500 of fixed costs. Oriole applies overhead on the basis of direct labor hours. During the current year, Oriole produced 81,600 putters, worked 95,000 direct labor hours, and incurred variable overhead costs of $232,600 and fixed overhead costs of $328,400. (a) Compute the predetermined variable overhead rate and the predetermined fixed overhead rate. (Round answers to 2 decimal places, e.g. 2.75.)

Current Attempt in Progress Your answer is partially correct. The standard cost of Product B manufactured by Oriole Company includes 3.7 units of direct materials at $6.80 per unit. During June, 26,600 units of direct materials are purchased at a cost of $6.50 per unit, and 26,600 units of direct materials are used to produce 7,000 units of Product B. (a) Compute the total materials variance and the price and quantity variances. Total materials variance $ Materials price variance $ Materials quantity variance $ (b) Compute the total materials variance and the price and quantity variances, assuming the purchase price is $6.90 and the quantity purchased and used is 25,600 units. Total materials variance $ Materials price variance $ Materials quantity variance $ Pharoah Company's standard labor cost of producing one unit of Product DD is 3.30 hours at the rate of $14.20 per hour. During August, 43,500 hours of labor are incurred at a cost of $14.40 per hour to produce 13,000 units of Product DD. (a) Compute the total labor variance. Total labor variance $ (b) Compute the labor price and quantity variances. Labor price variance $ Labor quantity variance $ (c) Compute the labor price and quantity variances, assuming the standard is 3.7 hours of direct labor at $14.60 per hour. Labor price variance $ Labor quantity variance $ eTextbook and Media Oriole Company produces one product, a putter called GO-Putter. Oriole uses a standard cost system and determines that it should take one hour of direct labor to produce one GO-Putter. The normal production capacity for this putter is 115,000 units per year. The total budgeted overhead at normal capacity is $747,500 comprised of $230,000 of variable costs and $517,500 of fixed costs. Oriole applies overhead on the basis of direct labor hours. During the current year, Oriole produced 81,600 putters, worked 95,000 direct labor hours, and incurred variable overhead costs of $232,600 and fixed overhead costs of $328,400. (a) Compute the predetermined variable overhead rate and the predetermined fixed overhead rate. (Round answers to 2 decimal places, e.g. 2.75.) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started