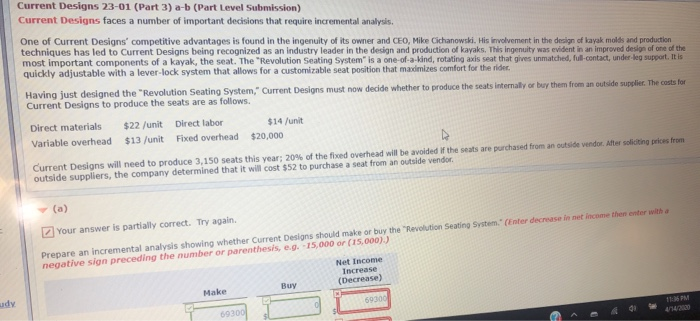

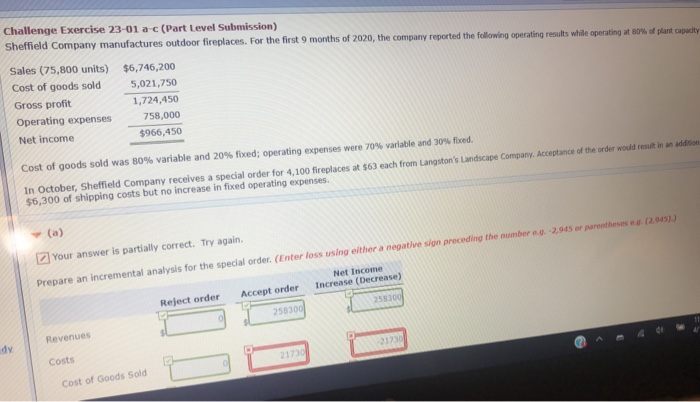

Current Designs 23-01 (Part 3) a b (Part Level Submission) Current Designs faces a number of important decisions that require incremental analysis One of Current Designs' competitive advantages is found in the ingenuity of its owner and CEO, Mike Cichanowski. His involvement in the design of kayak molds and production techniques has led to Current Designs being recognized as an Industry leader in the design and production of kayaks. This ingenuity was evident in an improved design of one of the most important components of a kayak, the seat. The Revolution Seating System" is a one of a kind, rotating axis seat that gives unmatched, full-contact, under leg support. It is quickly adjustable with a lever lock system that allows for a customizable seat position that maximizes comfort for the rider Having just designed the "Revolution Seating System, Current Designs must now decide whether to produce the seats internally or buy them from an outside supplier. The costs for Current Designs to produce the seats are as follows Direct materials Variable overhead $22 /unit $13/unit Direct labor Fixed overhead $14 /unit $20,000 Current Designs will need to produce 3,150 seats this year: 20% of the fixed overhead will be avoided if the seats are purchased from an outside vendor. After soliciting price from outside suppliers, the company determined that it will cost $52 to purchase a seat from an outside vendor e rech t ice then Your answer is partially correct. Try again. on Seating Syst Prepare an incremental analysis showing whether Current Designs should make or buy the v negative sign preceding the number or parenthesis... 15.000 or (15.000) Net Income Increase (Decrease) Buy Make udy 69300 11MM 2000 01 Challenge Exercise 23-01 a-c (Part Level Submission) Sheffield Company manufactures outdoor fireplaces. For the first 9 months of 2020, the company reported the following operating results while operating at 80% of plant padi Sales (75,800 units) Cost of goods sold Gross profit Operating expenses Net income $6,746,200 5,021,750 1,724,450 758,000 $966,450 a do Cost of goods sold was 80% variable and 20% fixed; operating expenses were 70% variable and 30% fred. In October, Sheffield Company receives a special order for 4,100 fireplaces at $63 each from Langston's Landscape Company, Acceptance of the order would result $6,300 of shipping costs but no increase in foed operating expenses. ( 2 5 ) Your answer is partially correct. Try again. Prepare an incremental analysis for the special order. (Enter loss using either a negative sin preceding the number .. 2,945 or parentheses Net Income Increase (Decrease) Accept order Reject order 258300 258309 Revenues ty Costs Cost of Goods Sold