Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Current Distribution of Contributed Property. The ABC Partnership made the following current distributions in the current year. The dollar amounts listed are the amounts before

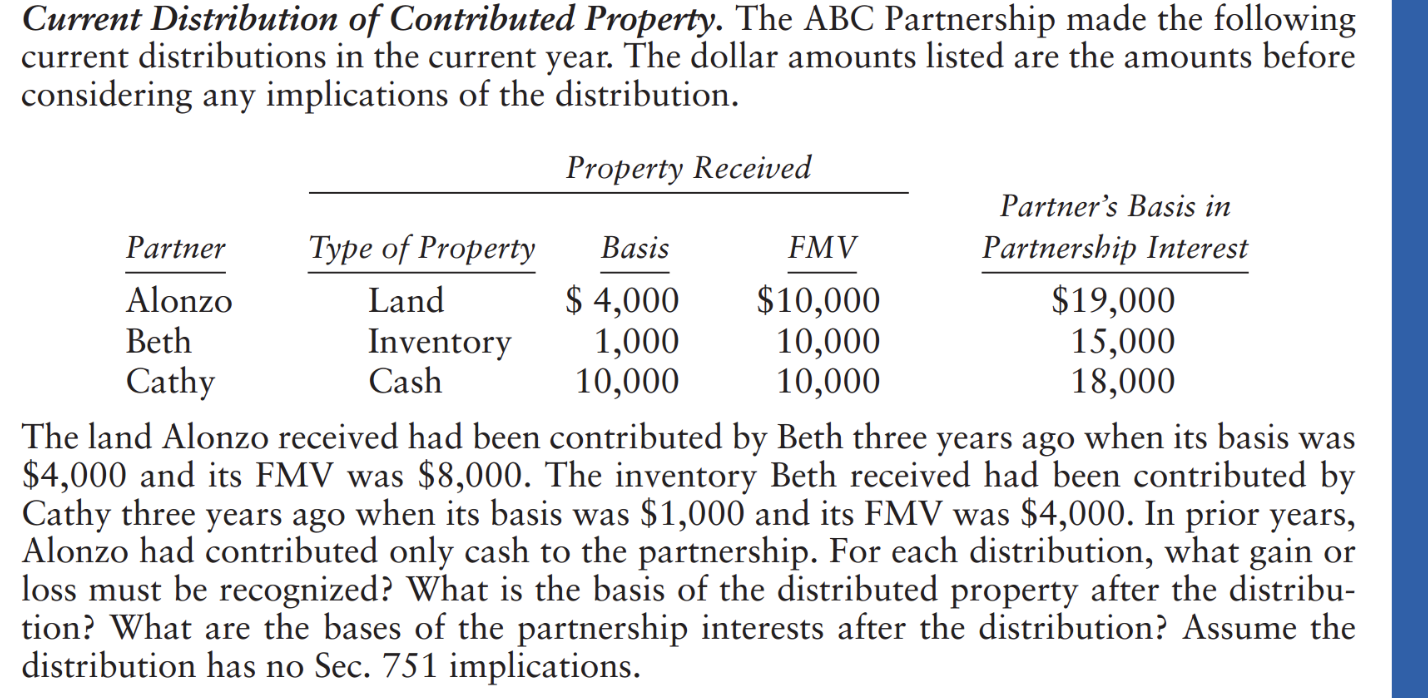

Current Distribution of Contributed Property. The ABC Partnership made the following current distributions in the current year. The dollar amounts listed are the amounts before considering any implications of the distribution. The land Alonzo received had been contributed by Beth three years ago when its basis was $4,000 and its FMV was $8,000. The inventory Beth received had been contributed by Cathy three years ago when its basis was $1,000 and its FMV was $4,000. In prior years, Alonzo had contributed only cash to the partnership. For each distribution, what gain or loss must be recognized? What is the basis of the distributed property after the distribution? What are the bases of the partnership interests after the distribution? Assume the distribution has no Sec. 751 implications

Current Distribution of Contributed Property. The ABC Partnership made the following current distributions in the current year. The dollar amounts listed are the amounts before considering any implications of the distribution. The land Alonzo received had been contributed by Beth three years ago when its basis was $4,000 and its FMV was $8,000. The inventory Beth received had been contributed by Cathy three years ago when its basis was $1,000 and its FMV was $4,000. In prior years, Alonzo had contributed only cash to the partnership. For each distribution, what gain or loss must be recognized? What is the basis of the distributed property after the distribution? What are the bases of the partnership interests after the distribution? Assume the distribution has no Sec. 751 implications Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started