Answered step by step

Verified Expert Solution

Question

1 Approved Answer

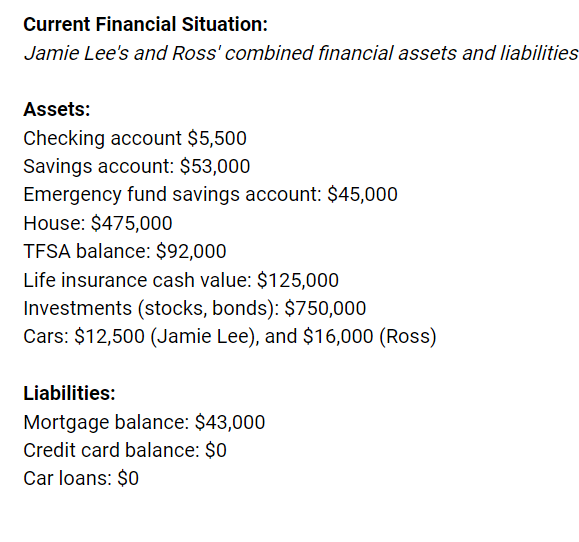

Current Financial Situation: Jamie Lee's and Ross' combined financial assets and liabilities Assets: Checking account $5,500 Savings account: $53,000 Emergency fund savings account: $45,000 House:

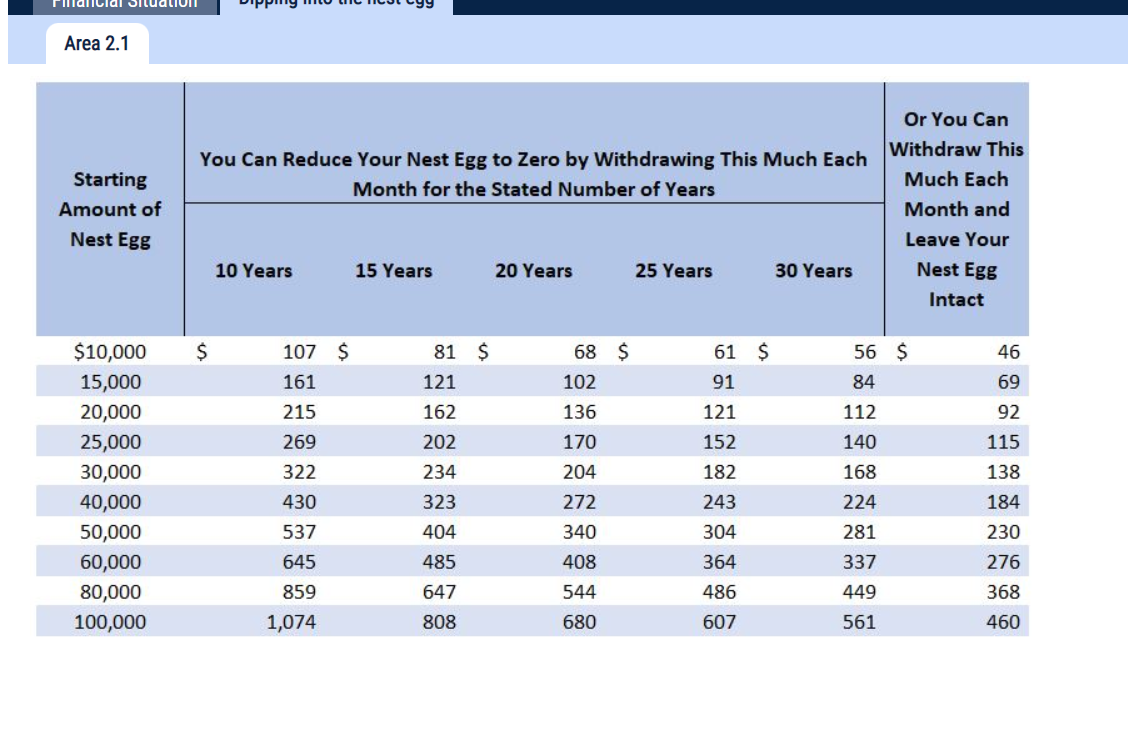

Current Financial Situation: Jamie Lee's and Ross' combined financial assets and liabilities Assets: Checking account $5,500 Savings account: $53,000 Emergency fund savings account: $45,000 House: $475,000 TFSA balance: $92,000 Life insurance cash value: $125,000 Investments (stocks, bonds): $750,000 Cars: \$12,500 (Jamie Lee), and \$16,000 (Ross) Liabilities: Mortgage balance: $43,000 Credit card balance: $0 Car loans: $0 How much can they withdraw each month that will reduce their nest egg to zero? Area 2.1 Current Financial Situation: Jamie Lee's and Ross' combined financial assets and liabilities Assets: Checking account $5,500 Savings account: $53,000 Emergency fund savings account: $45,000 House: $475,000 TFSA balance: $92,000 Life insurance cash value: $125,000 Investments (stocks, bonds): $750,000 Cars: \$12,500 (Jamie Lee), and \$16,000 (Ross) Liabilities: Mortgage balance: $43,000 Credit card balance: $0 Car loans: $0 How much can they withdraw each month that will reduce their nest egg to zero? Area 2.1

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started