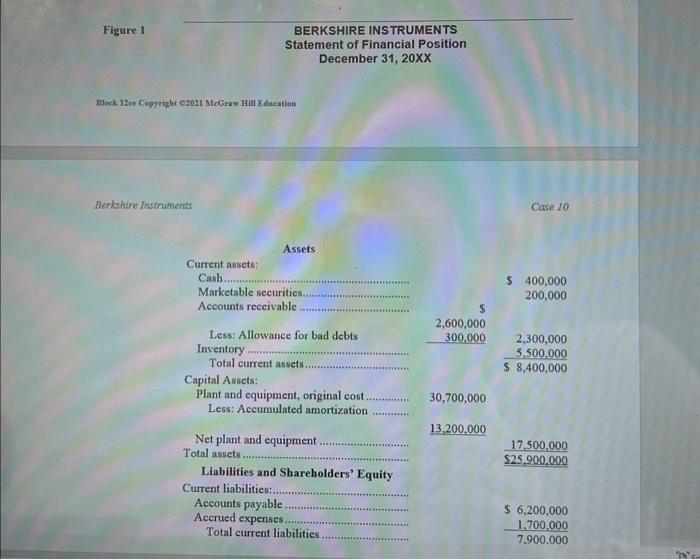

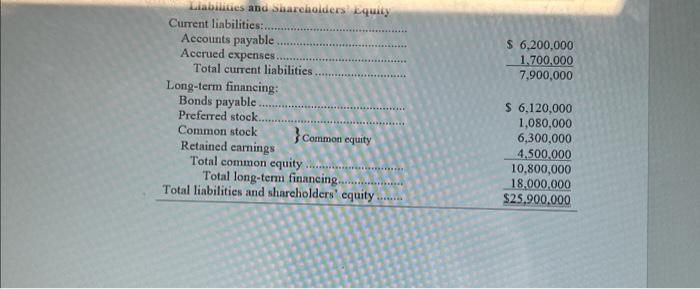

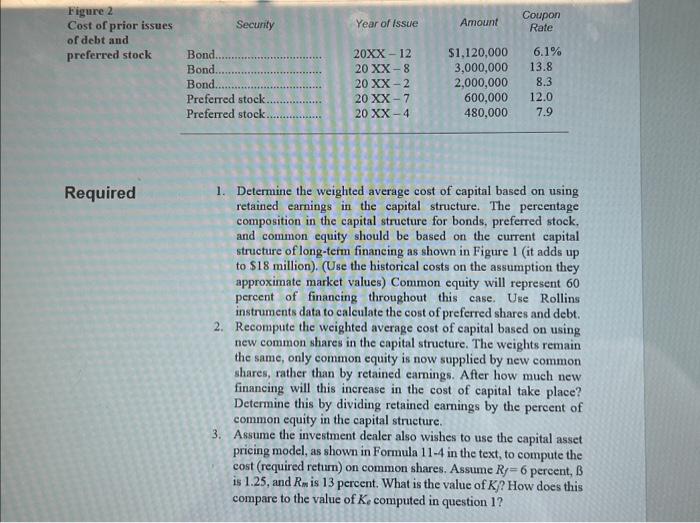

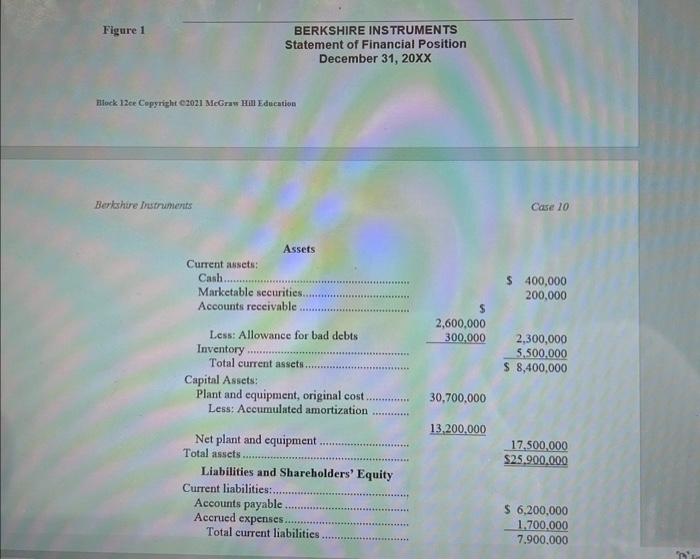

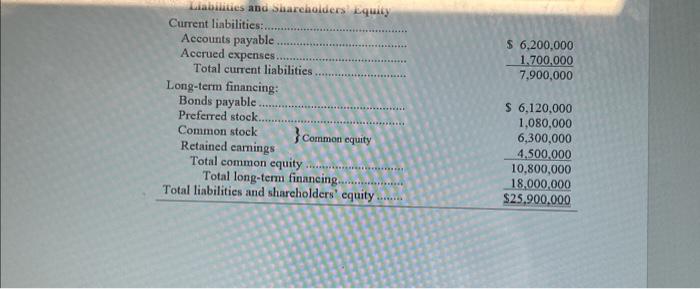

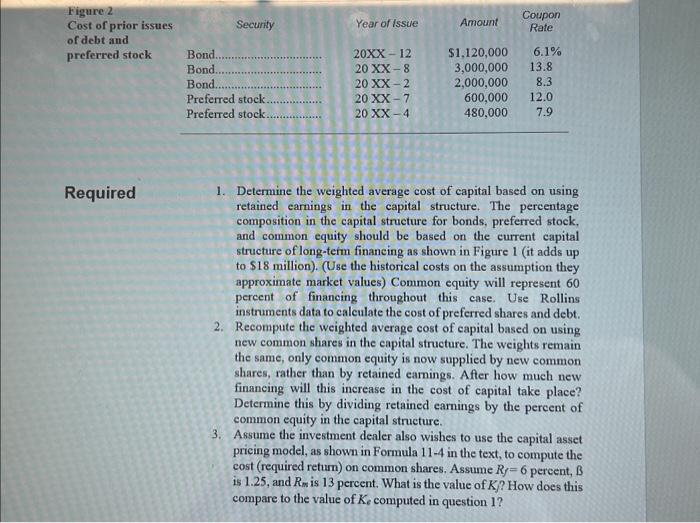

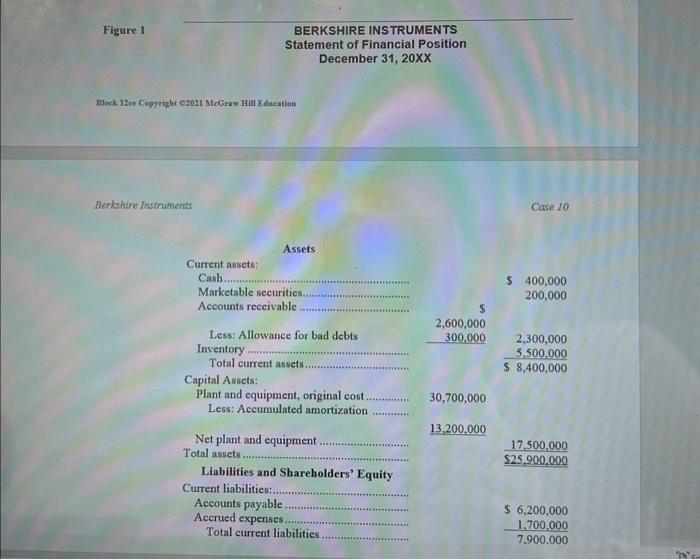

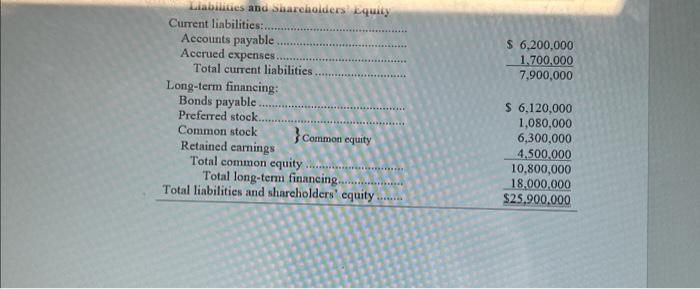

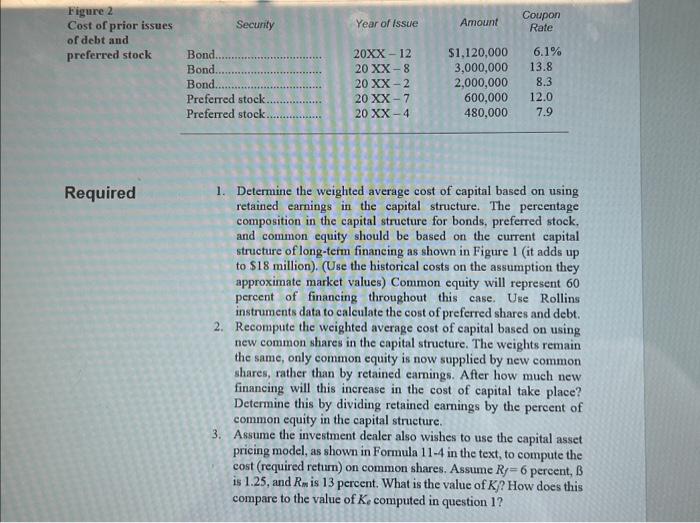

Current liabilities: Accounts payable Accrued expenses Total current liabilities Long-term financing: Bonds payable Preferred stock Common stock Retained eamings Total common equity Total long-term financing Total liabilities and shareholders' equity $6,200,0001,700,0007,900,000 S 6,120,000 1,080,000 6,300,000 4,500,000 10,800,000 $25,900,00018,000,000 Figure 1 BERKSHIRE INSTRUMENTS Statement of Financial Position December 31, 20XX Hock 12ce Cepgright e2021 MeGraw Hill Educatios Berkhare Instruments Case 10 Assets Current assets: Cash Marketable securities \$ 400,000 Accounts receivable 200,000 Less: Allowance for bad debts Inventory Total current assets Capital Assets: Plant and equipment, original cost Less: Accumulated amortization 30,700,000 Net plant and equipment 13,200,000 Total assets Liabilities and Shareholders' Equity $25,900,00017,500,000 Current liabilities: Accounts payable Accrued expenses. $6,200,0001.700,0007.900,000 Total curent liabilities Figure 1 BERKSHIRE INSTRUMENTS Statement of Financial Position December 31, 20XX Hilock 12ce Copgright ezo21 MeGraw Hill Educatios Berkhire instoments Case 10 Assets Current assets: Cash Marketable securities. Accounts receivable Less: Allowance for bad debts Inventory Total current assets Capital Assets: Plant and equipment, original cost Less: Accumulated amortization S 400,000 200,000 Net plant and equipment Total assets Liabilities and Shareholders' Equity \begin{tabular}{rr} $ & \\ 2,600,000 & \\ 300,000 & 2,300,000 \\ \hline & 5,500,000 \\ \hline & $8,400,000 \end{tabular} 30,700,000 13,200,000 $25,900,00017,500,000 Current liabilities: Accounts payable Accrued expenses $6,200,000 Total curent liabilities 7.900,0001,700,000 Current liabilities: Accounts payable Accrued expenses Total current liabilities Long-term financing: Bonds payable Preferred stock Common stock Retained camings Total common equity Total long-term finaneing Total liabilities and shareholders' equity S6,200,0001,700,0007,900,000 S 6,120,000 1,080,000 6,300,000 4,500,00010,800,000 $25,900,00018,000,000 preferred stock had been in the past. The information is provided in Figure 2. When Al got the data, he felt he was making real progress toward determining the cost of capital for the firm. However, his investment dealer indicated that he was going about the process in an incorrect manner. The from 82 cents to the current value. The dealer indicated that the underwriting cost (flotation cost) on a preferred share issue would be $2.60 per share and $2.00 per share on common shares. Al Hansen further observed that his firm was in a 35 percent marginal tax bracket. With all this information in hand, Al Hansen sat down to determine his firm's cost of capital. He was a little confused about computing the firm's cost of common equity. He knew there were two different formulas: one: one for the cost of retained carnings and one for the cost of new common stock. His investment dealer suggested that he follow the normally accepted approach used in determining the marginal cost of capital. Finst, determine the cost of capital for as large a capital structure as current retained earnings will support; then, determine the cost of capital based on exclusively using new common stock. 1. Determine the weighted average cost of capital based on using retained earnings in the capital structure. The percentage composition in the capital structure for bonds, preferred stock, and common equity should be based on the current capital structure of long-term finaneing as shown in Figure 1 (it adds up to $18 million). (Use the historical costs on the assumption they approximate market values) Common equity will represent 60 percent of financing throughout this case. Use Rollins instruments data to calculate the cost of preferred shares and debt. 2. Recompute the weighted average cost of capital based on using new common shares in the capital structure. The weights remain the same, only common equity is now supplied by new common shares, rather than by retained earnings. After how much new finaneing will this increase in the cost of capital take place? Determine this by dividing retained earnings by the pereent of common equity in the capital structure. 3. Assume the investment dealer also wishes to use the capital asset pricing model, as shown in Formula 114 in the text, to compute the cost (required return) on common shares. Assume Rf=6 pereent, B is 1.25 , and Rm is 13 pereent. What is the value of K ? How does this compare to the value of Ke computed in question 1 ? Berkshire Instruments Al Hansen, the newly appointed vice president of finance of Berkshire Instruments, was eager to talk to his investment dealer about future financing for the firm. One of Al's first assignments was to determine the firm's cost of capital. In assessing the weights to use in computing the cost of capital, he examined the current balance sheet, presented in Figure 1. In their discussion, Al and his investment dealer determined that the current mix in the capital structure was very close to optimal and that Berkshire Instruments should continue with it in the future. (Our assumption here is that the current historical capital structure approximates the market value capital structure) Of some concern was the appropriate cost to assign to each of the elements in the capital structure. Al Hansen. requested that his administrative assistant provide data on what the cost to issue debt and preferred stock had been in the past. The information is provided in Figure 2. When Al got the data, he felt he was making real progress toward determining the cost of capital for the firm. However, his investment dealer indicated that he was going ahout the nrocess in an ineorrect manner. The important issue is the current cost of funds, not the historical cost. The dealer suggested that a comparable firm in the industry, in terms of size and bond rating (BBB), Rollins Instruments, had issued bonds a year and a half ago for 9.3 percent interest at a $1,000 par value, and the bonds were currently selling for $890. The bonds had 20 years remaining to maturity. The dealer also observed that Rollings Instruments had just issued preferred shares at $60 per share, and the preferred stock paid an annual dividend of \$4.80. In terms of cost of common equity, the dealer suggested that Al Hansen use the dividend valuation model as a first approach to determining cost of equity. Based on that approach, Al observed that earnings were \$3 a share and that 40 percent would be paid out in dividends (D1). The current share price was $25. Dividends in the last four years had grown from 82 cents to the current value. The dealer indicated that the underwriting cost (flotation cost) on a preferred share issue would be $2.60 per share and $2.00 per share on common shares. Al Hansen further observed that his firm was in a 35 percent maroinal tax bracket. 1. Determine the weighted average cost of capital based on using retained earnings in the capital structure. The percentage composition in the capital structure for bonds, preferred stock, and common equity should be based on the current capital structure of long-term financing as shown in Figure 1 (it adds up to $18 million). (Use the historical costs on the assumption they approximate market values) Common equity will represent 60 percent of financing throughout this case. Use Rollins instruments data to calculate the cost of preferred shares and debt. 2. Recompute the weighted average cost of capital based on using new common shares in the capital structure. The weights remain the same, only common equity is now supplied by new common shares, rather than by retained earnings. After how much new finaneing will this increase in the cost of capital take place? Determine this by dividing retained earnings by the pereent of common equity in the capital structure. 3. Assume the investment dealer also wishes to use the capital asset pricing model, as shown in Formula 114 in the text, to compute the cost (required return) on common shares. Assume Rf=6 pereent, B is 1.25 , and Rm is 13 pereent. What is the value of K ? How does this compare to the value of Ke computed in question 1