Answered step by step

Verified Expert Solution

Question

1 Approved Answer

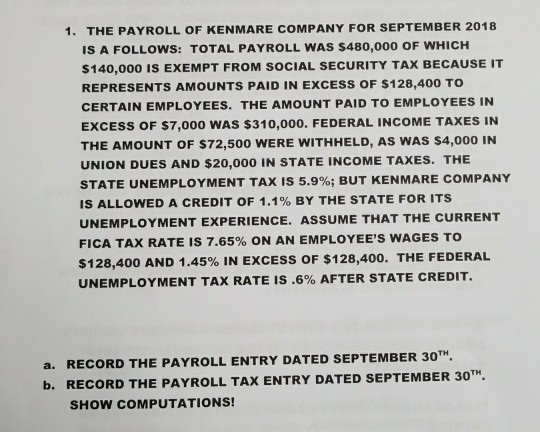

Current Liabilities and Contingencies 1. THE PAYROLL OF KENMARE COMPANY FOR SEPTEMBER 2018 IS A FOLLoWS: TOTAL PAYROLL WAS $480,000 OF WHICH s140,000 IS EXEMPT

Current Liabilities and Contingencies

1. THE PAYROLL OF KENMARE COMPANY FOR SEPTEMBER 2018 IS A FOLLoWS: TOTAL PAYROLL WAS $480,000 OF WHICH s140,000 IS EXEMPT FROM SOCIAL SECURITY TAX BECAUSE IT REPRESENTS AMOUNTS PAID IN EXCESS OF $128,400 TO CERTAIN EMPLOYEES. THE AMOUNT PAID TO EMPLOYEES IN EXCESS OF $7,000 WAS $310,00O. FEDERAL INCOME TAXES IN THE AMOUNT OF S72,500 WERE WITHHELD, AS WAS $4,000 IN UNION DUES AND $20,000 IN STATE INCOME TAXES. THE STATE UNEMPLOYMENT TAX IS 5.9%; BUT KENMARE COMPANY IS ALLOWED A CREDIT OF 1.1% BY THE STATE FOR ITS UNEMPLOYMENT EXPERIENCE. ASSUME THAT THE CURRENT FICA TAX RATE IS 7.65% ON AN EMPLOYEE'S WAGES TO $128,400 AND 1.45% IN EXCESS OF $128,400. THE FEDERAL UNEMPLOYMENT TAX RATE IS .60% AFTER STATE CREDIT. a. RECORD THE PAYROLL ENTRY DATED SEPTEMBER 30* b. RECORD THE PAYROLL TAX ENTRY DATED SEPTEMBER 30" SHOW COMPUTATIONS

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started