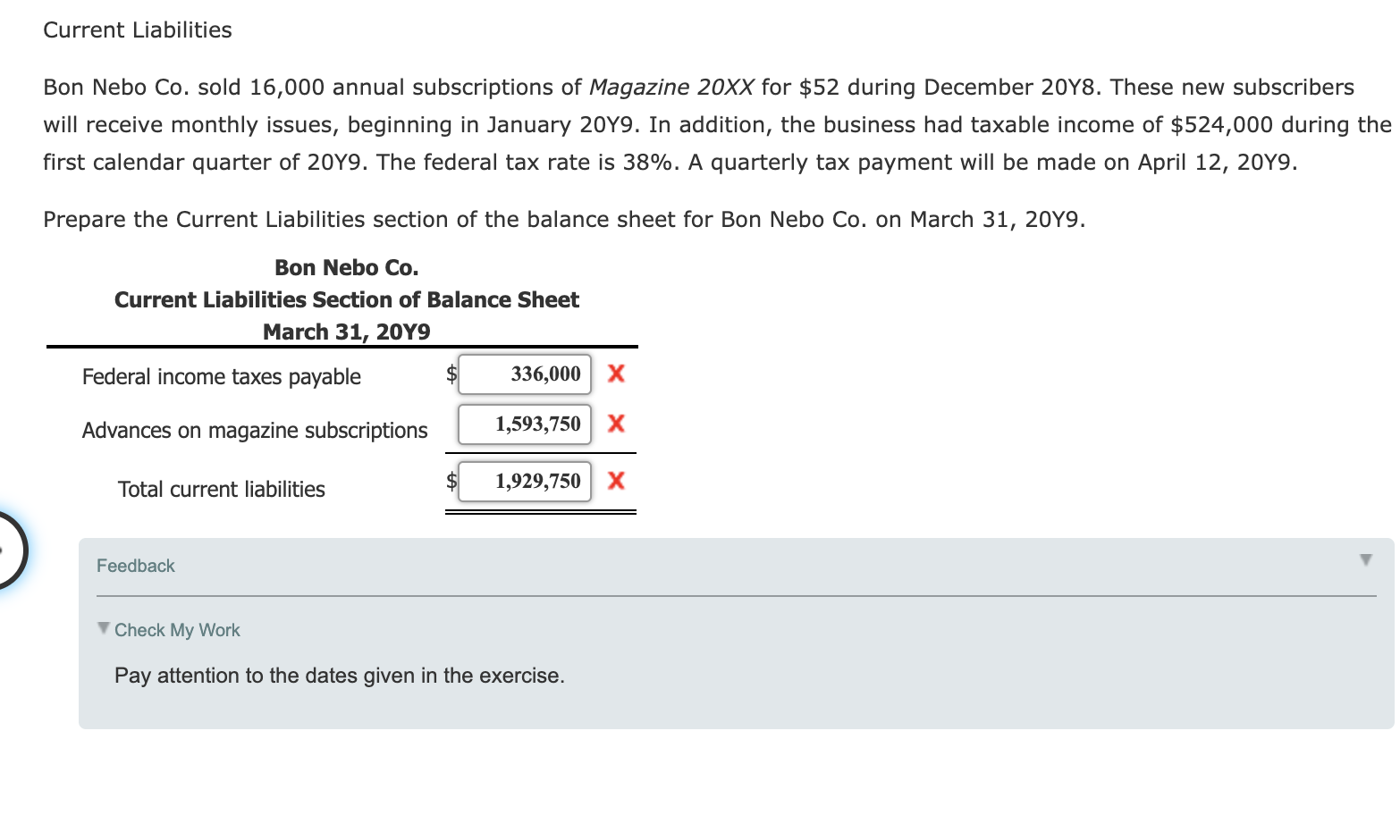

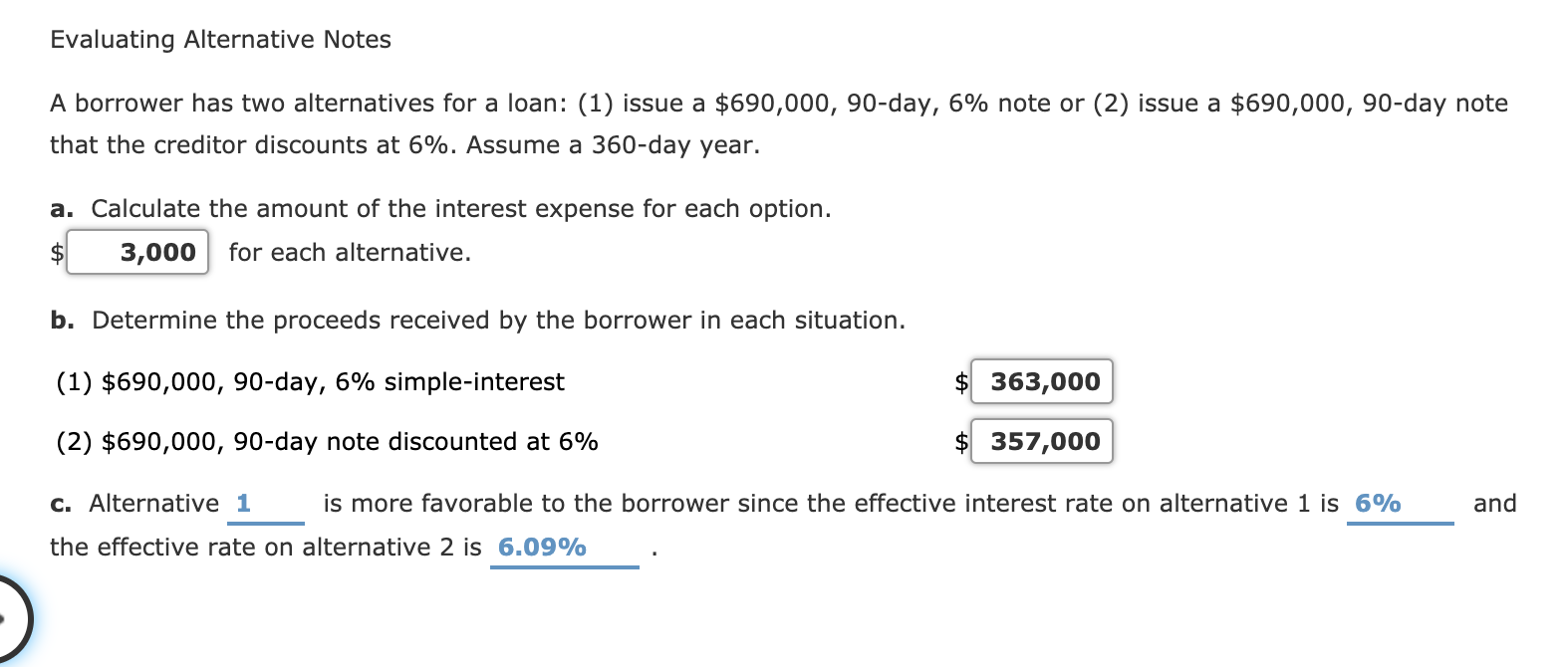

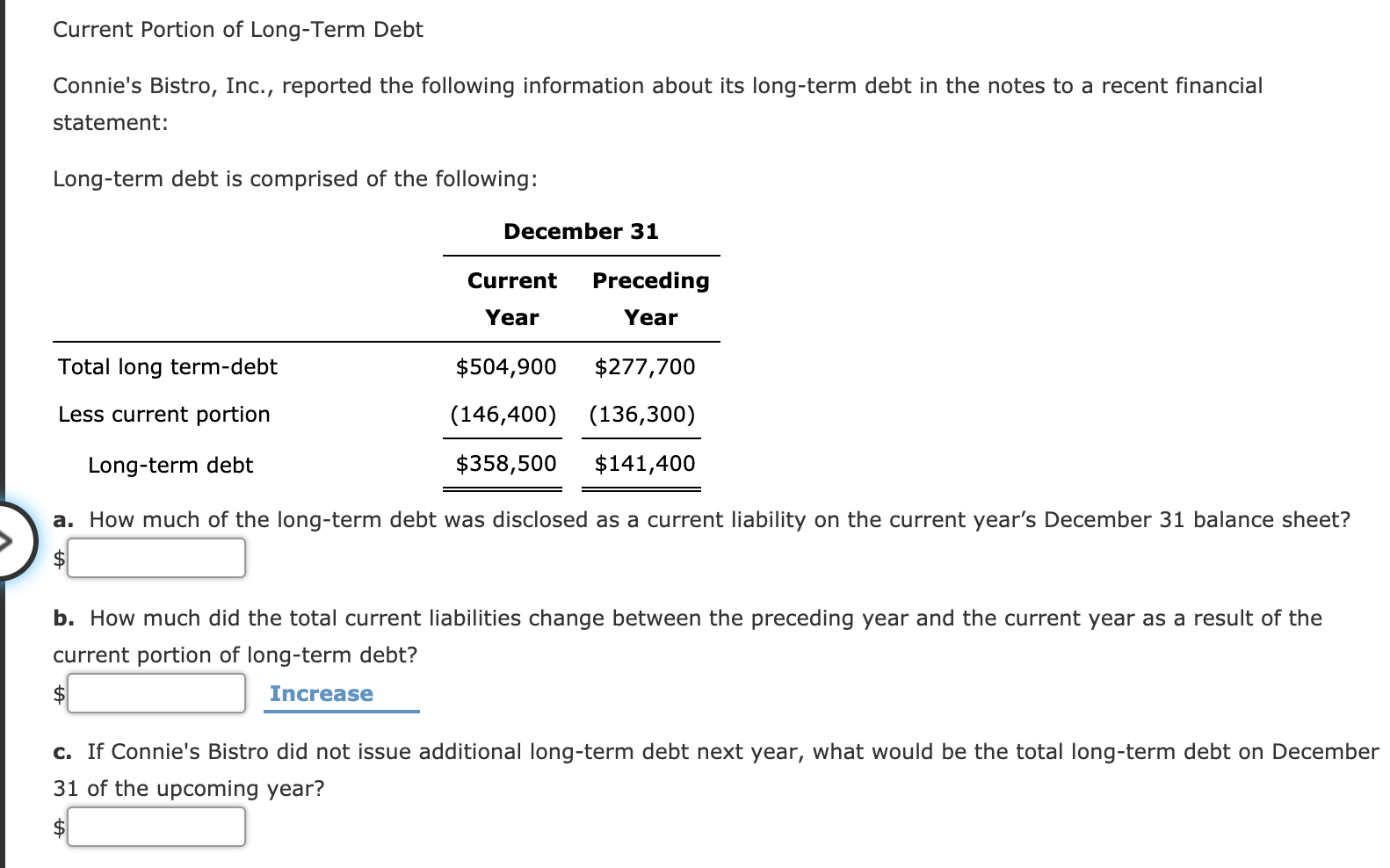

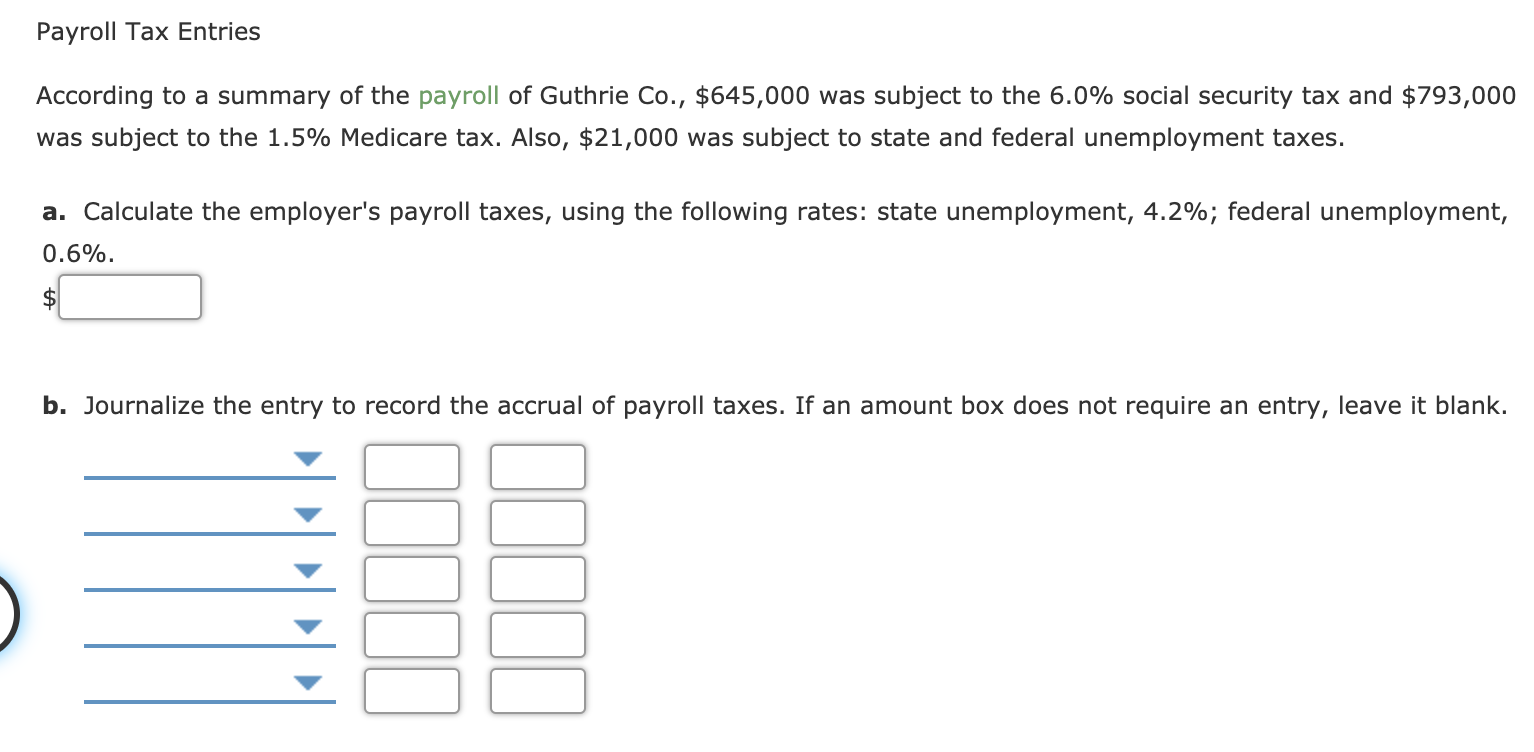

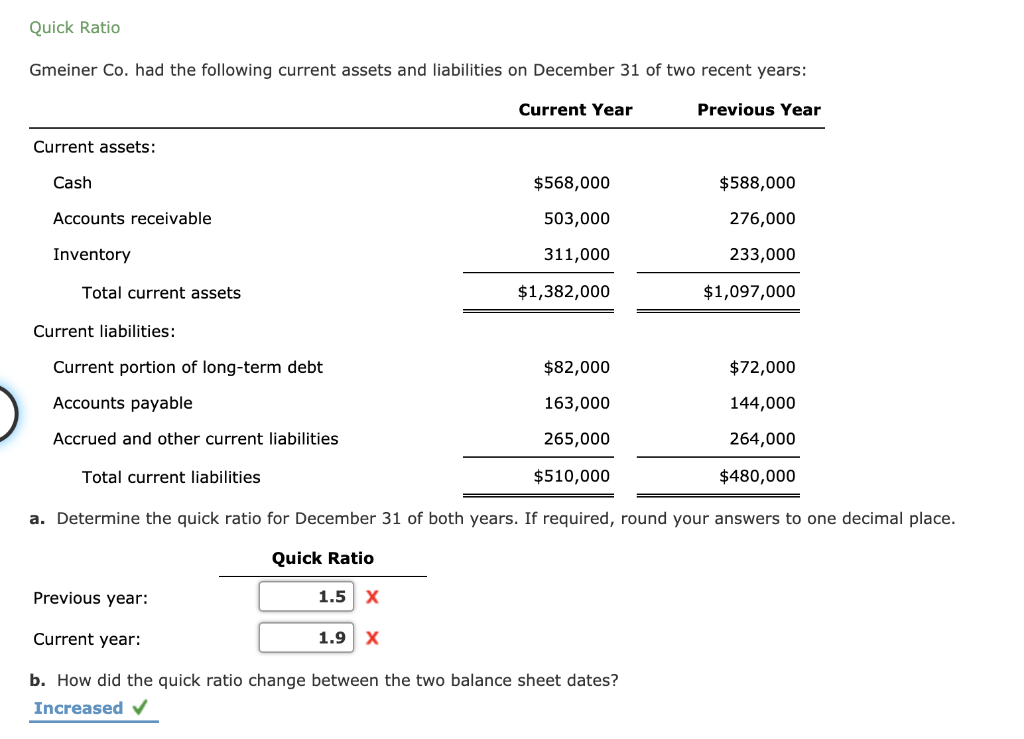

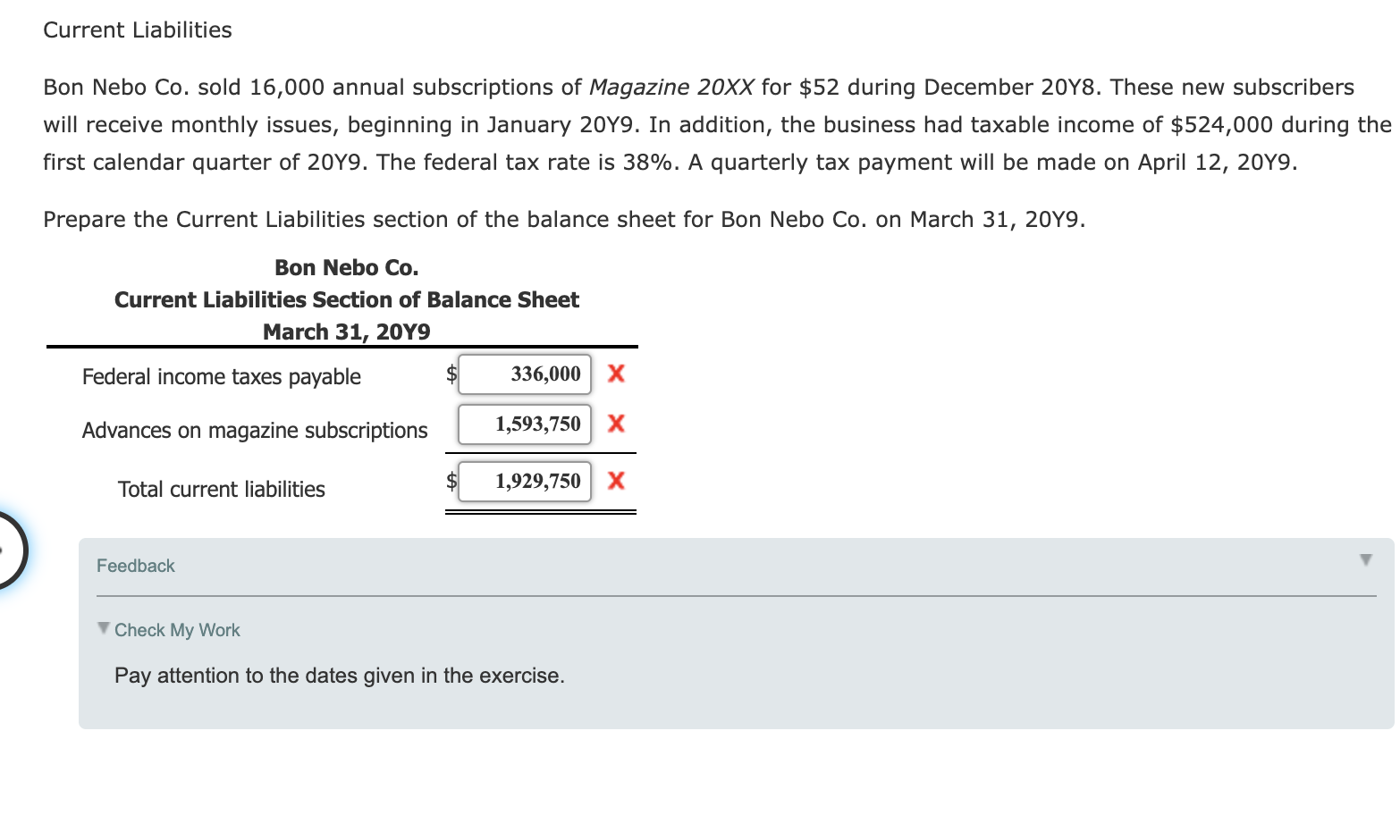

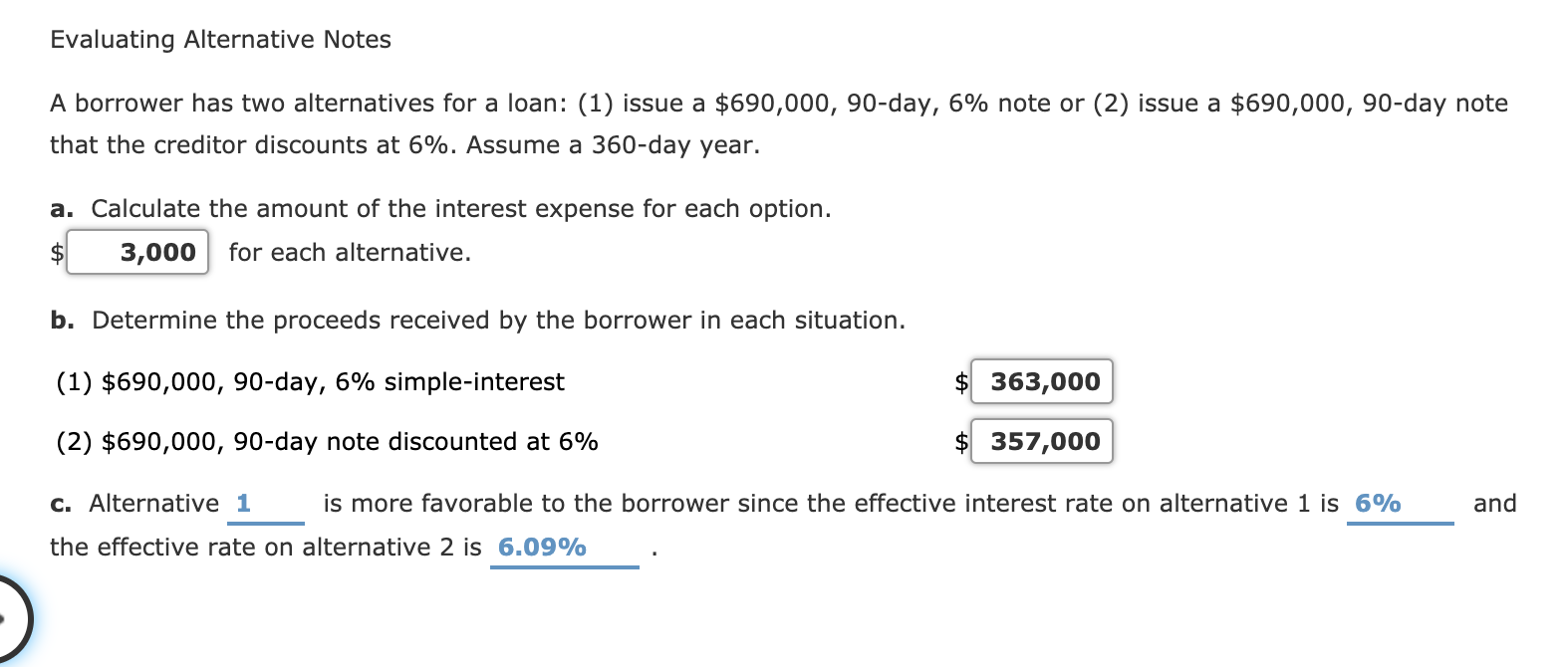

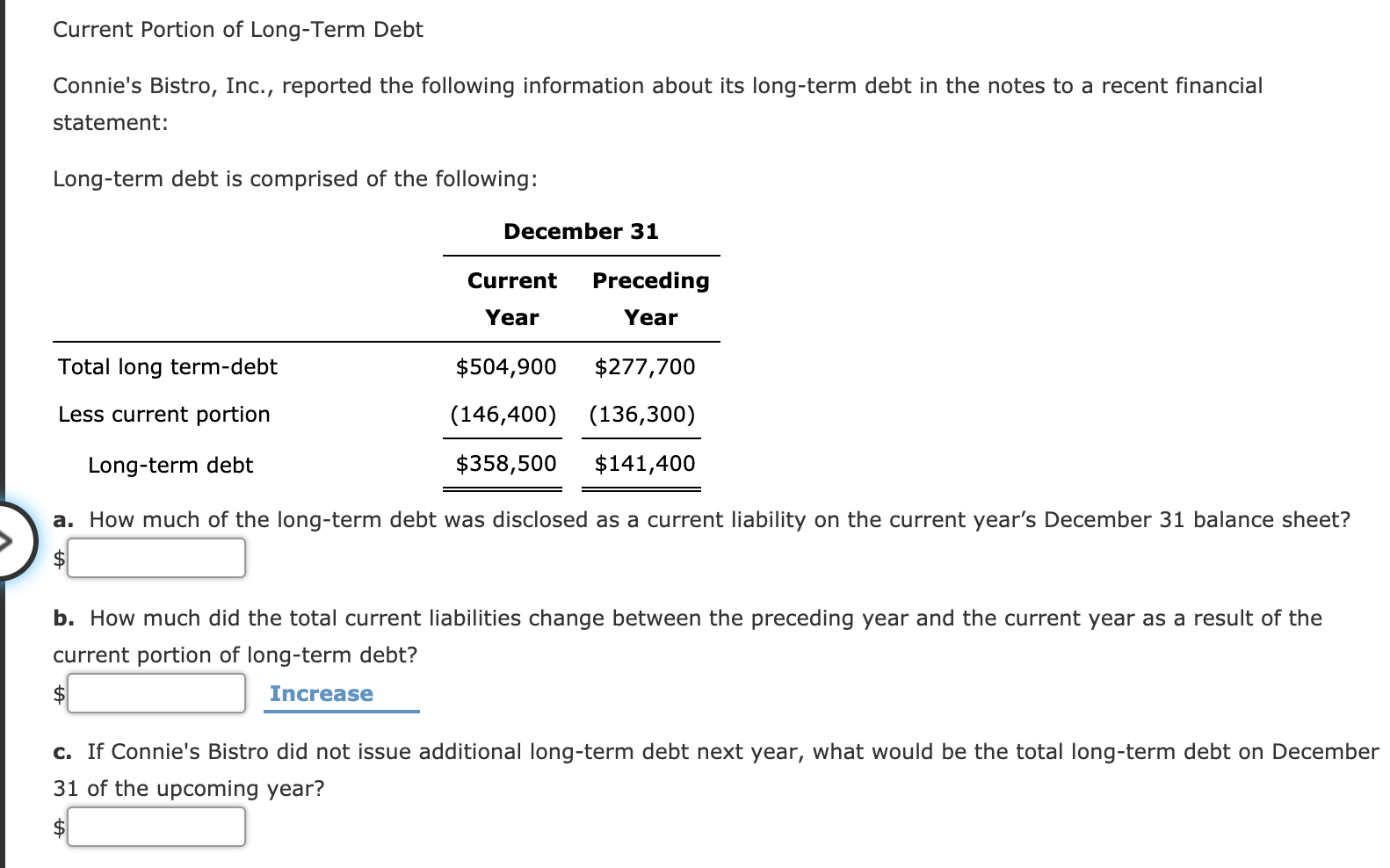

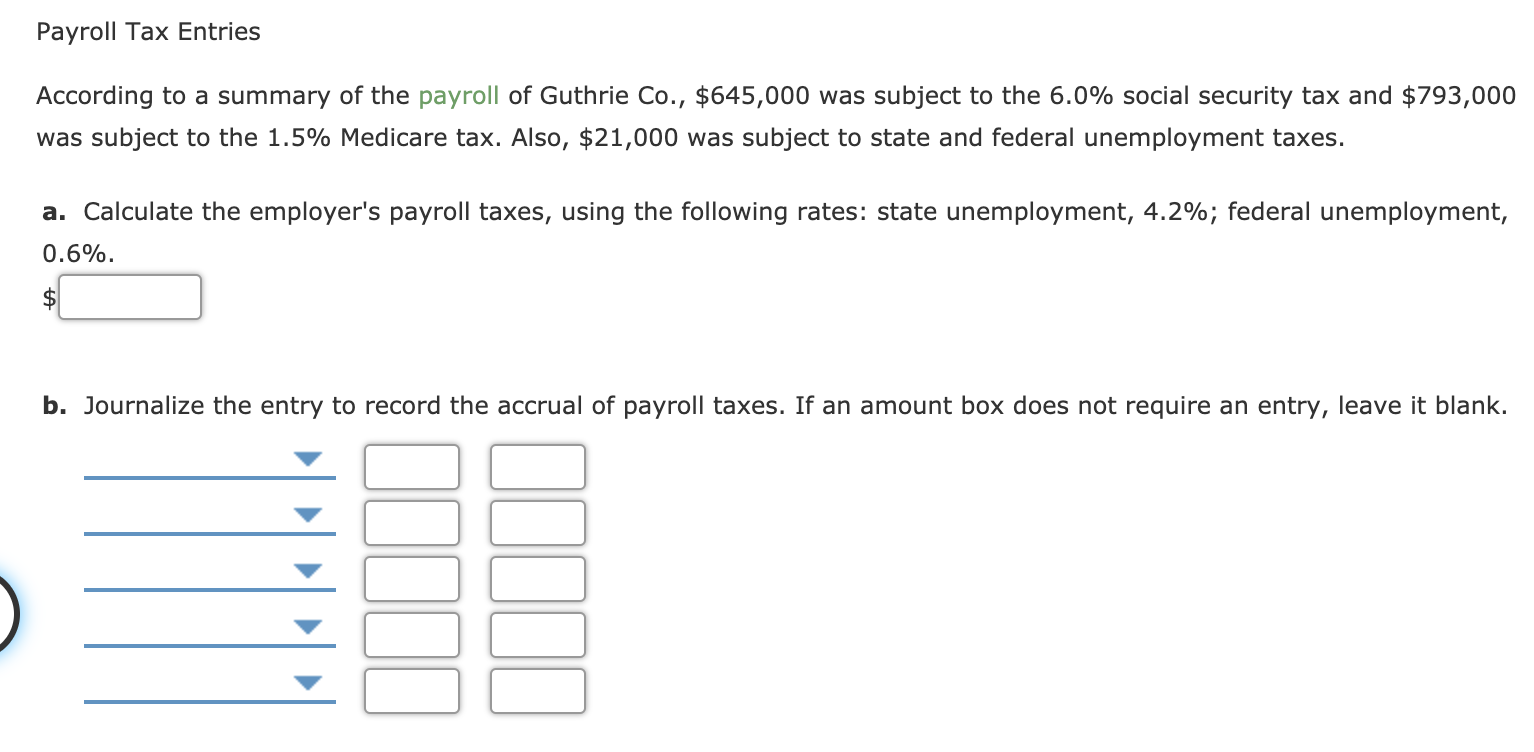

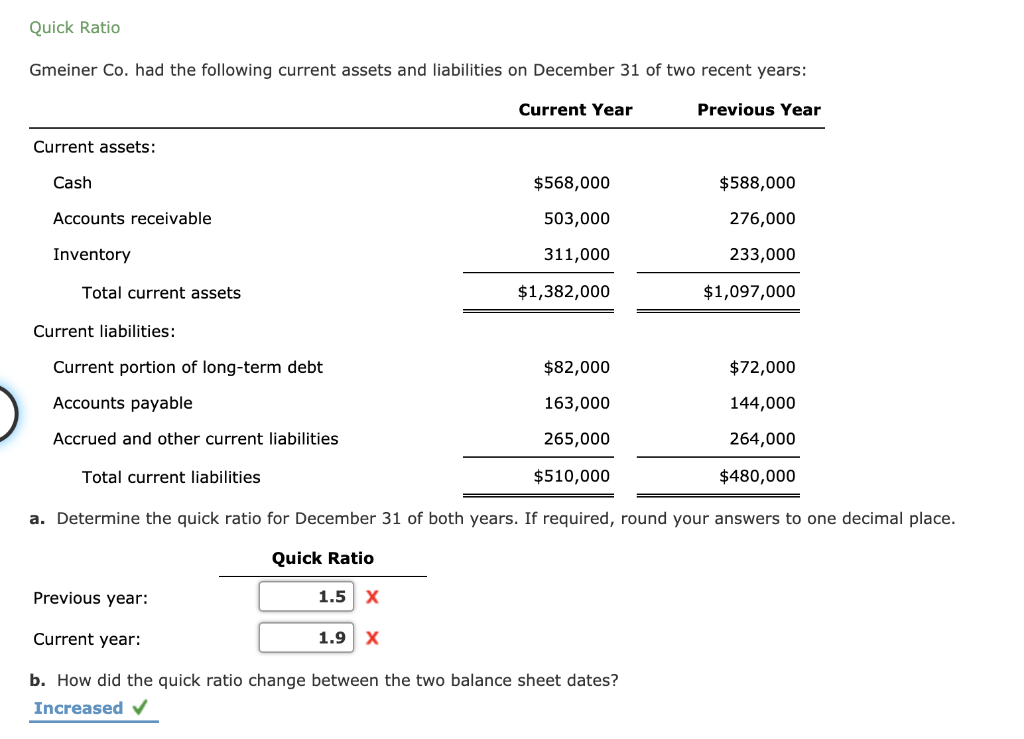

Current Liabilities Bon Nebo Co. sold 16,000 annual subscriptions of Magazine 20XX for $52 during December 20Y8. These new subscribers will receive monthly issues, beginning in January 2019. In addition, the business had taxable income of $524,000 during the first calendar quarter of 2049. The federal tax rate is 38%. A quarterly tax payment will be made on April 12, 2049. Prepare the Current Liabilities section of the balance sheet for Bon Nebo Co. on March 31, 2049. Bon Nebo Co. Current Liabilities Section of Balance Sheet March 31, 2049 Federal income taxes payable 336,000 x Advances on magazine subscriptions 1,593,750 Total current liabilities $ 1,929,750 x Feedback Check My Work Pay attention to the dates given in the exercise. Evaluating Alternative Notes A borrower has two alternatives for a loan: (1) issue a $690,000, 90-day, 6% note or (2) issue a $690,000, 90-day note that the creditor discounts at 6%. Assume a 360-day year. a. Calculate the amount of the interest expense for each option. $ 3,000 for each alternative. b. Determine the proceeds received by the borrower in each situation. (1) $690,000, 90-day, 6% simple-interest $363,000 $ 357,000 (2) $690,000, 90-day note discounted at 6% c. Alternative 1 is more favorable to the borrower since the effective interest rate on alternative 1 is 6% and the effective rate on alternative 2 is 6.09% Current Portion of Long-Term Debt Connie's Bistro, Inc., reported the following information about its long-term debt in the notes to a recent financial statement: Long-term debt is comprised of the following: December 31 Current Preceding Year Year Total long term-debt $504,900 (146,400) $277,700 (136,300) Less current portion Long-term debt $358,500 $141,400 a. How much of the long-term debt was disclosed as a current liability on the current year's December 31 balance sheet? b. How much did the total current liabilities change between the preceding year and the current year as a result of the current portion of long-term debt? Increase C. If Connie's Bistro did not issue additional long-term debt next year, what would be the total long-term debt on December 31 of the upcoming year? Payroll Tax Entries According to a summary of the payroll of Guthrie Co., $645,000 was subject to the 6.0% social security tax and $793,000 was subject to the 1.5% Medicare tax. Also, $21,000 was subject to state and federal unemployment taxes. a. Calculate the employer's payroll taxes, using the following rates: state unemployment, 4.2%; federal unemployment, 0.6%. $ b. Journalize the entry to record the accrual of payroll taxes. If an amount box does not require an entry, leave it blank. Quick Ratio Gmeiner Co. had the following current assets and liabilities on December 31 of two recent years: Current Year Previous Year Current assets: Cash $568,000 Accounts receivable 503,000 $588,000 276,000 233,000 Inventory 311,000 Total current assets $1,382,000 $1,097,000 Current liabilities: Current portion of long-term debt $82,000 $72,000 Accounts payable 163,000 144,000 Accrued and other current liabilities 265,000 264,000 $480,000 Total current liabilities $510,000 a. Determine the quick ratio for December 31 of both years. If required, round your answers to one decimal place. Quick Ratio Previous year: 1.5 x Current year: 1.9 b. How did the quick ratio change between the two balance sheet dates? Increased