Answered step by step

Verified Expert Solution

Question

1 Approved Answer

For each of the following statements, decide whether it is true or false, and explain your answer in at most two sentences using the

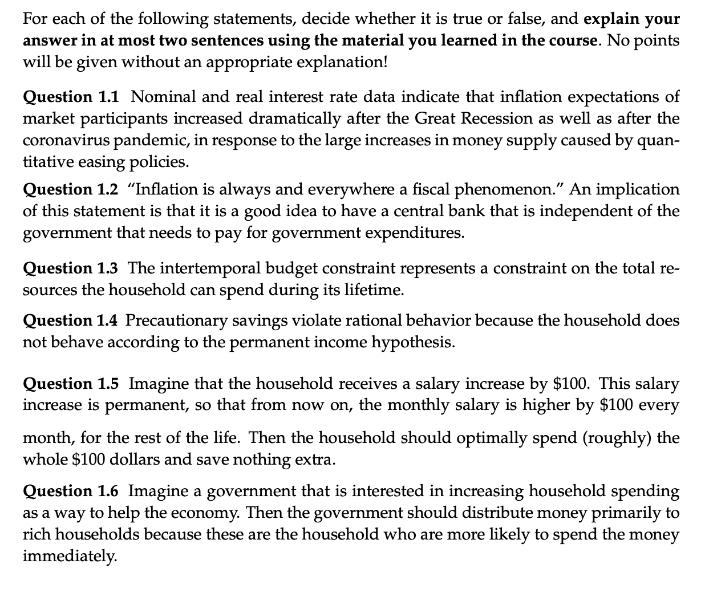

For each of the following statements, decide whether it is true or false, and explain your answer in at most two sentences using the material you learned in the course. No points will be given without an appropriate explanation! Question 1.1 Nominal and real interest rate data indicate that inflation expectations of market participants increased dramatically after the Great Recession as well as after the coronavirus pandemic, in response to the large increases in money supply caused by quan- titative easing policies. Question 1.2 "Inflation is always and everywhere a fiscal phenomenon." An implication of this statement is that it is a good idea to have a central bank that is independent of the government that needs to pay for government expenditures. Question 1.3 The intertemporal budget constraint represents a constraint on the total re- sources the household can spend during its lifetime. Question 1.4 Precautionary savings violate rational behavior because the household does not behave according to the permanent income hypothesis. Question 1.5 Imagine that the household receives a salary increase by $100. This salary increase is permanent, so that from now on, the monthly salary is higher by $100 every month, for the rest of the life. Then the household should optimally spend (roughly) the whole $100 dollars and save nothing extra. Question 1.6 Imagine a government that is interested in increasing household spending as a way to help the economy. Then the government should distribute money primarily to rich households because these are the household who are more likely to spend the money immediately.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

11 True Quantitative easing policies increase the money supply which lea...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started