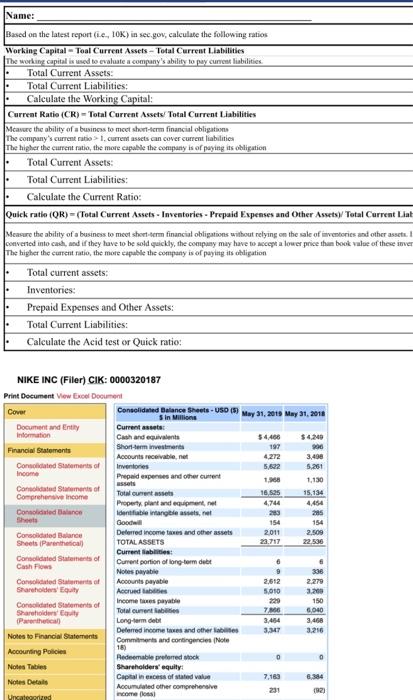

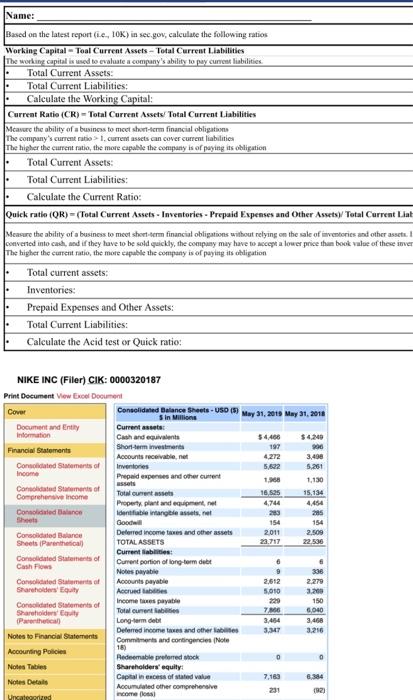

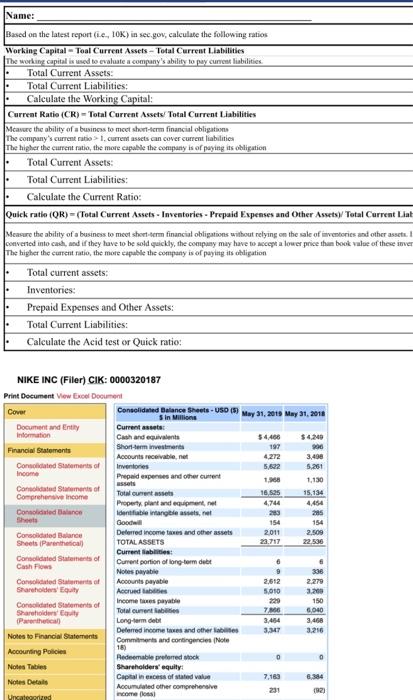

Current Position Analysis, determine for each year (1) the working capital, (2) the current ratio, and (3) the quick ratio. Round ratios to one decimal place.

Name: . Based on the latest report (ie., LOK) in sec.gov, calculate the following ratios Working Capital - Toal Current Assets - Total Current Liabilities The working capital is used to evaluate a company's ability to pay current liabilities Total Current Assets: Total Current Liabilities: Calculate the Working Capital: Current Ratio (CR) - Total Current Assets/Total Current Liabilities Measure the ability of a business to meet short-term financial obligations The company's current ratio 1. current assets can cover current liabilities The higher the current ratio, the more capable the company is of paying its obligation Total Current Assets: Total Current Liabilities: Calculate the Current Ratio: Quick ratio (OR) - (Total Current Assets - Inventories - Prepaid Expenses and Other Assetsy Total Current Liat Measure the ability of a business to meet short-term financial obligations without relying on the sale of inventories and other assets. I converted into cash, and if they have to be sold quickly, the company may have to accept a lower price the book value of these inver The higher the current ratio, the more capable the company is of paying its obligation Total current assets: Inventories: Prepaid Expenses and Other Assets: Total Current Liabilities: Calculate the Acid test or Quick ratio: . 1. NIKE INC (Filer) CIK: 0000320187 Print Document View Excel Document Cover Consolidated Balance Sheets - USD 159 May 31, 2015 May 31, 2018 Sin Million Document and Ently Current assets: Information Cash and equivalents $4240 Financial Statements Short-term investment 197 900 Accounts receivable, nel 4.272 3,400 Consolidated Statements of Inventories 5.622 5.261 Income Prepaid expenses and other current assets 1,130 Consolidated States of Comprehensive Income Total currents 16.595 15,134 Property plant and centre 4.744 4454 Consolidated Balance Identifiable intangible assets.net 285 205 Sheets Goodwill 154 154 Consolidated Balance Deferred income taxes and other assets 2011 2.509 Sheets Parenthetical TOTAL ASSETS 22.717 Consolidated Statement of Current abilities: Current portion of long term dubt 6 Cash Flow Notes payable 336 Consolidated mets of Accounts payable 2,612 2.270 Shareholders Accrueda 5.010 3.200 Condited Statements of Income mes payable Shareholders Total current 7.66 6,040 Parental Long-term debit 3.460 Deferred income taxes and others 3.37 3.26 Notes to Financial Statements Commitments and contingencies Note Accounting Policies Redeemable preferred lock 0 Notes Tables Shareholders' equity: Capital Inces of stated value 7,163 Notes Details Accumulated other comprehensive 201 (92) Uncategorized ncome fol 150