Answered step by step

Verified Expert Solution

Question

1 Approved Answer

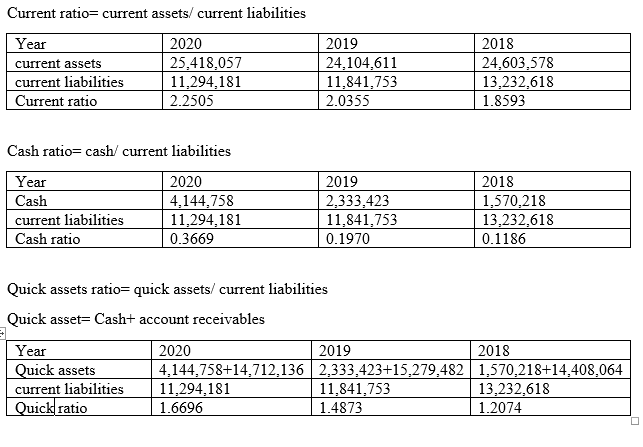

Current ratio= current assets/ current liabilities Year 2020 25,418,057 current assets current liabilities 11,294,181 Current ratio 2.2505 Cash ratio= cash/ current liabilities Year 2020

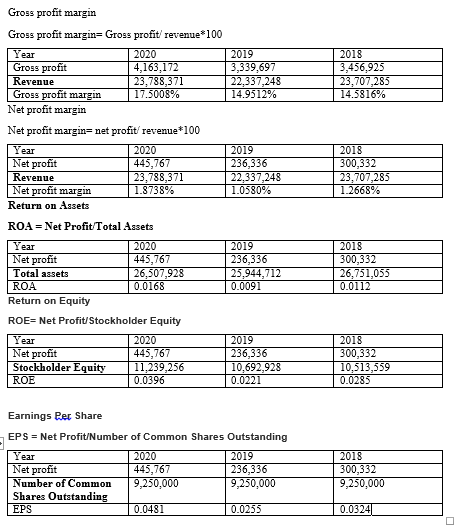

Current ratio= current assets/ current liabilities Year 2020 25,418,057 current assets current liabilities 11,294,181 Current ratio 2.2505 Cash ratio= cash/ current liabilities Year 2020 Cash 4,144,758 11,294,181 0.3669 current liabilities Cash ratio Year Quick assets current liabilities Quick ratio Quick assets ratio= quick assets/ current liabilities Quick asset Cash+ account receivables 2020 4,144,758+14,712,136 2019 24,104,611 11,841,753 2.0355 11,294,181 1.6696 2019 2,333,423 11,841,753 0.1970 2019 2,333,423+15,279,482 11,841,753 1.4873 2018 24,603,578 13,232,618 1.8593 2018 1,570,218 13,232,618 0.1186 2018 1,570,218+14,408,064 13,232,618 1.2074 Gross profit margin Gross profit margin= Gross profit/ revenue* 100 2020 Year Gross profit 4,163,172 23,788,371 17.5008% Revenue Gross profit margin Net profit margin Net profit margin= net profit/ revenue *100 Year Net profit Revenue Net profit margin Return on Assets ROA = Net Profit/Total Assets 2020 Year Net profit Total assets 445,767 26,507,928 ROA 0.0168 Return on Equity ROE= Net Profit/Stockholder Equity Year Net profit Stockholder Equity ROE Earnings Per Share EPS = Net Profit/Number Year Net profit 2020 445,767 23,788,371 1.8738% Number of Common Shares Outstanding EPS 2020 445,767 11,239,256 0.0396 of Common Shares 2020 445,767 9,250,000 0.0481 2019 3,339,697 22,337,248 14.9512% 2019 236,336 22,337,248 1.0580% 2019 236,336 25,944,712 0.0091 2019 236,336 10,692,928 0.0221 tstanding 2019 236,336 9,250,000 0.0255 2018 3,456,925 23,707,285 14.5816% 2018 300,332 23,707,285 1.2668% 2018 300,332 26,751,055 0.0112 2018 300,332 10,513,559 0.0285 2018 300,332 9,250,000 0.0324

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 Current Ratio 2020 2541805711294181 22505 2019 2410461111841753 20355 2 Cash Ratio Cash to Curren...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started