Answered step by step

Verified Expert Solution

Question

1 Approved Answer

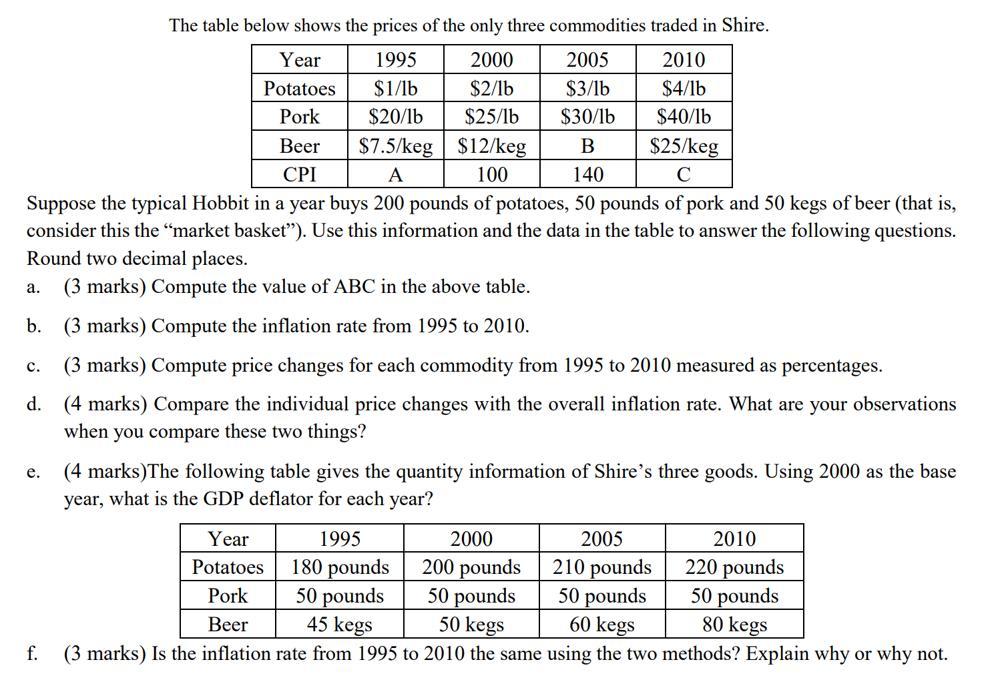

The table below shows the prices of the only three commodities traded in Shire. Year 1995 2000 2005 2010 Potatoes $1/lb $2/1b $3/lb $4/1b

The table below shows the prices of the only three commodities traded in Shire. Year 1995 2000 2005 2010 Potatoes $1/lb $2/1b $3/lb $4/1b Pork $20/1b $25/1b $30/1b $40/1b Beer $7.5/keg $12/keg B CPI A 100 140 Suppose the typical Hobbit in a year buys 200 pounds of potatoes, 50 pounds of pork and 50 kegs of beer (that is, consider this the "market basket"). Use this information and the data in the table to answer the following questions. Round two decimal places. a. (3 marks) Compute the value of ABC in the above table. b. (3 marks) Compute the inflation rate from 1995 to 2010. C. (3 marks) Compute price changes for each commodity from 1995 to 2010 measured as percentages. d. (4 marks) Compare the individual price changes with the overall inflation rate. What are your observations when you compare these two things? $25/keg C e. (4 marks) The following table gives the quantity information of Shire's three goods. Using 2000 as the base year, what is the GDP deflator for each year? 1995 Year Potatoes 180 pounds 2000 200 pounds 2005 210 pounds Pork 50 pounds 50 pounds 50 pounds Beer 45 kegs 50 kegs 60 kegs f. (3 marks) Is the inflation rate from 1995 to 2010 the same using the two methods? Explain why or why not. 2010 220 pounds 50 pounds 80 kegs

Step by Step Solution

★★★★★

3.52 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

Qa Looking at the table for the year 2010 A represents the cost of 200 pounds of potatoes B represents the cost of 50 kegs of beer C represents the price index From the table we can find the correspon...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started