The Rink offers annual $200 memberships that entitie members to unlimited use of ice-skating facilities and locker rooms. Each new membership also entitles the

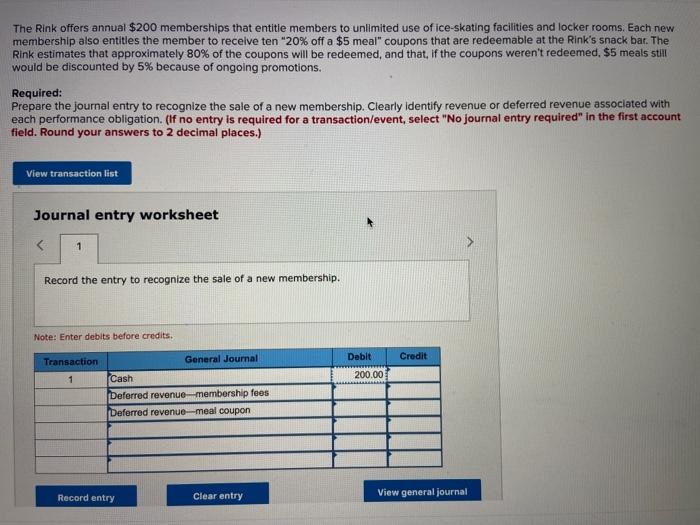

The Rink offers annual $200 memberships that entitie members to unlimited use of ice-skating facilities and locker rooms. Each new membership also entitles the member to receive ten "20% off a $5 meal" coupons that are redeemable at the Rink's snack bar. The Rink estimates that approximately 80% of the coupons will be redeemed, and that, if the coupons weren't redeemed, $5 meals still would be discounted by 5% because of ongoing promotions. Required: Prepare the journal entry to recognize the sale of a new membership. Clearly identify revenue or deferred revenue associated with each performance obligation. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Round your answers to 2 decimal places.) View transaction list Journal entry worksheet Record the entry to recognize the sale of a new membership. Note: Enter debits before credits. General Journal Debit Credit Transaction Cash 200.00 Deferred revenue-membership fees Deferred revenue-meal coupon Record entry Clear entry View general journal

Step by Step Solution

3.58 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Transaction General Journal Debit Credit 1 Cash ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started