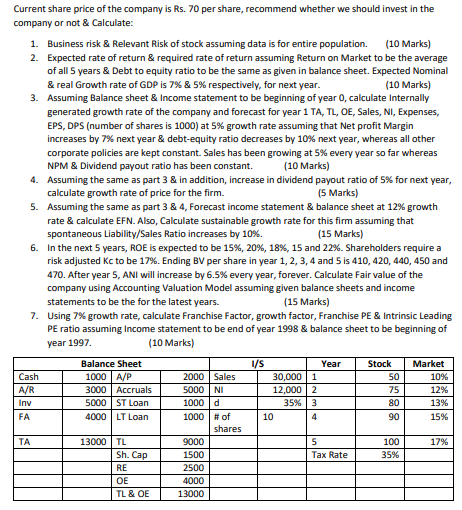

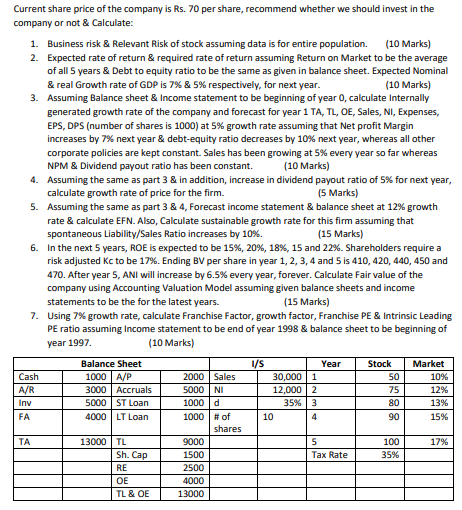

Current share price of the company is Rs. 70 per share, recommend whether we should invest in the company or not & Calculate: 1. Business risk & Relevant Risk of stock assuming data is for entire population. (10 Marks) 2. Expected rate of return & required rate of return assuming Return on Market to be the average of all 5 years & Debt to equity ratio to be the same as given in balance sheet. Expected Nominal & real Growth rate of GDP is 7% & 5% respectively, for next year. (10 Marks) 3. Assuming Balance sheet & Income statement to be beginning of year 0, calculate Internally generated growth rate of the company and forecast for year 1 TA, TL, OE, Sales, NI, Expenses, EPS, DPS (number of shares is 1000) at 5% growth rate assuming that Net profit Margin increases by 7% next year & debt-equity ratio decreases by 10% next year, whereas all other corporate policies are kept constant. Sales has been growing at 5% every year so far whereas NPM & Dividend payout ratio has been constant. (10 Marks) 4. Assuming the same as part 3 & in addition, increase in dividend payout ratio of 5% for next year, calculate growth rate of price for the firm. (5 Marks) 5. Assuming the same as part 3 & 4, Forecast income statement & balance sheet at 12% growth rate & calculate EFN. Also, Calculate sustainable growth rate for this firm assuming that spontaneous Liability/Sales Ratio increases by 10%. (15 Marks) 6. In the next 5 years, ROE is expected to be 15%, 20%, 18%, 15 and 22%. Shareholders require a risk adjusted Kc to be 17%. Ending BV per share in year 1, 2, 3, 4 and 5 is 410, 420, 440, 450 and 470. After year 5, ANI will increase by 6.5% every year, forever. Calculate Fair value of the company using Accounting Valuation Model assuming given balance sheets and income statements to be the for the latest years. (15 Marks) 7. Using 7% growth rate, calculate Franchise Factor, growth factor, Franchise PE & Intrinsic Leading PE ratio assuming Income statement to be end of year 1998 & balance sheet to be beginning of (10 Marks) year 1997. Year Cash A/R Inv FA Balance Sheet 1000A/P 3000 Accruals 5000 ST Loan 4000 LT Loan 1/S 30,0001 12,000 2 35% 3 10 4 Stock 50 75 80 90 Market 10% 12% 13% 15% 2000 Sales 5000 NI 1000 d 1000 # of shares 9000 1500 2500 4000 13000 TA 17% 5 Tax Rate 100 35% 13000 TL Sh. Cap RE OE TL & OE Current share price of the company is Rs. 70 per share, recommend whether we should invest in the company or not & Calculate: 1. Business risk & Relevant Risk of stock assuming data is for entire population. (10 Marks) 2. Expected rate of return & required rate of return assuming Return on Market to be the average of all 5 years & Debt to equity ratio to be the same as given in balance sheet. Expected Nominal & real Growth rate of GDP is 7% & 5% respectively, for next year. (10 Marks) 3. Assuming Balance sheet & Income statement to be beginning of year 0, calculate Internally generated growth rate of the company and forecast for year 1 TA, TL, OE, Sales, NI, Expenses, EPS, DPS (number of shares is 1000) at 5% growth rate assuming that Net profit Margin increases by 7% next year & debt-equity ratio decreases by 10% next year, whereas all other corporate policies are kept constant. Sales has been growing at 5% every year so far whereas NPM & Dividend payout ratio has been constant. (10 Marks) 4. Assuming the same as part 3 & in addition, increase in dividend payout ratio of 5% for next year, calculate growth rate of price for the firm. (5 Marks) 5. Assuming the same as part 3 & 4, Forecast income statement & balance sheet at 12% growth rate & calculate EFN. Also, Calculate sustainable growth rate for this firm assuming that spontaneous Liability/Sales Ratio increases by 10%. (15 Marks) 6. In the next 5 years, ROE is expected to be 15%, 20%, 18%, 15 and 22%. Shareholders require a risk adjusted Kc to be 17%. Ending BV per share in year 1, 2, 3, 4 and 5 is 410, 420, 440, 450 and 470. After year 5, ANI will increase by 6.5% every year, forever. Calculate Fair value of the company using Accounting Valuation Model assuming given balance sheets and income statements to be the for the latest years. (15 Marks) 7. Using 7% growth rate, calculate Franchise Factor, growth factor, Franchise PE & Intrinsic Leading PE ratio assuming Income statement to be end of year 1998 & balance sheet to be beginning of (10 Marks) year 1997. Year Cash A/R Inv FA Balance Sheet 1000A/P 3000 Accruals 5000 ST Loan 4000 LT Loan 1/S 30,0001 12,000 2 35% 3 10 4 Stock 50 75 80 90 Market 10% 12% 13% 15% 2000 Sales 5000 NI 1000 d 1000 # of shares 9000 1500 2500 4000 13000 TA 17% 5 Tax Rate 100 35% 13000 TL Sh. Cap RE OE TL & OE