Answered step by step

Verified Expert Solution

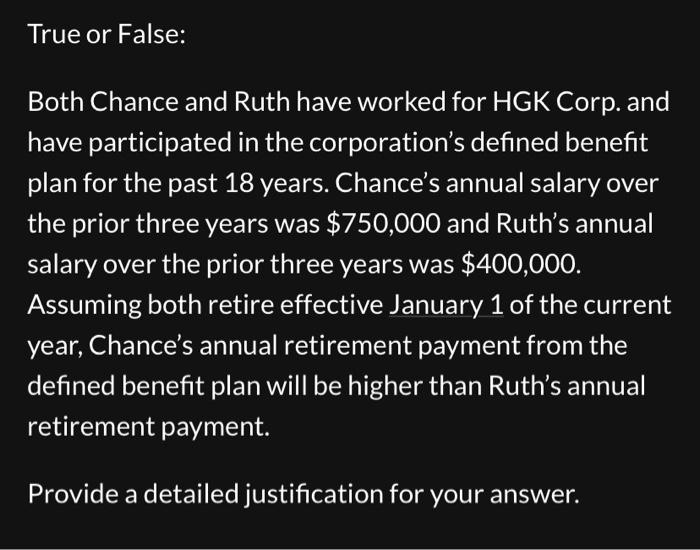

Question

1 Approved Answer

Current tax year: True or False and why? Both Chance and Ruth have worked for HGK Corp. and have participated in the corporation's defined benefit

Current tax year:

Both Chance and Ruth have worked for HGK Corp. and have participated in the corporation's defined benefit plan for the past 18 years. Chance's annual salary over the prior three years was $750,000 and Ruth's annual salary over the prior three years was $400,000. Assuming both retire effective January 1 of the current year, Chance's annual retirement payment from the defined benefit plan will be higher than Ruth's annual retirement payment. Provide a detailed justification for your True or False and why?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started