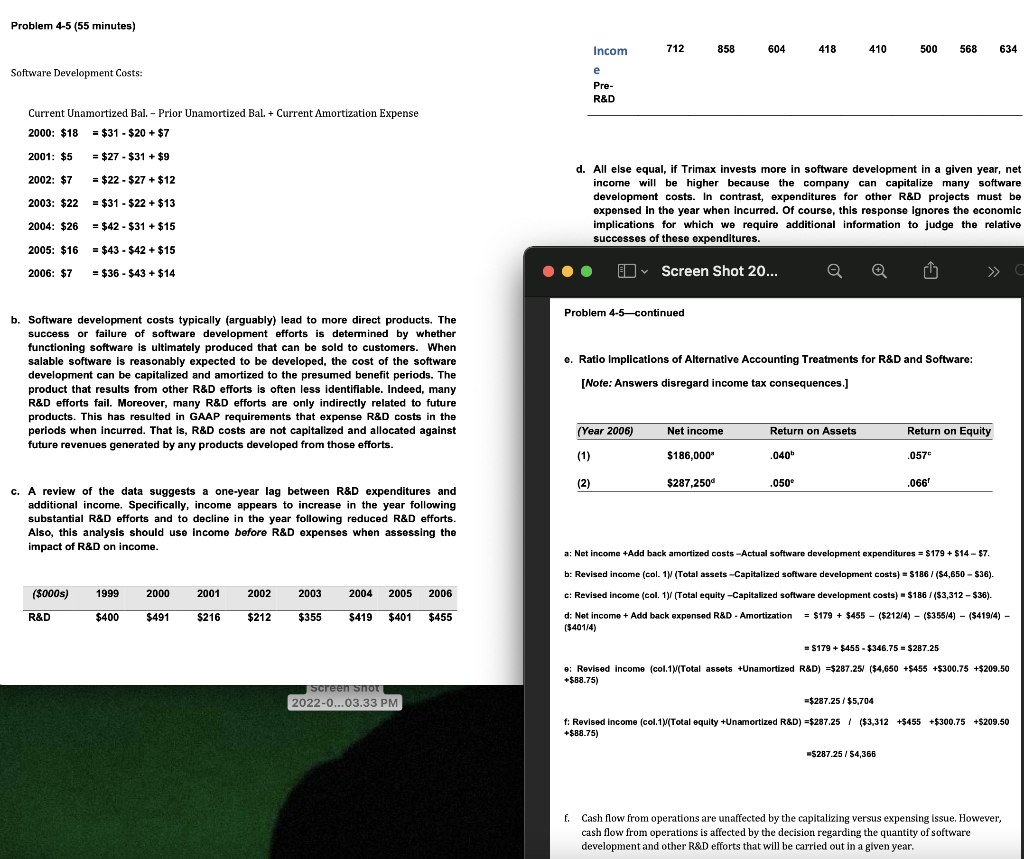

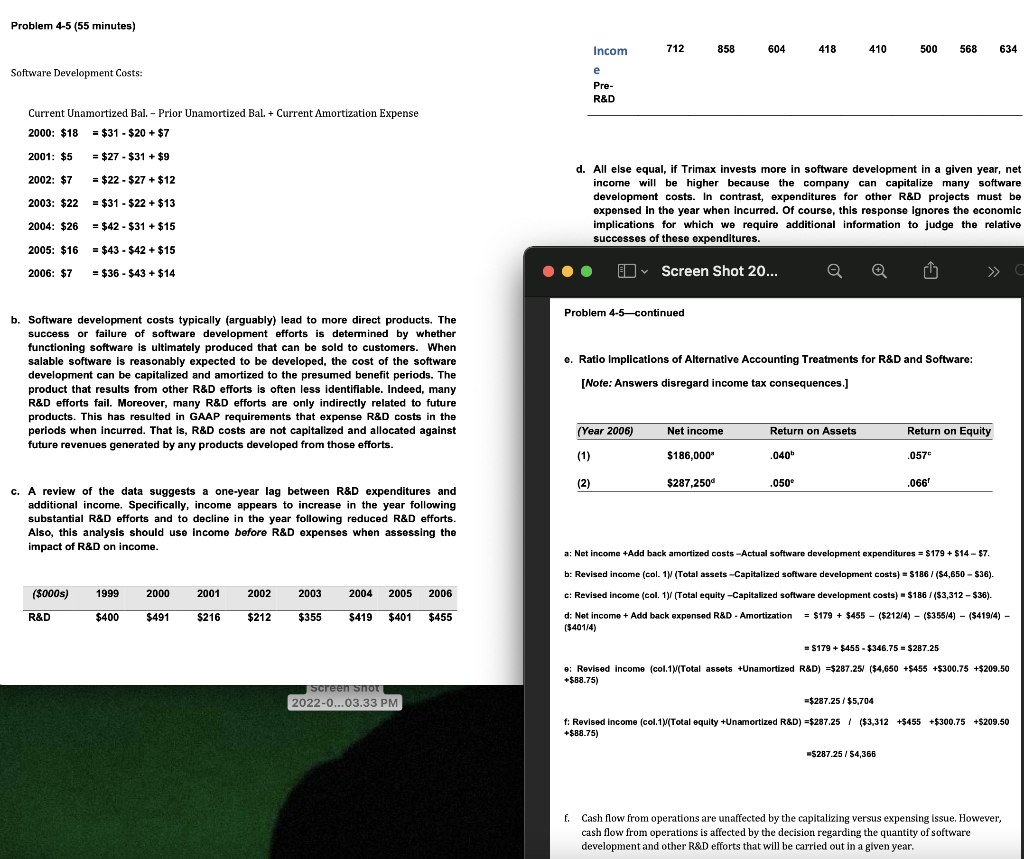

Current Unamortized Bal. - Prior Unamortized Bal. + Current Amortization Expense 2000: $18=$31$20+$7 2001: $5=$27$31+$9 2002: $7=$22$27+$12 d. All else equal, if Trimax invests more in software development in a given year, net 2003:$22=$31$22+$13 income will be higher because the company can capitalize many software development costs. In contrast, expenditures for other R\&D projects must be expensed in the year when incurred. Of course, this response ignores the economic 2004:$26=$42$31+$15 implications for which we requir 2005:$16=$43$42+$15 2006: $7=$36$43+$14 b. Software development costs typically (arguably) lead to more direct products. The Problem 4-5-continued success or failure of software development efforts is determined by whether functioning software is ultimately produced that can be sold to customers. When salable software is reasonably expected to be developed, the cost of the software e. Ratio Implications of Alternative Accounting Treatments for R\&D and Software: development can be capitalized and amortized to the presumed benefit periods. The [Note: Answers disregard income tax consequences.] product that results from other R\&D efforts is often less identifiable. Indeed, many R\&D efforts fail. Moreover, many R\&D efforts are only indirectly related to future periods when incurred. That is, R\&D costs are not capitalized and allocated against future revenues generated by any products developed from those efforts. c. A review of the data suggests a one-year lag between R\&D expenditures and additional income. Specifically, income appears to increase in the year following substantial R\&D efforts and to decline in the year following reduced R\&D efforts. Also, this analysis should use income before R\&D expenses when assessing the impact of R\&D on income. a: Net income +Add back amortized costs -Actual software development expenditures =$179+$14$7. b: Revised income (col. 1N (Total assets -Capitalized software development costs) =$186/($4,650$36). e: Revised income (col. 1)/ (Total equity -Capitalized software development costs )=$186/($3,312$36). d: Net income + Add back expensed R\&D - Amortization =$179+$455($212/4)($355/4)($419/4) +$88.75)=$287.25/$5,704 f: Revised income (col.1)(Total equity +Unamortized R\&D) =$287.25($3,312+$455+$300.75+$209.50 +$88.75) =$287.25/$4,366 f. Cash flow from operations are unaffected by the capitalizing versus expensing issue. However, cash flow from operations is affected by the decision regarding the quantity of software development and other R\&D efforts that will be carried out in a given year. Current Unamortized Bal. - Prior Unamortized Bal. + Current Amortization Expense 2000: $18=$31$20+$7 2001: $5=$27$31+$9 2002: $7=$22$27+$12 d. All else equal, if Trimax invests more in software development in a given year, net 2003:$22=$31$22+$13 income will be higher because the company can capitalize many software development costs. In contrast, expenditures for other R\&D projects must be expensed in the year when incurred. Of course, this response ignores the economic 2004:$26=$42$31+$15 implications for which we requir 2005:$16=$43$42+$15 2006: $7=$36$43+$14 b. Software development costs typically (arguably) lead to more direct products. The Problem 4-5-continued success or failure of software development efforts is determined by whether functioning software is ultimately produced that can be sold to customers. When salable software is reasonably expected to be developed, the cost of the software e. Ratio Implications of Alternative Accounting Treatments for R\&D and Software: development can be capitalized and amortized to the presumed benefit periods. The [Note: Answers disregard income tax consequences.] product that results from other R\&D efforts is often less identifiable. Indeed, many R\&D efforts fail. Moreover, many R\&D efforts are only indirectly related to future periods when incurred. That is, R\&D costs are not capitalized and allocated against future revenues generated by any products developed from those efforts. c. A review of the data suggests a one-year lag between R\&D expenditures and additional income. Specifically, income appears to increase in the year following substantial R\&D efforts and to decline in the year following reduced R\&D efforts. Also, this analysis should use income before R\&D expenses when assessing the impact of R\&D on income. a: Net income +Add back amortized costs -Actual software development expenditures =$179+$14$7. b: Revised income (col. 1N (Total assets -Capitalized software development costs) =$186/($4,650$36). e: Revised income (col. 1)/ (Total equity -Capitalized software development costs )=$186/($3,312$36). d: Net income + Add back expensed R\&D - Amortization =$179+$455($212/4)($355/4)($419/4) +$88.75)=$287.25/$5,704 f: Revised income (col.1)(Total equity +Unamortized R\&D) =$287.25($3,312+$455+$300.75+$209.50 +$88.75) =$287.25/$4,366 f. Cash flow from operations are unaffected by the capitalizing versus expensing issue. However, cash flow from operations is affected by the decision regarding the quantity of software development and other R\&D efforts that will be carried out in a given year