Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Currently, Teewinot sells 1,500,000 per year, but they expect demand to increase by 10% each year for the next 4 years then drop down

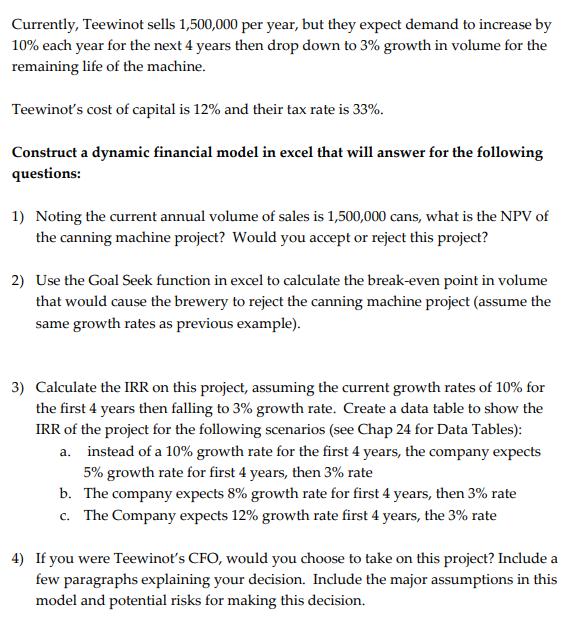

Currently, Teewinot sells 1,500,000 per year, but they expect demand to increase by 10% each year for the next 4 years then drop down to 3% growth in volume for the remaining life of the machine. Teewinot's cost of capital is 12% and their tax rate is 33%. Construct a dynamic financial model in excel that will answer for the following questions: 1) Noting the current annual volume of sales is 1,500,000 cans, what is the NPV of the canning machine project? Would you accept or reject this project? 2) Use the Goal Seek function in excel to calculate the break-even point in volume that would cause the brewery to reject the canning machine project (assume the same growth rates as previous example). 3) Calculate the IRR on this project, assuming the current growth rates of 10% for the first 4 years then falling to 3% growth rate. Create a data table to show the IRR of the project for the following scenarios (see Chap 24 for Data Tables): a. instead of a 10% growth rate for the first 4 years, the company expects 5% growth rate for first 4 years, then 3% rate b. The company expects 8% growth rate for first 4 years, then 3% rate c. The Company expects 12% growth rate first 4 years, the 3% rate 4) If you were Teewinot's CFO, would you choose to take on this project? Include a few paragraphs explaining your decision. Include the major assumptions in this model and potential risks for making this decision.

Step by Step Solution

★★★★★

3.45 Rating (177 Votes )

There are 3 Steps involved in it

Step: 1

To answer the questions we need to build a dynamic financial model in Excel to calculate the Net Present Value NPV Internal Rate of Return IRR and breakeven point for Teewinots canning machine project ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started