Answered step by step

Verified Expert Solution

Question

1 Approved Answer

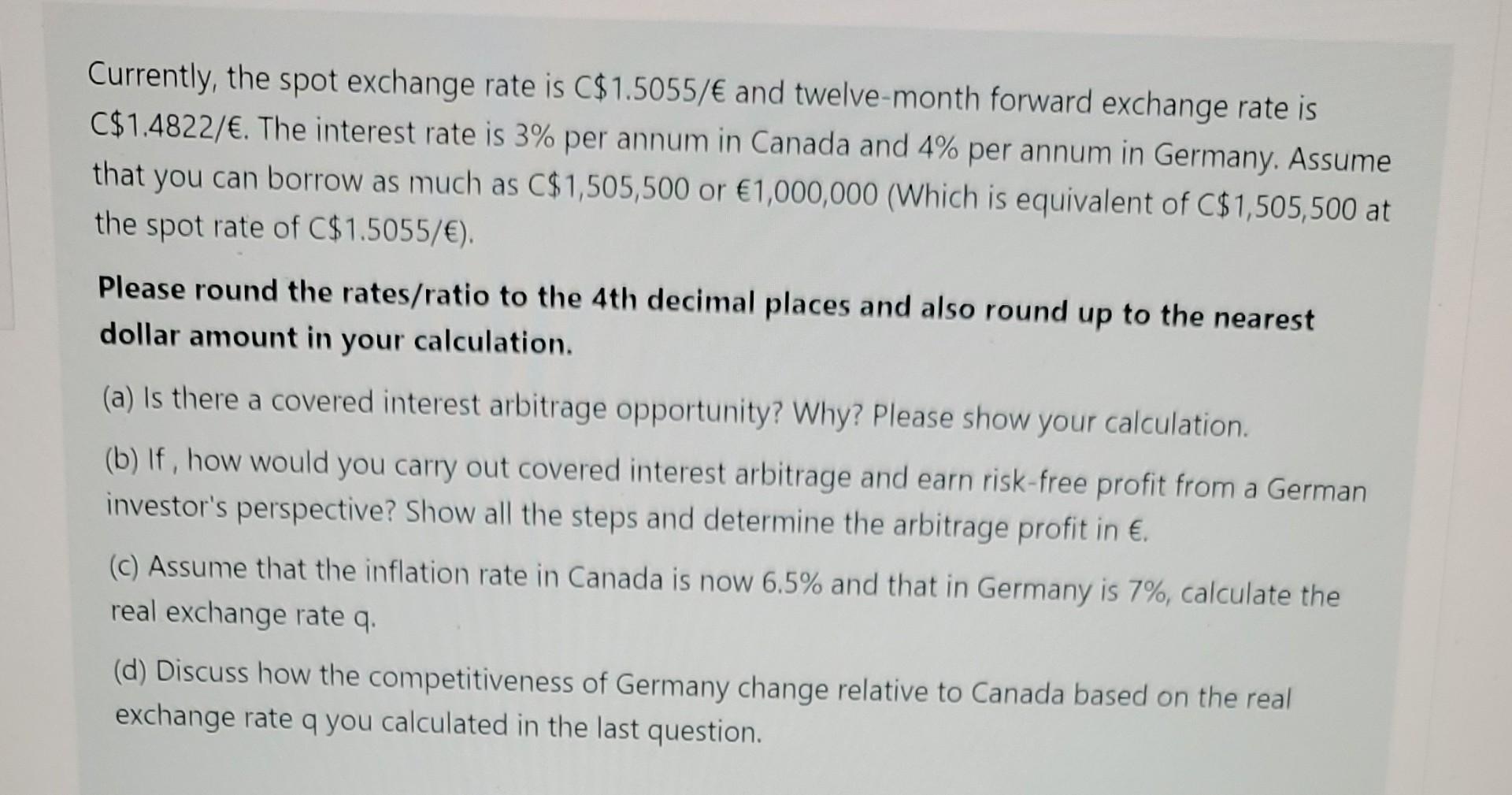

Currently, the spot exchange rate is C$1.5055/ and twelve-month forward exchange rate is C$1.4822/. The interest rate is 3% per annum in Canada and 4%

Currently, the spot exchange rate is C$1.5055/ and twelve-month forward exchange rate is C$1.4822/. The interest rate is 3% per annum in Canada and 4% per annum in Germany. Assume the spot rate of C$1.5055/). Please round the rates/ratio to the 4 th decimal places and also round up to the nearest dollar amount in your calculation. (a) Is there a covered interest arbitrage opportunity? Why? Please show your calculation. (b) If, how would you carry out covered interest arbitrage and earn risk-free profit from a German investor's perspective? Show all the steps and determine the arbitrage profit in . (c) Assume that the inflation rate in Canada is now 6.5\% and that in Germany is 7%, calculate the real exchange rate q. (d) Discuss how the competitiveness of Germany change relative to Canada based on the real exchange rate q you calculated in the last

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started