Answered step by step

Verified Expert Solution

Question

1 Approved Answer

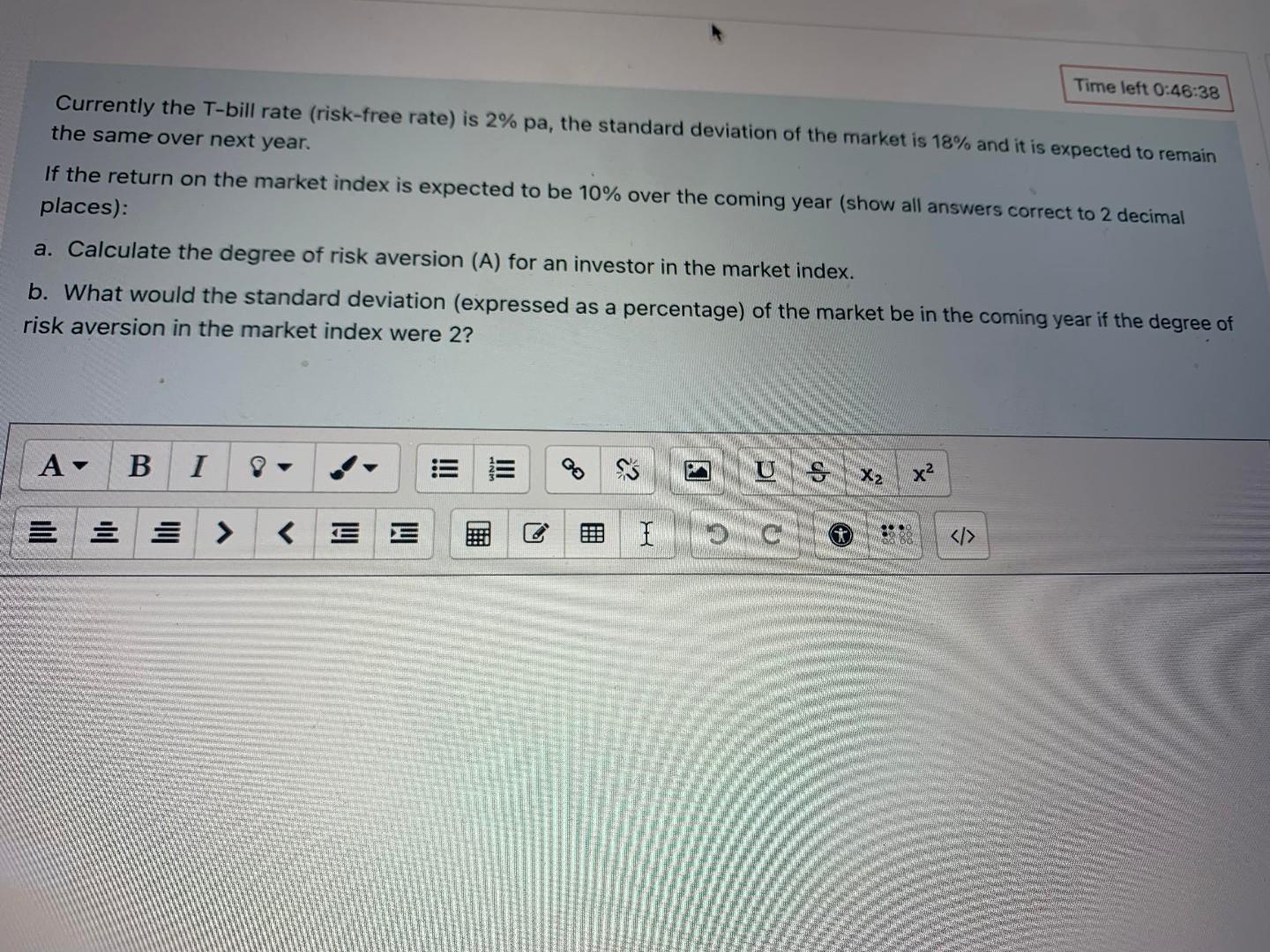

Currently the T-bill rate (risk-free rate) is 2%pa, the standard deviation of the market is 18% and it is expected to remain the same over

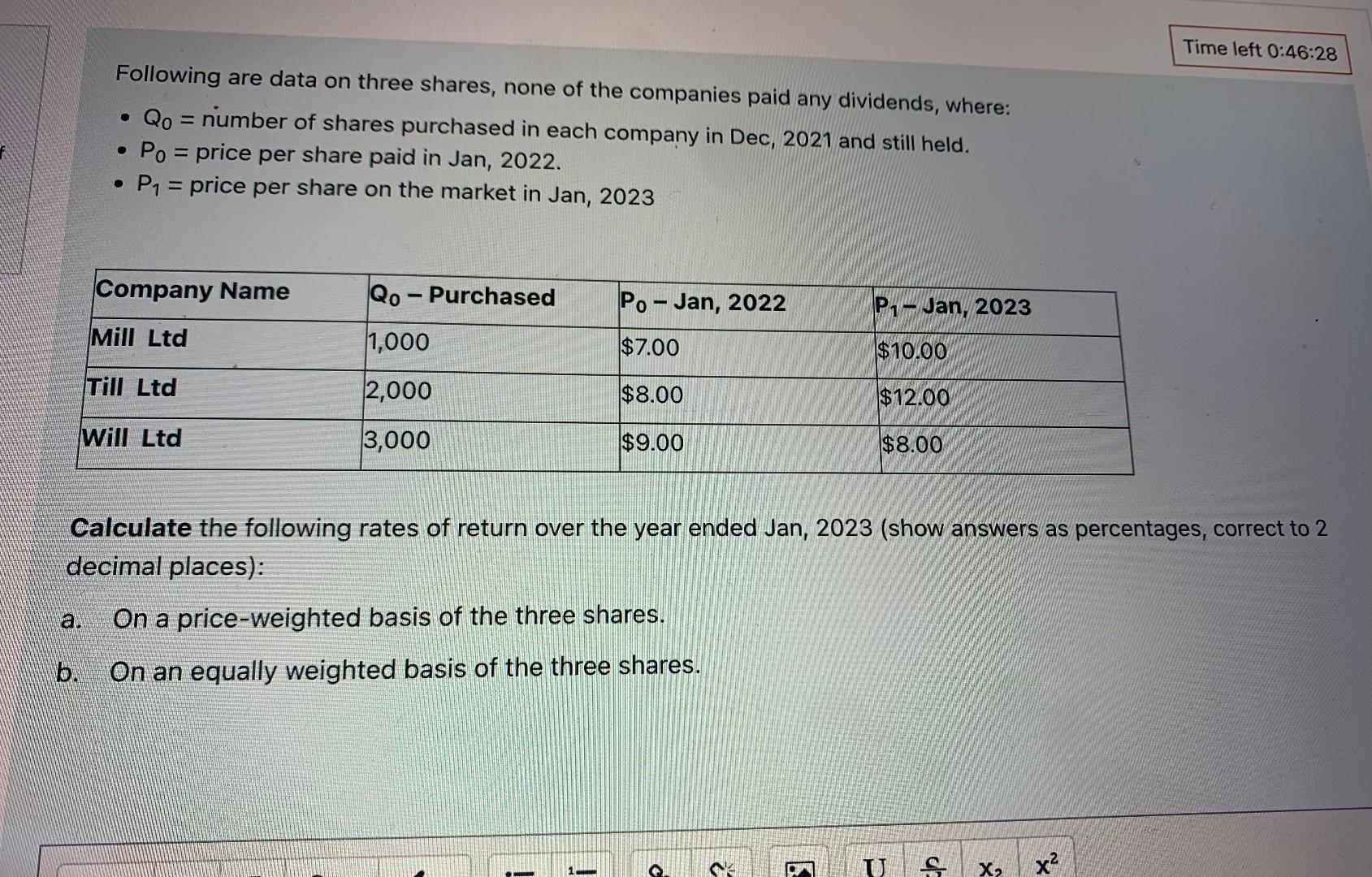

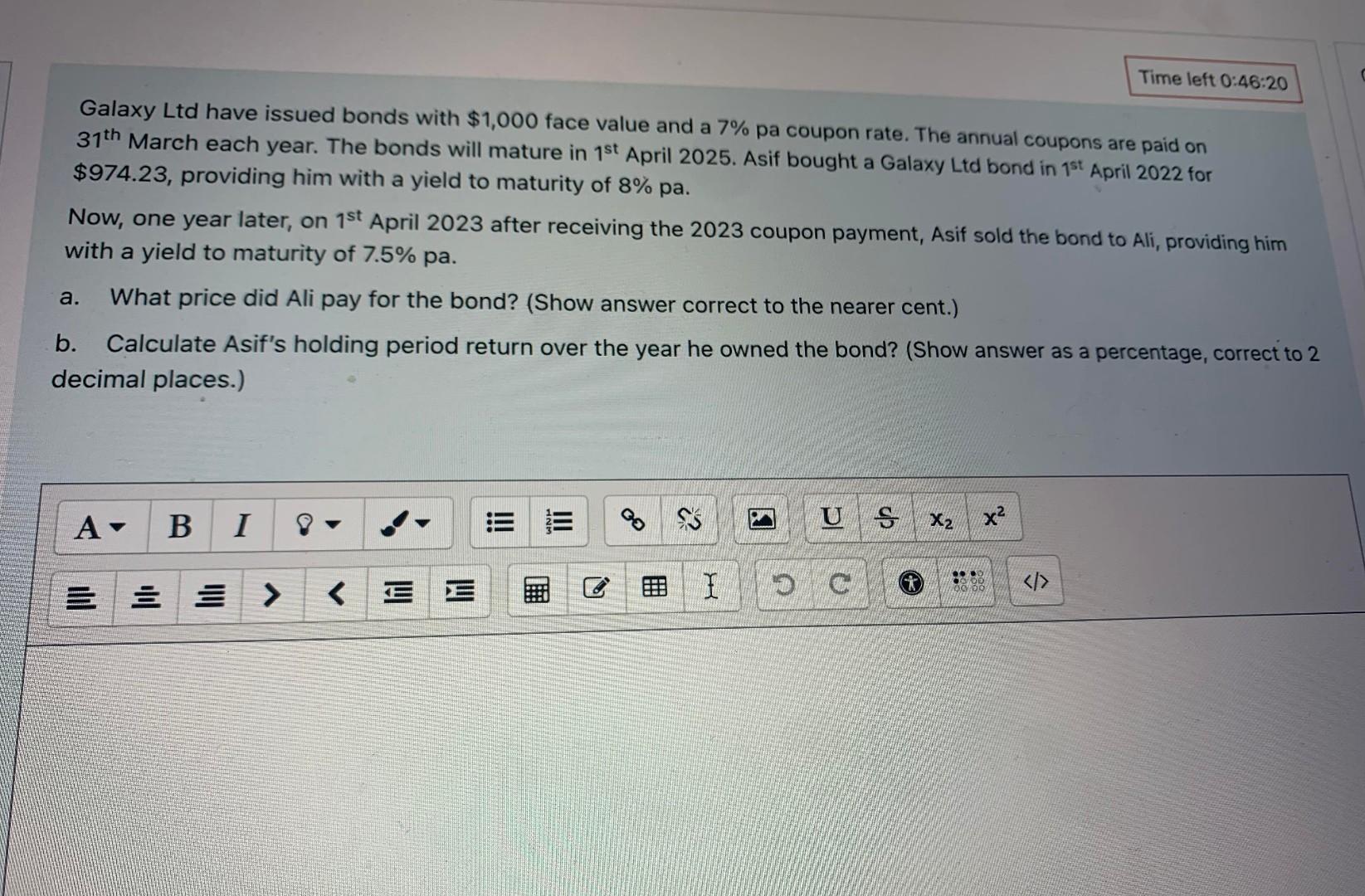

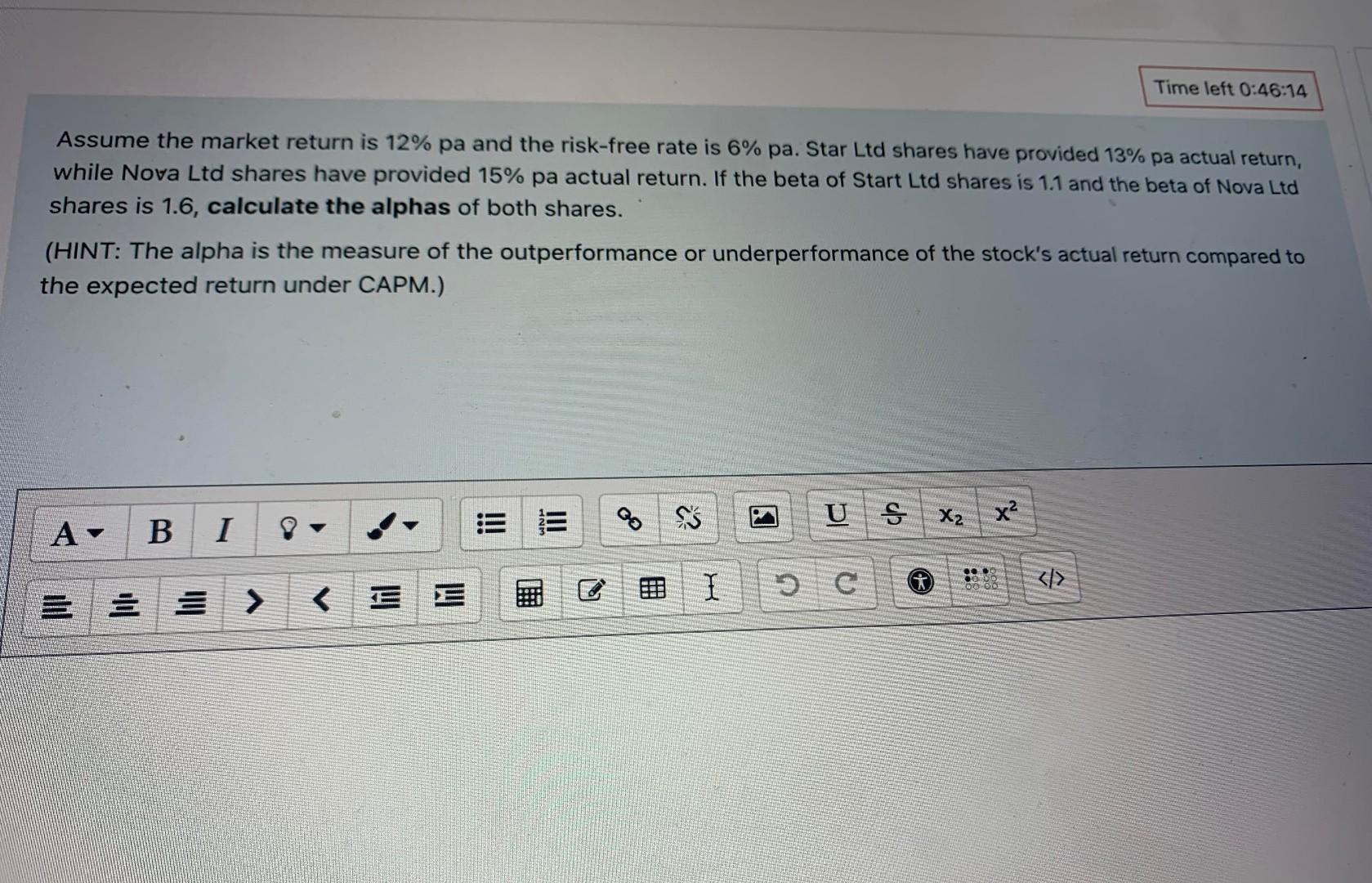

Currently the T-bill rate (risk-free rate) is 2%pa, the standard deviation of the market is 18% and it is expected to remain the same over next year. If the return on the market index is expected to be 10% over the coming year (show all answers correct to 2 decimal places): a. Calculate the degree of risk aversion (A) for an investor in the market index. b. What would the standard deviation (expressed as a percentage) of the market be in the coming year if the degree of risk aversion in the market index were 2 ? Following are data on three shares, none of the companies paid any dividends, where: - Q0= number of shares purchased in each company in Dec, 2021 and still held. - P0= price per share paid in Jan, 2022. - P1= price per share on the market in Jan, 2023 Calculate the following rates of return over the year ended Jan, 2023 (show answers as percentages, correct to 2 decimal places): a. On a price-weighted basis of the three shares. b. On an equally weighted basis of the three shares. Galaxy Ltd have issued bonds with $1,000 face value and a 7% pa coupon rate. The annual coupons are paid on 31th March each year. The bonds will mature in 1st April 2025. Asif bought a Galaxy Ltd bond in 1st April 2022 for $974.23, providing him with a yield to maturity of 8% pa. Now, one year later, on 1st April 2023 after receiving the 2023 coupon payment, Asif sold the bond to Ali, providing him with a yield to maturity of 7.5% pa. a. What price did Ali pay for the bond? (Show answer correct to the nearer cent.) b. Calculate Asif's holding period return over the year he owned the bond? (Show answer as a percentage, correct to 2 decimal places.) Assume the market return is 12% pa and the risk-free rate is 6% pa. Star Ltd shares have provided 13% pa actual return, while Nova Ltd shares have provided 15% pa actual return. If the beta of Start Ltd shares is 1.1 and the beta of Nova Ltd shares is 1.6 , calculate the alphas of both shares. (HINT: The alpha is the measure of the outperformance or underperformance of the stock's actual return compared to the expected return under CAPM.) Currently the T-bill rate (risk-free rate) is 2%pa, the standard deviation of the market is 18% and it is expected to remain the same over next year. If the return on the market index is expected to be 10% over the coming year (show all answers correct to 2 decimal places): a. Calculate the degree of risk aversion (A) for an investor in the market index. b. What would the standard deviation (expressed as a percentage) of the market be in the coming year if the degree of risk aversion in the market index were 2 ? Following are data on three shares, none of the companies paid any dividends, where: - Q0= number of shares purchased in each company in Dec, 2021 and still held. - P0= price per share paid in Jan, 2022. - P1= price per share on the market in Jan, 2023 Calculate the following rates of return over the year ended Jan, 2023 (show answers as percentages, correct to 2 decimal places): a. On a price-weighted basis of the three shares. b. On an equally weighted basis of the three shares. Galaxy Ltd have issued bonds with $1,000 face value and a 7% pa coupon rate. The annual coupons are paid on 31th March each year. The bonds will mature in 1st April 2025. Asif bought a Galaxy Ltd bond in 1st April 2022 for $974.23, providing him with a yield to maturity of 8% pa. Now, one year later, on 1st April 2023 after receiving the 2023 coupon payment, Asif sold the bond to Ali, providing him with a yield to maturity of 7.5% pa. a. What price did Ali pay for the bond? (Show answer correct to the nearer cent.) b. Calculate Asif's holding period return over the year he owned the bond? (Show answer as a percentage, correct to 2 decimal places.) Assume the market return is 12% pa and the risk-free rate is 6% pa. Star Ltd shares have provided 13% pa actual return, while Nova Ltd shares have provided 15% pa actual return. If the beta of Start Ltd shares is 1.1 and the beta of Nova Ltd shares is 1.6 , calculate the alphas of both shares. (HINT: The alpha is the measure of the outperformance or underperformance of the stock's actual return compared to the expected return under CAPM.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started