Question

Current/Temporal example with excess Peter Corporation acquired 100% of the common stock of Spicey Company for $4,000,000 on January 2, 2019. The stockholders equity of

Current/Temporal example with excess

Peter Corporation acquired 100% of the common stock of Spicey Company for $4,000,000 on January 2, 2019. The stockholders equity of Spicey at that date consisted of 5,000,000 euros capital stock and 2,000,000 euros retained earnings. The spot rate for euros on that date was $.50/euro. Any fair value/book value difference is attributable to a patent with a 10-year remaining life as of 1/2/19.

Exchange rates for 2019 in U.S. dollars per euro are: Average exchange rate for 2019 is $.55 Exchange rate applicable to dividends is $.54 Ending inventory was purchased when the rate was $.59 12/31/19 rate is $.60 1/2/19 inventory was 2,000,000 euros and purchases which occurred evenly throughout the year were 6,000,000 euros.

Allocation of Excess

Current Rate Method Patent Amortization and Balance AND Rollforward

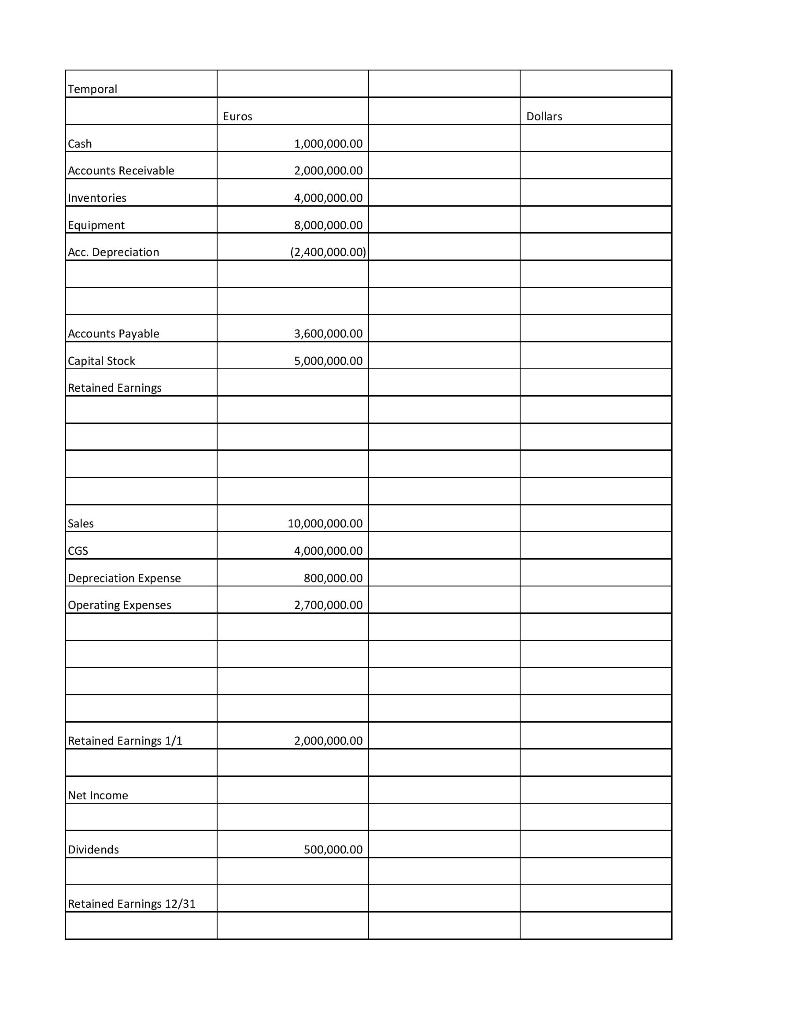

Temporal Method Patent Amortization and Ending Balance Computation and Rollforward

Please use both methods and show your work when you solve. Please use current rate method and temporal

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started