Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Currington Company wants to use absorption cost-plus pricing to set the selling price on a newly remodeled product. The company plans to invest ( $

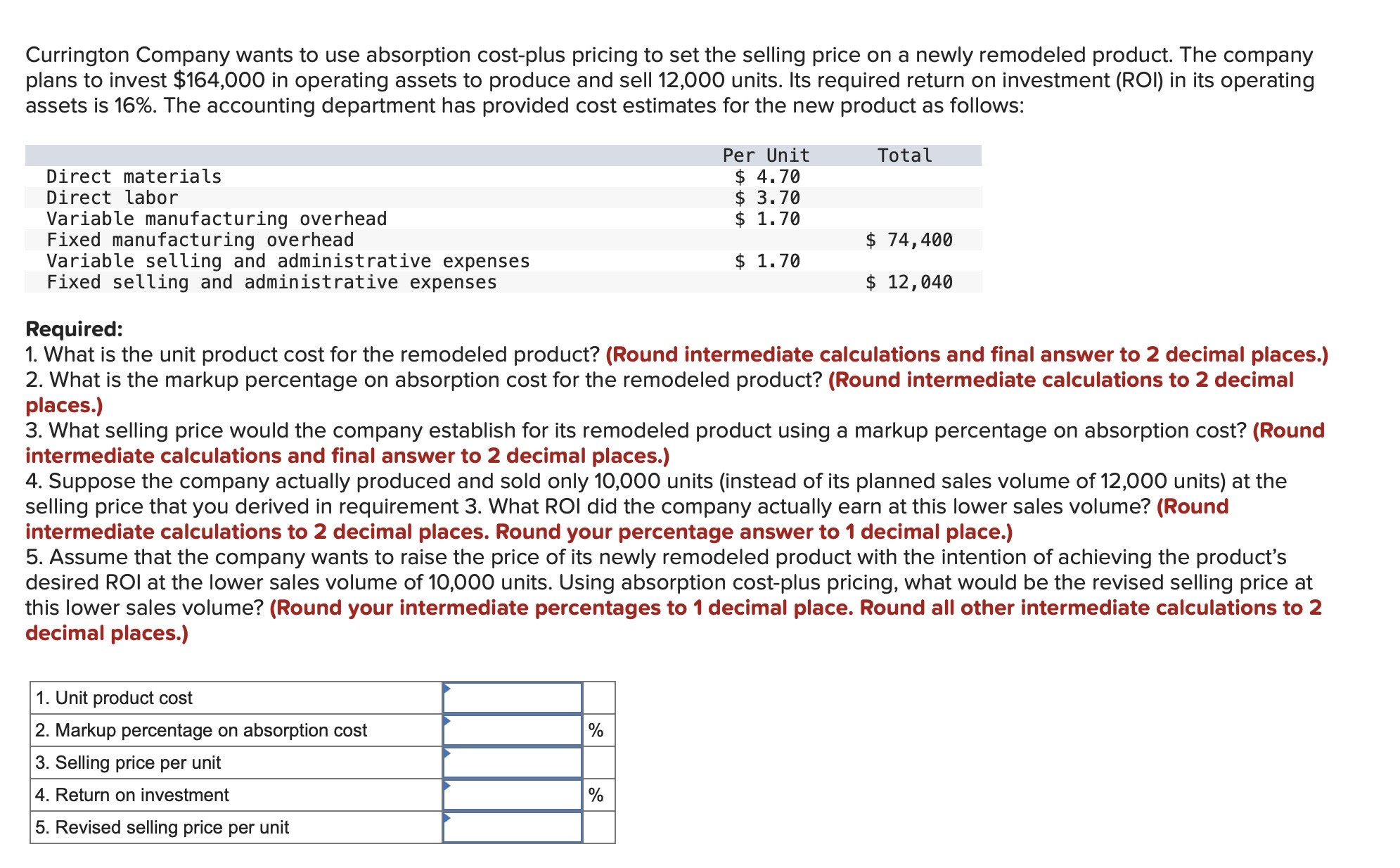

Currington Company wants to use absorption cost-plus pricing to set the selling price on a newly remodeled product. The company plans to invest \\( \\$ 164,000 \\) in operating assets to produce and sell 12,000 units. Its required return on investment (ROI) in its operating assets is \16. The accounting department has provided cost estimates for the new product as follows: Required: 1. What is the unit product cost for the remodeled product? (Round intermediate calculations and final answer to \\( \\mathbf{2} \\) decimal places.) 2. What is the markup percentage on absorption cost for the remodeled product? (Round intermediate calculations to 2 decimal places.) 3. What selling price would the company establish for its remodeled product using a markup percentage on absorption cost? (Round intermediate calculations and final answer to 2 decimal places.) 4. Suppose the company actually produced and sold only 10,000 units (instead of its planned sales volume of 12,000 units) at the selling price that you derived in requirement 3 . What ROI did the company actually earn at this lower sales volume? (Round intermediate calculations to 2 decimal places. Round your percentage answer to 1 decimal place.) 5. Assume that the company wants to raise the price of its newly remodeled product with the intention of achieving the product's desired ROI at the lower sales volume of 10,000 units. Using absorption cost-plus pricing, what would be the revised selling price at this lower sales volume? (Round your intermediate percentages to 1 decimal place. Round all other intermediate calculations to 2 decimal places.)

Currington Company wants to use absorption cost-plus pricing to set the selling price on a newly remodeled product. The company plans to invest \\( \\$ 164,000 \\) in operating assets to produce and sell 12,000 units. Its required return on investment (ROI) in its operating assets is \16. The accounting department has provided cost estimates for the new product as follows: Required: 1. What is the unit product cost for the remodeled product? (Round intermediate calculations and final answer to \\( \\mathbf{2} \\) decimal places.) 2. What is the markup percentage on absorption cost for the remodeled product? (Round intermediate calculations to 2 decimal places.) 3. What selling price would the company establish for its remodeled product using a markup percentage on absorption cost? (Round intermediate calculations and final answer to 2 decimal places.) 4. Suppose the company actually produced and sold only 10,000 units (instead of its planned sales volume of 12,000 units) at the selling price that you derived in requirement 3 . What ROI did the company actually earn at this lower sales volume? (Round intermediate calculations to 2 decimal places. Round your percentage answer to 1 decimal place.) 5. Assume that the company wants to raise the price of its newly remodeled product with the intention of achieving the product's desired ROI at the lower sales volume of 10,000 units. Using absorption cost-plus pricing, what would be the revised selling price at this lower sales volume? (Round your intermediate percentages to 1 decimal place. Round all other intermediate calculations to 2 decimal places.) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started