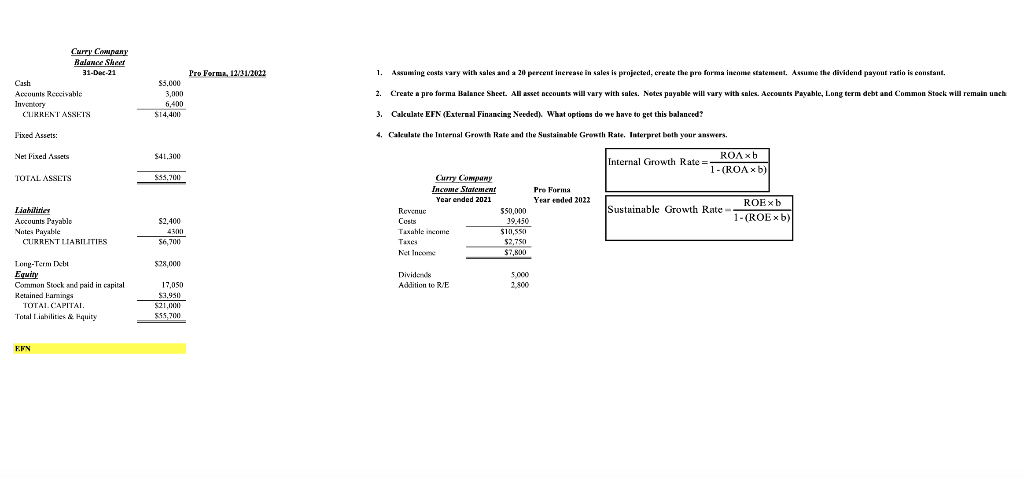

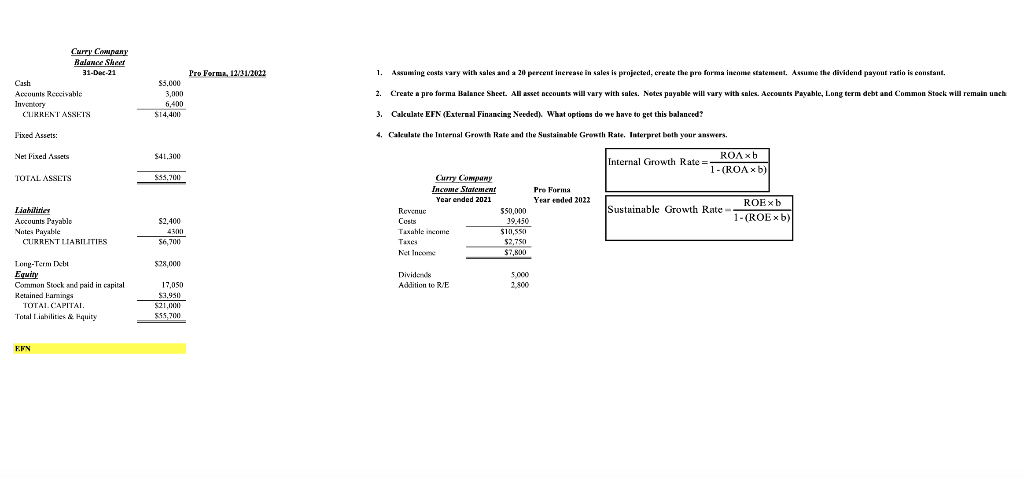

Curry Cowany Balance Sheer 31-Dec-21 Cash Accounts Recivable Pro Forma, 12/31/2022 1. Assuming costs vary with sales and a 20 percent inerease in sales is projected, create the pro forma intente statement. Assume the dividend payout ratio is constant $5,000 3,000 6.400 $14.400 2. Create a pro forma Balance Sheet. All asset accounts will vary with sales. Notes payable will vary with sales. Accounts Payable, Long term debt and Common Stock will remain unch Inventory CURRENT ASSETS Fixed Assets: Net Fixed Assets $41.300 TOTAL ASSETS $45.200 3. Calculate EFN (External Financing Needed). What options do we have to get this balanced? 4. Calculate the Internal Growth Rate and the Sustainable Growth Rale. Interpret both your answers. ROAXb Internal Growth Rate = 1 - (ROAxb) Curry Company Income Starcament Pre Forms Year ended 2021 Year ended 2022 ROExb Revenue 550.000 Sustainable Growth Rate Costs 19.450 1 - (ROExb) Taxable income $11,550 Taxes $2,750 Net inne $2.800 Liabilities Accounts Payablo Notes Payable CURRENT LIABILITIES $2.400 430 56,700 $28,000 Dividers Addition to R/E 5000 1.300 17,050 Long-Term Dat Equity Common Stock and paid in capital Retained barnings TOTAL CAPITAI. . (. Total Libilities & quity $21.000 $55,200 EFN Curry Cowany Balance Sheer 31-Dec-21 Cash Accounts Recivable Pro Forma, 12/31/2022 1. Assuming costs vary with sales and a 20 percent inerease in sales is projected, create the pro forma intente statement. Assume the dividend payout ratio is constant $5,000 3,000 6.400 $14.400 2. Create a pro forma Balance Sheet. All asset accounts will vary with sales. Notes payable will vary with sales. Accounts Payable, Long term debt and Common Stock will remain unch Inventory CURRENT ASSETS Fixed Assets: Net Fixed Assets $41.300 TOTAL ASSETS $45.200 3. Calculate EFN (External Financing Needed). What options do we have to get this balanced? 4. Calculate the Internal Growth Rate and the Sustainable Growth Rale. Interpret both your answers. ROAXb Internal Growth Rate = 1 - (ROAxb) Curry Company Income Starcament Pre Forms Year ended 2021 Year ended 2022 ROExb Revenue 550.000 Sustainable Growth Rate Costs 19.450 1 - (ROExb) Taxable income $11,550 Taxes $2,750 Net inne $2.800 Liabilities Accounts Payablo Notes Payable CURRENT LIABILITIES $2.400 430 56,700 $28,000 Dividers Addition to R/E 5000 1.300 17,050 Long-Term Dat Equity Common Stock and paid in capital Retained barnings TOTAL CAPITAI. . (. Total Libilities & quity $21.000 $55,200 EFN