Answered step by step

Verified Expert Solution

Question

1 Approved Answer

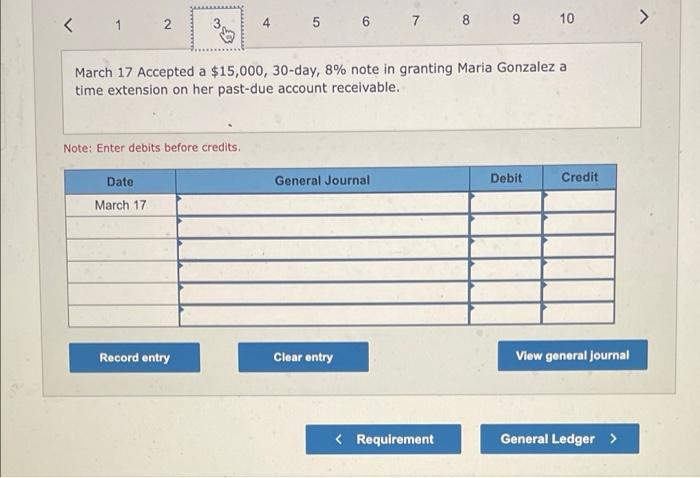

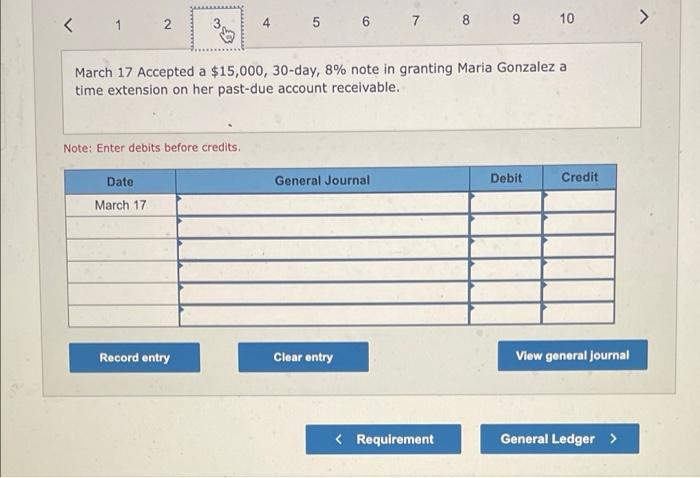

Curse es Year 1 December 15 Accepted a $21,600, 60-day, 8: note in granting June Taylor a time extension on his past-due account receivable. December

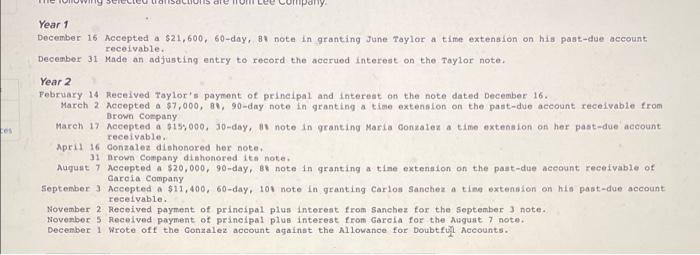

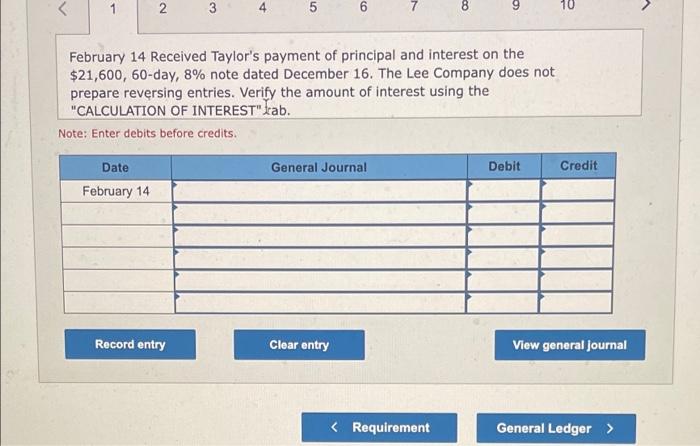

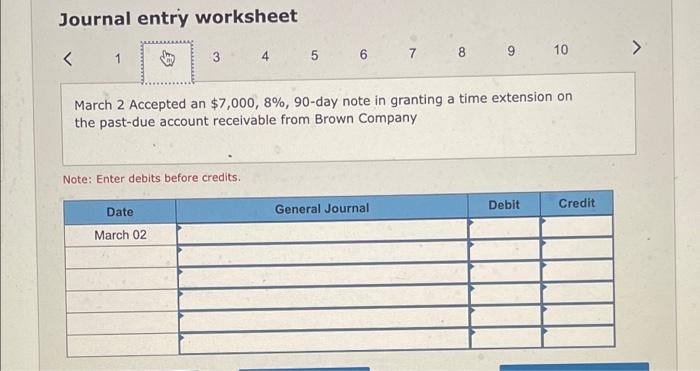

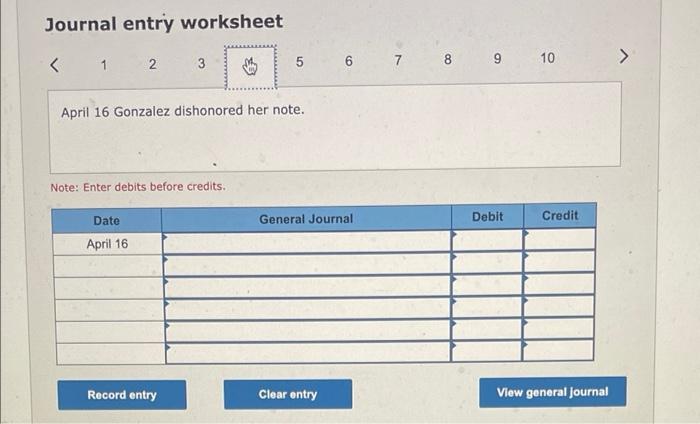

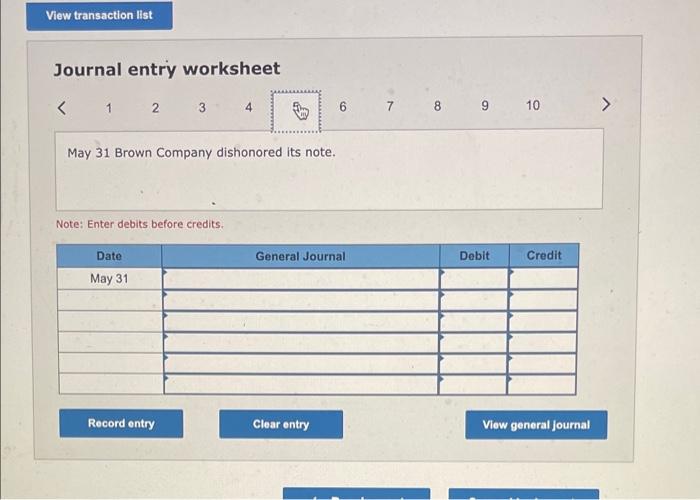

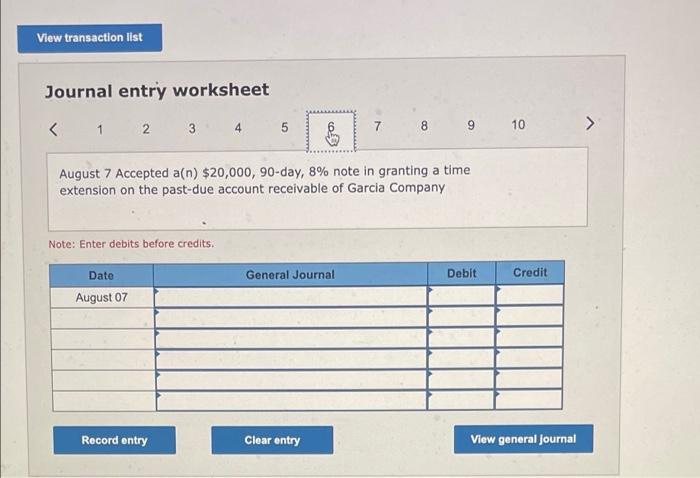

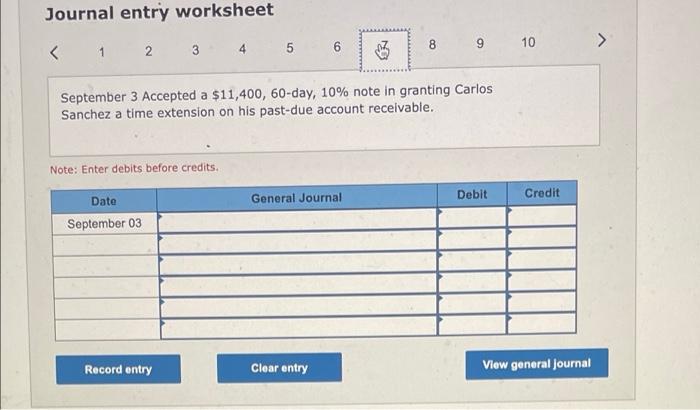

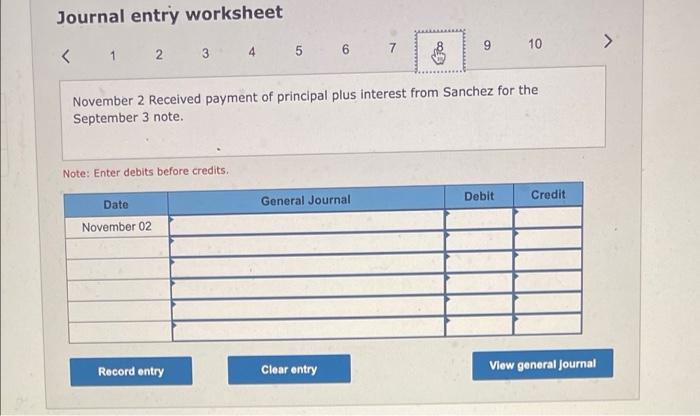

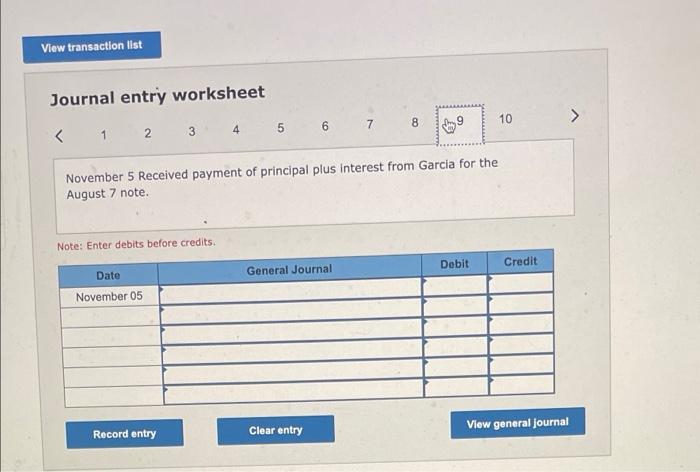

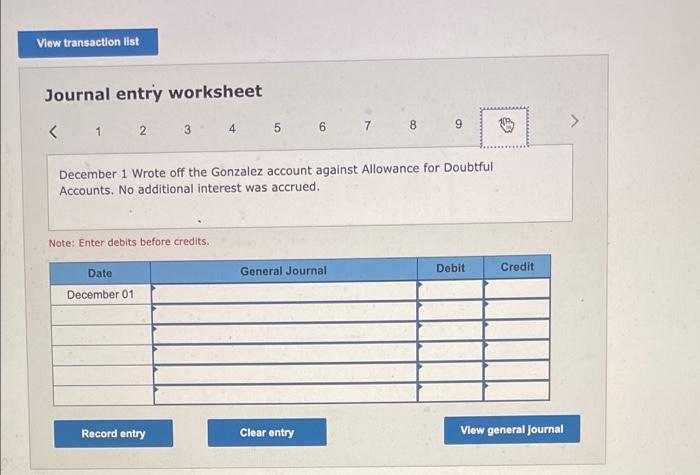

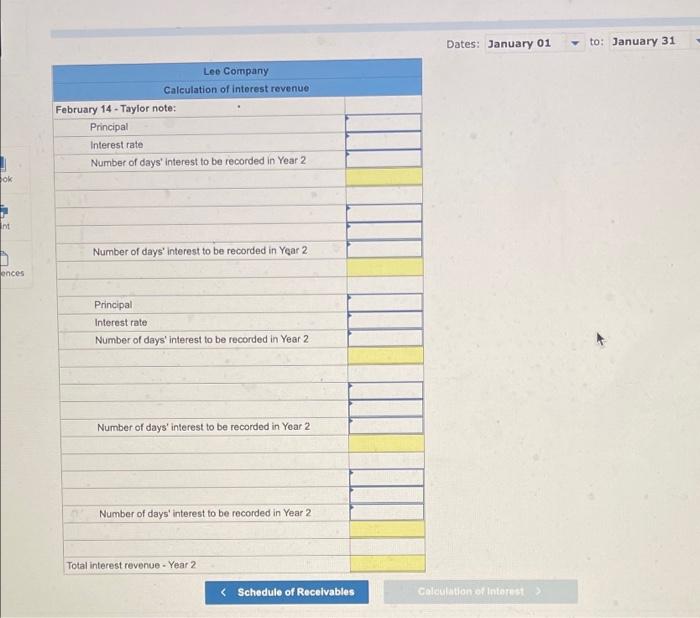

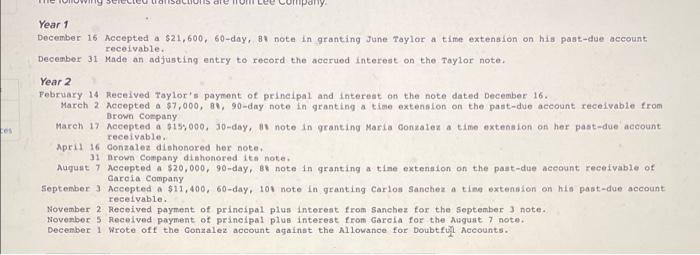

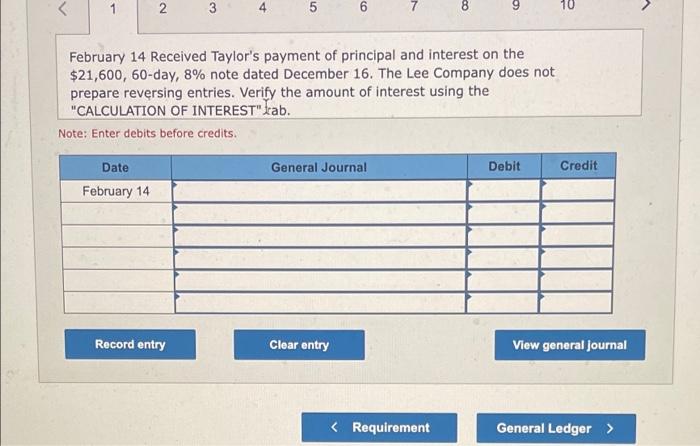

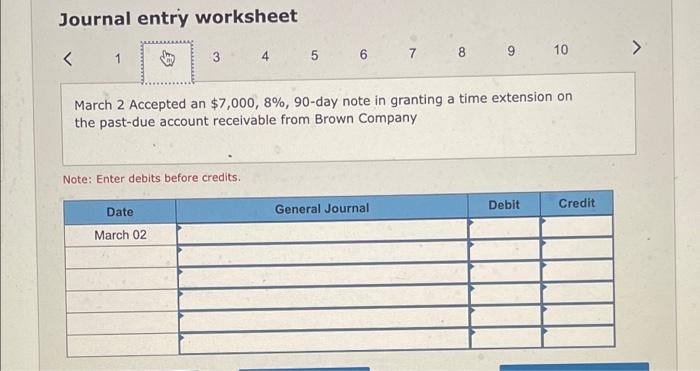

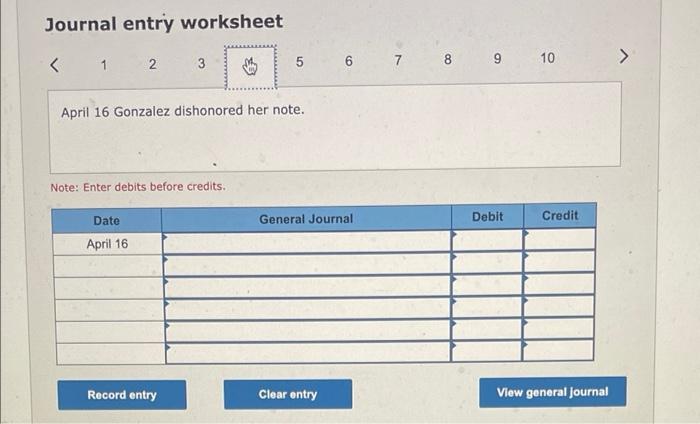

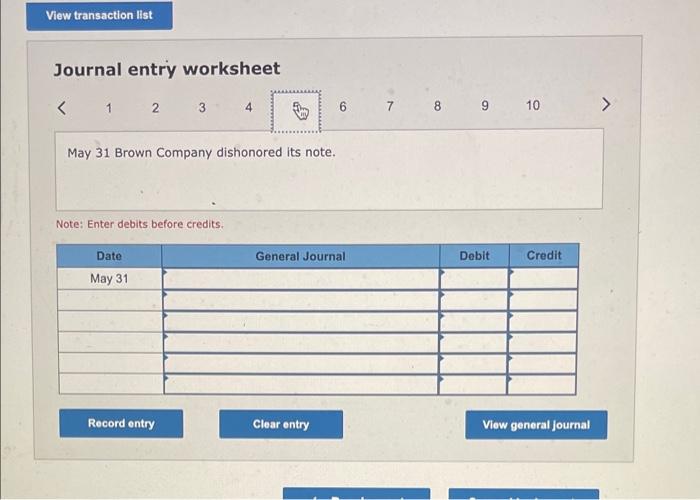

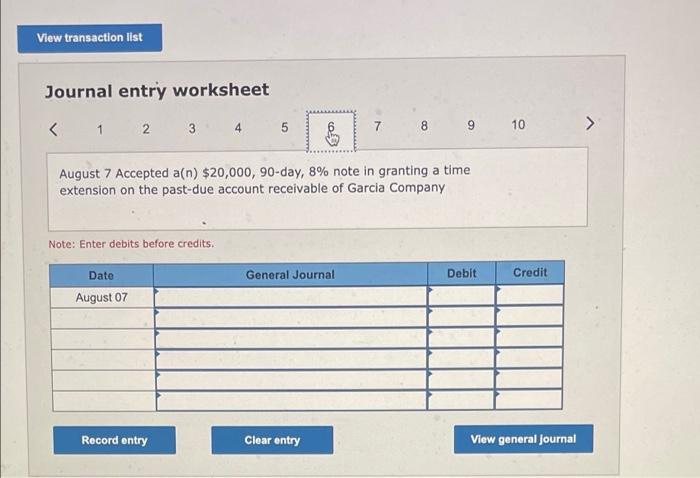

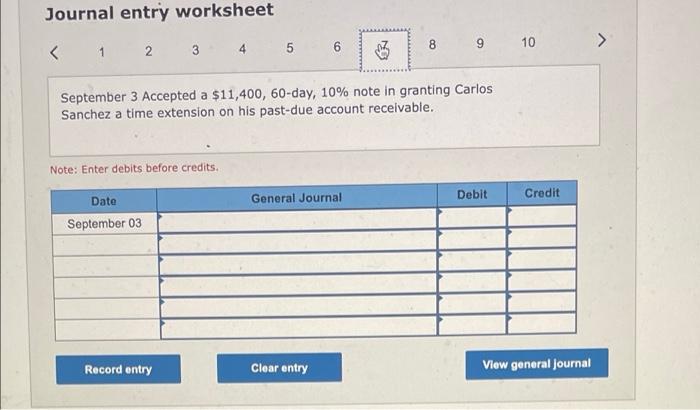

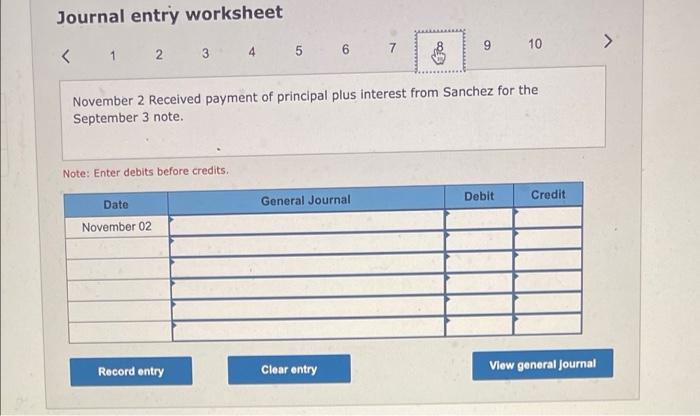

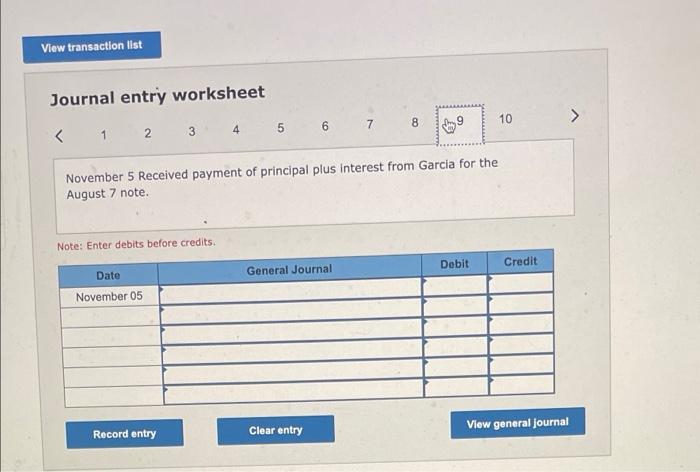

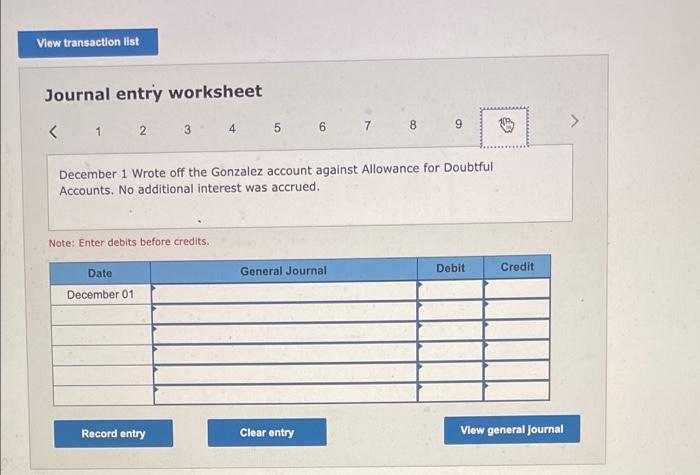

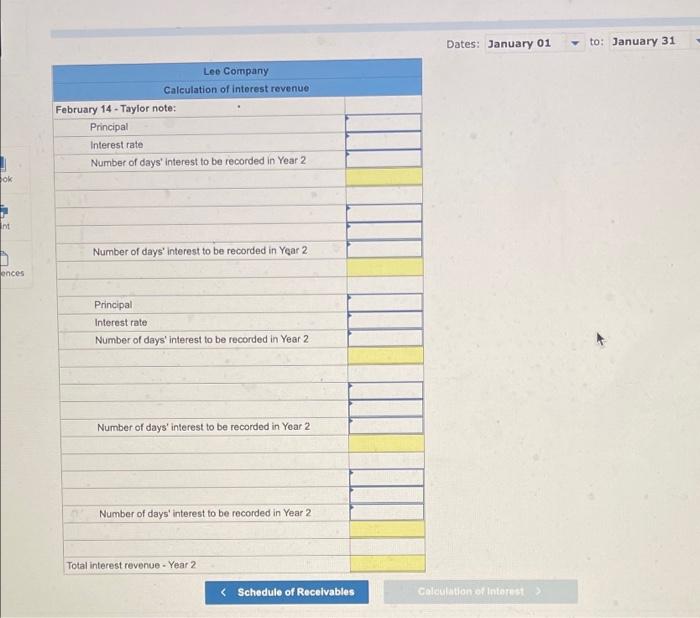

Curse es Year 1 December 15 Accepted a $21,600, 60-day, 8: note in granting June Taylor a time extension on his past-due account receivable. December 31 Made an adjusting entry to record the accrued interest on the Taylor note. Year 2 February 14 Received Taylor's payment of principal and interest on the note dated December 16. March 2 Accepted a $7,000, 89, 90-day note in granting a time extension on the past-due account receivable from Brown Company March 17 Accepted a $1,090, Jo-day, note in granting Maria Gonzalez a time extension on her past-due account receivable. April 16 Gonzalez dishonored her note. 31 Brown Company dishonored its note. August 7 Accepted a $20,000, 90-day, Bnote in granting a tine extension on the past-due account receivable or Garcia Company September ) Accepted a $11,400, 60-day, 104 note in granting Carlos Sanchez a tine extension on his past due account receivable. November 2 Received payment of principal plus interent from Sanchez for the September ) note. November 5 Received payment of principal plus interest from Garcia for the August 7 note. December 1 Wrote of the Gonzalez account against the Allowance for Doubtful Accounts. 1 2 3 4 5 6 8 10 February 14 Received Taylor's payment of principal and interest on the $21,600, 60-day, 8% note dated December 16. The Lee Company does not prepare reversing entries. Verify the amount of interest using the "CALCULATION OF INTEREST" Lab. Note: Enter debits before credits. General Journal Debit Credit Date February 14 Record entry Clear entry View general Journal Journal entry worksheet 1 3 4 5 6 7 8 9 March 2 Accepted an $7,000, 8%, 90-day note in granting a time extension on the past-due account receivable from Brown Company Note: Enter debits before credits Debit Credit General Journal Date March 02 8 9 10 March 17 Accepted a $15,000, 30-day, 8% note in granting Maria Gonzalez a time extension on her past-due account receivable. Note: Enter debits before credits. General Journal Debit Credit Date March 17 Record entry Clear entry View general Journal Journal entry worksheet 10 April 16 Gonzalez dishonored her note. Note: Enter debits before credits. General Journal Debit Credit Date April 16 Record entry Clear entry View general Journal View transaction list Journal entry worksheet August 7 Accepted a(n) $20,000, 90-day, 8% note in granting a time extension on the past-due account receivable of Garcia Company Note: Enter debits before credits. General Journal Debit Credit Date August 07 Record entry Clear entry View general journal Journal entry worksheet > 1 2 10 7 8 10 5 6 3 4 De 9 1 2 November 5 Received payment of principal plus interest from Garcia for the August 7 note. Note: Enter debits before credits. Debit Credit Date General Journal November 05 Record entry Clear entry View general journal View transaction list Journal entry worksheet 9 1 2 3 4 December 1 Wrote off the Gonzalez account against Allowance for Doubtful Accounts. No additional interest was accrued. Note: Enter debits before credits. General Journal Debit Credit Date December 01 Record entry Clear entry View general journal Dates: January 01 to: January 31 Lee Company Calculation of interest revenue February 14 - Taylor note: Principal Interest rate Number of days' interest to be recorded in Year 2 ok ht Number of days Interest to be recorded in Year 2 ences Principal Interest rate Number of days interest to be recorded in Year 2 Number of days interest to be recorded in Year 2 Number of days' interest to be recorded in Year 2 Total interest revenue - Year 2 Schedule of Receivables Calculation of Interest

Curse es Year 1 December 15 Accepted a $21,600, 60-day, 8: note in granting June Taylor a time extension on his past-due account receivable. December 31 Made an adjusting entry to record the accrued interest on the Taylor note. Year 2 February 14 Received Taylor's payment of principal and interest on the note dated December 16. March 2 Accepted a $7,000, 89, 90-day note in granting a time extension on the past-due account receivable from Brown Company March 17 Accepted a $1,090, Jo-day, note in granting Maria Gonzalez a time extension on her past-due account receivable. April 16 Gonzalez dishonored her note. 31 Brown Company dishonored its note. August 7 Accepted a $20,000, 90-day, Bnote in granting a tine extension on the past-due account receivable or Garcia Company September ) Accepted a $11,400, 60-day, 104 note in granting Carlos Sanchez a tine extension on his past due account receivable. November 2 Received payment of principal plus interent from Sanchez for the September ) note. November 5 Received payment of principal plus interest from Garcia for the August 7 note. December 1 Wrote of the Gonzalez account against the Allowance for Doubtful Accounts. 1 2 3 4 5 6 8 10 February 14 Received Taylor's payment of principal and interest on the $21,600, 60-day, 8% note dated December 16. The Lee Company does not prepare reversing entries. Verify the amount of interest using the "CALCULATION OF INTEREST" Lab. Note: Enter debits before credits. General Journal Debit Credit Date February 14 Record entry Clear entry View general Journal Journal entry worksheet 1 3 4 5 6 7 8 9 March 2 Accepted an $7,000, 8%, 90-day note in granting a time extension on the past-due account receivable from Brown Company Note: Enter debits before credits Debit Credit General Journal Date March 02 8 9 10 March 17 Accepted a $15,000, 30-day, 8% note in granting Maria Gonzalez a time extension on her past-due account receivable. Note: Enter debits before credits. General Journal Debit Credit Date March 17 Record entry Clear entry View general Journal Journal entry worksheet 10 April 16 Gonzalez dishonored her note. Note: Enter debits before credits. General Journal Debit Credit Date April 16 Record entry Clear entry View general Journal View transaction list Journal entry worksheet August 7 Accepted a(n) $20,000, 90-day, 8% note in granting a time extension on the past-due account receivable of Garcia Company Note: Enter debits before credits. General Journal Debit Credit Date August 07 Record entry Clear entry View general journal Journal entry worksheet > 1 2 10 7 8 10 5 6 3 4 De 9 1 2 November 5 Received payment of principal plus interest from Garcia for the August 7 note. Note: Enter debits before credits. Debit Credit Date General Journal November 05 Record entry Clear entry View general journal View transaction list Journal entry worksheet 9 1 2 3 4 December 1 Wrote off the Gonzalez account against Allowance for Doubtful Accounts. No additional interest was accrued. Note: Enter debits before credits. General Journal Debit Credit Date December 01 Record entry Clear entry View general journal Dates: January 01 to: January 31 Lee Company Calculation of interest revenue February 14 - Taylor note: Principal Interest rate Number of days' interest to be recorded in Year 2 ok ht Number of days Interest to be recorded in Year 2 ences Principal Interest rate Number of days interest to be recorded in Year 2 Number of days interest to be recorded in Year 2 Number of days' interest to be recorded in Year 2 Total interest revenue - Year 2 Schedule of Receivables Calculation of Interest

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started