Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Curtiss Construction Company, Incorporated, entered Into a fixed-price contract with Axelrod Assoclates on July 1, 2024, to construct a four-story office bullding. At that time,

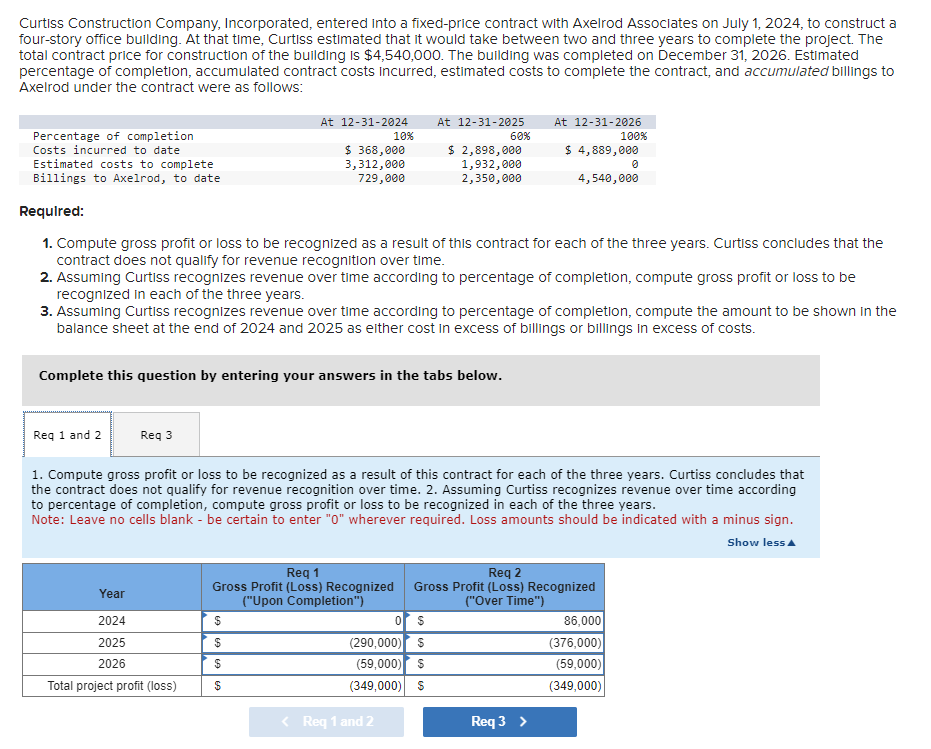

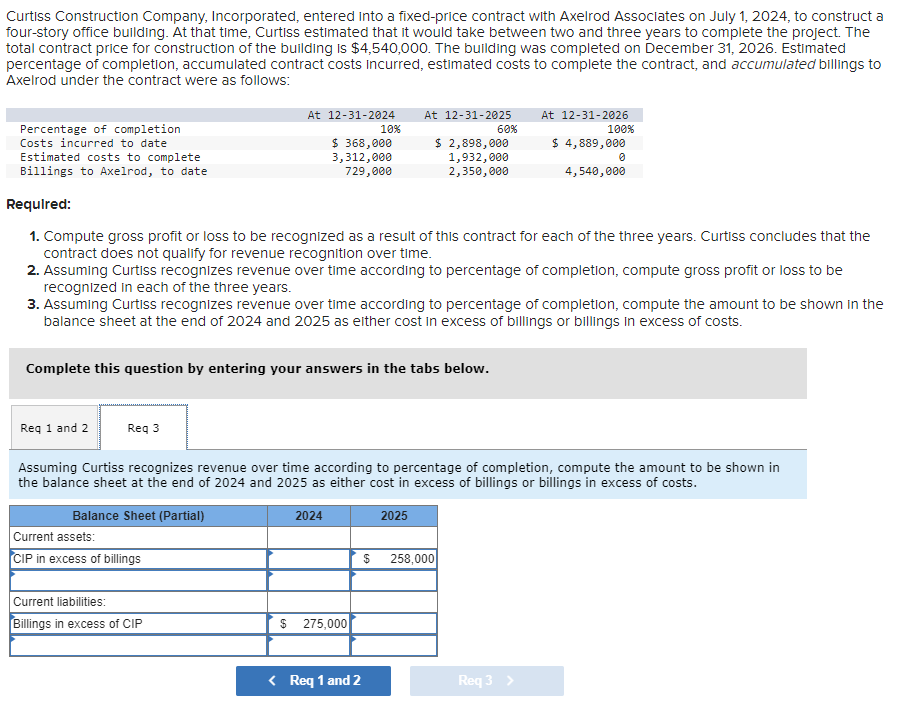

Curtiss Construction Company, Incorporated, entered Into a fixed-price contract with Axelrod Assoclates on July 1, 2024, to construct a four-story office bullding. At that time, Curtiss estimated that it would take between two and three years to complete the project. The total contract price for construction of the building is $4,540,000. The building was completed on December 31, 2026. Estimated percentage of completion, accumulated contract costs incurred, estimated costs to complete the contract, and accumulated billings to Axelrod under the contract were as follows: Required: 1. Compute gross profit or loss to be recognized as a result of this contract for each of the three years. Curtiss concludes that the contract does not qualify for revenue recognition over time. 2. Assuming Curtiss recognizes revenue over time according to percentage of completion, compute gross profit or loss to be recognized in each of the three years. 3. Assuming Curtiss recognizes revenue over time according to percentage of completion, compute the amount to be shown in the balance sheet at the end of 2024 and 2025 as elther cost in excess of billings or billings in excess of costs. Complete this question by entering your answers in the tabs below. 1. Compute gross profit or loss to be recognized as a result of this contract for each of the three years. Curtiss concludes that the contract does not qualify for revenue recognition over time. 2. Assuming Curtiss recognizes revenue over time according to percentage of completion, compute gross profit or loss to be recognized in each of the three years. Note: Leave no cells blank - be certain to enter "0" wherever required. Loss amounts should be indicated with a minus sign. Curtiss Construction Company, Incorporated, entered Into a fixed-price contract with Axelrod Associates on July 1, 2024, to construct a four-story office bullding. At that time, Curtiss estimated that it would take between two and three years to complete the project. The total contract price for construction of the building is $4,540,000. The bullding was completed on December 31, 2026. Estimated percentage of completion, accumulated contract costs incurred, estimated costs to complete the contract, and accumulated billings to Axelrod under the contract were as follows: Requlred: 1. Compute gross profit or loss to be recognized as a result of this contract for each of the three years. Curtiss concludes that the contract does not qualify for revenue recognition over time. 2. Assuming Curtiss recognizes revenue over time according to percentage of completion, compute gross profit or loss to be recognized in each of the three years. 3. Assuming Curtiss recognizes revenue over time according to percentage of completion, compute the amount to be shown in the balance sheet at the end of 2024 and 2025 as elther cost in excess of billings or billings in excess of costs. Complete this question by entering your answers in the tabs below. Assuming Curtiss recognizes revenue over time according to percentage of completion, compute the amount to be shown in the balance sheet at the end of 2024 and 2025 as either cost in excess of billings or billings in excess of costs

Curtiss Construction Company, Incorporated, entered Into a fixed-price contract with Axelrod Assoclates on July 1, 2024, to construct a four-story office bullding. At that time, Curtiss estimated that it would take between two and three years to complete the project. The total contract price for construction of the building is $4,540,000. The building was completed on December 31, 2026. Estimated percentage of completion, accumulated contract costs incurred, estimated costs to complete the contract, and accumulated billings to Axelrod under the contract were as follows: Required: 1. Compute gross profit or loss to be recognized as a result of this contract for each of the three years. Curtiss concludes that the contract does not qualify for revenue recognition over time. 2. Assuming Curtiss recognizes revenue over time according to percentage of completion, compute gross profit or loss to be recognized in each of the three years. 3. Assuming Curtiss recognizes revenue over time according to percentage of completion, compute the amount to be shown in the balance sheet at the end of 2024 and 2025 as elther cost in excess of billings or billings in excess of costs. Complete this question by entering your answers in the tabs below. 1. Compute gross profit or loss to be recognized as a result of this contract for each of the three years. Curtiss concludes that the contract does not qualify for revenue recognition over time. 2. Assuming Curtiss recognizes revenue over time according to percentage of completion, compute gross profit or loss to be recognized in each of the three years. Note: Leave no cells blank - be certain to enter "0" wherever required. Loss amounts should be indicated with a minus sign. Curtiss Construction Company, Incorporated, entered Into a fixed-price contract with Axelrod Associates on July 1, 2024, to construct a four-story office bullding. At that time, Curtiss estimated that it would take between two and three years to complete the project. The total contract price for construction of the building is $4,540,000. The bullding was completed on December 31, 2026. Estimated percentage of completion, accumulated contract costs incurred, estimated costs to complete the contract, and accumulated billings to Axelrod under the contract were as follows: Requlred: 1. Compute gross profit or loss to be recognized as a result of this contract for each of the three years. Curtiss concludes that the contract does not qualify for revenue recognition over time. 2. Assuming Curtiss recognizes revenue over time according to percentage of completion, compute gross profit or loss to be recognized in each of the three years. 3. Assuming Curtiss recognizes revenue over time according to percentage of completion, compute the amount to be shown in the balance sheet at the end of 2024 and 2025 as elther cost in excess of billings or billings in excess of costs. Complete this question by entering your answers in the tabs below. Assuming Curtiss recognizes revenue over time according to percentage of completion, compute the amount to be shown in the balance sheet at the end of 2024 and 2025 as either cost in excess of billings or billings in excess of costs Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started