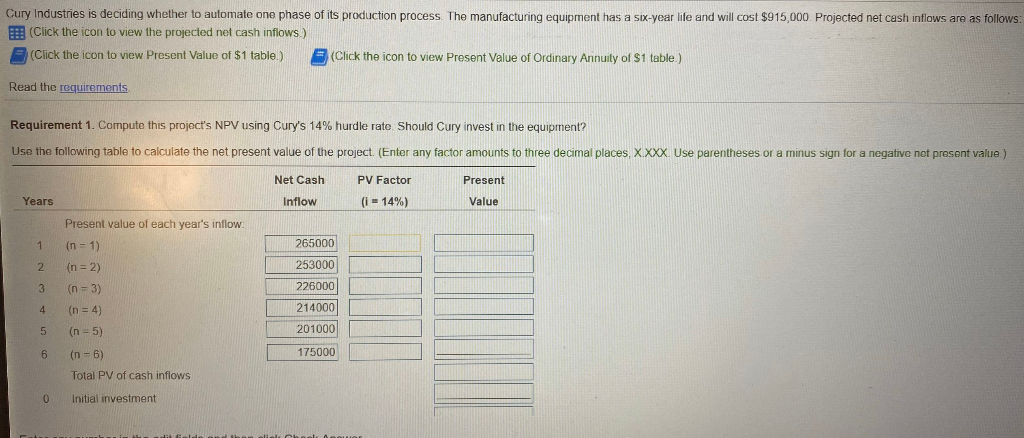

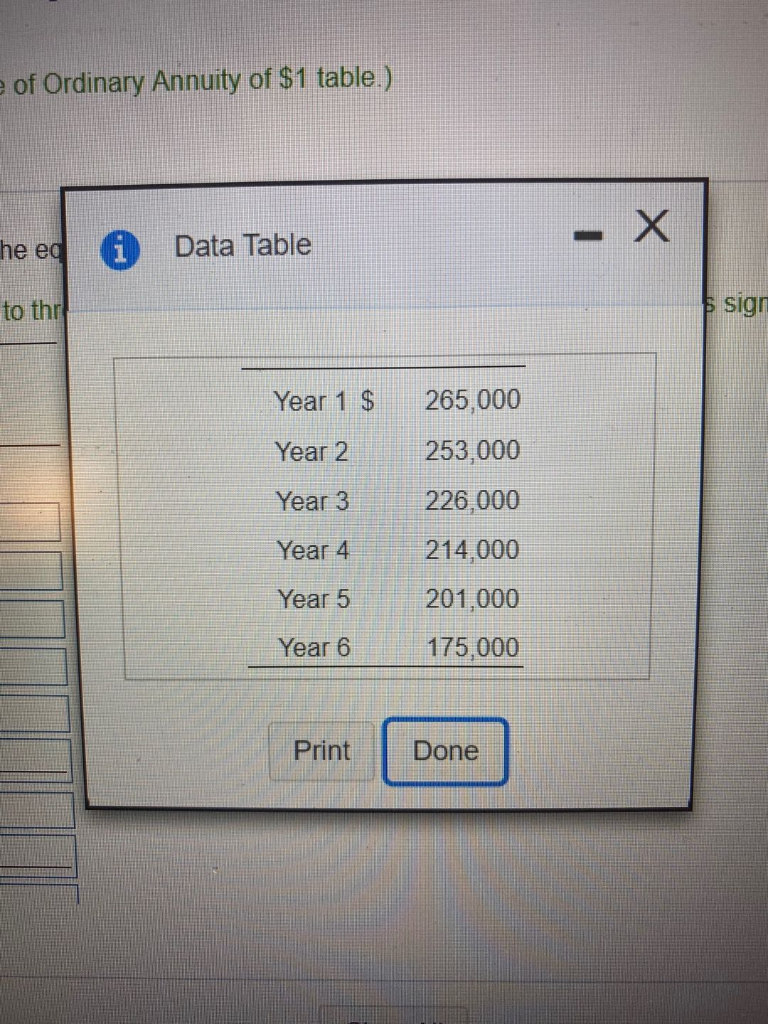

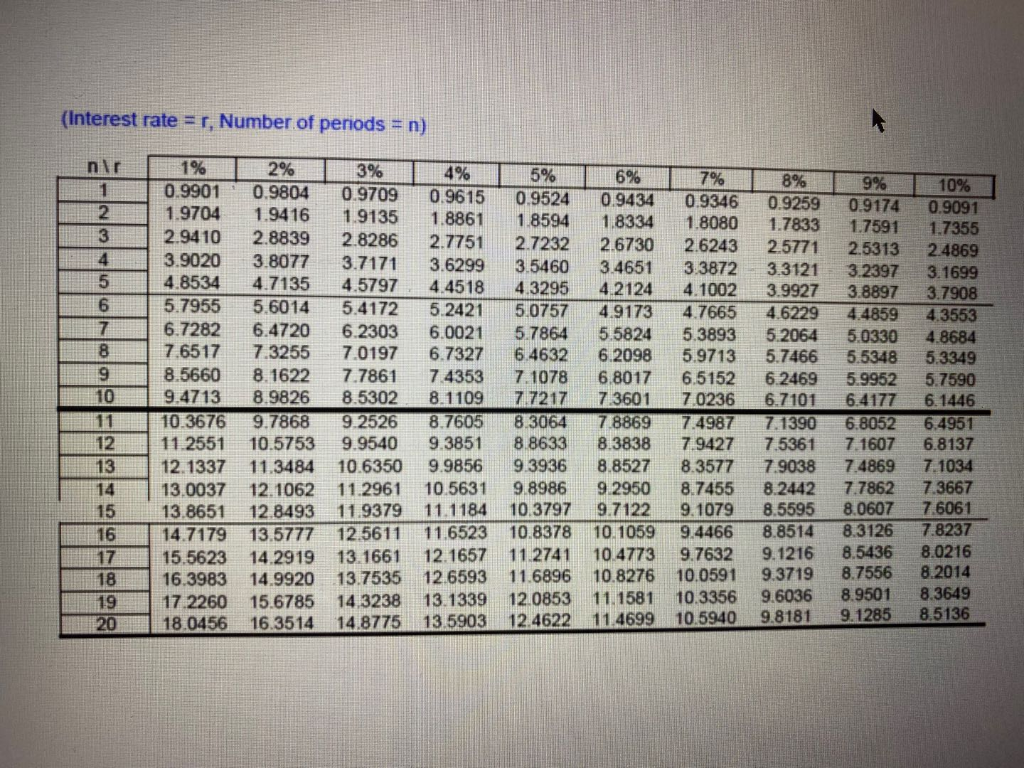

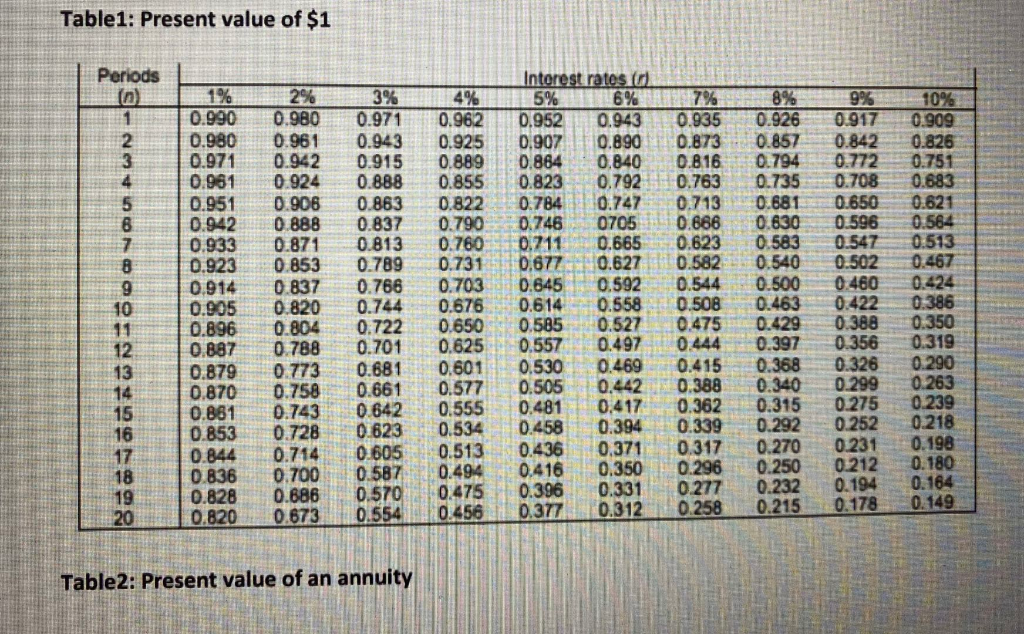

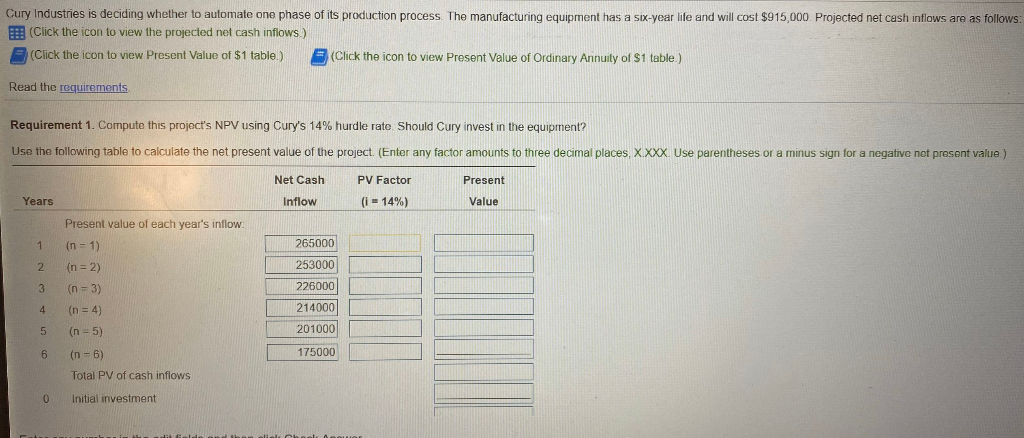

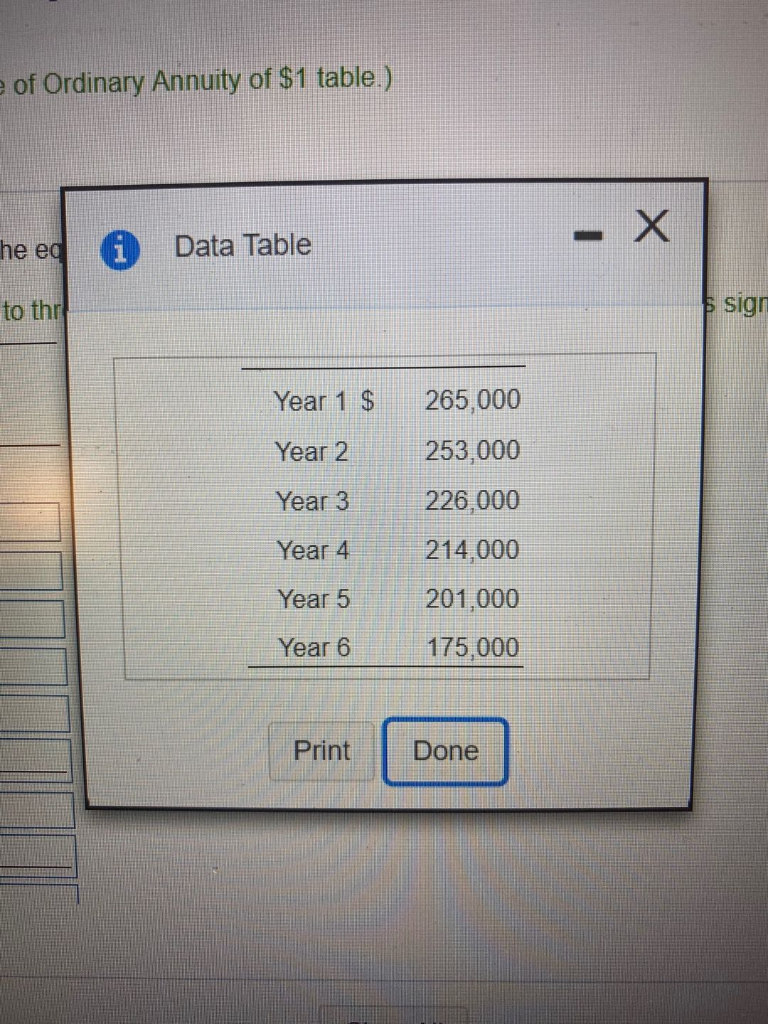

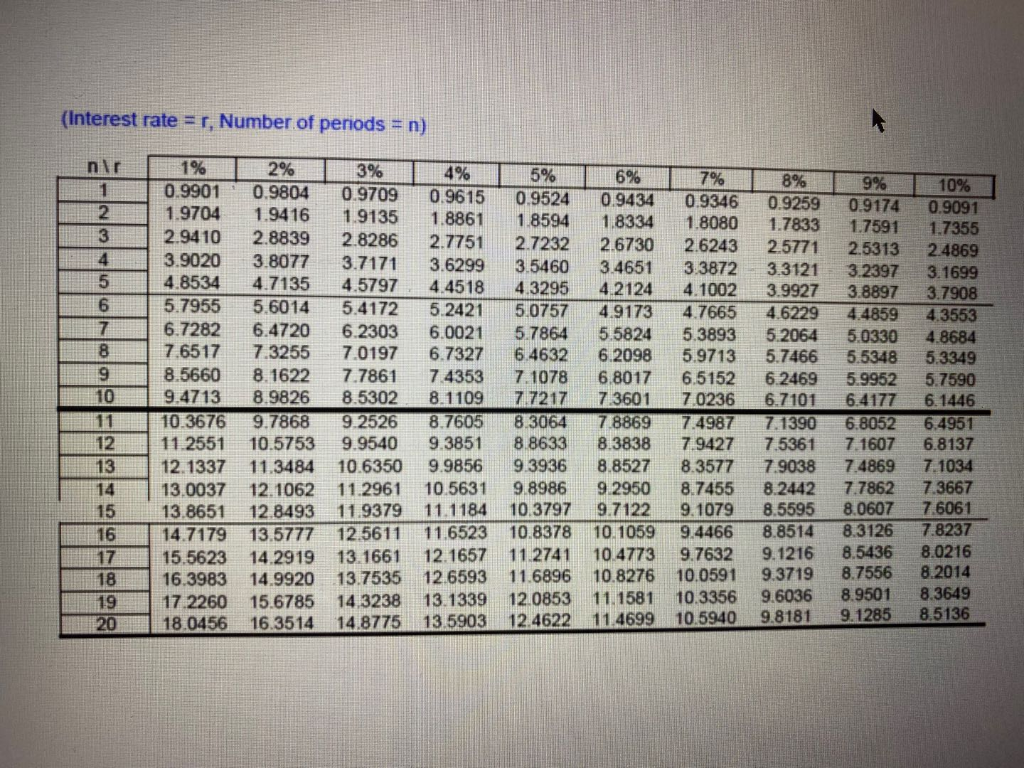

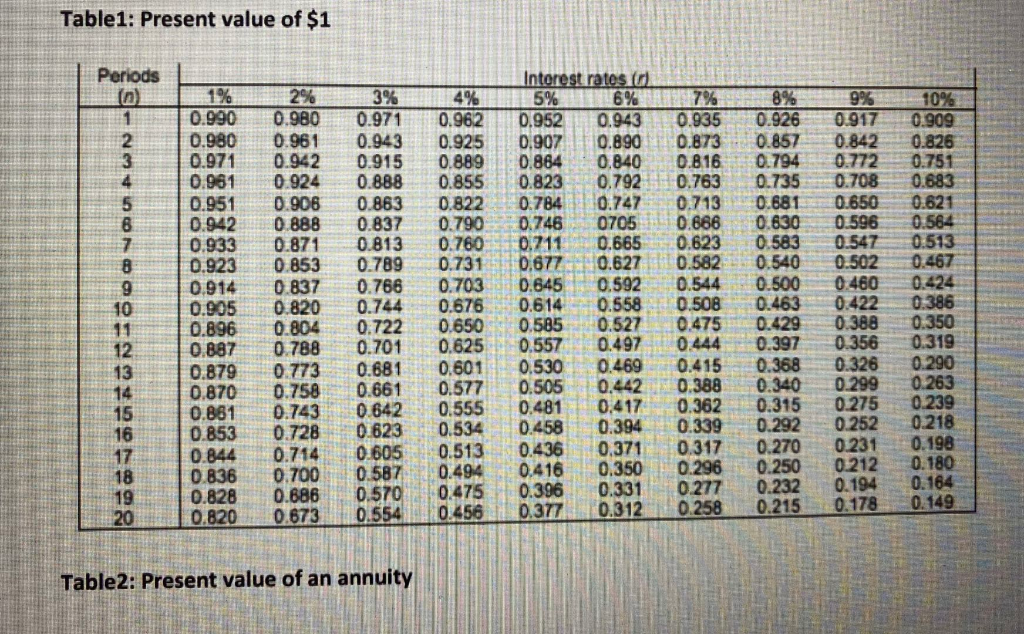

Cury Industries is deciding whether to automate one phase of its production process. The manufacturing equipment has a six-your life and will cost $915,000. Projected net cash inflows are as follows. (Click the icon to view the projected net cash inflows.) (Click the icon to view Present Value of $1 table) (Click the icon to view Present Value of Ordinary Annuity of $1 table.) Read the requirements Requirement 1. Compute this project's NPV using Cury's 14% hurdle rate Should Cury invest in the equipment? Use the following table to calculate the net present value of the project. (Enter any factor amounts to three decimal places, X.XXX Use parentheses or a minus sign for a negative not present value ) Net Cash PV Factor Present Years Inflow (i = 14%) Value Present value of each year's inflow (n = 1) 265000 2 (n=2) 253000 (n = 3) 226000 4 (n = 4) 214000 5 (n = 5) 201000 6 (n = 6) 175000 Total PV of cash inflows AN 0 Initial investment e of Ordinary Annuity of $1 table.) he eqi Data Table to the sign Year 1 $ Year 2 Year 3 HERE 265,000 253,000 226,000 214,000 201,000 175,000 Year 4 Year 5 Year 6 Print Done (Interest rate = r, Number of periods = n) nir 1% 1 0 .9901 |2 | 1.9704 3 2.9410 3.9020 5 4 .8534 5.7955 7 6 .7282 8 7 .6517 9 8 .5660 10 9 .4713 1110.3676 * 12 11.2551 13 12.1337 13.0037 15 . 13.8651 16 1 4.7179 15.5623 181 16.3983 19 1 7.2260 20 1 8.0456 2% 3% 4% 5% 6% 7% 8% 9% 10% 0.9804 0.9709 0.9615 0.9524 0.9434 0.9346 0.9259 0.9174 0.9091 1.9416 1.9135 1.8861 1.85941.83341.8080 1.7833 1.7591 1.7355 2.8839 2.8286 2.7751 2.7232 2.6730 2.6243 2.5771 2.5313 2.4869 3.8077 3.7171 3.6299 3.5460 3.4651 3.3872 3.3121 3.2397 3.1699 4.7135 4.5797 4.4518 4.32954.2124 4.10023.9927 3.8897 3.7908 5.6014 5.4172 5.2421 5,0757 4.9173 4.7665 4.6229 4.4859 4 3553 6.4720 6.2303 6.0021 5.78645.5824 5.3893 5.2064 5.0330 4.8684 7.3255 7,01976.7327 6.4632 6.2098 5.9713 5.7466 5.5348 5.3349 8.16227.7861 7.4353 7 1078 6.8017 6.5152 6.2469 5.9952 5.7590 8.9826 8.5302 8.1109 7.721773601 7.0236 6.7101 6.4177 6.1446 9.7868 9.2526 8.76058.3064788697.49877.13906.8052 6.4951 10.5753 9.9540 9.3851 88633 8.3838 79427 7.5361 7.1607 6.8137 11.3484 10.6350 9.9856 9.3936 8.8527 8.35777.9038 7.4869 7.1034 12.1062 11.2961 10.5631 9.8986 929508.7455 8.2442 7.7862 7.3667 12.8493 11.9379 11.1184 10.3797 9.7122 9.1079 8.5595 8.06077 6061 13.5777 12.5611 11.6523 10.8378 10.1059 9.4466 8.8514 8.3126 7.8237 14.291913.1661 12.1657 11.2741 10.4773 9.7632 9.1216 8.5436 8.0216 14.9920 13.7535 12.6593 11.6896 10.8276 10.0591 9.3719 8.7556 8.2014 14 3238 15.6785 13.1339 12.0853 11.1581 10.33569.6036 8.9501 8.3649 16.3514 14.8775 13 5903 12.4622 11.4699 10.5940 9.8181 9.1285 8.5136 Table1: Present value of $1 Periods 1% 8 OU AWNS 0.990 0.980 0.971 0.961 0.951 0.942 0.933 0.923 0.914 0.905 | 0.896 | 0.887 0.879 0.870 0.861 0.853 10.844 | 0.836 1 0.828 10.820 Interest rates d 3% 5% 96% 0.980 0.971 0.962 0.952 0.9430.935 0.9610.943 0.925 0.907 0.890 0.873 0.942 0.915 0.8890.864 0,840 0.816 0.924 0.888 0.855 0.823 0.792 0.763 0.906 0.8630.822 0.784 0.747 0.713 0.888 0.837 0.790 0.746 0705 0.666 0.871 0.813 0.760 0.211 0.665 0.623 0.853 0.789 0.731 0.677 0.627 0.582 0.837 0.766 0.703 0.645 0,592 0.544 0.820 0.744 0.676 0.614 0.558 0.508 0.804 0.722 0.650 0.585 0.527 0.475 0.788 0.701 0.625 0.557 0.4970 444 0.773 0.681 0.601 0.530 0.469 0.415 0.758 0.661 0.577 0.505 0.442 0.388 0.743 0642 0.555 0.481 0.417 0.362 0.7280 .623 0.534- 0.458 0.394 0.339 0.714 0.605 0.513 0.436 0.371 0.317 0.700 0.587 940.416 0.350 0.296 0.686 0.570 0.475 0.396 0.331 0.673 0.554 0.456 0.377 0.3120.258 9% 0.926 0.917 0.8570.842 0.794 0.772 0.7350.708 0.681 0.650 0.630 0.596 0.583 0.547 0.540 0.502 0.500 0.460 0.463 0.422 0.429 0.388 0.397 0.356 0.368 0.326 0.340 0.299 0.315 0.275 0.292 0.252 0.270 0.231 0.250 0.212 10% 0.909 0.826 0.751 0.683 0.621 0.564 0.513 0.467 0.424 0.386 0.350 0.319 0.290 0.263 0.239 0.218 0.198 0.180 0.164 0.194 18 20 0.215 Table2: Present value of an annuity