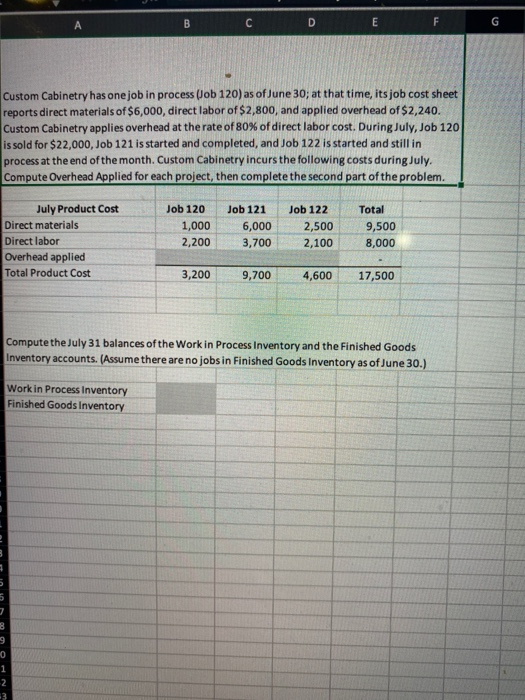

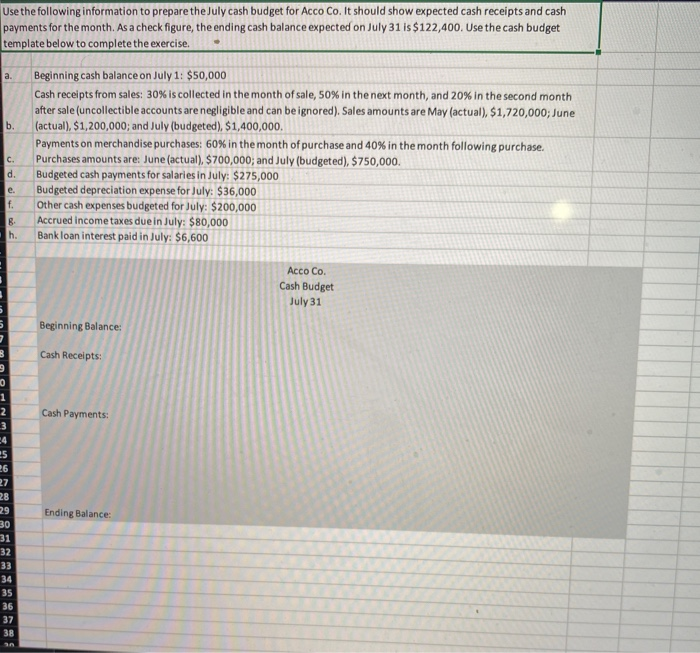

Custom Cabinetry has one job in process (Job 120) as of June 30; at that time, its job cost sheet reports direct materials of $6,000, direct labor of $2,800, and applied overhead of $2,240. Custom Cabinetry applies overhead at the rate of 80% of direct labor cost. During July, Job 120 is sold for $22,000, Job 121 is started and completed, and Job 122 is started and still in process at the end of the month. Custom Cabinetry incurs the following costs during July. Compute Overhead Applied for each project, then complete the second part of the problem. July Product Cost Direct materials Direct labor Overhead applied Total Product Cost Job 120 1,000 2,200 Job 121 6,000 3,700 Job 122 2,500 2,100 Total 9,500 8,000 3,200 9,7004,600 17,500 Compute the July 31 balances of the Work in Process Inventory and the Finished Goods Inventory accounts. (Assume there are no jobs in Finished Goods Inventory as of June 30.) Work in Process Inventory Finished Goods Inventory al mit in TON Use the following information to prepare the July cash budget for Acco Co. It should show expected cash receipts and cash payments for the month. As a check figure, the ending cash balance expected on July 31 is $122,400. Use the cash budget template below to complete the exercise. a. b. c. d. e . 8. h. Beginning cash balance on July 1: $50,000 Cash receipts from sales: 30% is collected in the month of sale, 50% in the next month, and 20% in the second month after sale (uncollectible accounts are negligible and can be ignored). Sales amounts are May (actual), $1,720,000; June (actual), $1,200,000; and July (budgeted) $1,400,000. Payments on merchandise purchases: 60% in the month of purchase and 40% in the month following purchase. Purchases amounts are: June (actual), $700,000; and July (budgeted), $750,000. Budgeted cash payments for salaries in July: $275,000 Budgeted depreciation expense for July: $36,000 Other cash expenses budgeted for July: $200,000 Accrued income taxes due in July: $80,000 Bank loan interest paid in July: $6,600 Acco Co. Cash Budget July 31 Beginning Balance Cash Receipts: Cash Payments: Ending Balance