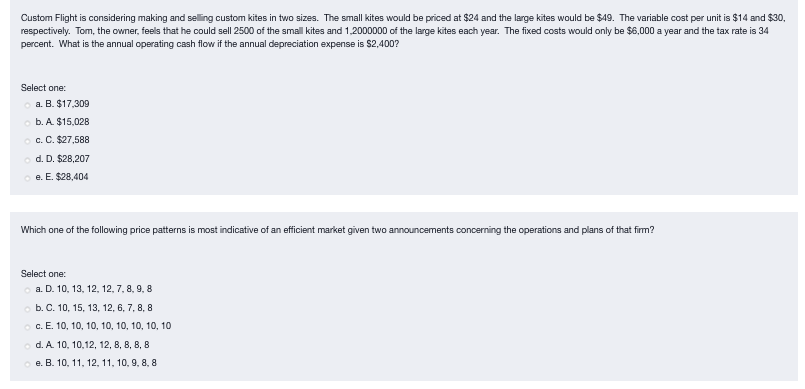

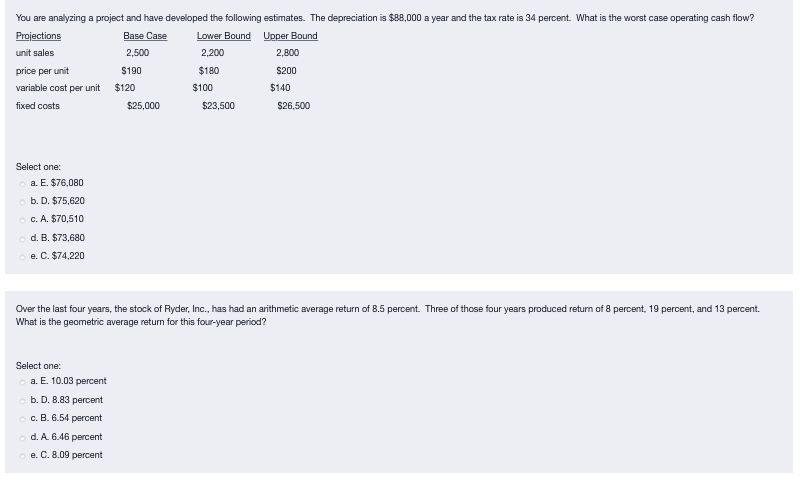

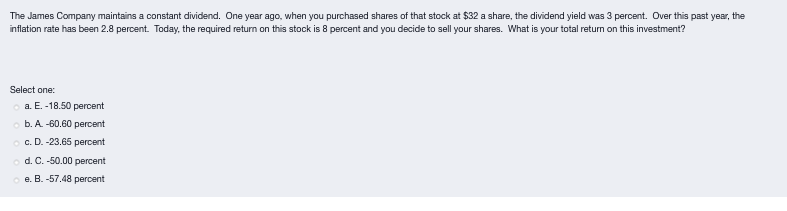

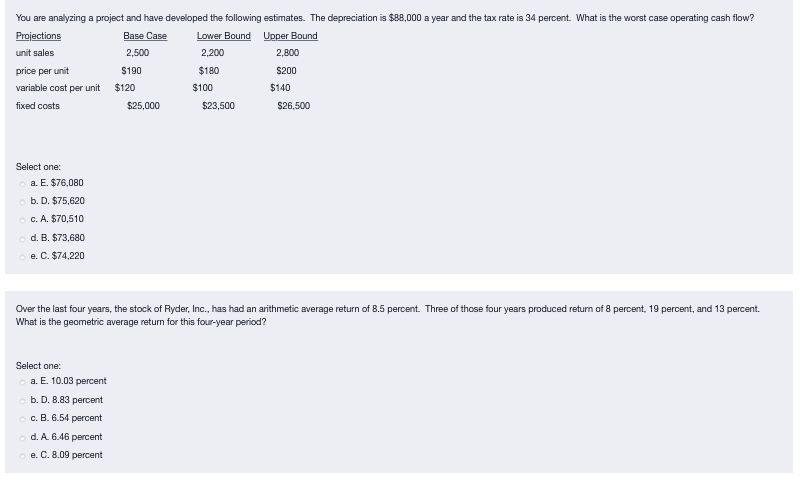

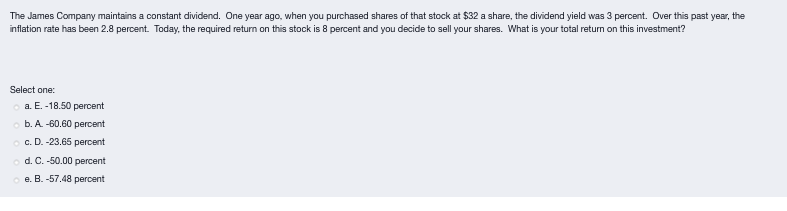

Custom Flight is considering making and selling custom kites in two sizes. The small kites would be priced at $24 and the large kites would be $49. The variable cost per unit is $14 and $30, respectively. Tom, the owner, feels that he could sell 2500 of the small kites and 1,2000000 of the large kites each year. The fixed costs would only be $6,000 a year and the tax rate is 34 percent. What is the annual operating cash flow if the annual depreciation expense is $2,400? Select one: a. B. $17.309 b. A $15.02B c. C. $27,588 d. D. $28,207 e. E. $28,404 Which one of the following price patterns is most indicative of an efficient market given two announcements concerning the operations and plans of that firma Select one: a. D. 10, 13, 12, 12, 7, 8, 9, 8 b. C. 10, 15, 13, 12, 6, 7, 8, 8 c. E. 10, 10, 10, 10, 10, 10, 10, 10 d. A. 10,10,12, 12, 8, 8, 8, 8 e. B. 10, 11, 12, 11, 10, 9, 8,8 You are analyzing a project and have developed the following estimates. The depreciation is $88,000 a year and the tax rate is 34 percent. What is the worst case operating cash flow? Projections Base Case Lower Bound Upper Bound unit sales 2,500 2,200 2,800 price per unit $190 $180 S200 variable cost per unit $120 $100 $140 fixed costs $25,000 $23,500 $26,500 Select one: a. E. $76,080 b. D. $75,620 C. A. $70,510 d. B. $73,680 e. C. $74,220 Over the last four years, the stock of Ryder, Inc., has had an arithmetic average return of 8.5 percent. Three of those four years produced return of 8 percent, 19 percent, and 13 percent. What is the geometric average return for this four-year period? Select one: a. E. 10.03 percent b. D. 8.83 percent c. B. 6.54 percent d. A. 6.46 percent e. C. 8.09 percent The James Company maintains a constant dividend. One year ago, when you purchased shares of that stock at $32 a share, the dividend yield was 3 percent. Over this past year, the inflation rate has been 2.8 percent. Today, the required return on this stock is 8 percent and you decide to sell your shares. What is your total return on this investment? Select one: a. E. -18.50 percent b. A.-60.60 percent c. D.-23.65 percent d. C.-50.00 percent e. B. -57.48 percent