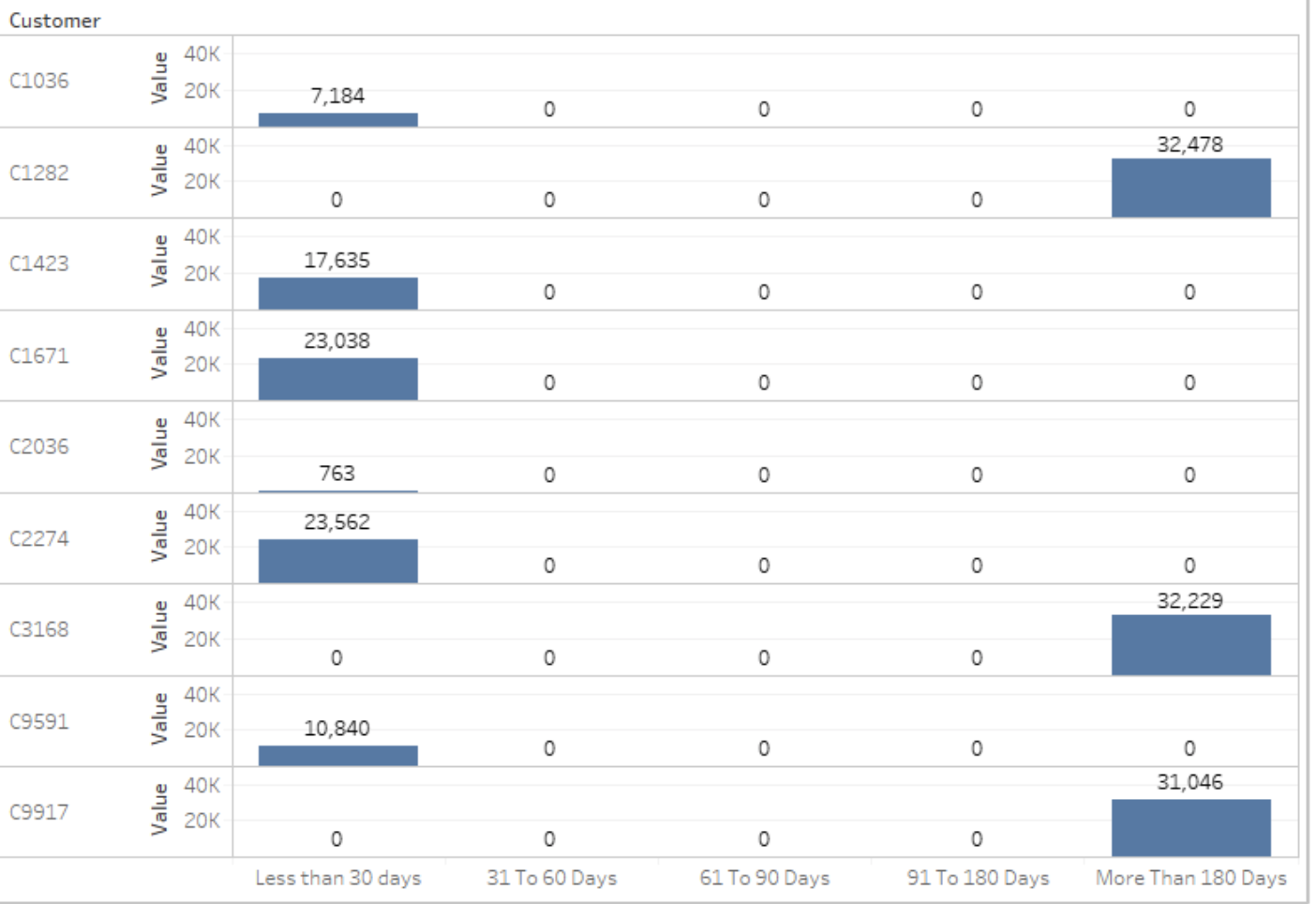

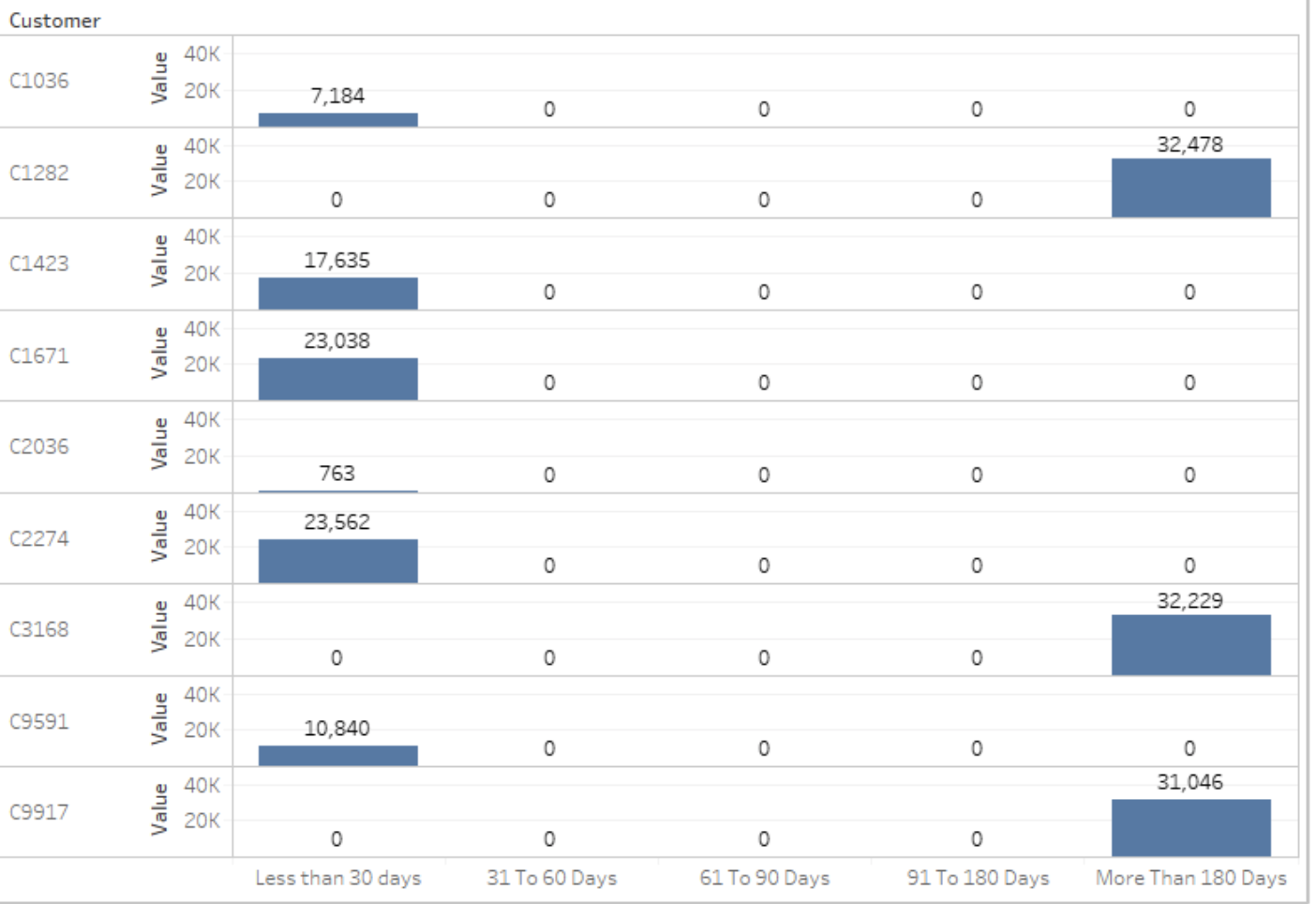

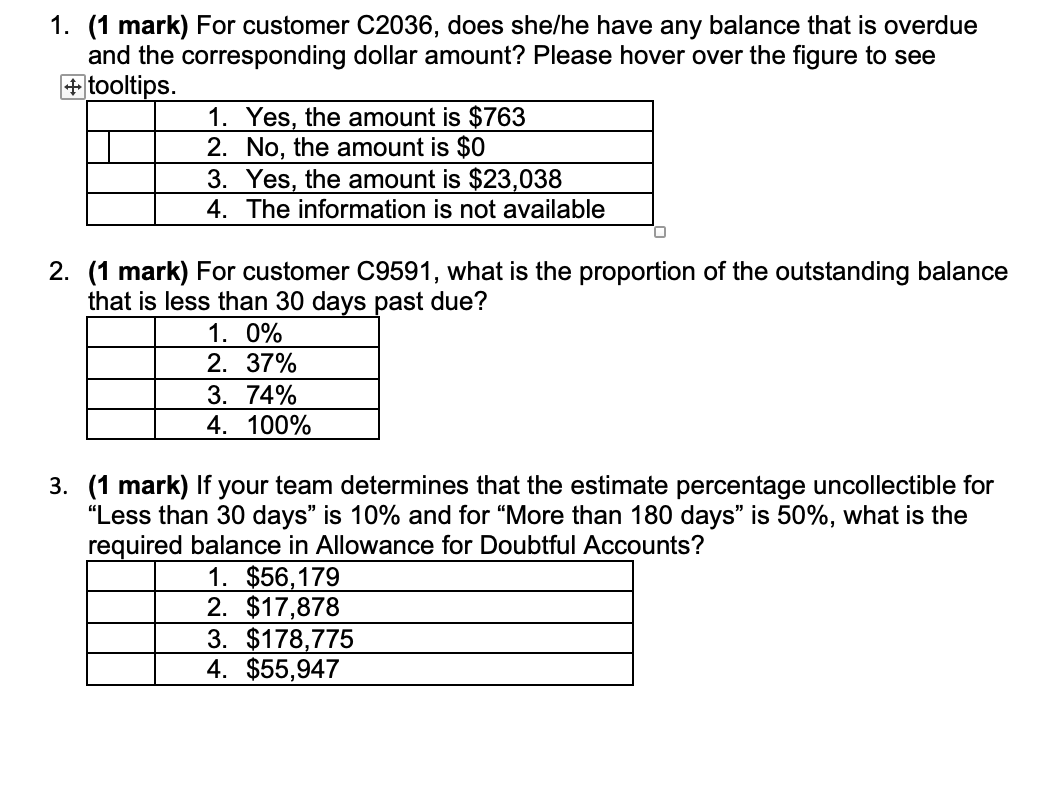

Customer 40K C1036 Value 20K 7,184 0 0 0 0 40K 32,478 C1282 Value 20K 0 0 0 0 40K C1423 Value 17,635 20K 0 0 0 0 40K 23,038 C1671 Value 20K 0 0 0 0 40K C2036 Value 20K 763 0 0 0 0 u 40K 23,562 C2274 Value 20K 0 0 0 0 40K 32,229 C3168 Value 20K 0 0 0 0 40K C9591 Value 20K 10,840 0 0 0 0 31,046 40K C9917 Value 20K 0 0 O 0 Less than 30 days 31 To 60 Days 61 To 90 Days 91 To 180 Days More Than 180 Days 1. (1 mark) For customer C2036, does she/he have any balance that is overdue and the corresponding dollar amount? Please hover over the figure to see #tooltips. 1. Yes, the amount is $763 2. No, the amount is $0 3. Yes, the amount is $23,038 4. The information is not available 2. (1 mark) For customer C9591, what is the proportion of the outstanding balance that is less than 30 days past due? 1. 0% 2. 37% 3. 74% 4. 100% 3. (1 mark) If your team determines that the estimate percentage uncollectible for Less than 30 days is 10% and for More than 180 days is 50%, what is the required balance in Allowance for Doubtful Accounts? 1. $56,179 2. $17,878 3. $178,775 4. $55,947 1. (2 marks) When looking at the visualization, it seems that there are two extremes. It's either less than 30 days past due or it's more than 180 days past due. In addition, these customers seem to either pay the full amount or delay the whole payment. If this is the pattern we observe, what would be your estimate percentage uncollectible for these accounts? ENTER YOUR ANSWER HERE 2. (3 marks) The review of uncollectible accounts receivable is often related to the credit management processes. Assuming that the company gives each customer a credit limit of $20,000 each year, based on the visualization and this credit limit information, what do you think about this company's credit management? Customer 40K C1036 Value 20K 7,184 0 0 0 0 40K 32,478 C1282 Value 20K 0 0 0 0 40K C1423 Value 17,635 20K 0 0 0 0 40K 23,038 C1671 Value 20K 0 0 0 0 40K C2036 Value 20K 763 0 0 0 0 u 40K 23,562 C2274 Value 20K 0 0 0 0 40K 32,229 C3168 Value 20K 0 0 0 0 40K C9591 Value 20K 10,840 0 0 0 0 31,046 40K C9917 Value 20K 0 0 O 0 Less than 30 days 31 To 60 Days 61 To 90 Days 91 To 180 Days More Than 180 Days 1. (1 mark) For customer C2036, does she/he have any balance that is overdue and the corresponding dollar amount? Please hover over the figure to see #tooltips. 1. Yes, the amount is $763 2. No, the amount is $0 3. Yes, the amount is $23,038 4. The information is not available 2. (1 mark) For customer C9591, what is the proportion of the outstanding balance that is less than 30 days past due? 1. 0% 2. 37% 3. 74% 4. 100% 3. (1 mark) If your team determines that the estimate percentage uncollectible for Less than 30 days is 10% and for More than 180 days is 50%, what is the required balance in Allowance for Doubtful Accounts? 1. $56,179 2. $17,878 3. $178,775 4. $55,947 1. (2 marks) When looking at the visualization, it seems that there are two extremes. It's either less than 30 days past due or it's more than 180 days past due. In addition, these customers seem to either pay the full amount or delay the whole payment. If this is the pattern we observe, what would be your estimate percentage uncollectible for these accounts? ENTER YOUR ANSWER HERE 2. (3 marks) The review of uncollectible accounts receivable is often related to the credit management processes. Assuming that the company gives each customer a credit limit of $20,000 each year, based on the visualization and this credit limit information, what do you think about this company's credit management