Answered step by step

Verified Expert Solution

Question

1 Approved Answer

customer for retirement after 90 days. He may either wait for 90 days or have the same bill discounted with his banker who will credit

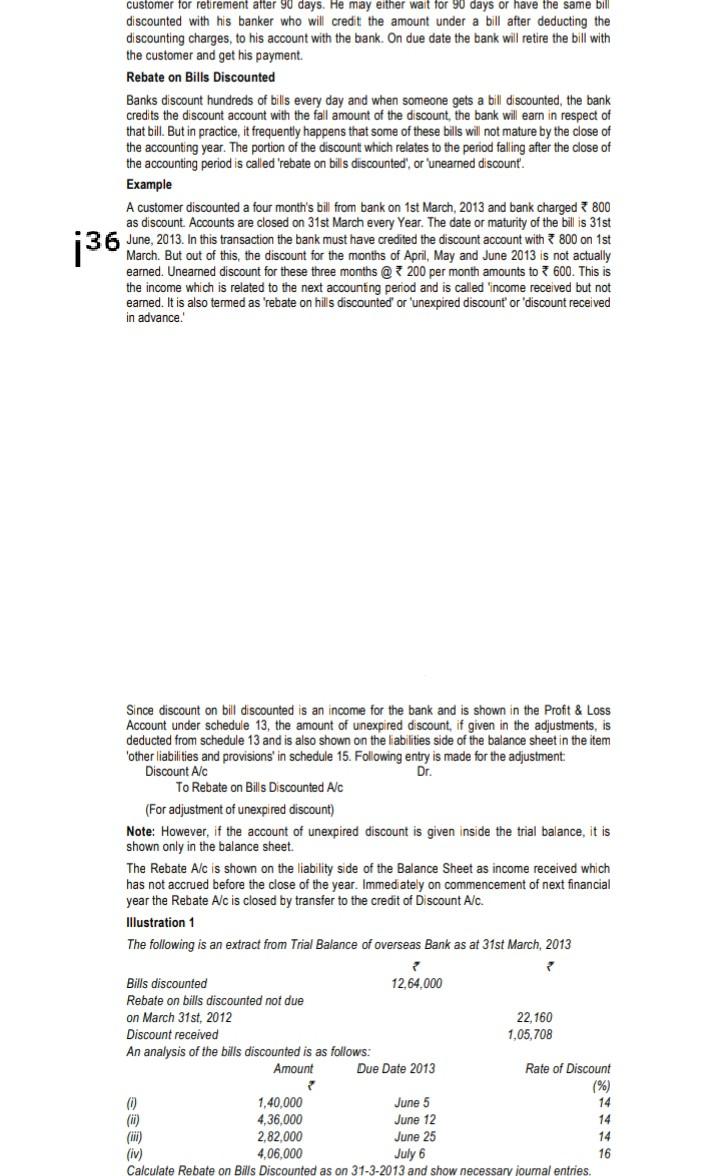

customer for retirement after 90 days. He may either wait for 90 days or have the same bill discounted with his banker who will credit the amount under a bill after deducting the discounting charges, to his account with the bank. On due date bank will retire the bill with the customer and get his payment. Rebate on Bills Discounted Banks discount hundreds of bills every day and when someone gets a bill discounted, the bank credits the discount account with the fall amount of the discount, the bank will earn in respect of that bill. But in practice, it frequently happens that some of these bills will not mature by the close of the accounting year. The portion of the discount which relates to the period falling after the close of the accounting period is called "rebate on bills discounted', or'unearned discount. Example A customer discounted a four month's bili from bank on 1st March, 2013 and bank charged 800 as discount. Accounts are closed on 31st March every year. The date or maturity of the bill is 31st June, 2013. In this transaction the bank must have credited the discount account with 800 on 1st March. But out of this, the discount for the months of April, May and June 2013 is not actually earned. Unearned discount for these three months @ 200 per month amounts 600. This is the income which is related to the next accounting period and is called 'income received but not earned. It is also termed as "rebate on hills discounted' or 'unexpired discount or "discount received in advance. 136 Since discount on bill discounted is an income for the bank and is shown in the Profit & Loss Account under schedule 13, the amount of unexpired discount, if given in the adjustments, is deducted from schedule 13 and is also shown on the liabilities side of the balance sheet in the item other liabilities and provisions' in schedule 15. Following entry is made for the adjustment Discount Alc Dr. To Rebate on Bills Discounted A/C (For adjustment of unexpired discount) Note: However, if the account of unexpired discount is given inside the trial balance, it is shown only in the balance sheet. The Rebate A/c is shown on the liability side of the Balance Sheet as income received which has not accrued before the close of the year. Immediately on commencement of next financial year the Rebate A/c is closed by transfer to the credit of Discount Alc. Illustration 1 The following is an extract from Trial Balance of overseas Bank as at 31st March, 2013 Bills discounted 12,64.000 Rebate on bills discounted not due on March 31st, 2012 22,160 Discount received 1,05,708 An analysis of the bills discounted is as follows: Amount Due Date 2013 Rate of Discount (%) 0 1,40,000 June 5 14 (ii) 4.36.000 June 12 14 (iii) 2,82,000 June 25 14 (iv) 4,06,000 July 6 16 Calculate Rebate on Bills Discounted as on 31-3-2013 and show necessary journal entries

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started