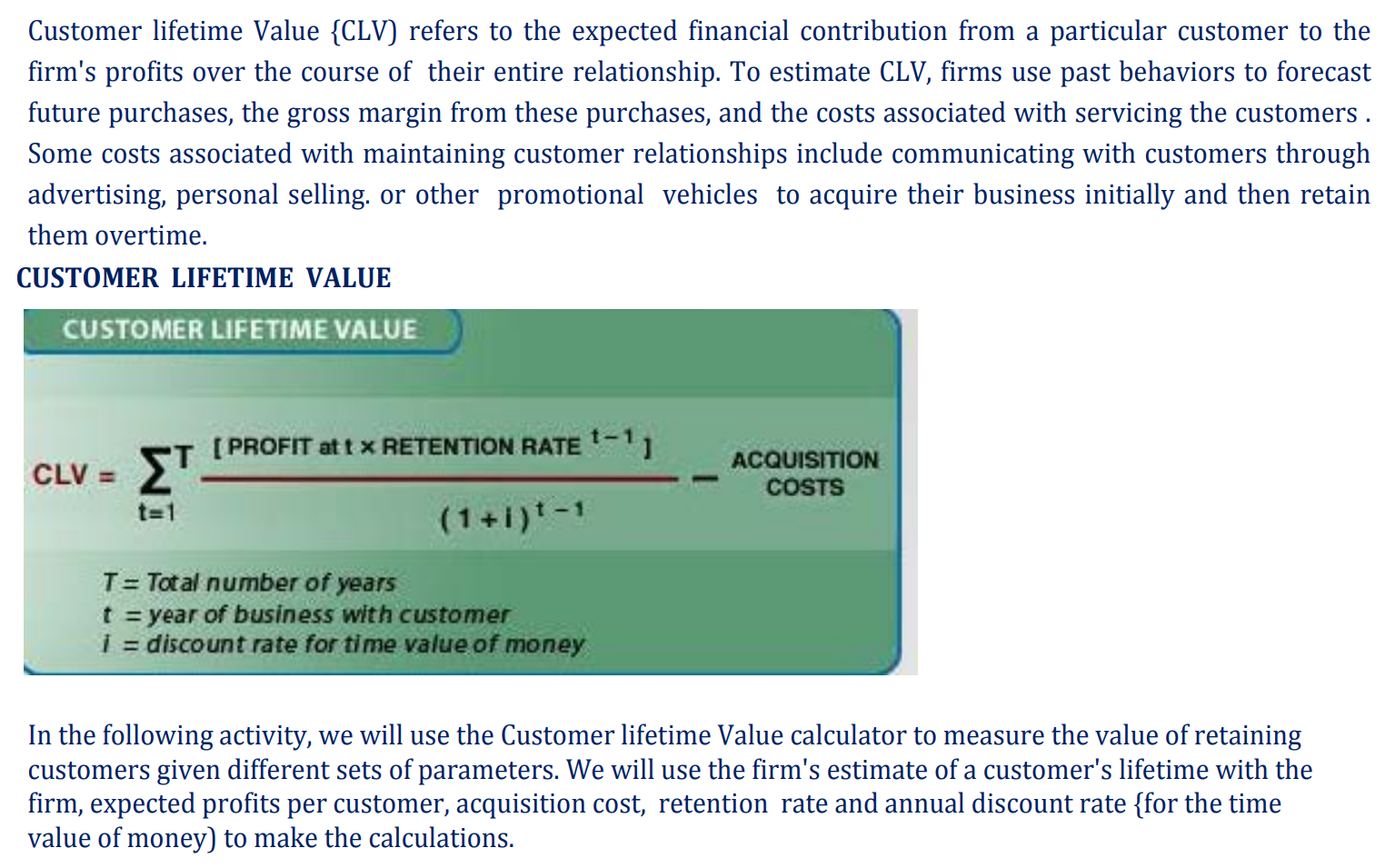

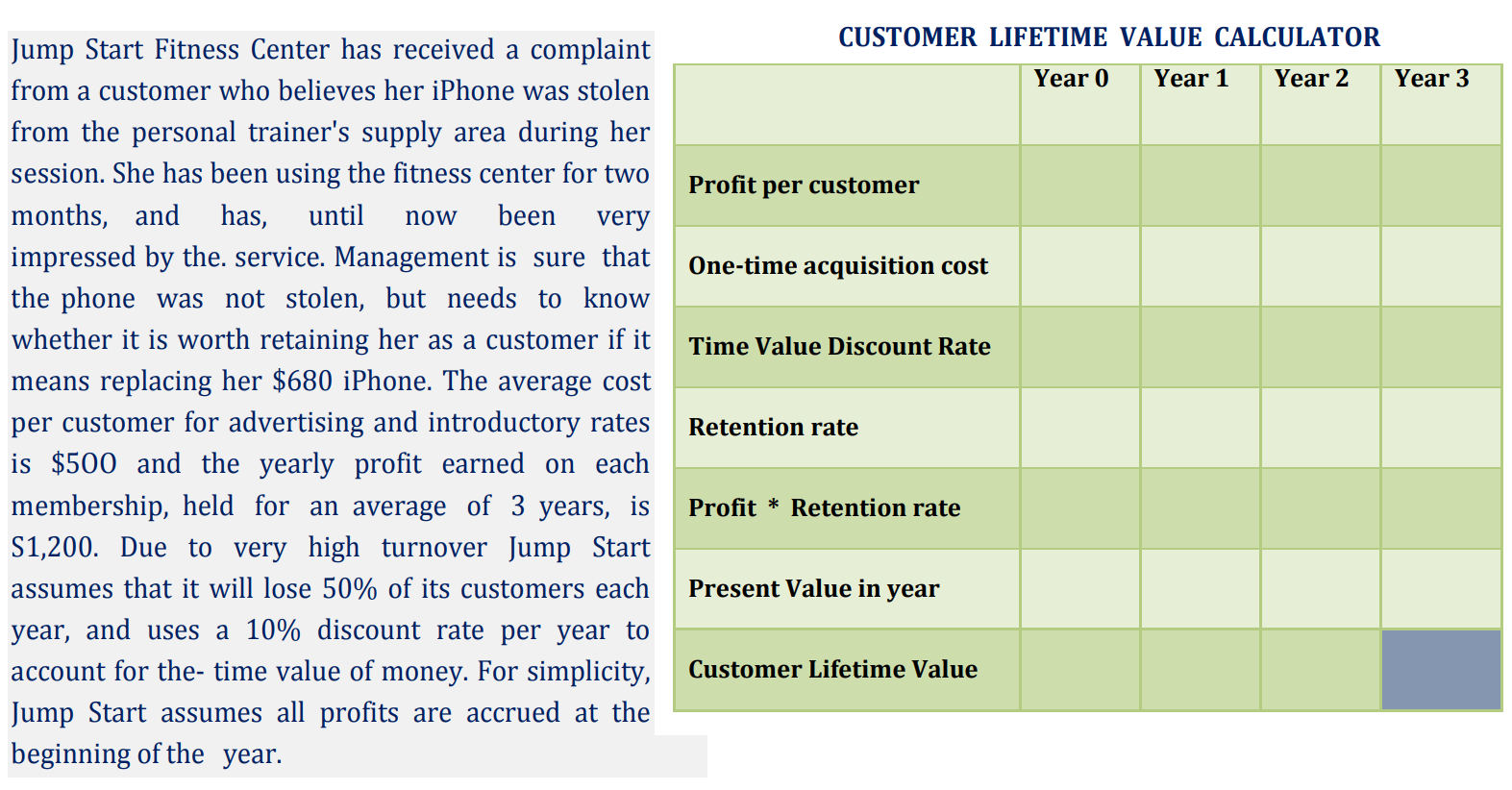

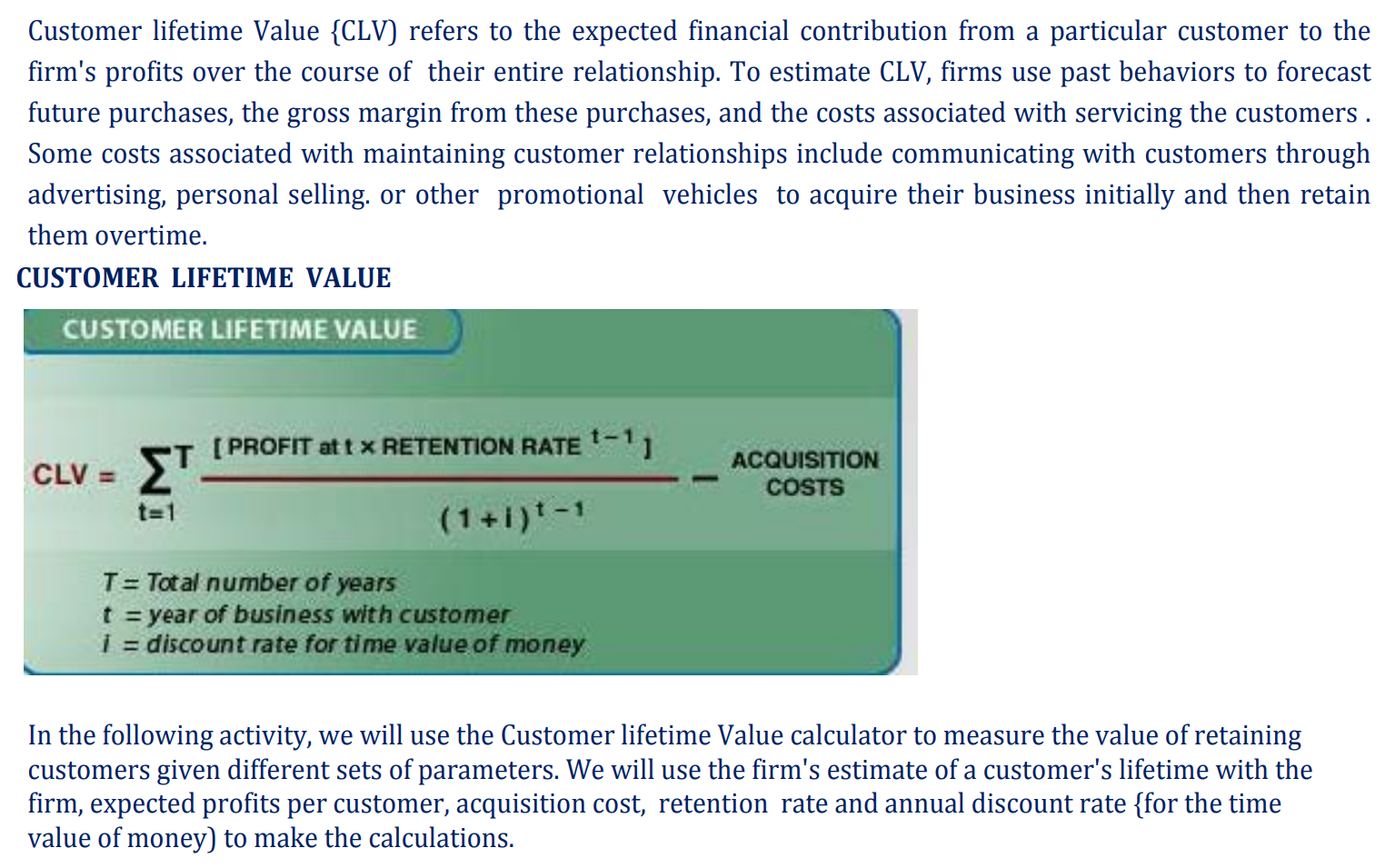

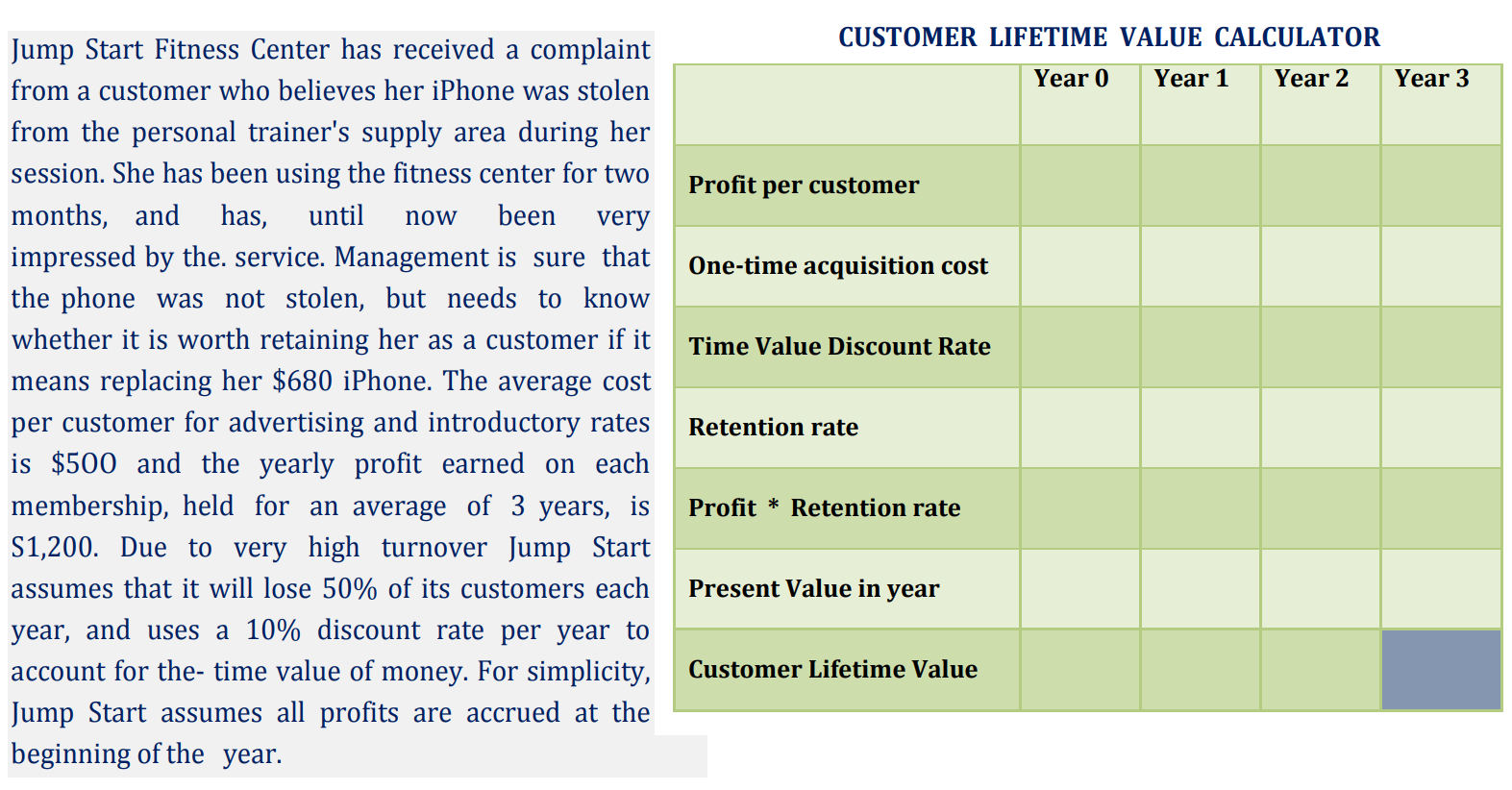

Customer lifetime Value {CLV) refers to the expected financial contribution from a particular customer to the firm's profits over the course of their entire relationship. To estimate CLV, firms use past behaviors to forecast future purchases, the gross margin from these purchases, and the costs associated with servicing the customers . Some costs associated with maintaining customer relationships include communicating with customers through advertising, personal selling. or other promotional vehicles to acquire their business initially and then retain them overtime. CUSTOMER LIFETIME VALUE CUSTOMER LIFETIME VALUE [PROFIT att x RETENTION RATE-I CLV = ST ACQUISITION COSTS t=1 T= Total number of years t = year of business with customer i = discount rate for time value of money In the following activity, we will use the Customer lifetime Value calculator to measure the value of retaining customers given different sets of parameters. We will use the firm's estimate of a customer's lifetime with the firm, expected profits per customer, acquisition cost, retention rate and annual discount rate {for the time value of money) to make the calculations. CUSTOMER LIFETIME VALUE CALCULATOR Year 0 Year 1 Year 2 Profit per customer One-time acquisition cost Time Value Discount Rate Jump Start Fitness Center has received a complaint from a customer who believes her iPhone was stolen from the personal trainer's supply area during her session. She has been using the fitness center for two months, and has until now been very impressed by the service. Management is sure that the phone was not stolen, but needs to know whether it is worth retaining her as a customer if it means replacing her $680 iPhone. The average cost per customer for advertising and introductory rates is $500 and the yearly profit earned on each membership, held for an average of 3 years, is S1,200. Due to very high turnover Jump Start assumes that it will lose 50% of its customers each year, and uses a 10% discount rate per year to account for the-time value of money. For simplicity, Jump Start assumes all profits are accrued at the beginning of the year. Retention rate Profit * Retention rate Present Value in year Customer Lifetime Value Customer lifetime Value {CLV) refers to the expected financial contribution from a particular customer to the firm's profits over the course of their entire relationship. To estimate CLV, firms use past behaviors to forecast future purchases, the gross margin from these purchases, and the costs associated with servicing the customers . Some costs associated with maintaining customer relationships include communicating with customers through advertising, personal selling. or other promotional vehicles to acquire their business initially and then retain them overtime. CUSTOMER LIFETIME VALUE CUSTOMER LIFETIME VALUE [PROFIT att x RETENTION RATE-I CLV = ST ACQUISITION COSTS t=1 T= Total number of years t = year of business with customer i = discount rate for time value of money In the following activity, we will use the Customer lifetime Value calculator to measure the value of retaining customers given different sets of parameters. We will use the firm's estimate of a customer's lifetime with the firm, expected profits per customer, acquisition cost, retention rate and annual discount rate {for the time value of money) to make the calculations. CUSTOMER LIFETIME VALUE CALCULATOR Year 0 Year 1 Year 2 Profit per customer One-time acquisition cost Time Value Discount Rate Jump Start Fitness Center has received a complaint from a customer who believes her iPhone was stolen from the personal trainer's supply area during her session. She has been using the fitness center for two months, and has until now been very impressed by the service. Management is sure that the phone was not stolen, but needs to know whether it is worth retaining her as a customer if it means replacing her $680 iPhone. The average cost per customer for advertising and introductory rates is $500 and the yearly profit earned on each membership, held for an average of 3 years, is S1,200. Due to very high turnover Jump Start assumes that it will lose 50% of its customers each year, and uses a 10% discount rate per year to account for the-time value of money. For simplicity, Jump Start assumes all profits are accrued at the beginning of the year. Retention rate Profit * Retention rate Present Value in year Customer Lifetime Value