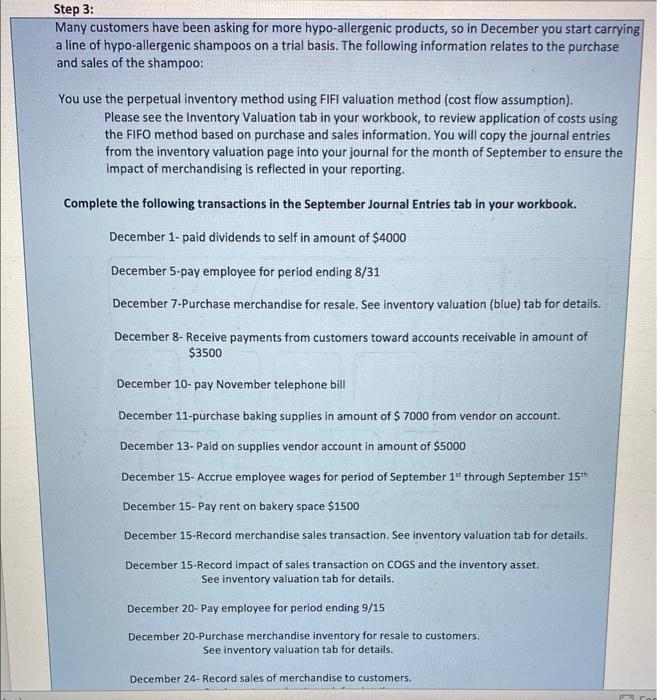

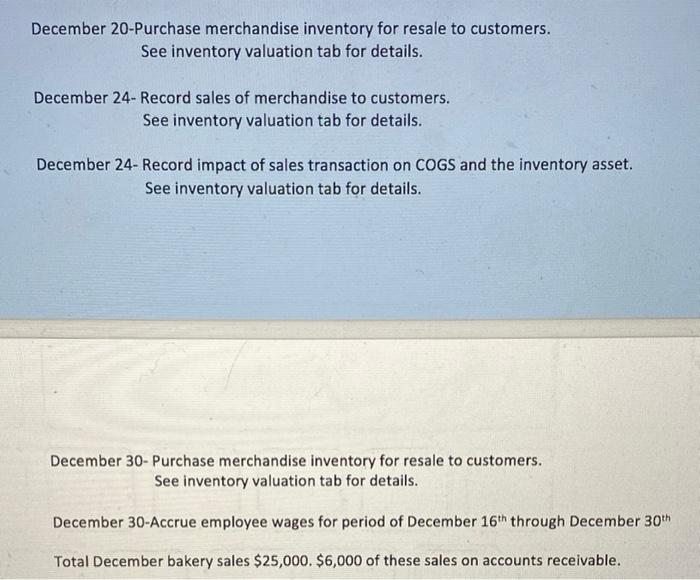

customers have been asking for more hypo-allergenic products, so in December you start carr of hypo-allergenic shampoos on a trial basis. The following information relates to the purchase ales of the shampoo: use the perpetual inventory method using FIFI valuation method (cost flow assumption). Please see the Inventory Valuation tab in your workbook, to review application of costs using the FIFO method based on purchase and sales information. You will copy the journal entries from the inventory valuation page into your journal for the month of September to ensure th: impact of merchandising is reflected in your reporting. iplete the following transactions in the September Journal Entries tab in your workbook. December 1-paid dividends to self in amount of $4000 December 5-pay employee for period ending 8/31 December 7-Purchase merchandise for resale. See inventory valuation (blue) tab for details. December 8- Receive payments from customers toward accounts receivable in amount of $3500 December 10-pay November telephone bill December 11-purchase baking supplies in amount of $7000 from vendor on account. December 13-Paid on supplies vendor account in amount of $5000 December 15-Accrue employee wages for period of September 111 through September 15th December 15 - Pay rent on bakery space $1500 December 15-Record merchandise sales transaction. See inventory valuation tab for details. December 15 -Record impact of sales transaction on COGS and the inventory asset. See inventory valuation tab for details. December 20-Pay employee for period ending 9/15 December 20-Purchase merchandise inventory for resale to customers. See inventory valuation tab for details. December 24-Record sales of merchandise to customers, December 20-Purchase merchandise inventory for resale to customers. See inventory valuation tab for details. December 24- Record sales of merchandise to customers. See inventory valuation tab for details. December 24-Record impact of sales transaction on COGS and the inventory asset. See inventory valuation tab for details. December 30- Purchase merchandise inventory for resale to customers. See inventory valuation tab for details. December 30-Accrue employee wages for period of December 16th through December 30th Total December bakery sales $25,000.$6,000 of these sales on accounts receivable. customers have been asking for more hypo-allergenic products, so in December you start carr of hypo-allergenic shampoos on a trial basis. The following information relates to the purchase ales of the shampoo: use the perpetual inventory method using FIFI valuation method (cost flow assumption). Please see the Inventory Valuation tab in your workbook, to review application of costs using the FIFO method based on purchase and sales information. You will copy the journal entries from the inventory valuation page into your journal for the month of September to ensure th: impact of merchandising is reflected in your reporting. iplete the following transactions in the September Journal Entries tab in your workbook. December 1-paid dividends to self in amount of $4000 December 5-pay employee for period ending 8/31 December 7-Purchase merchandise for resale. See inventory valuation (blue) tab for details. December 8- Receive payments from customers toward accounts receivable in amount of $3500 December 10-pay November telephone bill December 11-purchase baking supplies in amount of $7000 from vendor on account. December 13-Paid on supplies vendor account in amount of $5000 December 15-Accrue employee wages for period of September 111 through September 15th December 15 - Pay rent on bakery space $1500 December 15-Record merchandise sales transaction. See inventory valuation tab for details. December 15 -Record impact of sales transaction on COGS and the inventory asset. See inventory valuation tab for details. December 20-Pay employee for period ending 9/15 December 20-Purchase merchandise inventory for resale to customers. See inventory valuation tab for details. December 24-Record sales of merchandise to customers, December 20-Purchase merchandise inventory for resale to customers. See inventory valuation tab for details. December 24- Record sales of merchandise to customers. See inventory valuation tab for details. December 24-Record impact of sales transaction on COGS and the inventory asset. See inventory valuation tab for details. December 30- Purchase merchandise inventory for resale to customers. See inventory valuation tab for details. December 30-Accrue employee wages for period of December 16th through December 30th Total December bakery sales $25,000.$6,000 of these sales on accounts receivable