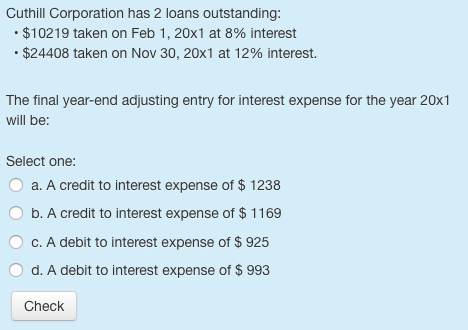

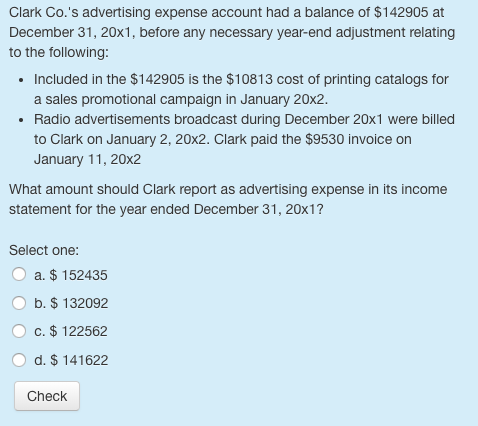

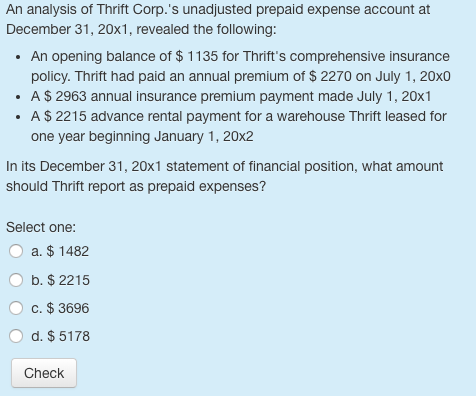

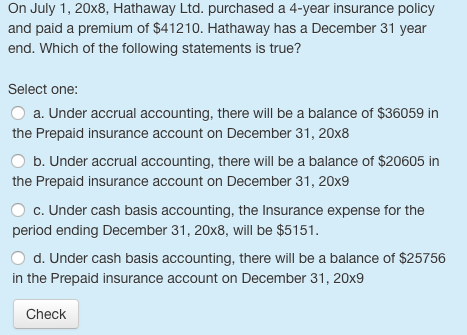

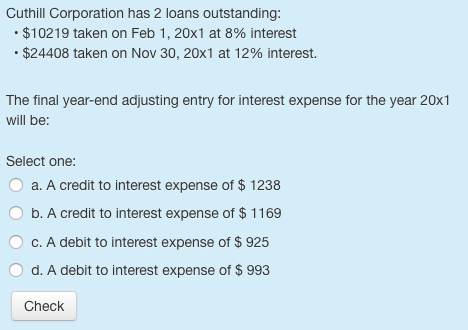

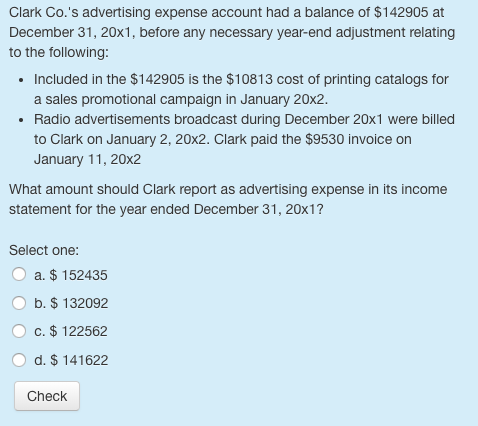

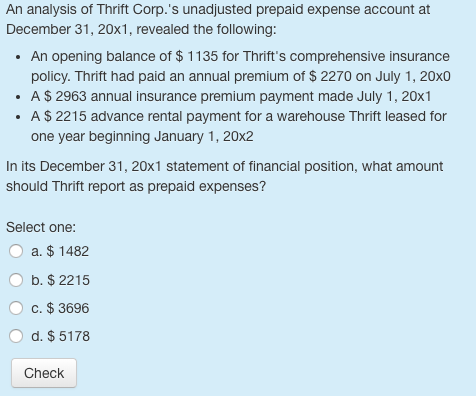

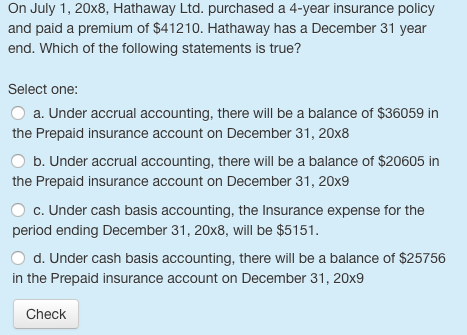

Cuthill Corporation has 2 loans outstanding . $10219 taken on Feb 1, 20x1 at 8% interest S24408 taken on Nov 30, 20x1 at 12% interest. The final year-end adjusting entry for interest expense for the year 20x1 will be: Select one: O a. A credit to interest expense of $ 1238 O b. A credit to interest expense of $ 1169 Oc. A debit to interest expense of $ 925 d. A debit to interest expense of $ 993 Check Clark Co.'s advertising expense account had a balance of $142905 at December 31, 20x1, before any necessary year-end adjustment relating to the following .Included in the $142905 is the $10813 cost of printing catalogs for a sales promotional campaign in January 20x2 . Radio advertisements broadcast during December 20x1 were billed to Clark on January 2, 20x2. Clark paid the $9530 invoice on January 11, 20x2 What amount should Clark report as advertising expense in its income statement for the year ended December 31, 20x1? Select one: a. $152435 b. $132092 c. $122562 d. $ 141622 Check An analysis of Thrift Corp.'s unadjusted prepaid expense account at December 31, 20x1, revealed the following: . An opening balance of $ 1135 for Thrift's comprehensive insurance policy. Thrift had paid an annual premium of $ 2270 on July 1,20x0 .A $ 2963 annual insurance premium payment made July 1, 20x1 A S 2215 advance rental payment for a warehouse Thirift leased for one year beginning January 1, 20x2 In its December 31, 20x1 statement of financial position, what amount should Thrift report as prepaid expenses? Select one: O a. $1482 O b. $2215 Oc. $ 3696 d. $ 5178 Check On July 1, 20x8, Hathaway Ltd. purchased a 4-year insurance policy and paid a premium of $41210. Hathaway has a December 31 year end. Which of the following statements is true? Select one: O a. Under accrual accounting, there will be a the Prepaid insurance account on December 31, 20x8 O b. Under accrual accounting, there will be a balance of $20605 in the Prepaid insurance account on December 31, 20x9 balance of $36059 in c. Under cash basis accounting, the insurance expense for the period ending December 31, 20x8, will be $5151 O d. Under cash basis accounting, there will be a balance of $25756 in the Prepaid insurance account on December 31, 20x9 Check