CVS Pharmacy is the company

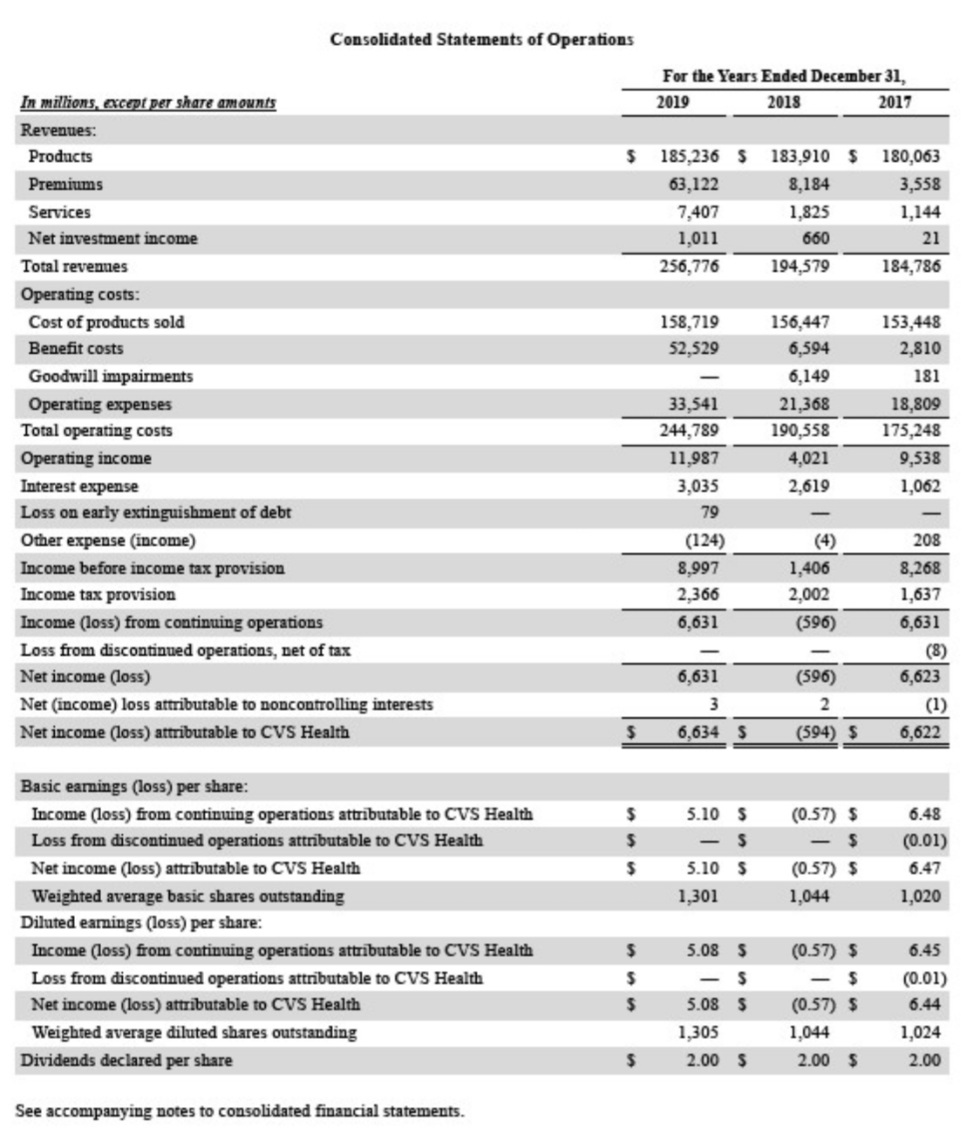

1. Review the Income statement over the last three fiscal years.

A, What has changed ?

B.To what can you attest the change?

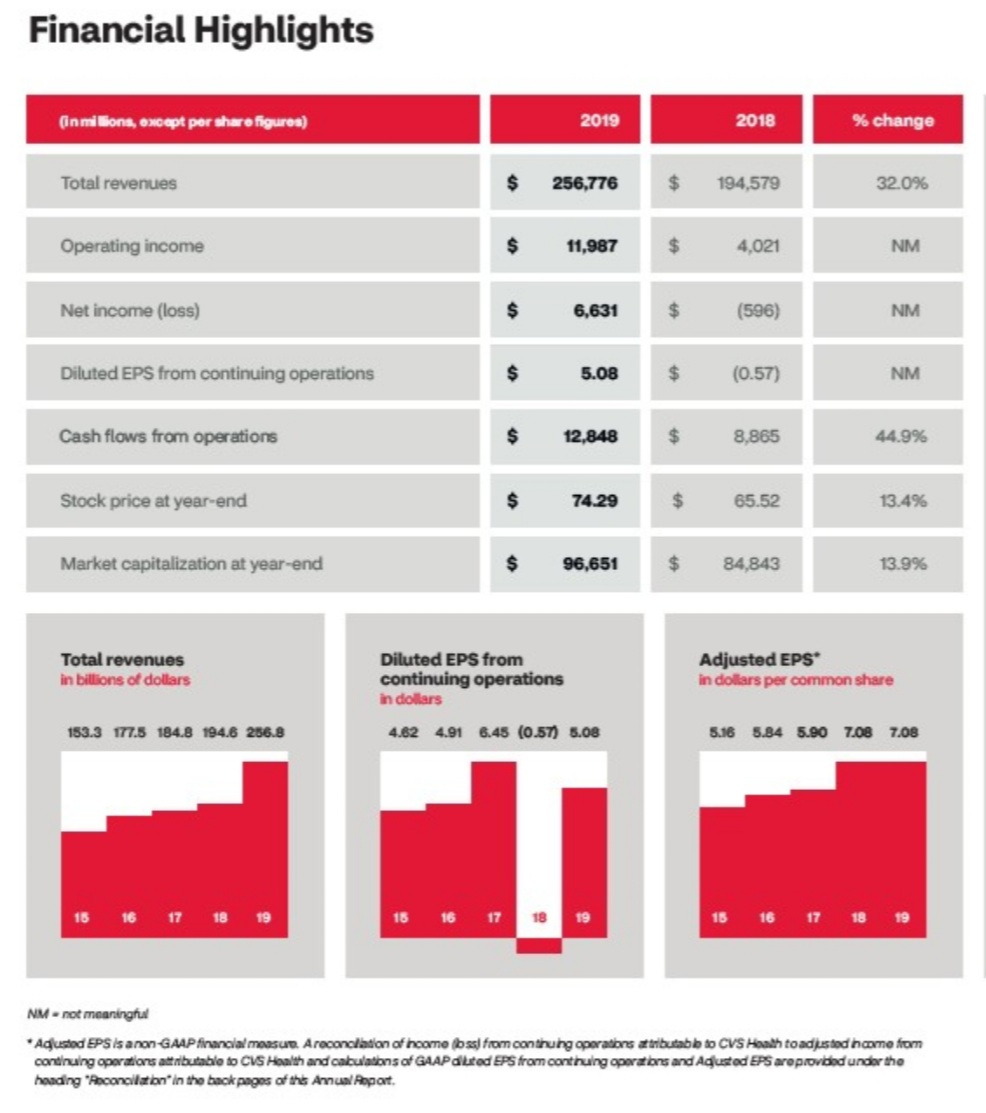

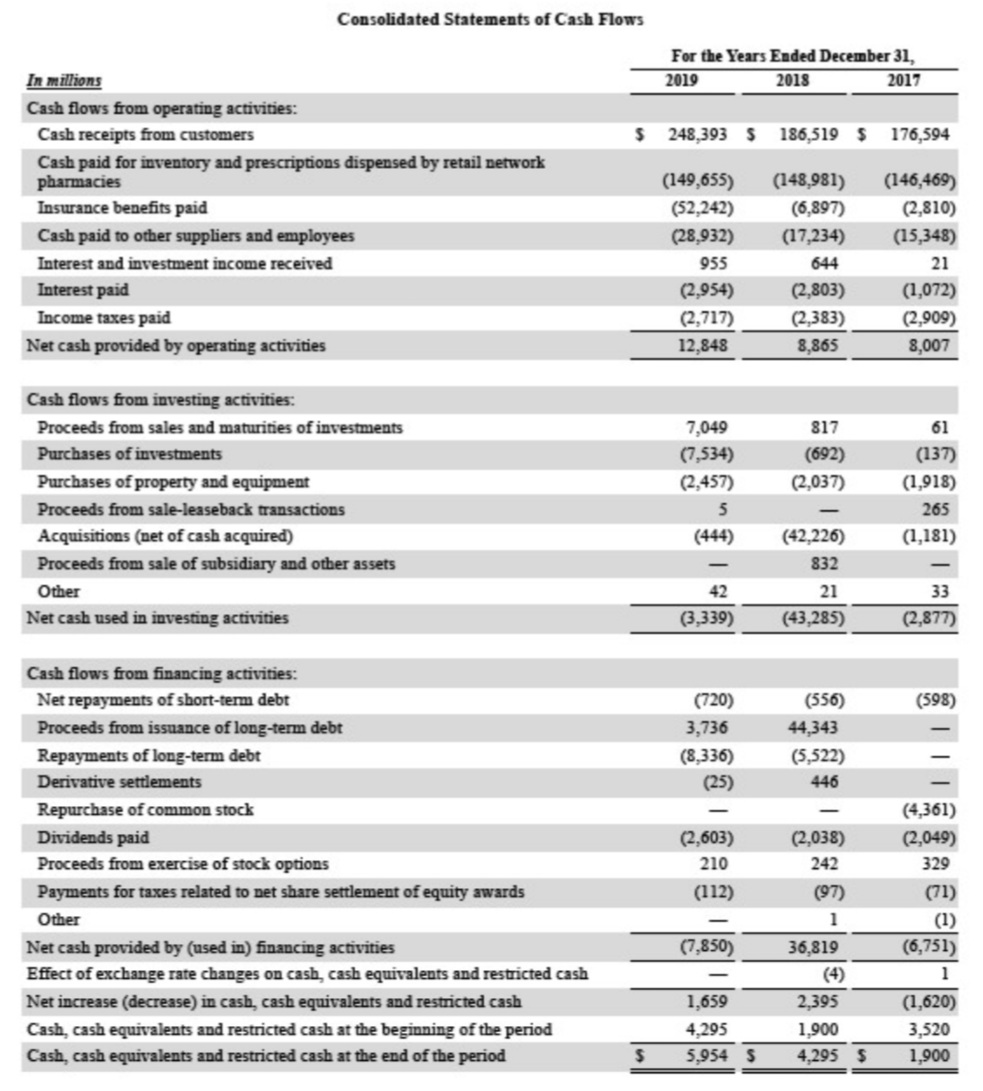

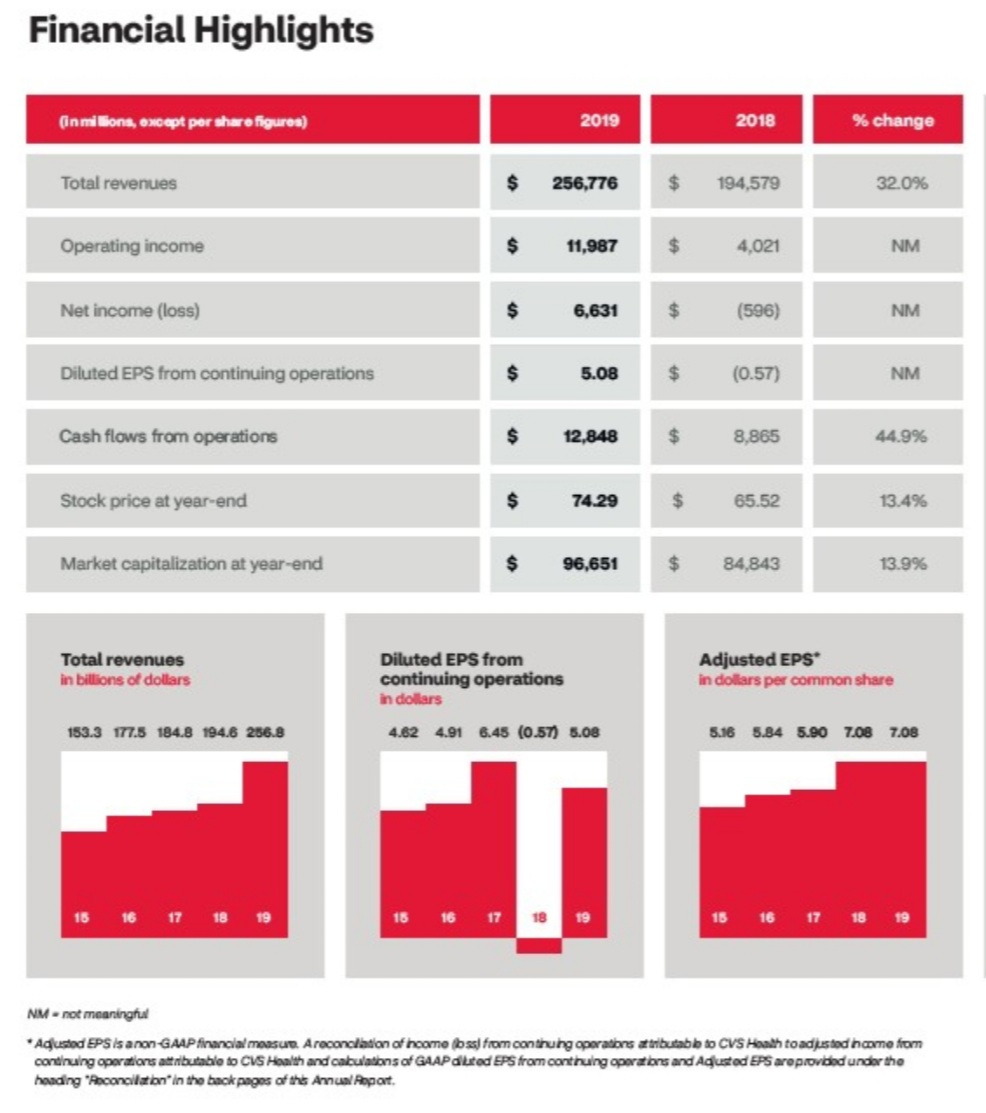

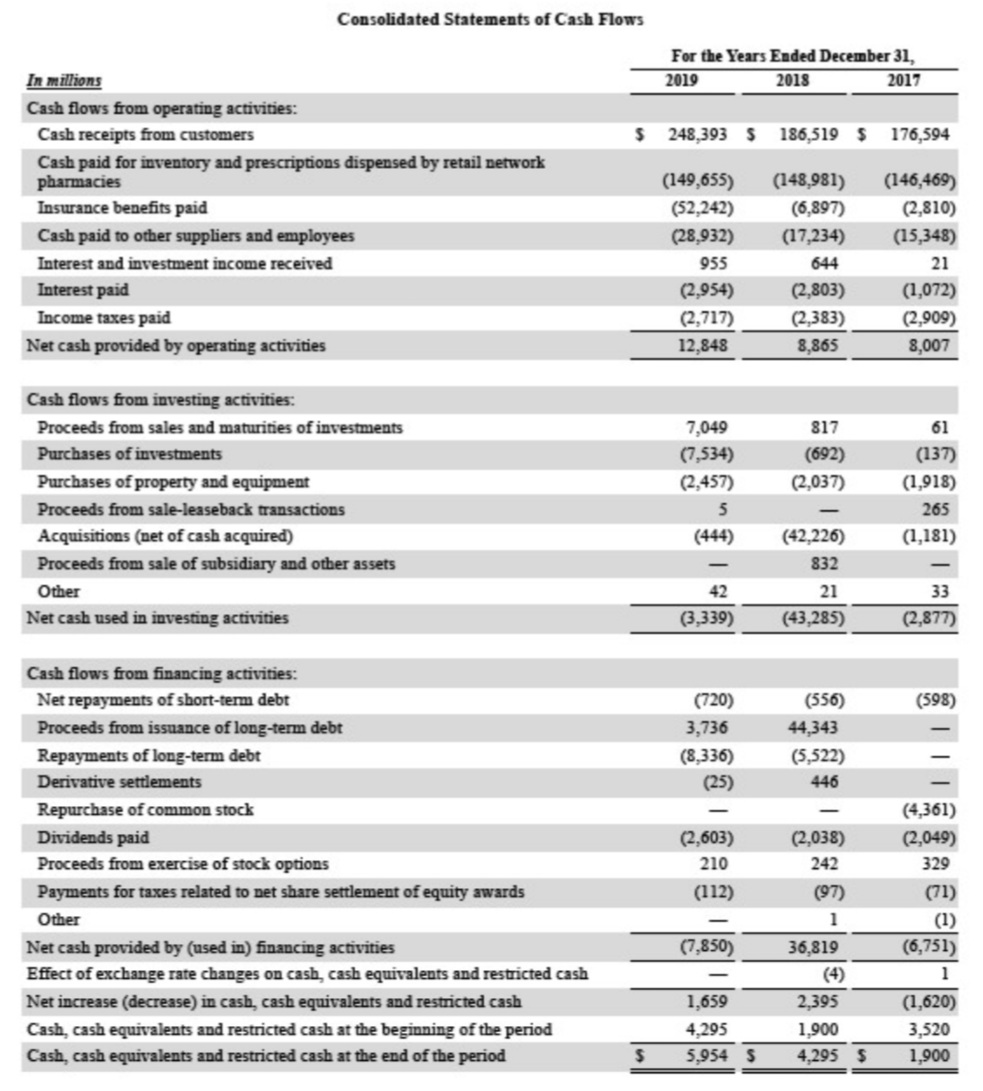

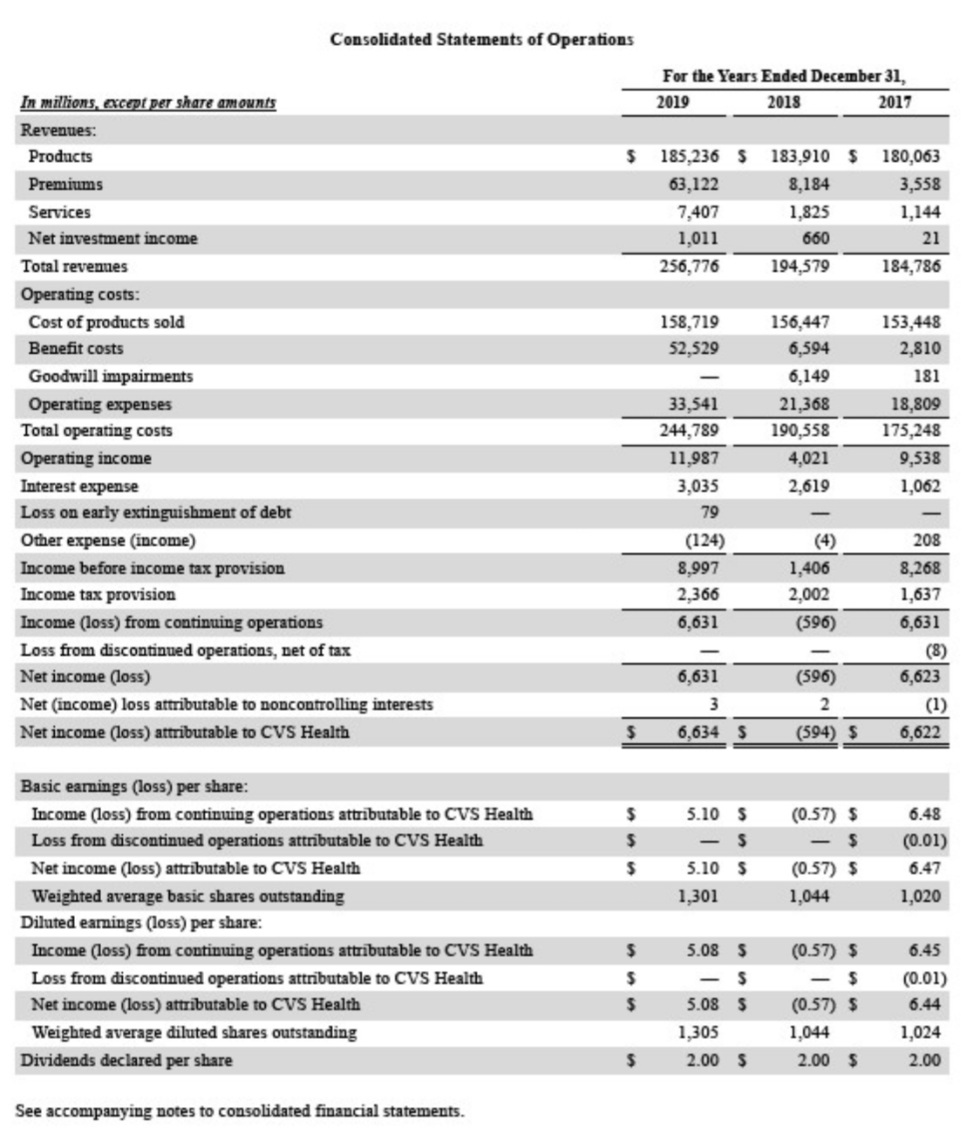

Financial Highlights in milions, except per sharofigures) 2019 2018 % change Total revenues 256,776 $ 194,579 32.0% Operating income 11,987 $ 4,021 NM Net income (loss) 6,631 $ (596) NM Diluted EPS from continuing operations 5.08 $ (0.57) NM Cash flows from operations $ 12,848 $ 8,865 44.9% Stock price at year-end 74.29 $ 65.52 13.4% Market capitalization at year-end 96,651 $ 84,843 13.9% Total revenues in billions of dollars Adjusted EPS in dollars per common share Diluted EPS from continuing operations in dollars 4.62 4.91 6.45 (0.57) 5.08 153.3 177.5 184.8 194.6 256.8 5.16 5.84 5.90 7.08 7.08 17 18 19 18 16 17 18 19 15 16 17 18 19 NM not meaninghal *Adustod EPS is anon GAAP financial mansue. A reconciation of name is from continuing operations attributabb to CVS Heath toadjusted income from continuing operations attributable to CVS Health and cabulations of GAAP alted EPS from contruing operations and Adjusted EPS are provided under the heading "Reconciliation in the back pages of the Annual Report Consolidated Statements of Cash Flows For the Years Ended December 31, 2019 2018 2017 $ 248,393 5 186,519 $ 176,594 In millions Cash flows from operating activities: Cash receipts from customers Cash paid for inventory and prescriptions dispensed by retail network pharmacies Insurance benefits paid Cash paid to other suppliers and employees Interest and investment income received Interest paid Income taxes paid Net cash provided by operating activities (149,655) (52,242) (28,932) 955 (2,954) (2,717) 12.848 (148,981) (6,897) (17,234) 644 (2,803) (2,383) 8,865 (146,469) (2,810) (15,348) 21 (1,072) (2,909) 8,007 Cash flows from investing activities: Proceeds from sales and maturities of investments Purchases of investments Purchases of property and equipment Proceeds from sale-leaseback transactions Acquisitions (net of cash acquired) Proceeds from sale of subsidiary and other assets Other Net cash used in investing activities 7,049 (7,534) (2,457) 5 817 (692) (2,037) 61 (137) (1,918) 265 (1,181) (42,226) 832 21 (43,285) 42 33 (2,877) (3,339) (598) (720) 3,736 (8,336) (25) (556) 44,343 (5,522) 446 Cash flows from financing activities: Net repayments of short-term debt Proceeds from issuance of long-term debt Repayments of long-term debt Derivative settlements Repurchase of common stock Dividends paid Proceeds from exercise of stock options Payments for taxes related to net share settlement of equity awards Other Net cash provided by (used in) financing activities Effect of exchange rate changes on cash, cash equivalents and restricted cash Net increase (decrease) in cash, cash equivalents and restricted cash Cash, cash equivalents and restricted cash at the beginning of the period Cash, cash equivalents and restricted cash at the end of the period (2,603) 210 (112) (2,038) 242 (97) (4,361) (2,049) 329 (71) (7,850) 36,819 1,659 4,295 5,954 5 2,395 1,900 4,295 $ (6,751) 1 (1,620) 3,520 1,900 $ Consolidated Statements of Operations For the Years Ended December 31, 2019 2018 2017 $ 185,236 S 183,910 $ 180,063 63,122 8,184 3,558 7,407 1,825 1,144 1,011 660 21 256,776 194,579 184,786 158,719 52.529 In millions, except per share amounts Revenues: Products Premiums Services Net investment income Total revenues Operating costs: Cost of products sold Benefit costs Goodwill impairments Operating expenses Total operating costs Operating income Interest expense Loss on early extinguishment of debt Other expense (income) Income before income tax provision Income tax provision Income (loss) from continuing operations Loss from discontinued operations, net of tax Net income (loss Net (income) loss attributable to noncontrolling interests Net income (loss) attributable to CVS Health 156,447 6,594 6,149 21,368 190,558 4,021 2,619 153,448 2,810 181 18,809 175,248 9,538 1,062 33,541 244,789 11,987 3,035 79 (124) 8,997 2,366 6,631 208 1,406 2,002 (596) 8,268 1,637 6,631 (8) 6,623 (1) 6,622 6,631 3 6,634 5 (596) 2 (594) $ $ $ 6.48 (0.01) $ 5.10 5 $ 5.10 5 1,301 (0.57) $ $ (0.57) 5 1,044 $ 6.47 1,020 Basic earnings (loss) per share: Income (loss) from continuing operations attributable to CVS Health Loss from discontinued operations attributable to CVS Health Net income (loss) attributable to CVS Health Weighted average basic shares outstanding Diluted earnings (loss) per share: Income (loss) from continuing operations attributable to CVS Health Loss from discontinued operations attributable to CVS Health Net income (loss) attributable to CVS Health Weighted average diluted shares outstanding Dividends declared per share $ 5.08 $ $ $ $ 5.08 $ 1,305 2.00 $ (0.57) - 5 (0.57) $ 1,044 2.00 $ 6.45 (0.01) 6.44 1,024 2.00 $ See accompanying notes to consolidated financial statements