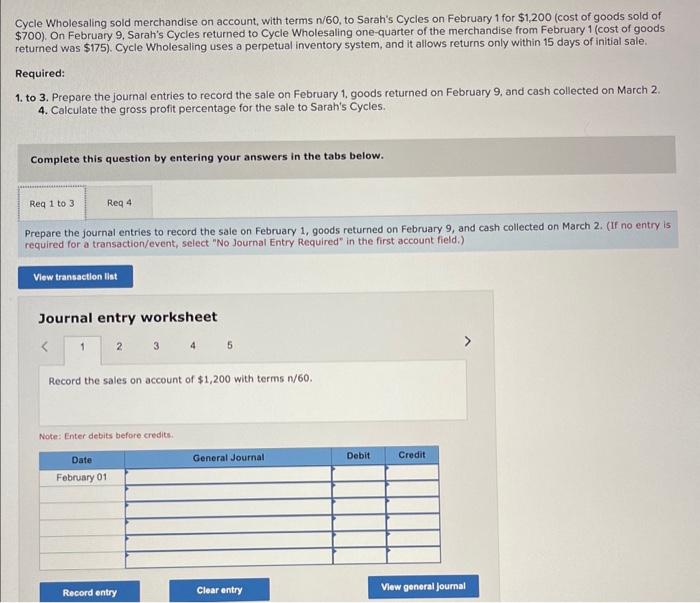

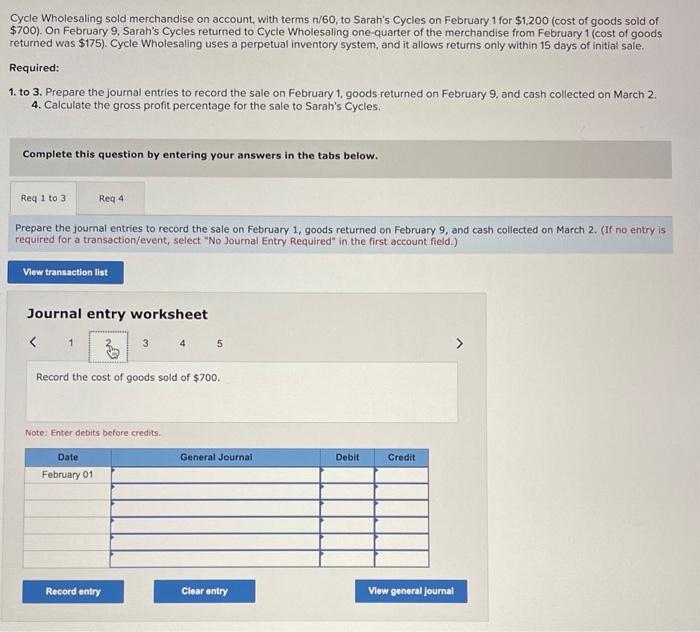

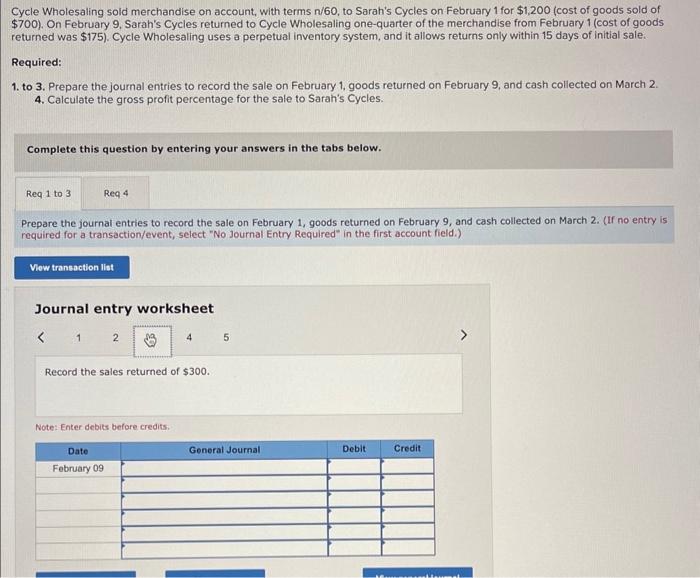

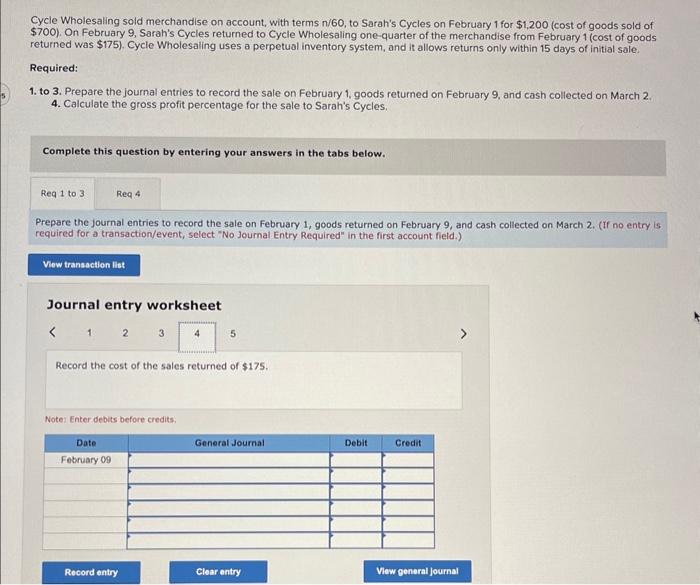

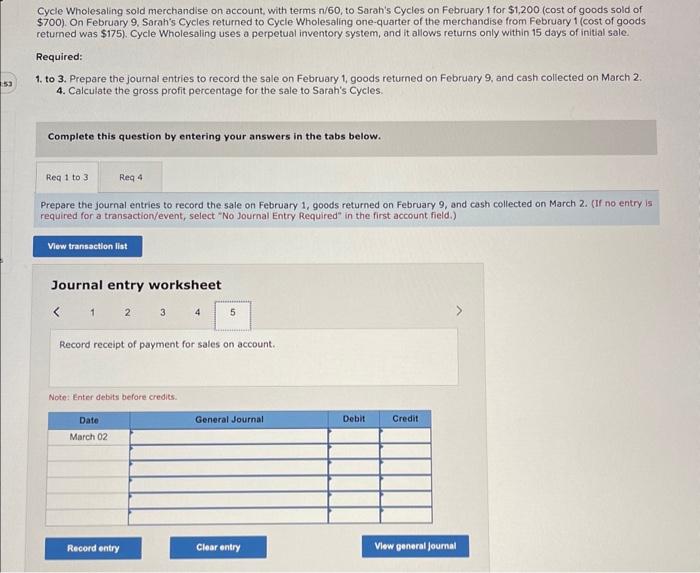

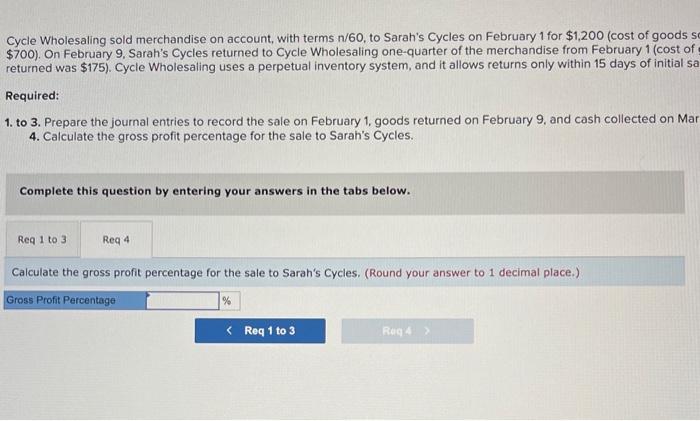

Cycle Wholesaling sold merchandise on account, with terms n/60, to Sarah's Cycles on February 1 for $1,200 (cost of goods sold of $700 ). On February 9. Sarah's Cycles returned to Cycle Wholesaling one-quarter of the merchandise from February 1 (cost of goods returned was \$175). Cycle Wholesaling uses a perpetual inventory system, and it allows returns only within 15 days of initial sale. Required: 1. to 3. Prepare the journal entries to record the sale on February 1, goods returned on February 9, and cash collected on March 2. 4. Calculate the gross profit percentage for the sale to Sarah's Cycles. Complete this question by entering your answers in the tabs below. Prepare the journal entries to record the sale on February 1, goods returned on February 9, and cash collected on March 2. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) Journal entry worksheet 45 Record the sales on account of $1,200 with terms n/60. Note: Enter debits before credits: Cycle Wholesaling sold merchandise on account, with terms n/60, to Sarah's Cycles on February 1 for $1,200 (cost of goods sold of $700 ). On February 9, Sarah's Cycles returned to Cycle Wholesaling one-quarter of the merchandise from February 1 (cost of goods returned was \$175). Cycle Wholesaling uses a perpetual inventory system, and it allows returns only within 15 days of initial sale. Required: 1. to 3. Prepare the journal entries to record the sale on February 1, goods returned on February 9, and cash collected on March 2. 4. Calculate the gross profit percentage for the sale to Sarah's Cycles. Complete this question by entering your answers in the tabs below. Prepare the journal entries to record the sale on February 1, goods returned on February 9, and cash collected on March 2. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) Journal entry worksheet 5 Record the cost of goods sold of $700. Note: Enter debits before credits. Cycle Wholesaling sold merchandise on account, with terms n/60, to Sarah's Cycles on February 1 for $1,200 (cost of goods sold of $700). On February 9, Sarah's Cycles returned to Cycle Wholesaling one-quarter of the merchandise from February 1 (cost of goods returned was \$175). Cycle Wholesaling uses a perpetual inventory system, and it allows returns only within 15 days of initial sale. Required: 1. to 3. Prepare the journal entries to record the sale on February 1, goods returned on February 9, and cash collected on March 2. 4. Calculate the gross profit percentage for the sale to Sarah's Cycles. Complete this question by entering your answers in the tabs below. Prepare the journal entries to record the sale on February 1, goods returned on February 9, and cash collected on March 2. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) Journal entry worksheet Record the sales returned of $300. Note: Enter debits before credits: Cycle Wholesaling sold merchandise on account, with terms n/60, to Sarah's Cycles on February 1 for $1,200 (cost of goods sold of $700) ). On February 9, Sarah's Cycles returned to Cycle Wholesaling one-quarter of the merchandise from February 1 (cost of goods returned was \$175). Cycle Wholesaling uses a perpetual inventory system, and it allows returns only within 15 days of initial sale. Required: 1. to 3. Prepare the journal entries to record the sale on February 1, goods returned on February 9, and cash collected on March 2. 4. Calculate the gross profit percentage for the sale to Sarah's Cycles. Complete this question by entering your answers in the tabs below. Prepare the journal entries to record the sale on February 1, goods returned on February 9, and cash collected on March 2. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) Journal entry worksheet Record the cost of the sales returned of $175. Note: Enter debits before credits; Cycle Wholesaling sold merchandise on account, with terms n/60, to Sarah's Cycles on February 1 for $1,200 (cost of goods sold of $700 ). On February 9, Sarah's Cycles returned to Cycle Wholesaling one-quarter of the merchandise from February 1 (cost of goods returned was \$175). Cycle Wholesaling uses a perpetual inventory system, and it allows returns only within 15 days of initial sale. Required: 1. to 3. Prepare the journal entries to record the sale on February 1, goods returned on February 9 , and cash collected on March 2. 4. Calculate the gross profit percentage for the sale to Sarah's Cycles. Complete this question by entering your answers in the tabs below. Prepare the journal entries to record the sale on February 1, goods returned on February 9, and cash collected on March 2. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) Journal entry worksheet