Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are a wealthy entrepreneur planning to acquire a supplier of raw materials. You are willing to purchase one of the four corporations through

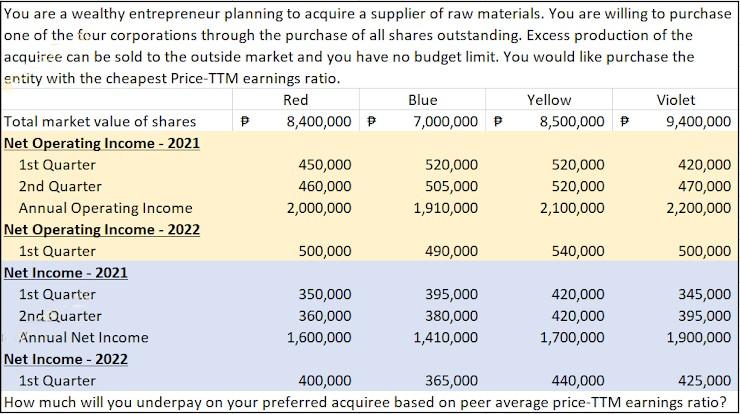

You are a wealthy entrepreneur planning to acquire a supplier of raw materials. You are willing to purchase one of the four corporations through the purchase of all shares outstanding. Excess production of the acquiree can be sold to the outside market and you have no budget limit. You would like purchase the entity with the cheapest Price-TTM earnings ratio. Red 8,400,000 P Total market value of shares Net Operating Income - 2021 1st Quarter 2nd Quarter Annual Operating Income Net Operating Income - 2022 1st Quarter Net Income - 2021 1st Quarter 2nd Quarter Annual Net Income Net Income - 2022 p 450,000 460,000 2,000,000 500,000 350,000 360,000 1,600,000 400,000 Blue 7,000,000 P 520,000 505,000 1,910,000 490,000 395,000 380,000 1,410,000 Yellow 8,500,000 P 520,000 520,000 2,100,000 540,000 420,000 420,000 1,700,000 Violet 9,400,000 420,000 470,000 2,200,000 500,000 345,000 395,000 1,900,000 1st Quarter 365,000 440,000 425,000 How much will you underpay on your preferred acquiree based on peer average price-TTM earnings ratio?

Step by Step Solution

★★★★★

3.46 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Lets calculate the PriceTTM earnings ratio for each corporation Red Corporation PriceTTM Earn...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started