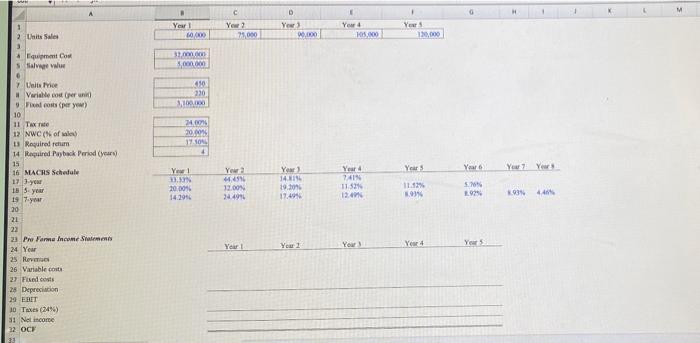

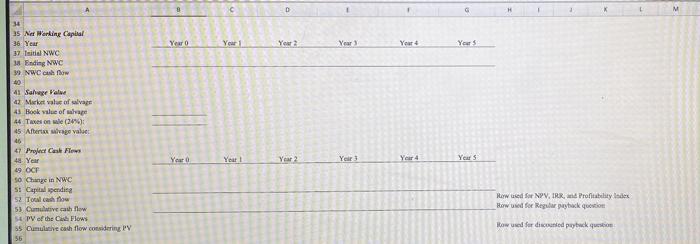

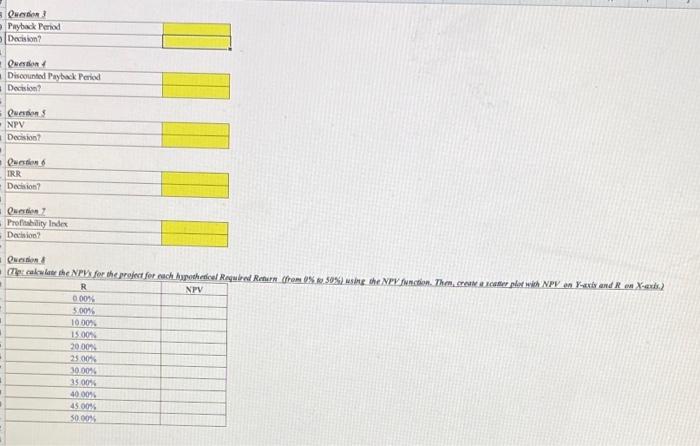

D 1 C You Year MO Yews 20.000 Yew 105.000 120,000 3. on 00 410 230 100.000 2 20.00 17:10 4 Year Year Yer Yes 1 2 Units Sales 3 que os Sawewe 6 7. Un rice # Variable cost per un Focos (per you) 10 11 Taxe 12 NWC (of 13 Required retum 14 Required Payback period (years) 15 16 MACRS Schedule 17 1 year 1B 5. you 19 year 20 21 22 23 Pre Farma Income Statements 24 You 25 Revo 26 Variable cost 22 Feed costs 28 Depreciation 29 ERIT 10 Taxes (24%) 31 Nol income 22 OCE 33 Yo! 33 20004 14.2014 You 4499 13.00 38.4944 Year 14.15 19.00 17.49 Year 7411 11:52 12. . 925 Year! Year Your Year 4 Yes 8 D G M Year Year 1 Year 2 Year Your Yours 36 35 Ne Working Capital 36 Year 37 Tsital NWC 38 Ending NWC 39 NWC now Year Year Year 2 Yer 3 Years Year 41 Sahur Value 42 Market value of a 43 Book value of a 44 The one (20): 45 Alberta ago vale 416 47 Prolet Cash Flows 48 Year 19 OCR so Change in NC 5: Capital pendice 52. Toch now 5) Cumulative cash flow 54 PV of the Cast Flows 55 Cumulative cath flow considering PV 56 Rewed Sor NVIRR. Profitability de Bewed for Regulation low used for discounted payback question Question Payback Pood Decision? Question Discounted Payback Period Decision? Questions NPV Decision? Question IRR Decision Question Profitability Index Decision? Question Con called the NPS for the project for each hypothetical Reguleed Return Cram 509) the NPV Action. Then.com refer plot NPV an axiy and Roxas R NPV 000 5.0096 10.00% 150 20.00 2500 30.00% 35.00% 400046 45.00% 50.00% D 1 C You Year MO Yews 20.000 Yew 105.000 120,000 3. on 00 410 230 100.000 2 20.00 17:10 4 Year Year Yer Yes 1 2 Units Sales 3 que os Sawewe 6 7. Un rice # Variable cost per un Focos (per you) 10 11 Taxe 12 NWC (of 13 Required retum 14 Required Payback period (years) 15 16 MACRS Schedule 17 1 year 1B 5. you 19 year 20 21 22 23 Pre Farma Income Statements 24 You 25 Revo 26 Variable cost 22 Feed costs 28 Depreciation 29 ERIT 10 Taxes (24%) 31 Nol income 22 OCE 33 Yo! 33 20004 14.2014 You 4499 13.00 38.4944 Year 14.15 19.00 17.49 Year 7411 11:52 12. . 925 Year! Year Your Year 4 Yes 8 D G M Year Year 1 Year 2 Year Your Yours 36 35 Ne Working Capital 36 Year 37 Tsital NWC 38 Ending NWC 39 NWC now Year Year Year 2 Yer 3 Years Year 41 Sahur Value 42 Market value of a 43 Book value of a 44 The one (20): 45 Alberta ago vale 416 47 Prolet Cash Flows 48 Year 19 OCR so Change in NC 5: Capital pendice 52. Toch now 5) Cumulative cash flow 54 PV of the Cast Flows 55 Cumulative cath flow considering PV 56 Rewed Sor NVIRR. Profitability de Bewed for Regulation low used for discounted payback question Question Payback Pood Decision? Question Discounted Payback Period Decision? Questions NPV Decision? Question IRR Decision Question Profitability Index Decision? Question Con called the NPS for the project for each hypothetical Reguleed Return Cram 509) the NPV Action. Then.com refer plot NPV an axiy and Roxas R NPV 000 5.0096 10.00% 150 20.00 2500 30.00% 35.00% 400046 45.00% 50.00%