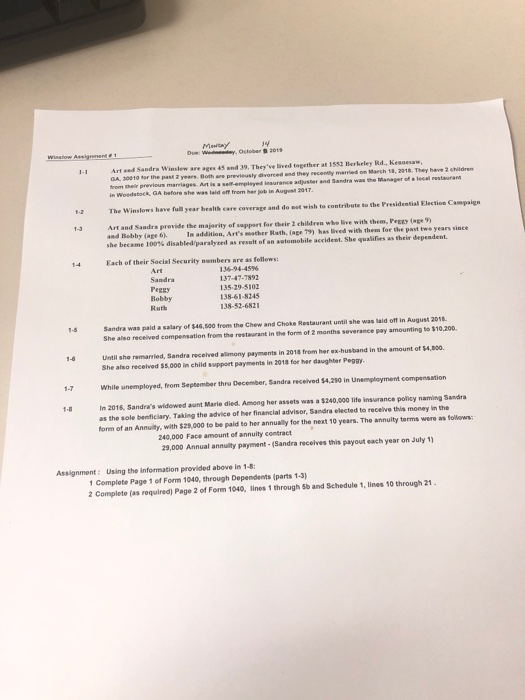

D . 2013 ore Arta Sandra Winslow are age 45 and 39. They've lived together at 155 berkeley Rd, kes GA10010 for the past years. Both are previously divorced and they recently married on March 1, 2016. They have 2 from a ges and Sandra was the Manager of all RGA one sh o t 2017 The Winslows have all year health care coverage and do not wish to contribute to the Presidential Election Campaign Art and Spride the maior for the whole with the and Bobby (age 6). Tad , Ar ather Rathage has lived with them for the pawe years since she became 100% disabled paralyzed as result of an automobile accident. She qualifies as their dependent. Each of the Social Security bensare a fost Sandra PE 137-47.7892 115.29.5102 139-61-5245 138-52.6821 Ruth Sandra was paid a salary of $48.500 from the Chew and Choke Restaurant until she was laid off in August 2016 She also received compensation from the rest o f the verance pay mongte 10.200 Until she remarried, Sandra received alimony payments in 2018 from her ex-husband in the amount of 14.100. She also received 55.000 in child support payments in 2018 for her daughter Pege. While unemployed, from September thru December. Sandra received 14.210 in Unemployment compensation In 2015, Sandra's widowed at Maria del Amogheresets was a 200.000 e urance policy naming Sandra as the sole bendiciary. Taking the advice of the financial advisor, Sandra elected to receive this money in the form of an Annuity, with $20,000 to be paid to her annually for the next 10 years. The annuity terms were as follows: 240.000 Face amount of annuity contract 29,000 Annual annuity payment. Sandra receive this payout each year on July 1) Assignment Using the information provided above in 1: 1 Complete Page 1 of Form 1040, through Dependent parts 1-5) 2 Complete as required) Page 2 of Form 1040, lines 1 through band Schedule 1. lines 10 through 21. D . 2013 ore Arta Sandra Winslow are age 45 and 39. They've lived together at 155 berkeley Rd, kes GA10010 for the past years. Both are previously divorced and they recently married on March 1, 2016. They have 2 from a ges and Sandra was the Manager of all RGA one sh o t 2017 The Winslows have all year health care coverage and do not wish to contribute to the Presidential Election Campaign Art and Spride the maior for the whole with the and Bobby (age 6). Tad , Ar ather Rathage has lived with them for the pawe years since she became 100% disabled paralyzed as result of an automobile accident. She qualifies as their dependent. Each of the Social Security bensare a fost Sandra PE 137-47.7892 115.29.5102 139-61-5245 138-52.6821 Ruth Sandra was paid a salary of $48.500 from the Chew and Choke Restaurant until she was laid off in August 2016 She also received compensation from the rest o f the verance pay mongte 10.200 Until she remarried, Sandra received alimony payments in 2018 from her ex-husband in the amount of 14.100. She also received 55.000 in child support payments in 2018 for her daughter Pege. While unemployed, from September thru December. Sandra received 14.210 in Unemployment compensation In 2015, Sandra's widowed at Maria del Amogheresets was a 200.000 e urance policy naming Sandra as the sole bendiciary. Taking the advice of the financial advisor, Sandra elected to receive this money in the form of an Annuity, with $20,000 to be paid to her annually for the next 10 years. The annuity terms were as follows: 240.000 Face amount of annuity contract 29,000 Annual annuity payment. Sandra receive this payout each year on July 1) Assignment Using the information provided above in 1: 1 Complete Page 1 of Form 1040, through Dependent parts 1-5) 2 Complete as required) Page 2 of Form 1040, lines 1 through band Schedule 1. lines 10 through 21