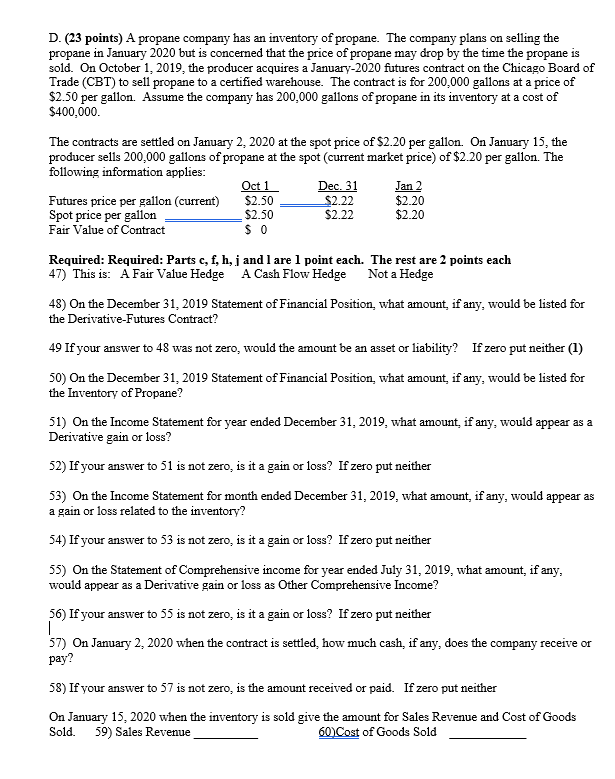

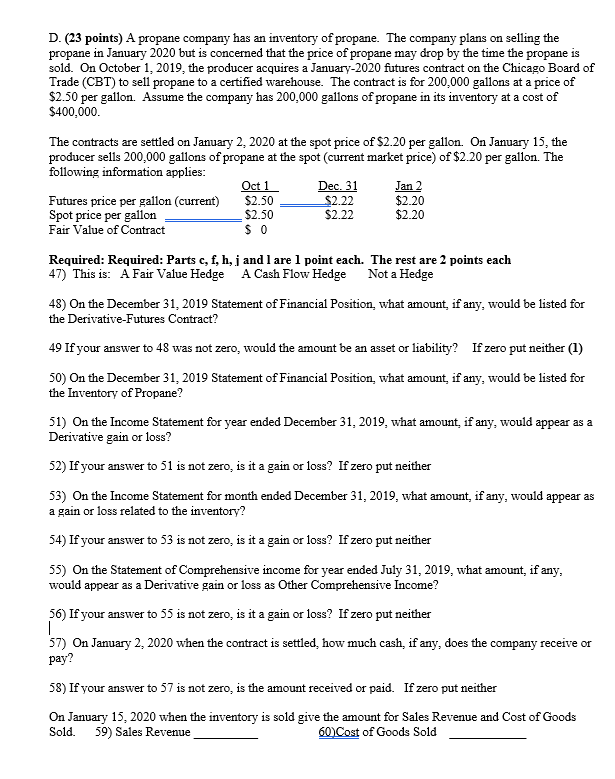

D. (23 points) A propane company has an inventory of propane. The company plans on selling the propane in January 2020 but is concerned that the price of propane may drop by the time the propane is sold. On October 1, 2019, the producer acquires a January-2020 futures contract on the Chicago Board of Trade (CBT) to sell propane to a certified warehouse. The contract is for 200,000 gallons at a price of $2.50 per gallon. Assume the company has 200,000 gallons of propane in its inventory at a cost of $400,000. The contracts are settled on January 2, 2020 at the spot price of $2.20 per gallon. On January 15, the producer sells 200,000 gallons of propane at the spot (current market price) of $2.20 per gallon. The following information applies: Oct 1 Dec. 31 Jan 2 Futures price per gallon (current) $2.50 $2.22 $2.20 Spot price per gallon $2.50 $2.22 $2.20 Fair Value of Contract $ 0 Required: Required: Parts c, f, h, j and I are 1 point each. The rest are 2 points each 47) This is: A Fair Value Hedge A Cash Flow Hedge Not a Hedge 48) On the December 31, 2019 Statement of Financial Position, what amount, if any, would be listed for the Derivative-Futures Contract? 49 If your answer to 48 was not zero, would the amount be an asset or liability? If zero put neither (1) 50) On the December 31, 2019 Statement of Financial Position, what amount, if any, would be listed for the Inventory of Propane? 51) On the Income Statement for year ended December 31, 2019, what amount, if any, would appear as a Derivative gain or loss? 52) If your answer to 51 is not zero, is it a gain or loss? If zero put neither 53) On the Income Statement for month ended December 31, 2019, what amount, if any, would appear as a gain or loss related to the inventory? 54) If your answer to 53 is not zero, is it a gain or loss? If zero put neither 55) On the Statement of Comprehensive income for year ended July 31, 2019, what amount, if any, would appear as a Derivative gain or loss as Other Comprehensive Income? 56) If your answer to 55 is not zero, is it a gain or loss? If zero put neither 57) On January 2, 2020 when the contract is settled, how much cash, if any, does the company receive or pay? 58) If your answer to 57 is not zero, is the amount received or paid. If zero put neither On January 15, 2020 when the inventory is sold give the amount for Sales Revenue and Cost of Goods Sold. 59) Sales Revenue 60 Cost of Goods Sold