Question: D 7.20 Intermediate Preparation of variable costing and absorption con statements and an explanation of the differences in profits dat have been extracted from the

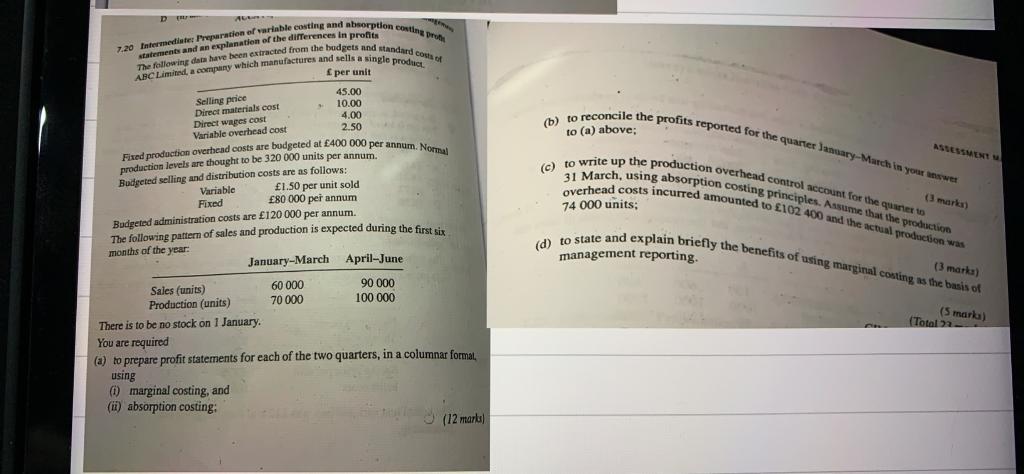

D 7.20 Intermediate Preparation of variable costing and absorption con statements and an explanation of the differences in profits dat have been extracted from the budgets and standard Cont mpany which manufactures and sells a single product per unit ABC ASSESSMENT 45.00 Selling price 10.00 Direct materials cost Direct wapes cost 4.00 Variable overhead cost 2.50 Fland production Overhead costs are budgeted at 400 000 per annum. Normal production levels are thought to be 320 000 units per annum Badgeted selling and distribution costs are as follows: Variable 1.50 per unit sold Fixed 80 000 per annum Budgeted administration costs are 120 000 per annum. The following pattern of sales and production is expected during the first six months of the year: January March April-June Sales (units) 60 000 90 000 Production (units) 70 000 100 000 (b) to reconcile the profits reported for the quarter lawary-Marchs in your wat to (a) above; (c) to write up the production overhead control account for the quanto 31 March, using absorption costing principles. Assume that the production overhead costs incurred amounted to 102 400 and the actual production was 74 000 units; (d) to state and explain briefly the benefits of using marginal costing as the basis of management reporting. (3 marks (3 marka (5 marka) (Toto 22 There is to be no stock on 1 January. You are required (a) to prepare profit statements for each of the two quarters, in a columnar formal, using O marginal costing, and (ii) absorption costing: (12 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts