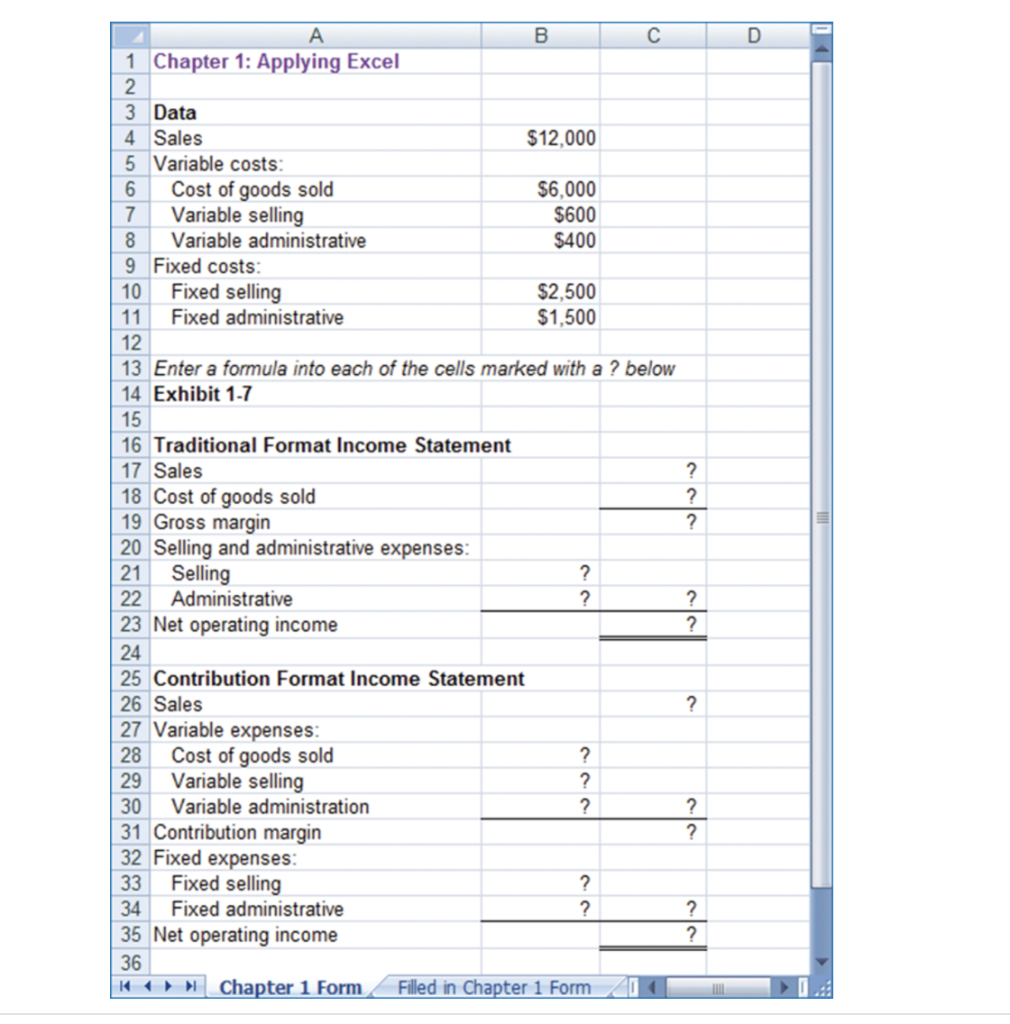

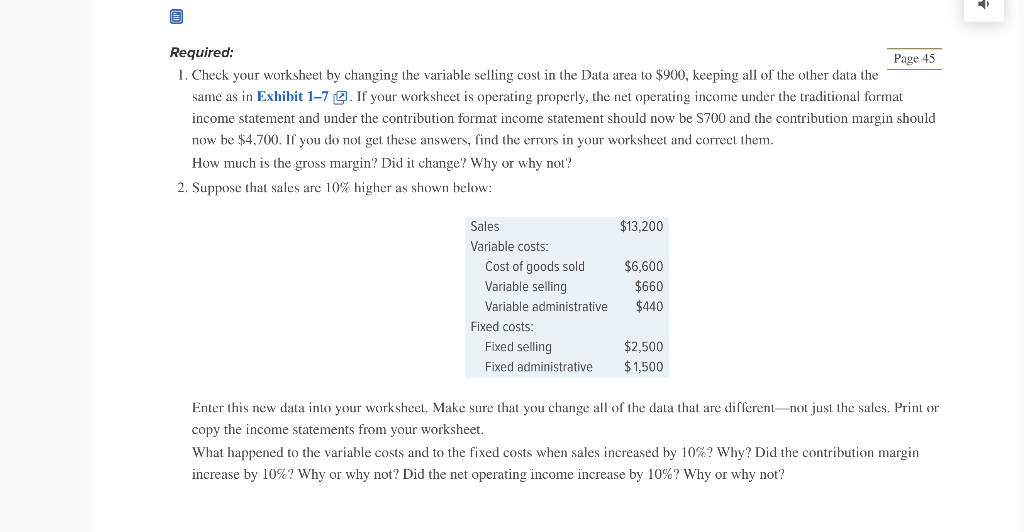

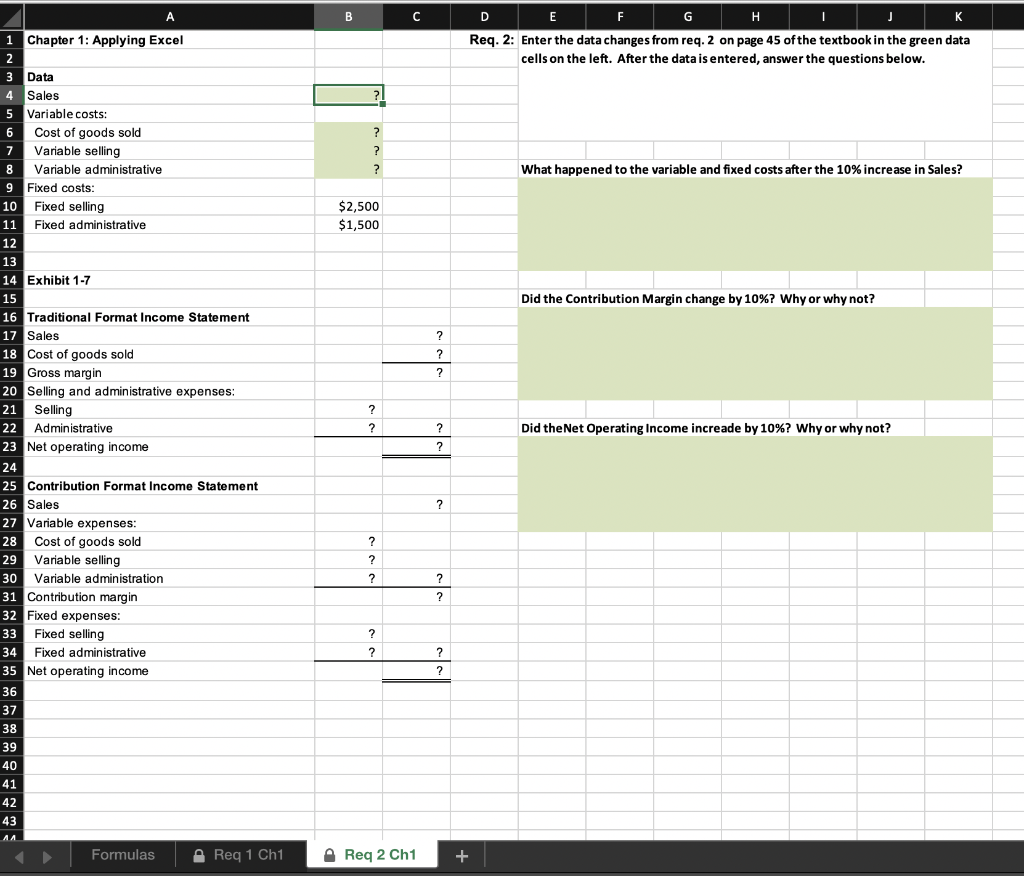

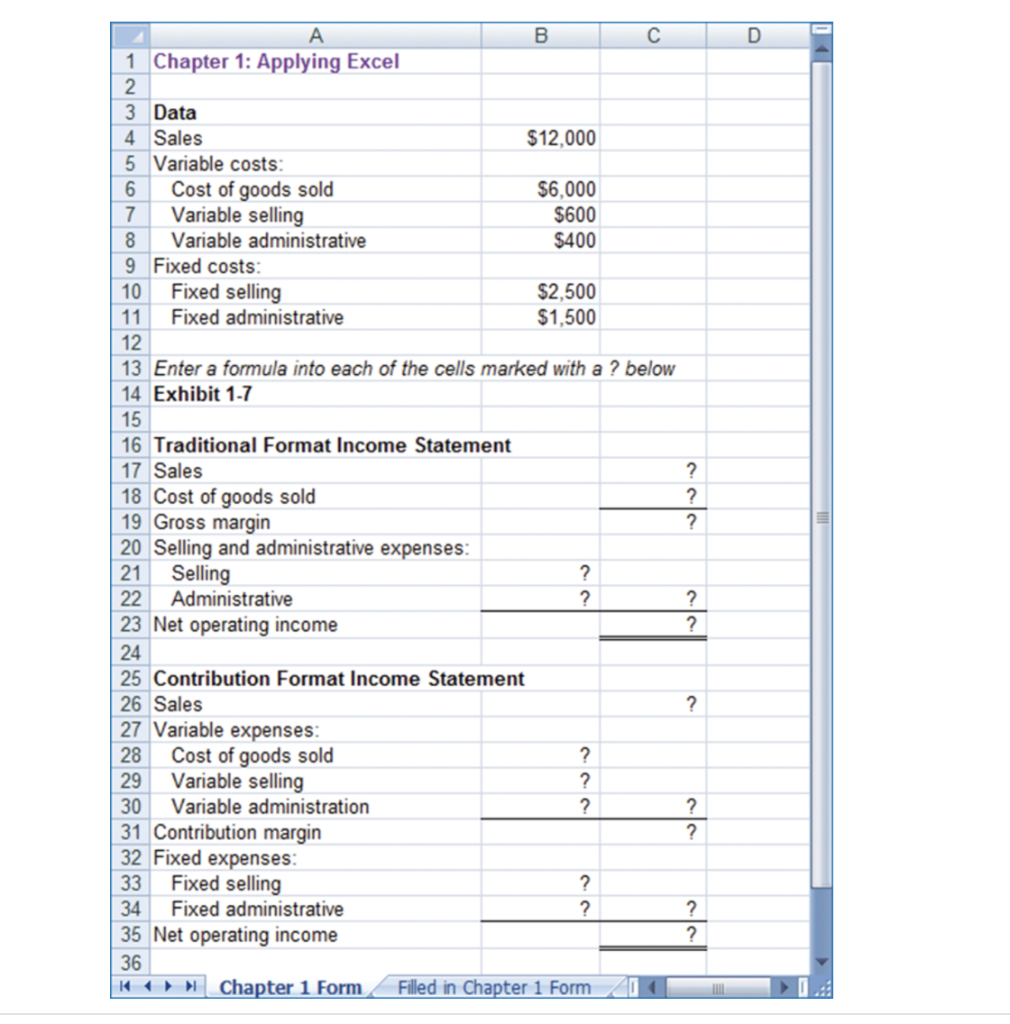

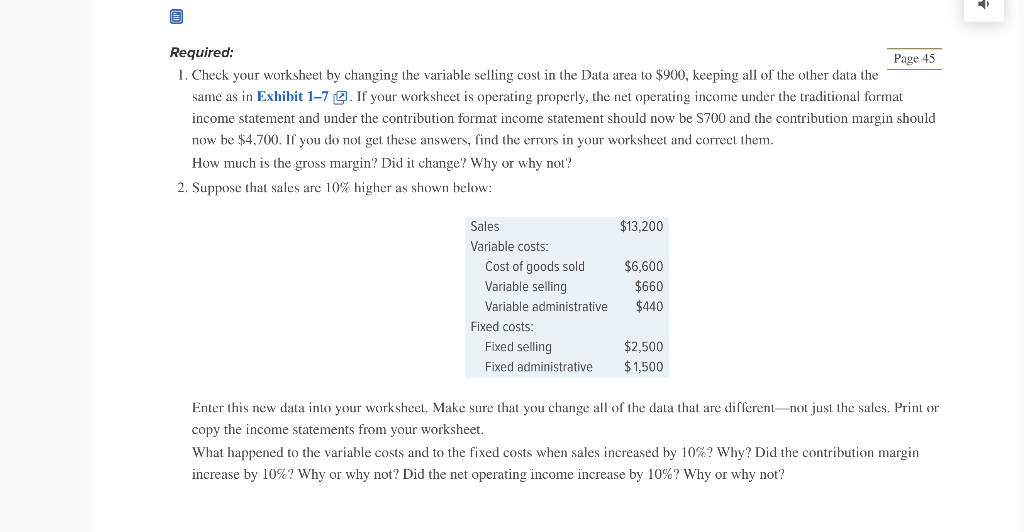

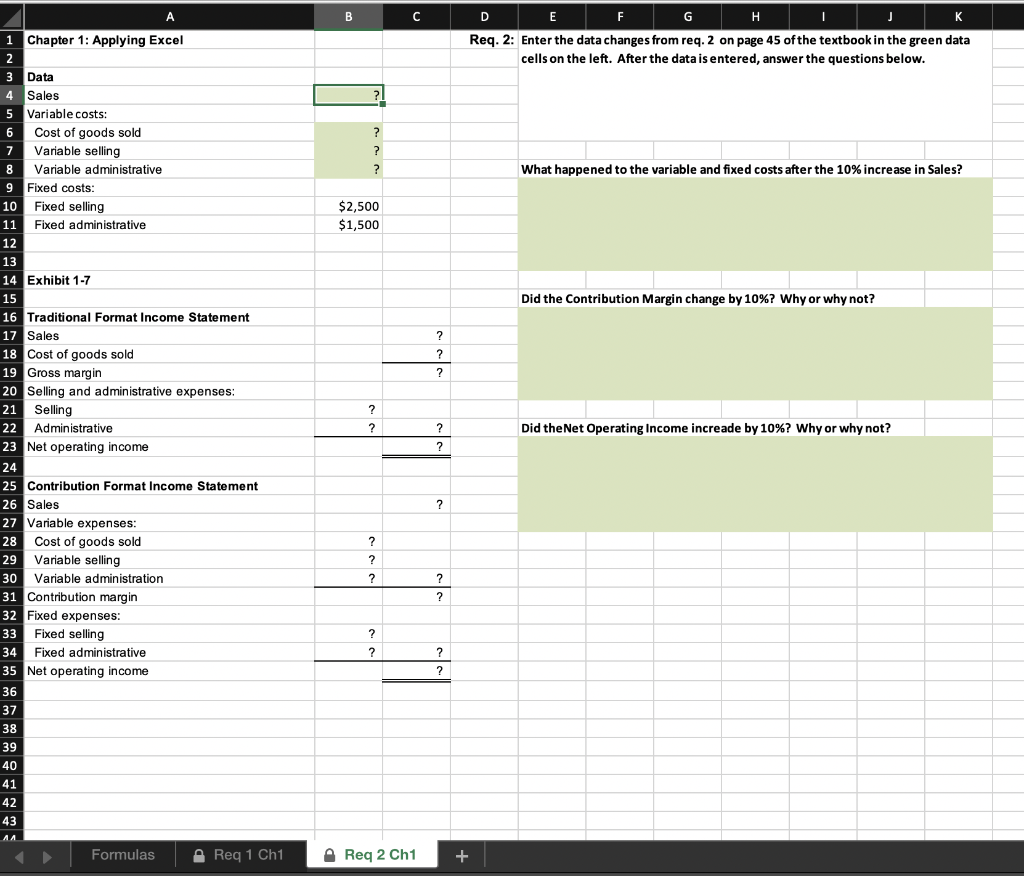

D A B 1 Chapter 1: Applying Excel 2 3 Data 4 Sales $12,000 5 Variable costs: 6 Cost of goods sold $6,000 7 Variable selling $600 8 Variable administrative $400 9 Fixed costs: 10 Fixed selling $2,500 11 Fixed administrative $1,500 12 13 Enter a formula into each of the cells marked with a ? below 14 Exhibit 1-7 15 16 Traditional Format Income Statement 17 Sales 18 Cost of goods sold 19 Gross margin 20 Selling and administrative expenses: 21 Selling ? 22 Administrative ? 23 Net operating income 24 25 Contribution Format Income Statement 26 Sales 27 Variable expenses: 28 Cost of goods sold ? 29 Variable selling ? 30 Variable administration ? 31 Contribution margin 32 Fixed expenses 33 Fixed selling ? 34 Fixed administrative ? 35 Net operating income 36 + Chapter 1 Form Filled in Chapter 1 Form ? ? ? ? ? ? ? ? ? ? Required: Page 45 1. Check your worksheet by changing the variable selling cost in the Data area to $900, keeping all of the other data the same as in Exhibit 1-7 q. If your worksheet is operating properly, the net operating income under the traditional format income statement and under the contribution format income statement should now be $700 and the contribution margin should now be $4.700. If you do not get these answers, find the errors in your worksheet and correct them. How much is the gross margin? Did it change? Why or why not? 2. Suppose that sales are 10% higher as shown below: $13,200 Sales Variable costs: Cost of goods sold Variable selling Variable administrative Fixed costs: Fixed selling Fixed administrative $6,600 $660 $440 $2,500 $1,500 Enter this new data into your worksheet. Make sure that you change all of the data that are differentnot just the sales. Print or copy the income statements from your worksheet. What happened to the variable costs and to the fixed costs when sales increased by 10%? Why? Did the contribution margin increase by 10%? Why or why not? Did the net operating income increase by 10%? Why or why not? A B C - K E F G H Req. 2: Enter the data changes from req. 2 on page 45 of the textbook in the green data cells on the left. After the data is entered, answer the questions below. ? ? ? ? What happened to the variable and fixed costs after the 10% increase in Sales? $2,500 $1,500 Did the Contribution Margin change by 10%? Why or why not? ? ? ? ? 1 Chapter 1: Applying Excel 2 3 Data 4 Sales 5 Variable costs: 6 Cost of goods sold 7 Variable selling 8 Variable administrative 9 Fixed costs: 10 Fixed selling 11 Fixed administrative 12 13 14 Exhibit 1-7 15 16 Traditional Format Income Statement 17 Sales 18 Cost of goods sold 19 Gross margin 20 Selling and administrative expenses: 21 Selling 22 Administrative 23 Net operating income 24 25 Contribution Format Income Statement 26 Sales 27 Variable expenses: 28 Cost of goods sold 29 Variable selling 30 Variable administration 31 Contribution margin 32 Fixed expenses: 33 Fixed selling 34 Fixed administrative 35 Net operating income 36 37 38 39 40 41 42 43 ? Did the Net Operating Income increade by 10%? Why or why not? ? ? ? ? ? ? ? ? ? ? ? ? Formulas Reg 1 Ch1 Req 2 Ch1 +