Answered step by step

Verified Expert Solution

Question

1 Approved Answer

d A Bonus Cap is a variant of the Bonus Certificate which pays its capital plus a fixed bonus if the underlying price does not

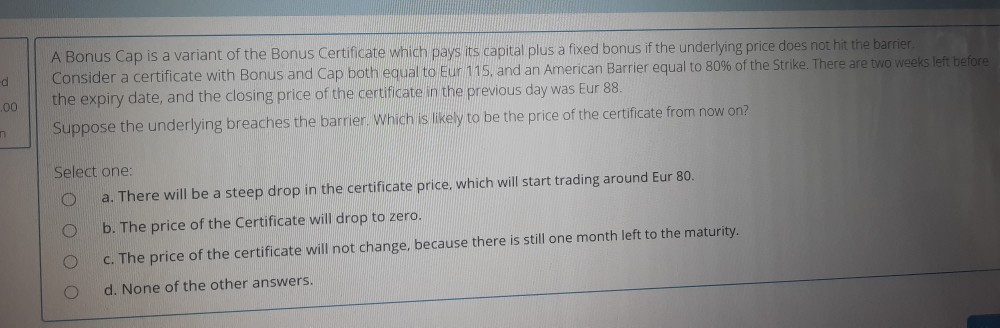

d A Bonus Cap is a variant of the Bonus Certificate which pays its capital plus a fixed bonus if the underlying price does not hit the barrier. Consider a certificate with Bonus and Cap both equal to Eur 115, and an American Barrier equal to 80% of the Strike. There are two weeks left before the expiry date, and the closing price of the certificate in the previous day was Eur 88. Suppose the underlying breaches the barrier. Which is likely to be the price of the certificate from now on? .00 n Select one: a. There will be a steep drop in the certificate price, which will start trading around Eur 80. b. The price of the Certificate will drop to zero. c. The price of the certificate will not change, because there is still one month left to the maturity. o d. None of the other answers

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started