Answered step by step

Verified Expert Solution

Question

1 Approved Answer

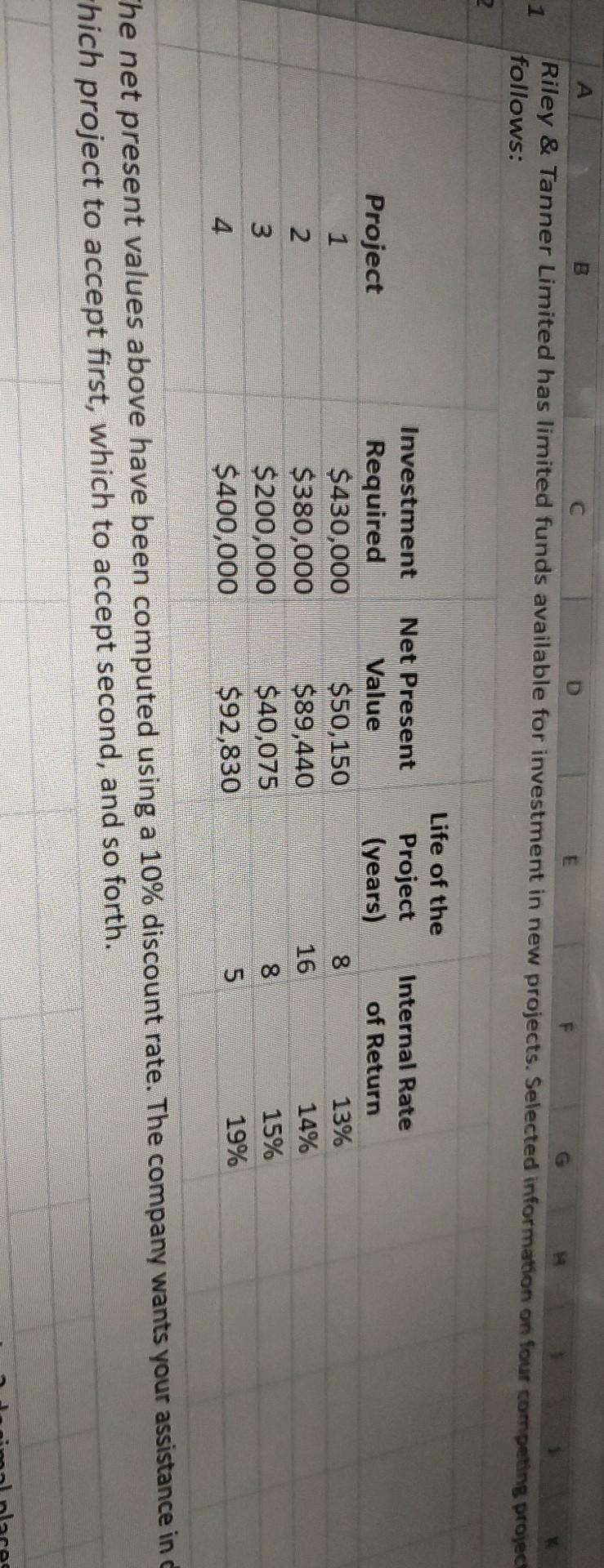

D B Riley & Tanner Limited has limited funds available for investment in new projects. Selected information on four competing project follows: 1 2. Life

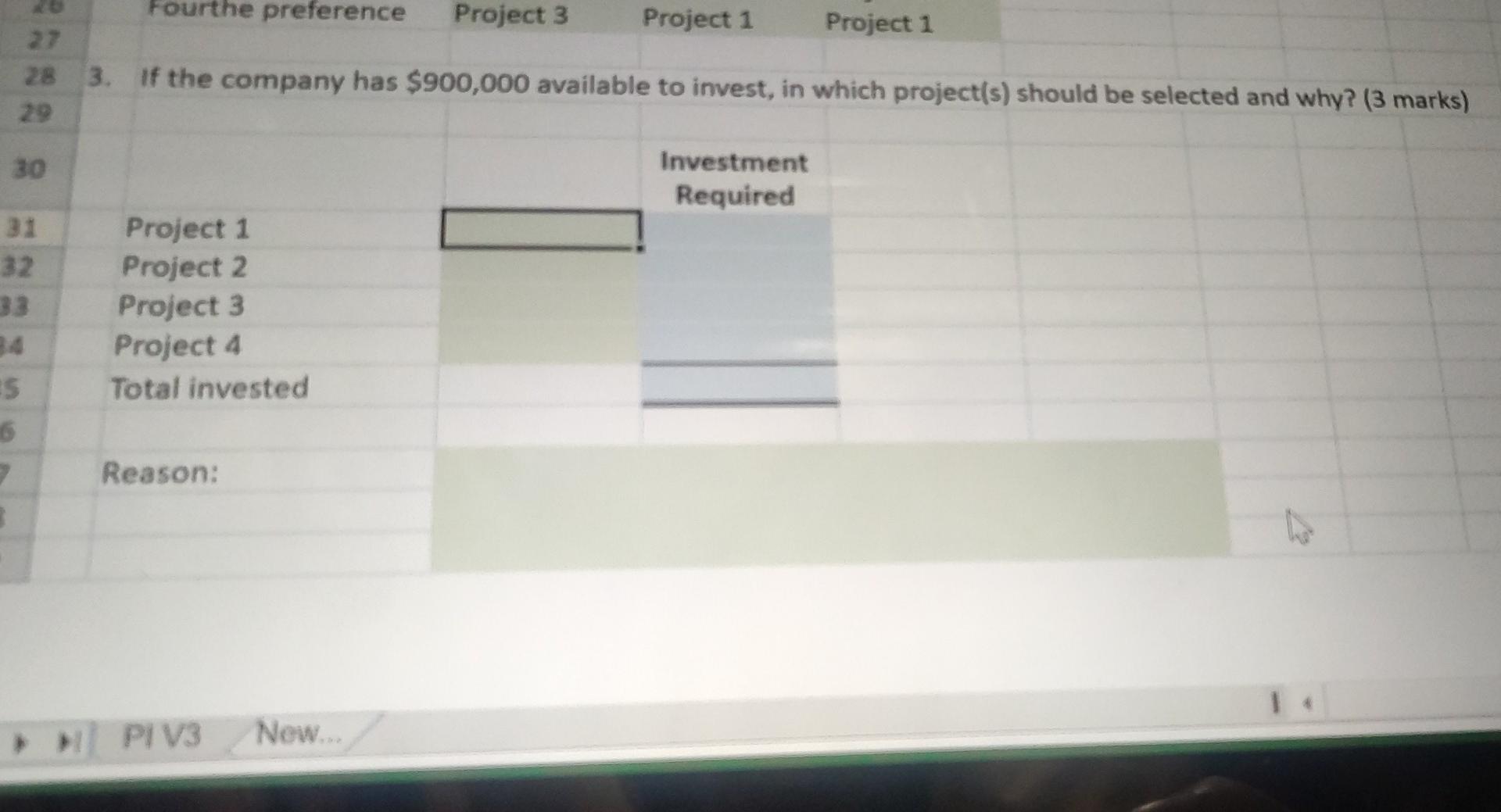

D B Riley & Tanner Limited has limited funds available for investment in new projects. Selected information on four competing project follows: 1 2. Life of the Project (years) Project 1 2 3 4 Investment Required $430,000 $380,000 $200,000 $400,000 Net Present Value $50,150 $89,440 $40,075 $92,830 Internal Rate of Return 8 13% 14% 8 15% 5 19% 16 00 The net present values above have been computed using a 10% discount rate. The company wants your assistance in hich project to accept first, which to accept second, and so forth. Fourthe preference Project 3 Project 1 Project 1 27 28 29 3. If the company has $900,000 available to invest, in which project(s) should be selected and why? (3 marks) 30 Investment Required 31 32 33 Project 1 Project 2 Project 3 Project 4 Total invested S 6 Reason: 3 PI V3 New

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started