Answered step by step

Verified Expert Solution

Question

1 Approved Answer

d. compare these proceeds to what you would realize if you simply continued to hold the shares. 4) Imagine that you are holding 5,000 shares

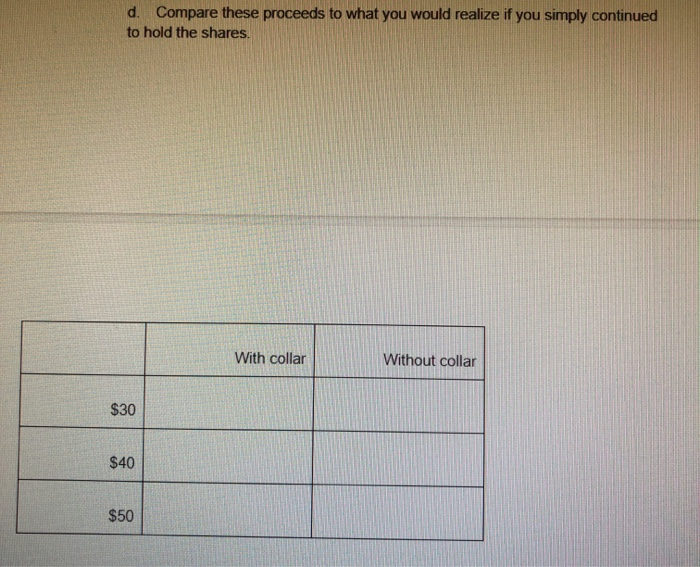

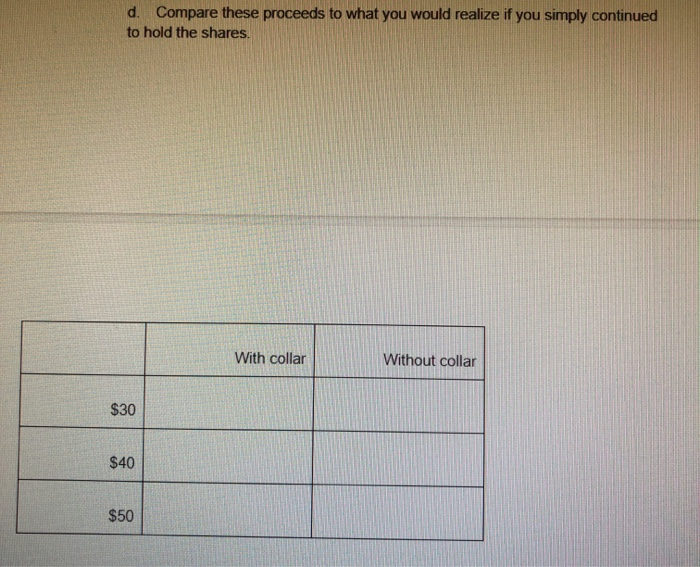

d. compare these proceeds to what you would realize if you simply continued to hold the shares.

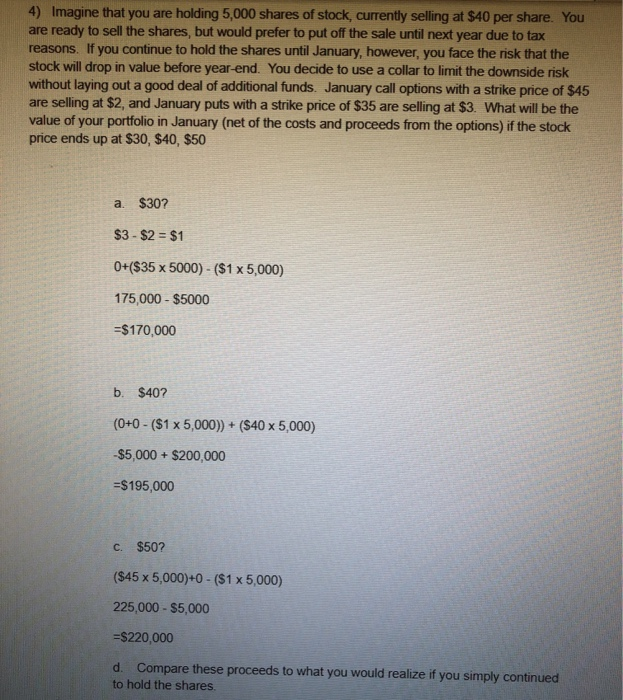

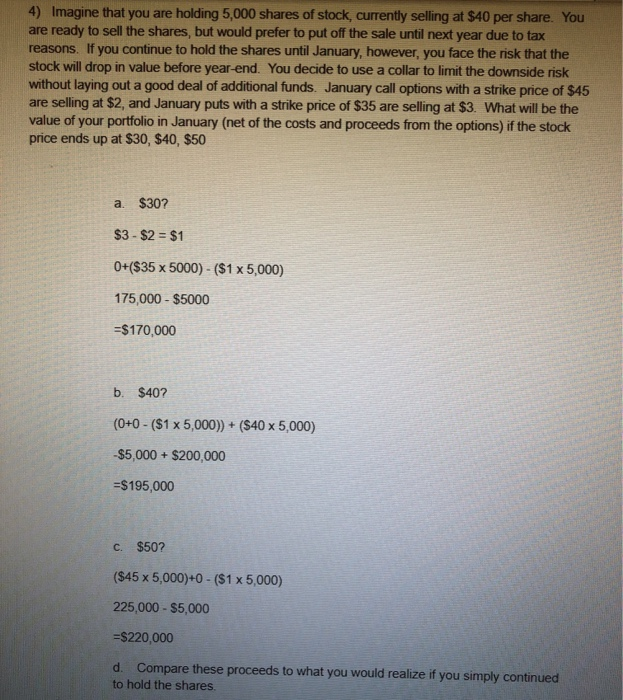

4) Imagine that you are holding 5,000 shares of stock, currently selling at $40 per share. You are ready to sell the shares, but would prefer to put off the sale until next year due to tax reasons. If you continue to hold the shares until January, however, you face the nsk that the stock will drop in value before year-end. You decide to use a collar to limit the downside risk without laying out a good deal of additional funds. January call options with a strike price of $45 are selling at $2, and January puts with a strike price of $35 are selling at $3. What will be the value of your portfolio in January (net of the costs and proceeds from the options) if the stock price ends up at $30, $40, $50 $30? $3 - $2 = $1 0+($35 x 5000) - ($1 x 5,000) 175,000 - $5000 =$170,000 b. $40? (0+0 - ($1 x 5,000)) + ($40 x 5,000) -$5,000 + $200,000 =$195,000 c. $50? ($45 x 5,000)+0 - ($1 x 5,000) 225,000 - $5,000 =$220,000 d. Compare these proceeds to what you would realize if you simply continued to hold the shares d. Compare these proceeds to what you would realize if you simply continued to hold the shares. With collar Without collar $30 $40 $50

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started