Answered step by step

Verified Expert Solution

Question

1 Approved Answer

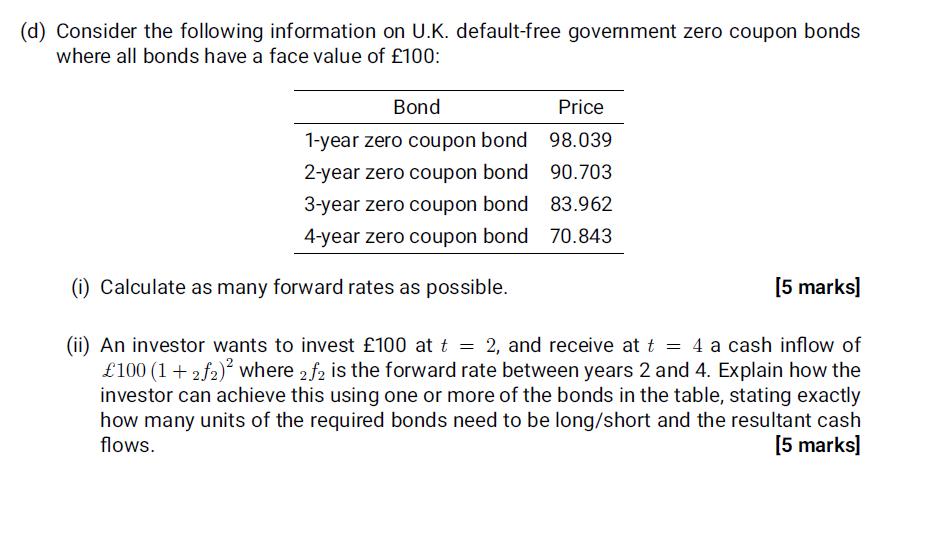

(d) Consider the following information on U.K. default-free government zero coupon bonds where all bonds have a face value of 100: Bond Price 1-year

(d) Consider the following information on U.K. default-free government zero coupon bonds where all bonds have a face value of 100: Bond Price 1-year zero coupon bond 98.039 2-year zero coupon bond 90.703 3-year zero coupon bond 83.962 4-year zero coupon bond 70.843 (i) Calculate as many forward rates as possible. [5 marks] (ii) An investor wants to invest 100 at t = 2, and receive at t = 4 a cash inflow of 100 (1+2f2) where 2f2 is the forward rate between years 2 and 4. Explain how the investor can achieve this using one or more of the bonds in the table, stating exactly how many units of the required bonds need to be long/short and the resultant cash flows. [5 marks]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

d i Calculate forward rates 1 year to 2 year forward rate 2 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started