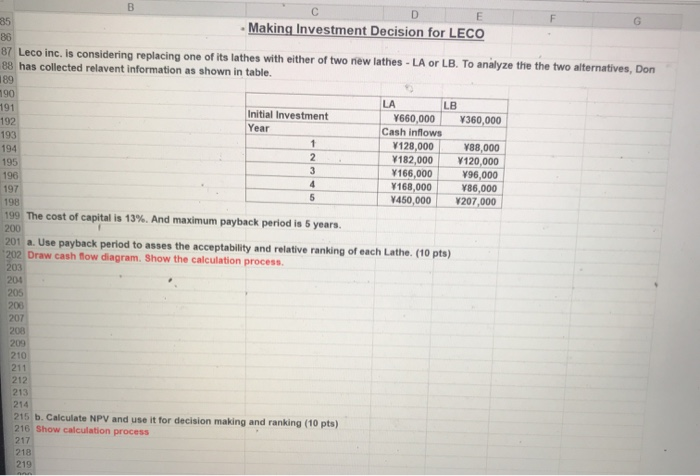

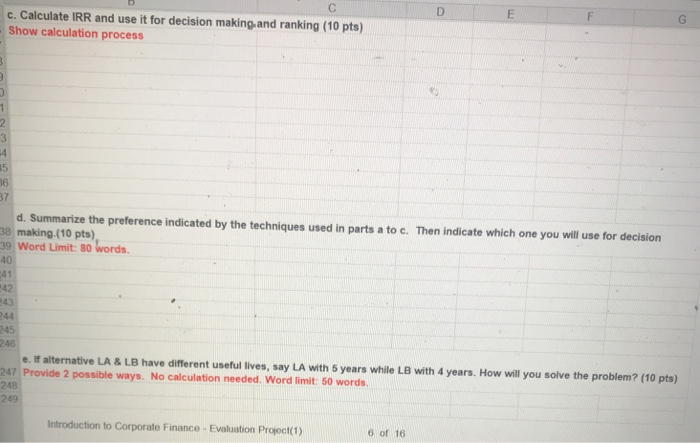

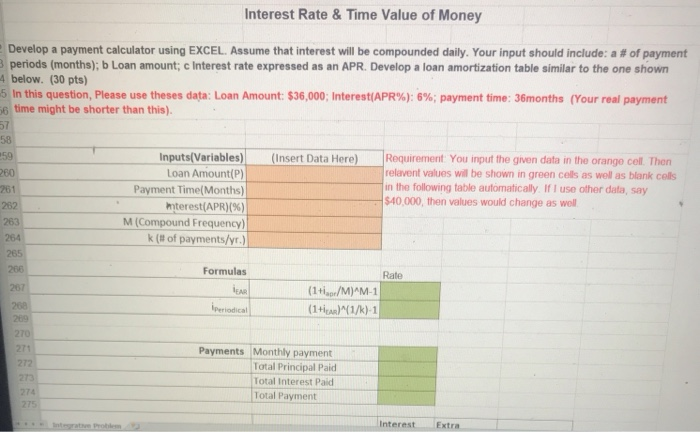

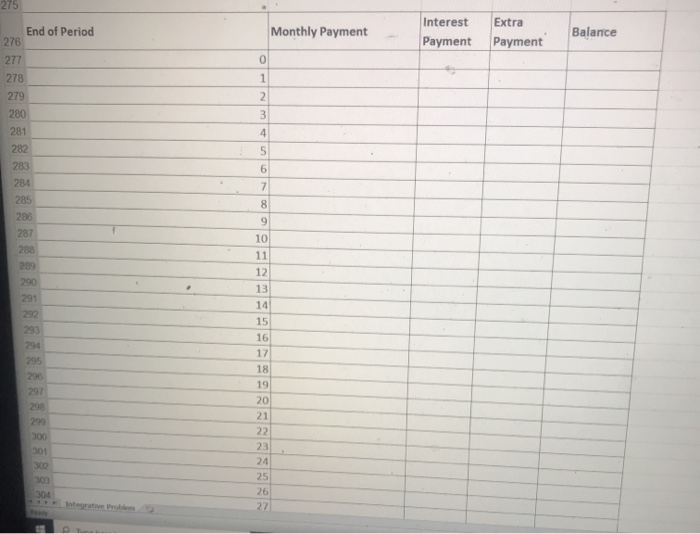

D E 85 Making Investment Decision for LECO 86 87 Leco inc. is considering replacing one of its lathes with either of two new lathes - LA or LB. To analyze the the two alternatives, Don 88 has collected relavent information as shown in table. 189 190 LA LB 191 Initial Investment 192 Y660,000 V360,000 Year Cash inflows 193 1 V128,000 V88,000 194 2 V182,000 V120,000 195 3 196 Y166,000 Y96,000 4 197 W168,000 +86,000 5 198 V450,000 V207,000 199 The cost of capital is 13%. And maximum payback period is 5 years. 200 201 a. Use payback period to asses the acceptability and relative ranking of each Lathe. (10 pts) 202 Draw cash flow diagram. Show the calculation process. 203 2014 205 200 207 208 209 210 211 212 213 214 215 b. Calculate NPV and use it for decision making and ranking (10 pts) 216 Show calculation process 217 218 219 D c. Calculate IRR and use it for decision making and ranking (10 pts) Show calculation process E F 1 2 3 14 15 36 37 d. Summarize the preference indicated by the techniques used in parts a to c. Then indicate which one you will use for decision 38 making (10 pts) 39 Word Limit: 80 words. 40 142 243 244 245 246 e. If alternative LA & LB have different useful lives, say LA with 5 years while LB with 4 years. How will you solve the problem? (10 pts) 247 Provide 2 possible ways. No calculation needed. Word limit: 50 words, 240 249 Introduction to Corporate Finance - Evaluation Project(1) 6 of 16 Interest Rate & Time Value of Money Develop a payment calculator using EXCEL. Assume that interest will be compounded daily. Your input should include: a # of payment periods (months); b Loan amount; c Interest rate expressed as an APR. Develop a loan amortization table similar to the one shown 4 below. (30 pts) 5 In this question, Please use theses data: Loan Amount: $36,000; Interest(APR%): 6%; payment time: 36months (Your real payment 56 time might be shorter than this). (Insert Data Here) 57 58 59 260 261 262 263 264 265 265 Inputs(Variables) Loan Amount(P) Payment Time(Months) mterest(APR)(%) M (Compound Frequency) k (it of payments/yr.) Requirement: You input the given data in the orange cell. Then relavent values will be shown in green cells as well as blank colls in the following table automatically. If I use other data, say $40,000, then values would change as well Formulas BEAR 267 Rate (1+i/M)^M-1 (1+i) (1/k)- 1 200 Periodical 270 271 272 273 Payments Monthly payment Total Principal Paid Total Interest Paid Total Payment 275 Interest Extra 275 End of Period Monthly Payment Interest Payment Extra Payment Balance 276 277 0 1 2 3 4 278 279 280 281 282 283 284 285 5 6 7 8 286 9 287 288 289 290 291 292 293 294 295 298 297 298 299 300 301 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 303