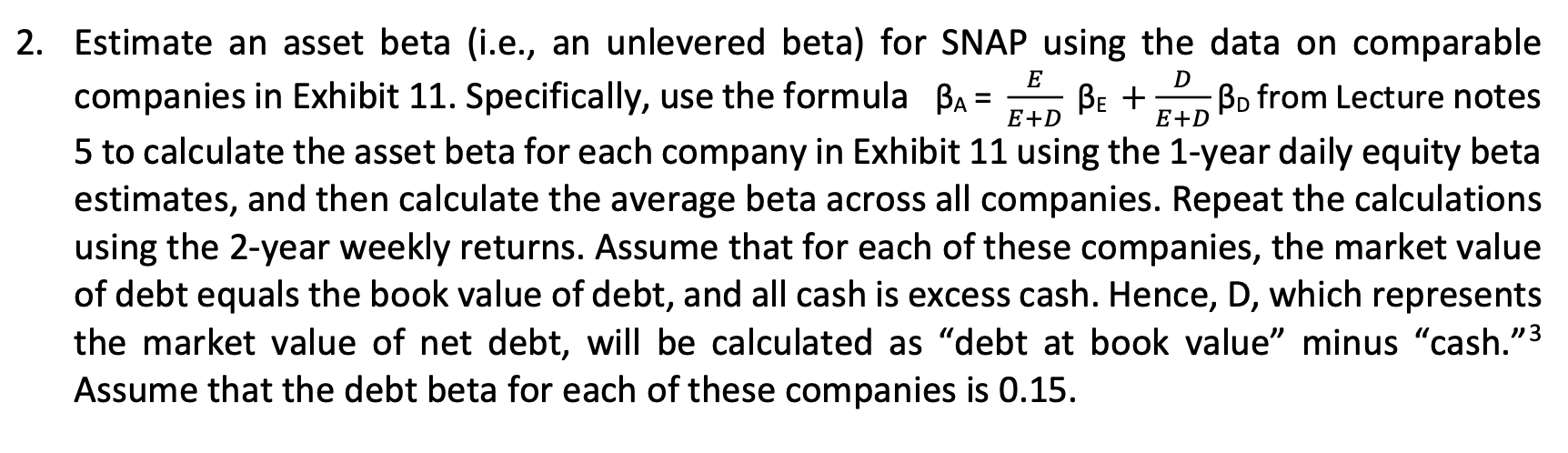

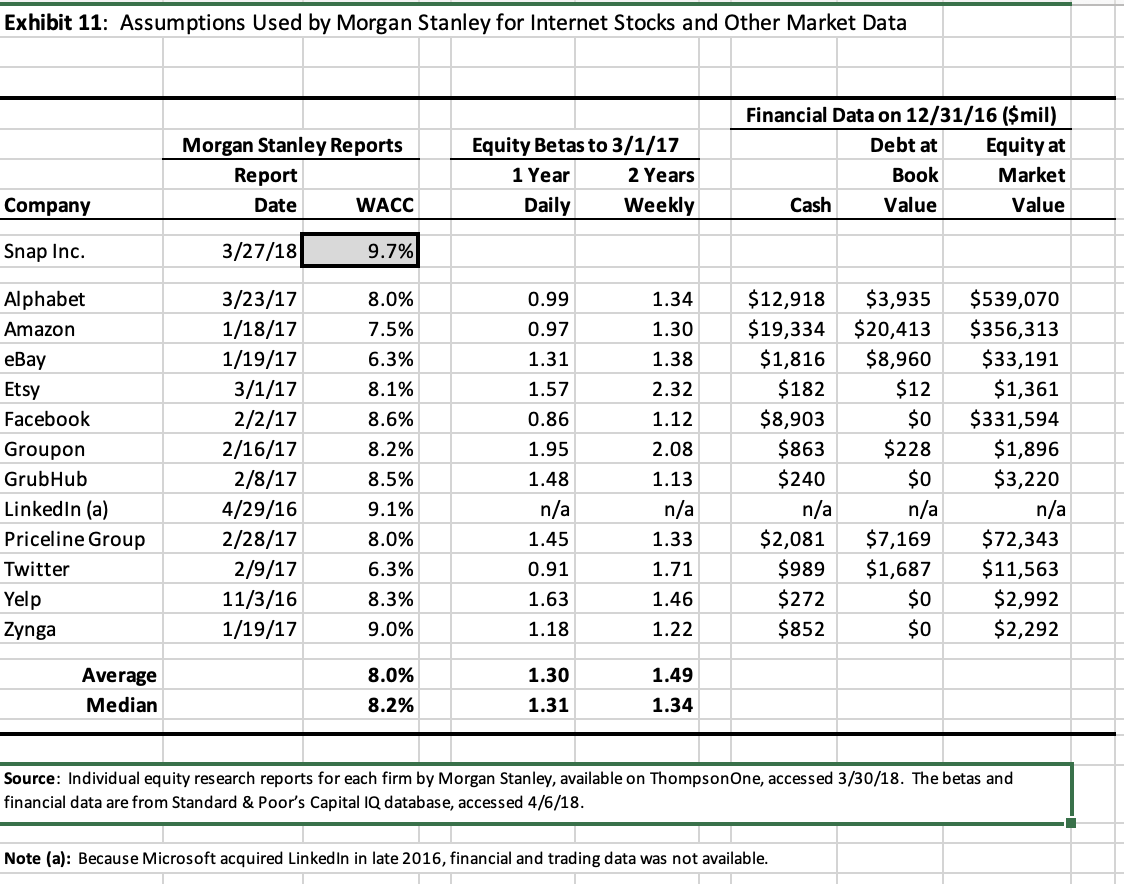

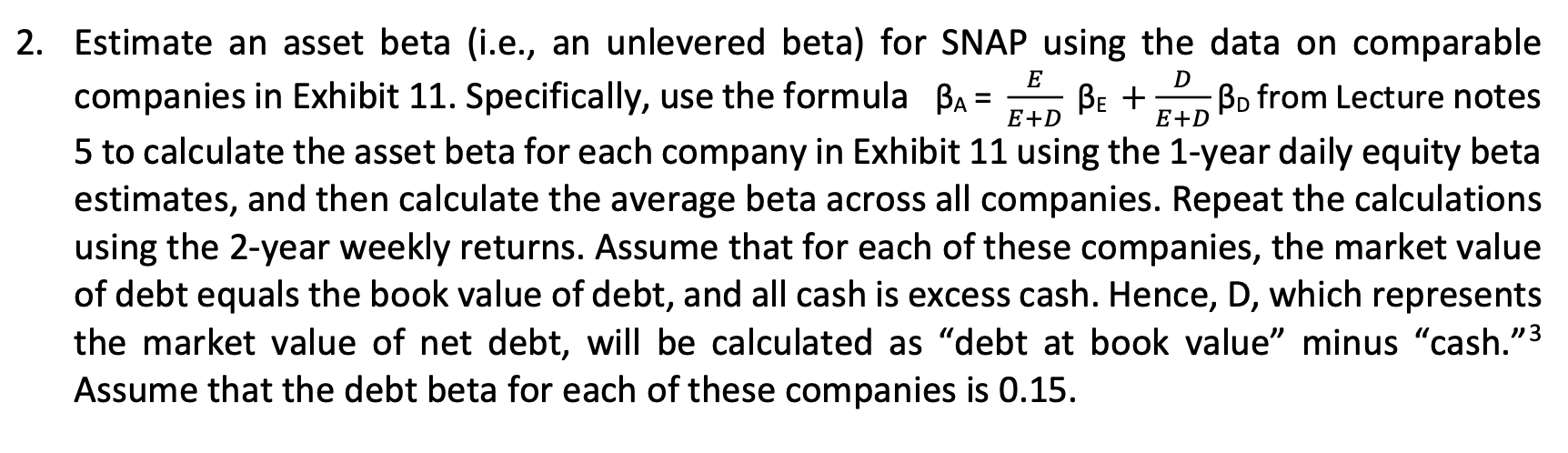

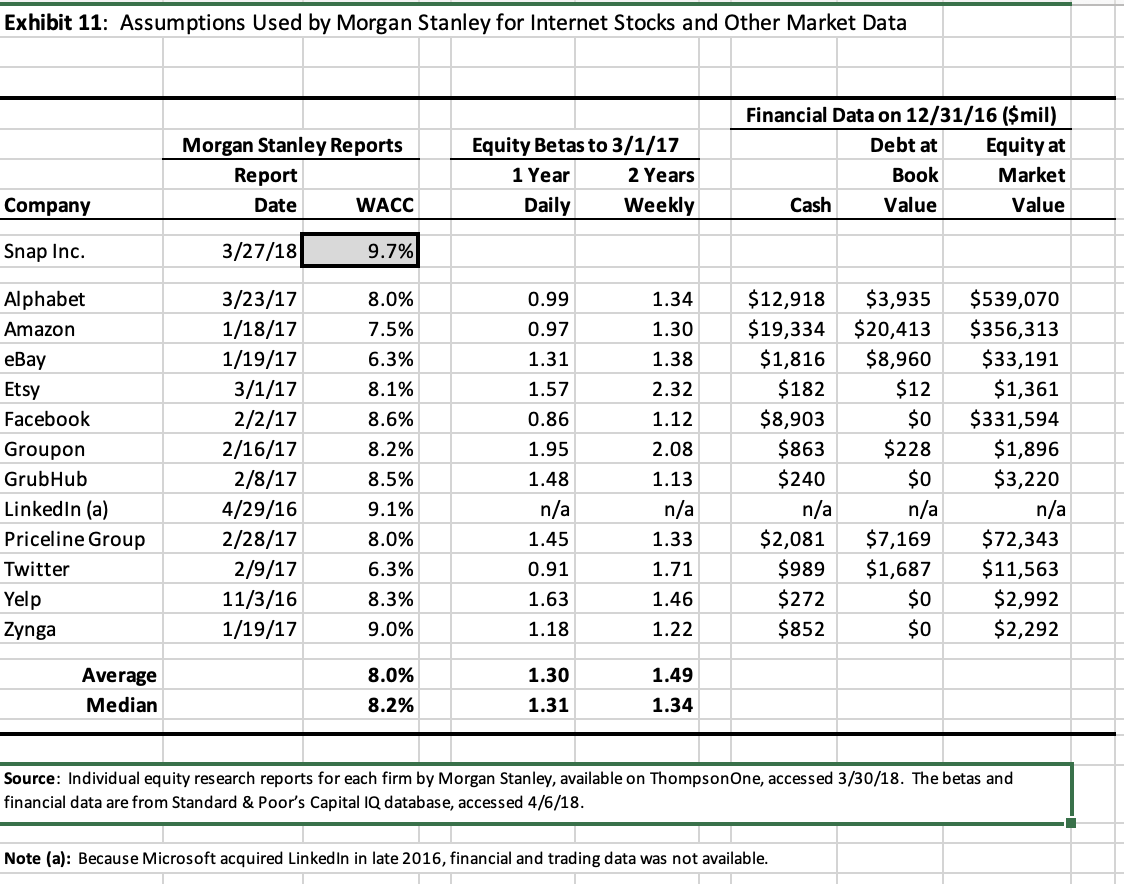

D E = E+D E+D 2. Estimate an asset beta (i.e., an unlevered beta) for SNAP using the data on comparable companies in Exhibit 11. Specifically, use the formula BA = Be + Bo from Lecture notes 5 to calculate the asset beta for each company in Exhibit 11 using the 1-year daily equity beta estimates, and then calculate the average beta across all companies. Repeat the calculations using the 2-year weekly returns. Assume that for each of these companies, the market value of debt equals the book value of debt, and all cash is excess cash. Hence, D, which represents the market value of net debt, will be calculated as "debt at book value minus "cash. Assume that the debt beta for each of these companies is 0.15. 13 Exhibit 11: Assumptions Used by Morgan Stanley for Internet Stocks and Other Market Data Morgan Stanley Reports Report Date WACC Equity Betas to 3/1/17 1 Year 2 Years Daily Weekly Financial Data on 12/31/16 ($mil) Debt at Equity at Book Market Cash Value Value Company Snap Inc. 3/27/18 9.7% 0.99 0.97 1.31 1.57 1.34 1.30 1.38 2.32 0.86 1.12 Alphabet Amazon eBay Etsy Facebook Groupon GrubHub LinkedIn (a) Priceline Group Twitter Yelp Zynga 3/23/17 1/18/17 1/19/17 3/1/17 2/2/17 2/16/17 2/8/17 4/29/16 2/28/17 2/9/17 11/3/16 1/19/17 8.0% 7.5% 6.3% 8.1% 8.6% 8.2% 8.5% 9.1% 8.0% 6.3% 8.3% 9.0% 1.95 1.48 n/a 1.45 2.08 1.13 n/a 1.33 1.71 1.46 1.22 $12,918 $19,334 $1,816 $182 $8,903 $863 $240 n/a $2,081 $989 $272 $852 $3,935 $20,413 $8,960 $12 $0 $228 $0 n/a $7,169 $1,687 $0 $0 $539,070 $356,313 $33,191 $1,361 $331,594 $1,896 $3,220 n/a $72,343 $11,563 $2,992 $2,292 0.91 1.63 1.18 8.0% 1.49 Average Median 1.30 1.31 8.2% 1.34 Source: Individual equity research reports for each firm by Morgan Stanley, available on Thompson One, accessed 3/30/18. The betas and financial data are from Standard & Poor's Capital IQ database, accessed 4/6/18. Note (a): Because Microsoft acquired LinkedIn in late 2016, financial and trading data was not available. D E = E+D E+D 2. Estimate an asset beta (i.e., an unlevered beta) for SNAP using the data on comparable companies in Exhibit 11. Specifically, use the formula BA = Be + Bo from Lecture notes 5 to calculate the asset beta for each company in Exhibit 11 using the 1-year daily equity beta estimates, and then calculate the average beta across all companies. Repeat the calculations using the 2-year weekly returns. Assume that for each of these companies, the market value of debt equals the book value of debt, and all cash is excess cash. Hence, D, which represents the market value of net debt, will be calculated as "debt at book value minus "cash. Assume that the debt beta for each of these companies is 0.15. 13 Exhibit 11: Assumptions Used by Morgan Stanley for Internet Stocks and Other Market Data Morgan Stanley Reports Report Date WACC Equity Betas to 3/1/17 1 Year 2 Years Daily Weekly Financial Data on 12/31/16 ($mil) Debt at Equity at Book Market Cash Value Value Company Snap Inc. 3/27/18 9.7% 0.99 0.97 1.31 1.57 1.34 1.30 1.38 2.32 0.86 1.12 Alphabet Amazon eBay Etsy Facebook Groupon GrubHub LinkedIn (a) Priceline Group Twitter Yelp Zynga 3/23/17 1/18/17 1/19/17 3/1/17 2/2/17 2/16/17 2/8/17 4/29/16 2/28/17 2/9/17 11/3/16 1/19/17 8.0% 7.5% 6.3% 8.1% 8.6% 8.2% 8.5% 9.1% 8.0% 6.3% 8.3% 9.0% 1.95 1.48 n/a 1.45 2.08 1.13 n/a 1.33 1.71 1.46 1.22 $12,918 $19,334 $1,816 $182 $8,903 $863 $240 n/a $2,081 $989 $272 $852 $3,935 $20,413 $8,960 $12 $0 $228 $0 n/a $7,169 $1,687 $0 $0 $539,070 $356,313 $33,191 $1,361 $331,594 $1,896 $3,220 n/a $72,343 $11,563 $2,992 $2,292 0.91 1.63 1.18 8.0% 1.49 Average Median 1.30 1.31 8.2% 1.34 Source: Individual equity research reports for each firm by Morgan Stanley, available on Thompson One, accessed 3/30/18. The betas and financial data are from Standard & Poor's Capital IQ database, accessed 4/6/18. Note (a): Because Microsoft acquired LinkedIn in late 2016, financial and trading data was not available