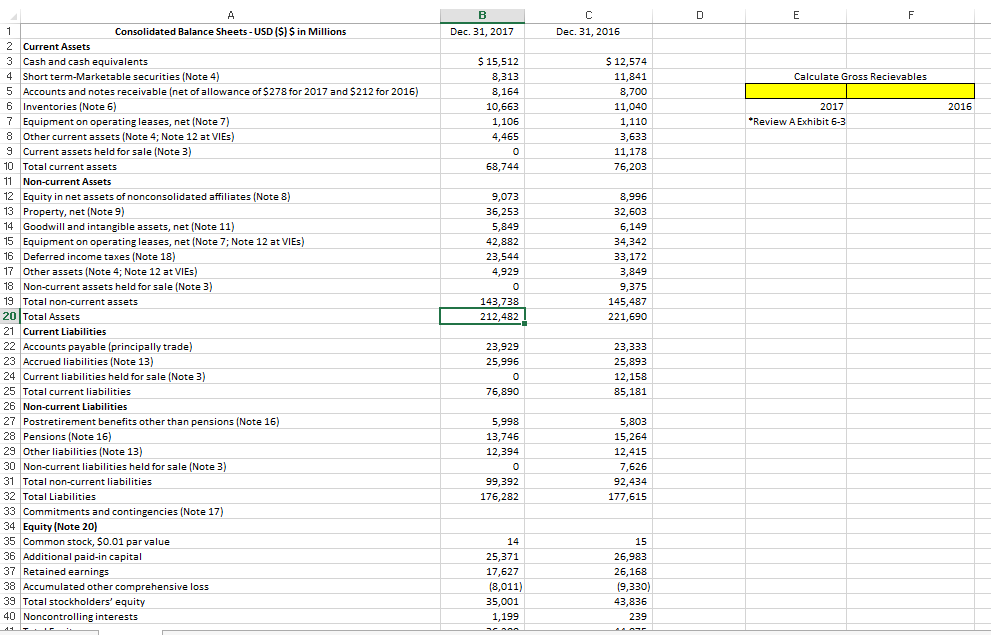

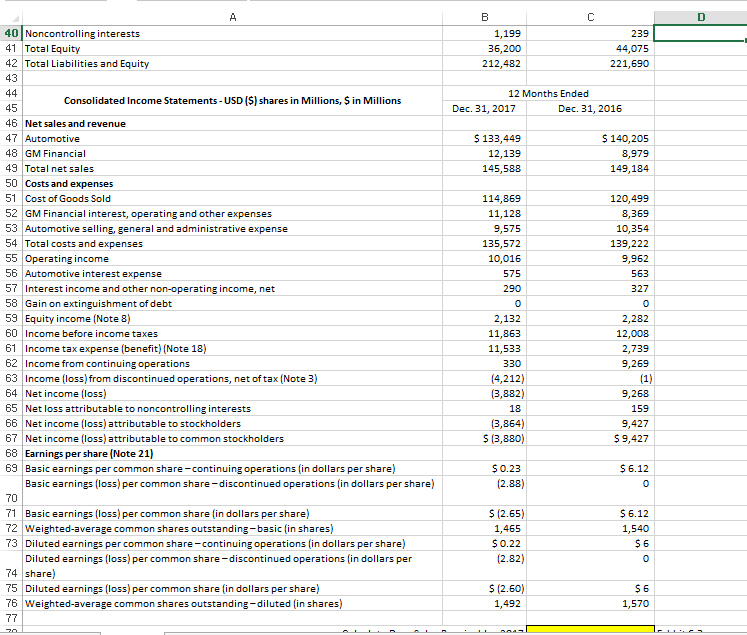

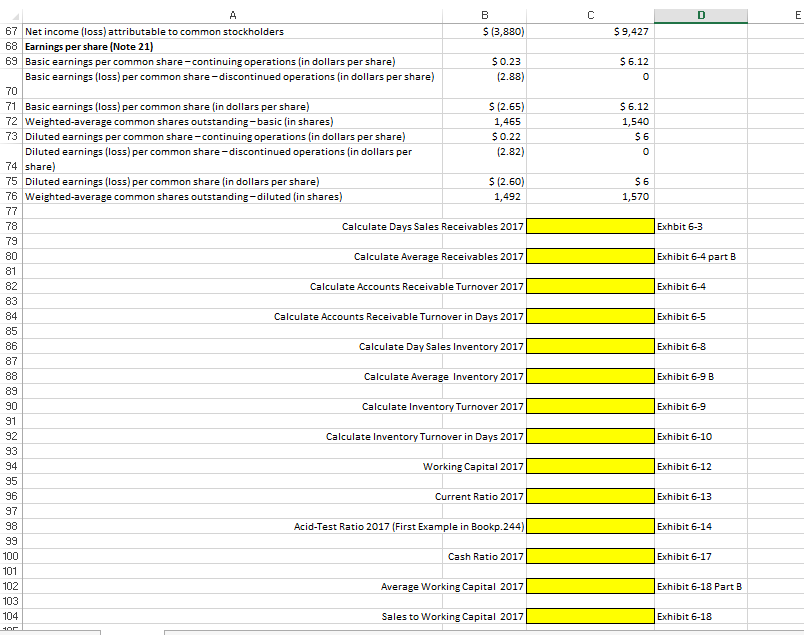

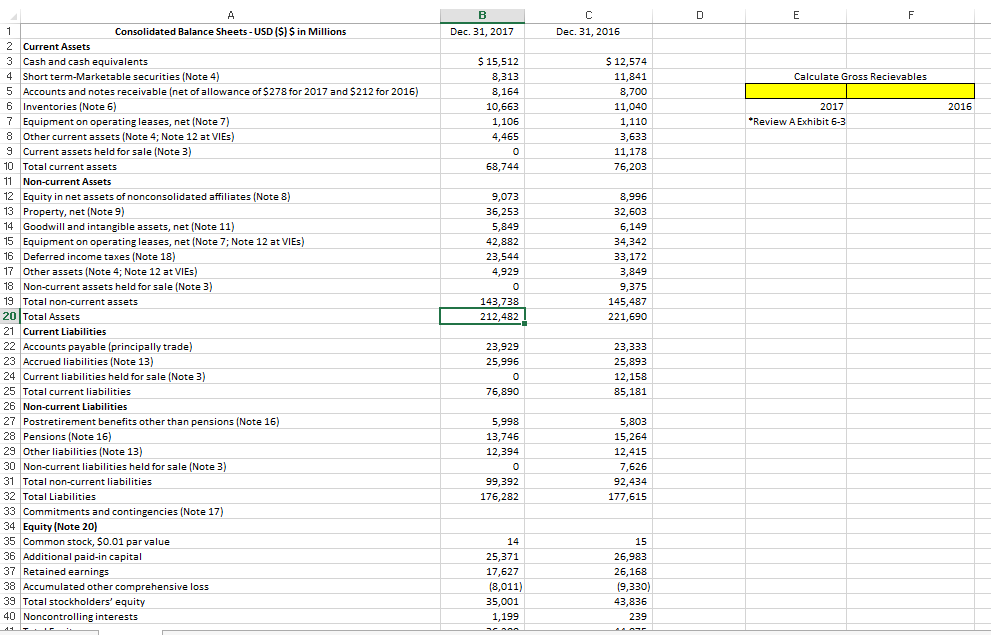

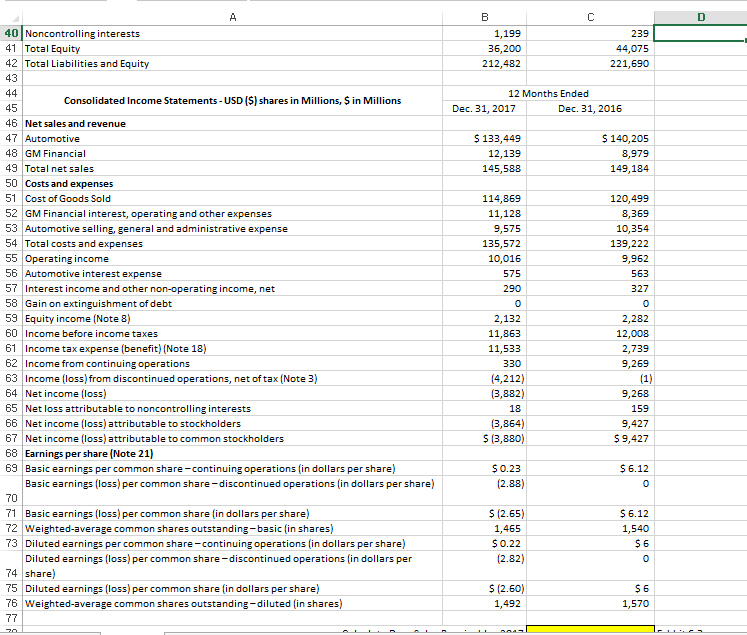

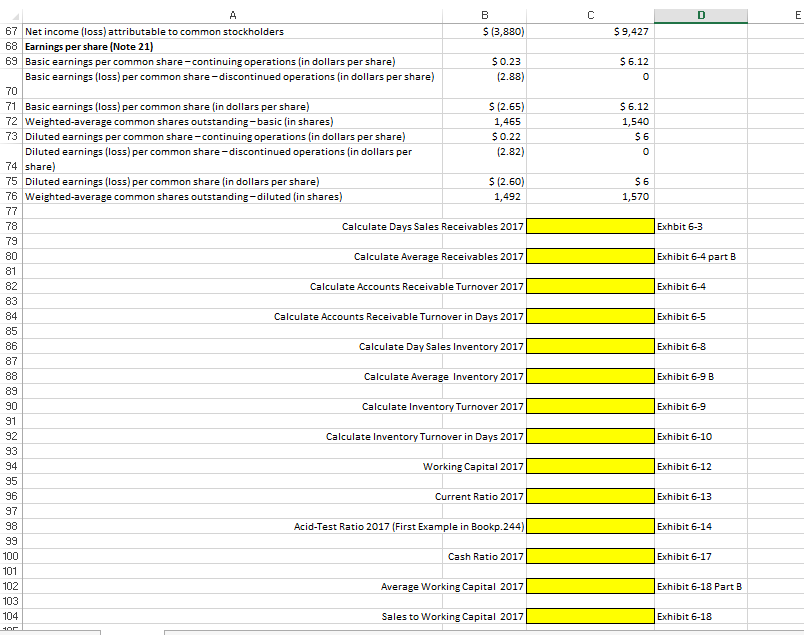

D E F B Dec 31, 2017 Dec. 31, 2016 1 Calculate Gross Recievables 2016 $ 15,512 8,313 8,164 10,663 1,106 4,465 0 68,744 $ 12,574 11,841 8,700 11,040 1,110 3,633 11,178 76,203 2017 Review A Exhibit 6-3 A Consolidated Balance Sheets - USD ($) $ in Millions 2 Current Assets Cash and cash equivalents 4 Short term-Marketable securities (Note 4) 5 Accounts and notes receivable (net of allowance of $278 for 2017 and $212 for 2016) 6 Inventories (Note 6) 7 Equipment on operating leases, net (Note 7) 8 Other current assets (Note 4; Note 12 at VIES) 9 Current assets held for sale (Note 3) 10 Total current assets 11. Non-current Assets 12 Equity in net assets of nonconsolidated affiliates (Note 8) 13 Property, net (Note 9) 14 Goodwill and intangible assets, net (Note 11) 15 Equipment on operating leases, net (Note 7; Note 12 at Vies) 16 Deferred income taxes (Note 18) 17 Other assets (Note 4; Note 12 at VIES) 18 Non-current assets held for sale (Note 3) 19 Total non-current assets 20 Total Assets 21 Current Liabilities 22 Accounts payable (principally trade) 23 Accrued liabilities (Note 13) 24 Current liabilities held for sale (Note 3) 25 Total current liabilities 26 Non-current Liabilities 27 Postretirement benefits other than pensions (Note 16) 28 Pensions (Note 16 29 Other liabilities (Note 13) 30 Non-current liabilities held for sale (Note 3) 31 Total non-current liabilities 32 Total Liabilities 33 Commitments and contingencies (Note 17) 34 Equity (Note 20) 35 Common stock, $0.01 par value 36 Additional paid-in capital 37 Retained earnings 38 Accumulated other comprehensive loss 39 Total stockholders' equity 40 Noncontrolling interests 9,073 36,253 5,849 42,882 23,544 4,929 0 143,738 212.482 8,996 32,603 6,149 34,342 33,172 3,849 9,375 145,487 221,690 23,929 25,996 0 76,890 23,333 25,893 12,158 85,181 5,998 13,746 12,394 0 99,392 176,282 5,803 15,264 12,415 7,626 92,434 177,615 14 25,371 17,627 (8,011) 35,001 1,199 15 26,983 26,168 19,330) 43,836 239 B D 1,199 36,200 212,482 239 44,075 221,690 12 Months Ended Dec. 31, 2017 Dec. 31, 2016 $ 133,449 12,139 145,588 $ 140,205 8,979 149,184 A 40 Noncontrolling interests 41 Total Equity 42 Total Liabilities and Equity 43 44 Consolidated Income Statements - USD ($) shares in Millions, $ in Millions 45 46 Net sales and revenue 47 Automotive 48 GM Financial 49 Total net sales 50 Costs and expenses 51 Cost of Goods Sold 52 GM Financial interest, operating and other expenses 53 Automotive selling, general and administrative expense 54 Total costs and expenses 55 Operating income 56 Automotive interest expense 57 Interest income and other non-operating income, net 58 Gain on extinguishment of debt 59 Equity income (Note 8) 60 Income before income taxes 61 Income tax expense (benefit) (Note 18) 62 Income from continuing operations 63 Income (loss) from discontinued operations, net of tax (Note 3) 64 Net income (loss) 65 Net loss attributable to noncontrolling interests 66 Net income (loss) attributable to stockholders 67 Net income (loss) attributable to common stockholders 68 Earnings per share (Note 21) 69 Basic earnings per common share-continuing operations (in dollars per share) Basic earnings (loss) per common share-discontinued operations (in dollars per share) 70 71 Basic earnings (loss) per common share (in dollars per share) 72 Weighted-average common shares outstanding-basic (in shares) 73 Diluted earnings per common share-continuing operations (in dollars per share) Diluted earnings (loss)per common share-discontinued operations (in dollars per 74 share) 75 Diluted earnings (loss) per common share (in dollars per share) 76 Weighted average common shares outstanding-diluted (in shares) 77 114,869 11,128 9,575 135,572 10,016 575 290 0 2,132 11,863 11,533 330 (4,212) (3,882) 18 (3,864) $ (3,880) 120,499 8,369 10,354 139,222 9,962 563 327 0 2,282 12,008 2,739 9,269 (1) 9,268 159 9,427 $ 9,427 $ 0.23 (2.88) $ 6.12 0 $ (2.65) 1,465 $ 0.22 (2.82) $ 6.12 1,540 $ 6 0 $ (2.60) 1,492 $ 6 1,570 70 C D E $ 9,427 $ 6.12 $ 6.12 1,540 $6 0 $ 6 1,570 Exhbit 6-3 Exhibit 6-4 part B Exhibit 6-4 A B 67 Net income (loss) attributable to common stockholders $ (3,880) 68 Earnings per share (Note 21) 69 Basic earnings per common share-continuing operations (in dollars per share) $ 0.23 Basic earnings (loss) per common share-discontinued operations (in dollars per share) (2.88) 70 71 Basic earnings (loss) per common share (in dollars per share) S (2.65) 72 Weighted-average common shares outstanding-basic (in shares) 1,465 73 Diluted earnings per common share-continuing operations (in dollars per share) $ 0.22 Diluted earnings (loss) per common share-discontinued operations (in dollars per (2.82) 74 share) 75 Diluted earnings (loss) per common share (in dollars per share) $ (2.60) 76 Weighted-average common shares outstanding-diluted (in shares) 1,492 77 78 Calculate Days Sales Receivables 2017 79 80 Calculate Average Receivables 2017 81 82 Calculate Accounts Receivable Turnover 2017 83 84 Calculate Accounts Receivable Turnover in Days 2017| 85 86 Calculate Day Sales Inventory 2017 87 88 Calculate Average Inventory 2017 89 90 Calculate Inventory Turnover 2017 91 92 Calculate Inventory Turnover in Days 2017 93 94 Working Capital 2017 95 96 Current Ratio 2017 97 98 Acid-Test Ratio 2017 (First Example in Bookp.244) 99 100 Cash Ratio 2017 101 102 Average Working Capital 2017 103 104 Sales to Working Capital 2017 Exhibit 6-5 Exhibit 6-8 Exhibit 6-9B Exhibit 6-9 Exhibit 6-10 Exhibit 6-12 Exhibit 6-13 Exhibit 6-14 Exhibit 6-17 Exhibit 6-18 Part B Exhibit 6-18